Top 23 equity in business in 2022

Below are the best information and knowledge on the subject equity in business compiled and compiled by our own team evbn:

Mục Lục

1. What Is Business Equity?

Author: www.uschamber.com

Date Submitted: 04/14/2019 02:06 AM

Average star voting: 3 ⭐ ( 79231 reviews)

Summary: Equity is the value of your company after deducting your liabilities from your assets. Learn more about how business equity works and how it’s calculated.

Match with the search results: . It’s the total amount of money that would be returned to your shareholders if your debt was paid off and your assets were liquidated….. read more

2. What Is Equity in Business?

Author: blog.hubspot.com

Date Submitted: 05/02/2021 03:00 AM

Average star voting: 4 ⭐ ( 66337 reviews)

Summary: Equity in business often determines a firm’s value. Learn how to define and calculate it alongside real examples from corporations.

Match with the search results: Equity measures the amount of money that would be returned to shareholders if the business liquidated its assets and paid off its liabilities….. read more

3. Equity for Shareholders: How It Works and How to Calculate It

Author: www.investopedia.com

Date Submitted: 04/23/2020 08:14 AM

Average star voting: 4 ⭐ ( 44146 reviews)

Summary: Equity typically refers to shareholders’ equity, which represents the residual value to shareholders after debts and liabilities have been settled.

Match with the search results: Equity represents the value that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debts were paid off ……. read more

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

4. What Is Business Equity? | A Guide for Small Business Owners

Author: www.patriotsoftware.com

Date Submitted: 06/20/2019 04:41 AM

Average star voting: 4 ⭐ ( 29820 reviews)

Summary: Many small business owners start their companies with their own money. Your money, or business equity, helps you grow your business.

Match with the search results: So, what is equity in a business? Business equity is the value of your assets after deducting your business’s liabilities. As a business owner, ……. read more

5. What is Equity? Definition of Equity, Equity Meaning – The Economic Times

Author: economictimes.indiatimes.com

Date Submitted: 09/09/2021 12:22 PM

Average star voting: 4 ⭐ ( 99214 reviews)

Summary: Equity definition – What is meant by the term Equity ? meaning of IPO, Definition of Equity on The Economic Times.

Match with the search results: Equity is the amount of money that a company’s owner has put into it or owns. On a company’s balance sheet, the difference between its liabilities and assets ……. read more

6. What is equity in business and equity in accounting?

Author: www.masterclass.com

Date Submitted: 09/06/2021 05:18 PM

Average star voting: 3 ⭐ ( 68210 reviews)

Summary: What is equity in business and how can you work it out? Read our simple guide to understand how equity in accounting works.

Match with the search results: Equity is a measure of a company’s total assets minus total liabilities. In the case of the company’s liquidation, the equity is the amount ……. read more

7. What is Equity? | Square Business Glossary

Author: www.indeed.com

Date Submitted: 07/07/2021 05:42 AM

Average star voting: 5 ⭐ ( 59462 reviews)

Summary: Equity has several meanings in the world of business. We explore the definition of equity and the business contexts in which it applies.

Match with the search results: Business equity is the value of the shares that a company issues to its investors. Since companies require money to support their operations ……. read more

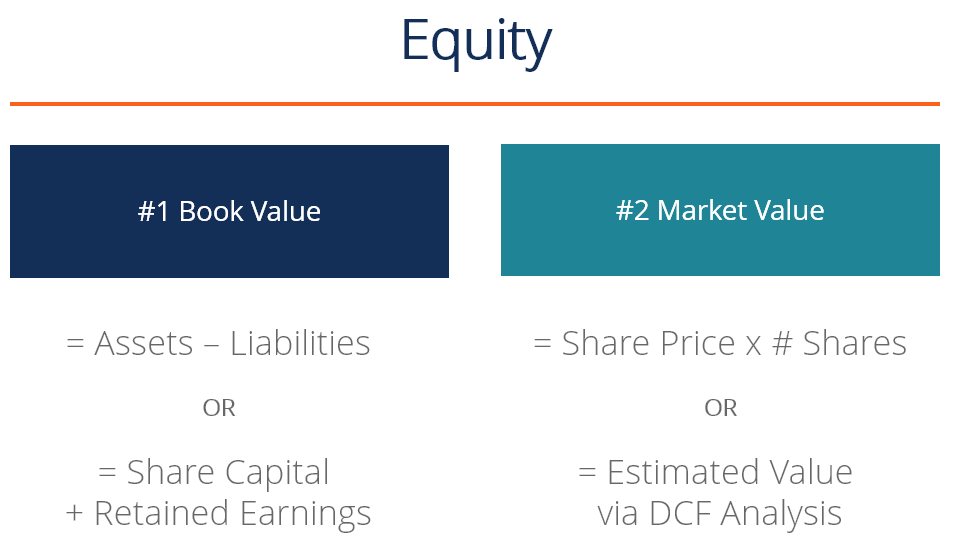

8. What is Equity? Definition, Example Guide to Understanding Equity

Author: www.simplybusiness.co.uk

Date Submitted: 09/05/2021 09:50 AM

Average star voting: 4 ⭐ ( 55037 reviews)

Summary: In finance and accounting, equity is the value attributable to a business. Book value of equity is the difference between assets and liabilities

Match with the search results: The equity meaning in business is the amount of money that could be returned to a company’s shareholders if all its assets were liquidated and ……. read more

9. What Is Equity?

Author: fastercapital.com

Date Submitted: 08/30/2021 03:51 PM

Average star voting: 4 ⭐ ( 26006 reviews)

Summary: Equity is the value of ownership. Learn about the many different ways it can be applied, and how it helps investors understand the companies they invest in.

Match with the search results: In business, the term equity refers to the ownership interest that shareholders have in a company. Equity represents the residual value of a company after ……. read more

:max_bytes(150000):strip_icc()/CompanyValue-3d6c3fea44be4f72adc23777af3b9217.jpg)

10. Business Basics – Equity: Dividing the Pie

Author: squareup.com

Date Submitted: 06/03/2019 11:38 AM

Average star voting: 4 ⭐ ( 41321 reviews)

Summary:

Match with the search results: A company’s equity means how many of its component assets are owned by the company, rather than leveraged with [debts]like business loans, vehicle financing, ……. read more

11. Business Equity for Entrepreneurs and Small Businesses

Author: corporatefinanceinstitute.com

Date Submitted: 05/29/2021 12:09 AM

Average star voting: 3 ⭐ ( 30162 reviews)

Summary: Find out everything you need to know about equity for entrepreneurs and small businesses. Financing and compensation, negotiating deals and so much more.

Match with the search results: . It’s the total amount of money that would be returned to your shareholders if your debt was paid off and your assets were liquidated….. read more

12. The Strategic Secret of Private Equity

Author: www.thebalancemoney.com

Date Submitted: 10/04/2019 12:58 AM

Average star voting: 4 ⭐ ( 22467 reviews)

Summary: The huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms’ aggressive use of debt, concentration on cash flow and margins, freedom from public company regulations, and hefty incentives for operating managers. But the fundamental reason for private equity’s success is the strategy of buying to sell—one rarely employed by public companies, which, in pursuit of synergies, usually buy to keep. The chief advantage of buying to sell is simple but often overlooked, explain Barber and Goold, directors of the Ashridge Strategic Management Centre. Private equity’s sweet spot is acquisitions that have been undermanaged or undervalued, where there’s a onetime opportunity to increase a business’s value. Once that gain has been realized, private equity firms sell for a maximum return. A corporate acquirer, in contrast, will dilute its return by hanging on to the business after the growth in value tapers off. Public companies that compete in this space can offer investors better returns than private equity firms do. (After all, a public company wouldn’t deduct the 30% that funds take out of gross profits.) Corporations have two options: (1) to copy private equity’s model, as investment companies Wendel and Eurazeo have done with dramatic success, or (2) to take a flexible approach, holding businesses for as long as they can add value as owners. The latter would give companies an advantage over funds, which must liquidate within a preset time—potentially leaving money on the table. Both options present public companies with challenges, including U.S. capital-gains taxes and a dearth of investment management skills. But the greatest barrier may be public companies’ aversion to exiting a healthy business and their inability to see it the way private equity firms do—as the culmination of a successful transformation, not a strategic error.

Match with the search results: Equity measures the amount of money that would be returned to shareholders if the business liquidated its assets and paid off its liabilities….. read more

13. What is equity in Business?

Author: www.sfu.ca

Date Submitted: 01/12/2020 06:35 AM

Average star voting: 3 ⭐ ( 11657 reviews)

Summary: Equity is what you as the business owners have. It is the ownership interest and a net value of the business with debt taken out.

Match with the search results: Equity represents the value that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debts were paid off ……. read more

14. What is equity in a business? | Eqvista

Author: grasshopper.com

Date Submitted: 07/25/2019 11:52 PM

Average star voting: 5 ⭐ ( 83956 reviews)

Summary: Equity in business means the value of ownership. Business equity is the value of the assets less liabilities in your business.

Match with the search results: So, what is equity in a business? Business equity is the value of your assets after deducting your business’s liabilities. As a business owner, ……. read more

15. 5 benefits of equity finance for growing businesses – British Business Bank

Author: hbr.org

Date Submitted: 03/23/2020 12:40 PM

Average star voting: 4 ⭐ ( 26472 reviews)

Summary: If your business is ready to grow, equity finance could help you. Here, we outline the benefits of this type of finance and how it supports growth.

Match with the search results: Equity is the amount of money that a company’s owner has put into it or owns. On a company’s balance sheet, the difference between its liabilities and assets ……. read more

16. What is Equity Financing & How Can it Help Your Startup Business

Author: www.cstproperties.com

Date Submitted: 03/24/2019 03:08 PM

Average star voting: 4 ⭐ ( 42102 reviews)

Summary: Equity financing is a means of financing a venture through giving away equity or shares in your company in return for funding. Learn about it at Angel Investment Network.

Match with the search results: Equity is a measure of a company’s total assets minus total liabilities. In the case of the company’s liquidation, the equity is the amount ……. read more

17. Small business equity financing | Start Up Loans

Author: eqvista.com

Date Submitted: 12/13/2021 07:37 AM

Average star voting: 4 ⭐ ( 81827 reviews)

Summary: If you can’t fund your business with your own money, you’ll need to attract investors. For some startups, equity financing could be the key.

Match with the search results: Business equity is the value of the shares that a company issues to its investors. Since companies require money to support their operations ……. read more

18. What does it mean to have equity in a company?

Author: www.british-business-bank.co.uk

Date Submitted: 11/14/2021 07:00 PM

Average star voting: 3 ⭐ ( 51938 reviews)

Summary: A comprehensive understanding of what equity is and how it works

Match with the search results: The equity meaning in business is the amount of money that could be returned to a company’s shareholders if all its assets were liquidated and ……. read more

19. Service Unavailable | Error | SmartAsset.com

Author: en.wikipedia.org

Date Submitted: 07/16/2019 12:09 AM

Average star voting: 4 ⭐ ( 92229 reviews)

Summary:

Match with the search results: In business, the term equity refers to the ownership interest that shareholders have in a company. Equity represents the residual value of a company after ……. read more

20. Building Business Equity and Growing Value | Seacoast BankNote

Author: www.australianinvestmentnetwork.com

Date Submitted: 06/19/2021 05:58 AM

Average star voting: 4 ⭐ ( 11135 reviews)

Summary: Creating a saleable business includes strategic planning that allows you to offer business equity beyond your main asset (product or service) to a buyer.

Match with the search results: A company’s equity means how many of its component assets are owned by the company, rather than leveraged with [debts]like business loans, vehicle financing, ……. read more

21. How to Calculate the Owner’s Equity in a Business

Author: www.startuploans.co.uk

Date Submitted: 08/26/2021 02:29 PM

Average star voting: 4 ⭐ ( 78180 reviews)

Summary: Owner’s equity is the book value of a business as it appears on financial statements such as a firm’s balance sheet. First, you must find the total assets and liabilities of the business. The owner’s equity is calculated by subtracting the total liabilities from the total assets owned by the firm.

Match with the search results: . It’s the total amount of money that would be returned to your shareholders if your debt was paid off and your assets were liquidated….. read more

22. What is Business Equity? Learn What is Equity Meaning in Business

Author: republic.com

Date Submitted: 03/20/2021 07:47 AM

Average star voting: 3 ⭐ ( 91427 reviews)

Summary: Equity in business is a critical part of your accounting, and knowing how to use financial reports is essential for any business owner. Read this in-depth article to learn more.

Match with the search results: Equity measures the amount of money that would be returned to shareholders if the business liquidated its assets and paid off its liabilities….. read more

23. 3 Key Types of Private Equity | HBS Online

Author: smartasset.com

Date Submitted: 09/22/2020 06:00 PM

Average star voting: 5 ⭐ ( 71201 reviews)

Summary: There are 3 key types of private equity: venture capital, growth equity, and buyouts. Here’s a closer look at each so you can build strong portfolios.

Match with the search results: Equity represents the value that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debts were paid off ……. read more

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)