The 7 Most Popular Types of Business Structures | Volusion

Looking to start your own business? You’re onto something big—entrepreneurs like yourself are fueling the economy. But business ownership comes in more forms than most people realize. If you’re looking to start, own, or co-own a business, your first step is to understand the different types of business setups.

Although there are several different types of businesses, choosing one doesn’t need to be difficult. If you’re starting your own business, you’ll want to create a business plan to help you better outline your goals before committing to one. To help you get started, we’ll explain the seven most common types of business so you can decide what type of business to register as.

7 Types of Business Structures to Choose From

- Sole Proprietorship

- General Partnership

- Limited Partnership (LP)

- Corporation

- Limited Liability Company (LLC)

- Nonprofit Organization

- Cooperative (Co-op)

Mục Lục

What is the difference between types of businesses?

Here is a detailed breakdown of different types of business according to nature or purpose:

1. Sole Proprietorship

A sole proprietorship is a business owned and operated by a single person, and requires no registration. If you’re operating a one-person business, you’re automatically considered a sole proprietor by the government. However, depending on your products and location, you may need to register for local business permits with your city or state.

One important thing to note is that there isn’t a legal or financial distinction between the business and the business owner. This means that you as the business owner are accountable for all of the profits, liabilities, and legal issues that your business may encounter. This is not typically an issue as long as you pay your bills and keep your business practices honest.

Sole proprietorships are the most common type of online business due to their simplicity and how easy they are to create. If you’re starting an ecommerce business by yourself, a sole proprietorship is probably the best type of business for you. If you’re starting a business with one or more partners, keep reading.

2. General Partnership

A General Partnership is a business owned by two or more people who share responsibilities and profits. A partnership with another individual offers many benefits—you can pool resources and knowledge with another, secure private funding, and more. Just keep in mind that within a general partnership, responsibilities and liability are split equally among each member.

A partnership does require that you register your business with your state and establish an official business name. After that, you’ll be required to obtain a business license, along with any other documentation that your state office can help you with. Beyond that, you’ll also need to register your business with the IRS for tax purposes.

Although this may seem like a complicated process, there are lots of benefits to a partnership, so if you’re looking to have a co-owner, don’t be afraid to go for it—many online companies are formed using partnerships. Having someone to help share the work of starting a new business is definitely worth the extra paperwork.

3. Limited Partnership (LP)

A limited partnership, or LP, is an offshoot version of a general partnership. With a limited partnership, there are two sets of partners: The General Partner and the Limited Partner. The general partner is usually involved in the everyday business decisions and has personal liability for the business. The limited partner (typically an investor) is not liable for debts and doesn’t partake in regular business management of the company.

While it may not be as common, it’s a great bet for businesses who are looking to raise capital from investors who aren’t interested in working the day-to-day aspects of your operations. Just like a general partnership, if you enter a limited partnership agreement, you’ll need to register your business with the state, establish a business name, and inform the IRS of your new business.

Again, this option is the most common for those looking for investment dollars, so keep that in mind when exploring your partnership options.

4. Corporation

A corporation is a fully independent business that’s made up of multiple shareholders who are provided with stock in the business. The most common is what’s known as a “C Corporation,” which allows your business to deduct taxes much like an individual—the caveat being that your profits will be taxed twice, both at the corporate level and at the personal level.

Don’t let this fact deter you, however—this is extremely common, and if you currently work for a company with multiple employees, that’s likely the business structure they’re using. You’ll need to file very specific documents with the state, followed by obtaining the appropriate business licenses and permits.

If you’re starting off as a smaller business—particularly one that only operates online—declaring yourself as a corporation wouldn’t be appropriate. However, if you’re already an established business with several employees, listing your company as a corporation might be the correct move.

5. Limited Liability Company (LLC)

A Limited Liability Company, better known as an LLC, is a mixture of a partnership and a corporation, designed to make it easier to start small businesses. It is also one of the most popular business types for startups. Instead of shareholders, LLC owners are referred to as members. No matter how many members a particular LLC has, there must be a managing member who takes care of the daily business operations.

The main difference between an LLC and a corporation is that LLCs aren’t taxed as a separate business entity. Instead, all profits and losses are moved from the business to the LLC members, who report profits and losses on a personal federal tax return.

The nice thing about pursuing an LLC is that members aren’t personally liable for business decisions or actions of the company in question, and there’s far less paperwork involved in creating an LLC as compared to a corporation. LLCs are another of the most common types of online businesses, since they allow small groups of people to easily form a company together.

6. Nonprofit Organization

A nonprofit organization is a type of business that’s intended to promote educational or charitable purposes. The “non-profit” aspect comes into play in that any money earned by the company must be kept by the organization to pay for its expenses, programs, etc.

Keep in mind that there are several types of nonprofits available, many of which can receive “tax exempt” status. This process requires filing paperwork, including an application, with the government for them to recognize you as a nonprofit organization. Depending on the parameters of your new business, they’ll be able to tell you which category you best fall under.

7. Cooperative

The last on our list is a cooperative, which is a business that’s fully owned and operated for the benefit of the members of the organization that use its services. In other words, whatever is earned by the cooperative is then shared among the members themselves, and isn’t required to be paid out to any external stakeholders, etc.

Unlike other types of businesses that have shareholders, cooperatives sell shares to cooperative “members,” who then have a say in the operations and direction of the cooperative itself. The main difference in the process of becoming a cooperative as opposed to the other types of businesses listed is that your organization must create bylaws, have a membership application, and have a board of directors with a charter member meeting.

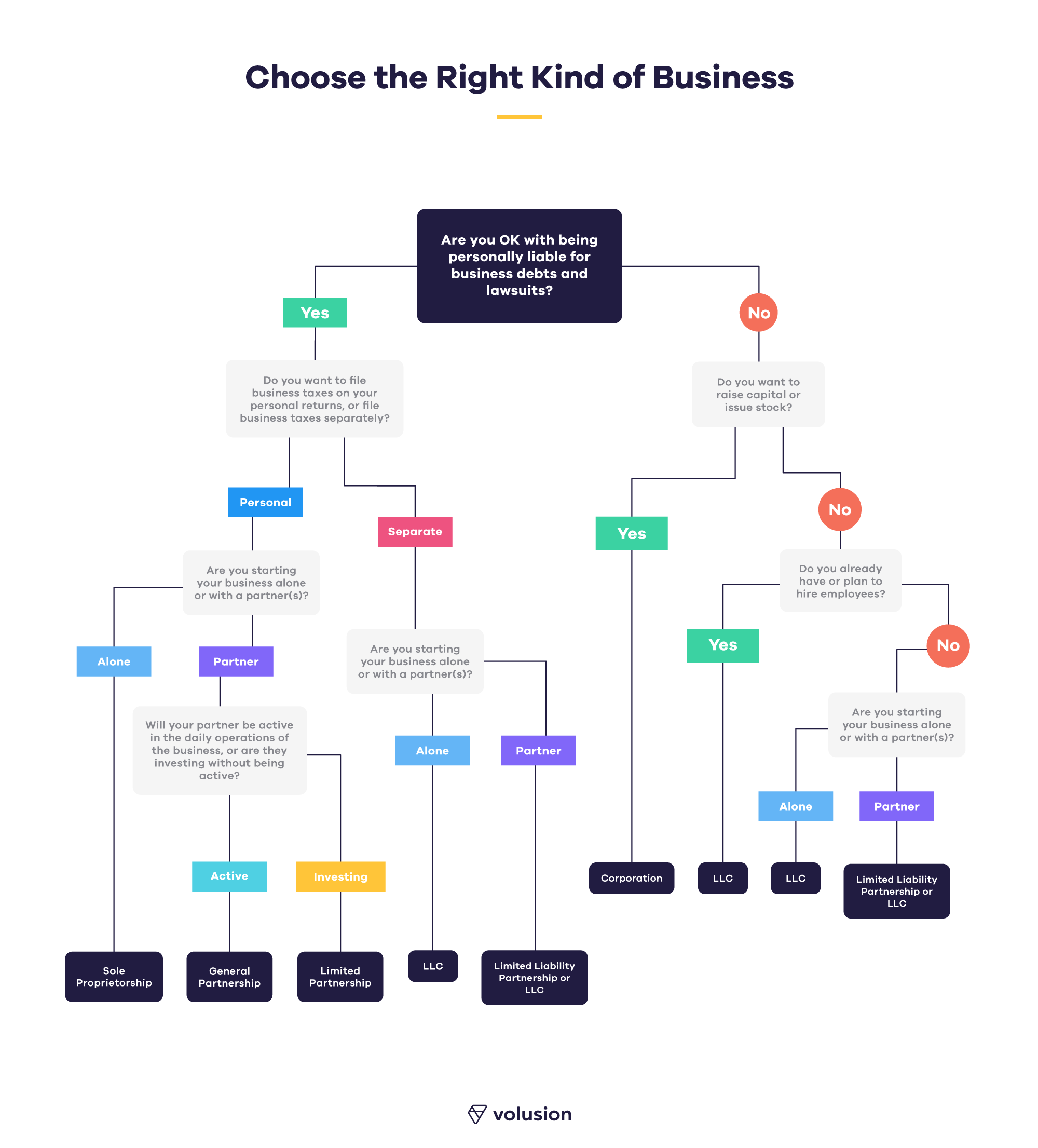

What should you know before choosing a business type?

A startup’s choice of business structure can have long-lasting effects on the way the business is run and operates, including how it files taxes and whether it can hire employees. Here are some questions you’ll need to ask yourself to help you choose a business structure that is right for your startup.

How much debt and liability are you comfortable with?

Most small businesses and startups accept the personal liability associated with a sole proprietorship or partnership as a necessary risk of doing business. If you’re in a high-risk industry (such as selling CBD or firearms online) or simply want to keep your business and personal matters private, you can limit personal liability by filing for a more formal business structure. The downside is that this typically takes more paperwork, costs more, and may have greater reporting or upkeep requirements than simpler business types.

How do you prefer to file taxes?

To oversimplify, you have two options when it comes to filing your business taxes: you can file business profits/expenses on your own personal tax returns, or you can have your business file taxes separately as its own entity. Most small business owners prefer the simplicity of filing taxes on their own returns, but filing business taxes individually can help you keep your personal and business finances separate.

Do you have a partner or investor?

If you’re starting your business with a partner or private investor, you won’t be able to form a sole proprietorship. You can choose between a partnership (where all responsibilities and liability are shared equally), a limited partnership (which lets you dictate responsibilities and liabilities for individual members), or an LLC (to protect all members from personal liability).

Do you plan to hire employees?

Some of the simplest business types—like sole proprietorships—can make it difficult to hire employees down the road. While it’s possible to change your business type to grow with your business, if you already have employees or plan to hire employees, it may be better to future-proof with a more formal business structure like an LLC or corporation.

Are you starting your business for profit or to help a cause?

If you’re just concerned with helping others and aren’t operating for profit, forming a nonprofit can grant you tax-exempt status—although there’s a lot of paperwork required.

Will your company be owned and operated democratically by its members with no single owner?

Cooperatives are one of the least common types of online businesses, although online cooperatives do exist, such as the outdoor goods store REI.

After you have decided which type of business is best for your startup, the next steps are dependent on your state and local laws and ordinances; for example, you may need to fill out additional forms specific to your location and type of business. Many resources recommend using the Small Business Association for your state as the starting point.

Finally, check your local and state laws regarding running a business out of your home, as zoning laws can sometimes be an important factor in deciding which type of business you want to create.

Final Thoughts

Every ecommerce business is different, so there is no “best” form of business organization to start as. Sit down and thoroughly review your business plan to determine what the long-term future looks like for your company. This will better help you decide which kind of business to pursue, based on the needs of the business itself.

Ready to start building your own online business? Volusion is the quickest and easiest way to start your own online store. With beautiful, free, and fully customizable themes, Volusion lets you build the business you’ve been dreaming of without coding or design experience. Try a 14-day free trial of our all-in-one ecommerce website builder now and see how simple it can be.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)