Temporary Car Insurance | Short Term Car Insurance | Tempcover

Temporary car insurance is the ideal insurance choice for drivers looking for more flexible, cost-effective options from their car insurance.

Temporary car insurance can help you get the cover you need for the time you want and is unbelievably quick and easy. We’ll compare prices from our panel of insurers and show you the cheapest price so you’re insured and the road in minutes.

Mục Lục

What is temporary car insurance?

Temporary car insurance is time-limited cover that’s ideal for when you need to borrow a car, pick up a new vehicle or just share a long drive. Whenever you need to use a car that you’re not already insured to drive, temporary cover is the flexible and affordable option.

How does short term car insurance work?

Short term car insurance gives you fully comprehensive car insurance for a duration that suits you. Temporary car cover is available hourly, daily, weekly, or monthly cover.

To get short term insurance, you just need to tell us a few details about the car and drive and choose when you want your cover to begin and for how long.

The details you will need:

-

The car’s reg number

-

Your details

(name, address, D.O.B etc)

-

Your licence type and how long you’ve held it

-

The value of the vehicle

-

Your email/phone number

(to send policy documents)

-

When you’d like the policy to start and end

What does temporary car insurance cover?

With comprehensive cover as standard on temporary car insurance, you’re covered for any damage to yourself, your car and/or any third parties involved in an accident.

What’s covered with short term car insurance

What’s not covered with short term car insurance

Fully comprehensive insurance on policies from 1 hour to 28 days

The excess you agreed to pay

Accidental and malicious damage to your car

Release from an impound (unless you buy a specific temporary impounded vehicle policy)

Legal liabilities for injury or damage to another person or their property

Additional drivers – we can only cover the driver named on the policy

Driving in the UK, and in some instances driving in the EU

Tempcover works with a panel of insurers to ensure we can provide temporary car insurance for as many drivers as possible. Because of this, full details of cover may differ depending on the insurer. Please double-check the policy wording before purchasing to confirm what is specifically covered in your policy.

Why might I need temporary car insurance?

- It’s flexible. With many of us driving less right now, get the right cover for when you’re actually driving with no long term commitments.

- It’s cost-effective. When all you need is a few days or weeks insurance, save money by only paying for what you need with short term car insurance.

- It’s fast. Getting a temporary car insurance quote is super quick. It takes just 90 seconds online or even quicker in the Tempcover app.

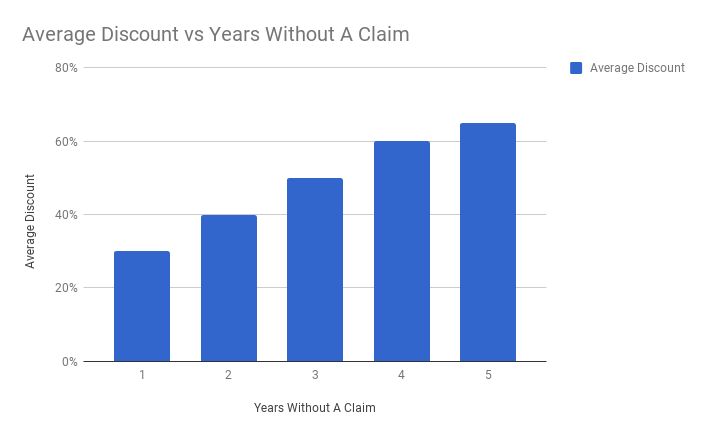

- No impact on No Claims Discount.

Get the highest level of cover available and peace of mind that there’s no impact on existing No Claims Discount.

A big No Claims Discount can take years to build. With temporary car insurance cover, you save in the long and short term!

Handy Tip – Not sure when you’ll be driving next? Rather than declaring your vehicle as SORN, insure your car for when you need it with temporary car insurance. As long as the vehicle is taxed and on private property, short term car insurance is a great alternative.

Whether you need hourly temporary car insurance, one day temporary car insurance, temporary weekly car insurance, or monthly temporary car insurance, you get the cover you need for the time you want.

Whether you’re borrowing a car, sharing the drive for a couple of days or a weekend away and need 2 day temporary car insurance or temporary car insurance for the weekend, you can find a temporary car insurance policy to suit.

It’s designed to suit those occasions when you need some flexibility from your insurance. Students home from university can find temporary car insurance for students and even young drivers can get cover for when they actually need it with temporary car insurance for young drivers.

Is temporary car insurance expensive?

Most drivers can find cheap temp car insurance with Tempcover because they’re only paying for the duration they need.

The cost of temporary car insurance can differ though, depending on the details you enter. As with any insurance, the price of your policy depends on several factors known as risk factors.

These factors are calculated by our panel of insurers to determine the risk of the details entered and therefore how much your policy should be.

Some of the factors that can impact the cost of your policy include:

- Your vehicle

- Your vehicle’s value

- Your driving history

- Your age

- Your location

Starting with your vehicle, this impacts the cost of your insurance because your insurer will want to know how much it would cost to repair or replace your vehicle, should it be involved in an accident or be written off.

Insurers will also want to know where you live as this is where most of us spend our time driving. If you live in an area that has a high crime or accident rate, you will likely have to pay more to cover the increased chances of you being involved in an incident.

There are a few factors about yourself that insurers will use to calculate your premium. Your driving history can indicate how experienced you are and your age again will give an indication of potential risk based on your years of experience.

Unfortunately, it is all too true that young drivers must pay more for their insurance. This is because new, young drivers are often inexperienced and have more accidents.

To reduce the cost of insurance, young drivers can look to temporary car insurance for cheaper cover as drivers can get cover as and when they need it. Students can also benefit from short-term cover with student car insurance.

Young drivers can also help cut the cost of insurance by opting for a cheaper, safer vehicle when looking for their first car.

It’s important to remember that while there are steps you can take to reduce the cost of cover, including opting for cheaper vehicles and by buying specific cover for the time you need, entering false information can lead to cancellation of cover and claims not being paid out.

If you’re looking for even cheaper temporary car insurance, be sure to opt-in to our email and SMS mailing lists when getting a quote. This is where we send news of our latest offers including discounts on temporary car insurance.

Am I eligible for temporary car insurance?

To get temporary car insurance cover, you must

To get temporary car insurance cover, your car must

Be aged 17-78 years old

Be valued between £1,500 and £65,000

Hold a UK or EU driving licence

Be in a roadworthy condition with a current and valid MOT (unless you are using the insurance policy to take the vehicle to a pre-booked MOT)

Have been a permanent UK resident for the last 12 months or a British expatriate

The vehicle must be taxed (unless you are using the insurance policy to obtain tax for the vehicle immediately after purchase)

Have no more than 7 licence points in the last 3 years

Not be modified in any way except for those designed to aid disabled drivers

Have not been disqualified from driving for the last 2 years

Be a right-hand drive car

Have had no more than 2 fault claims in the last 3 years

Have no more than 8 seats

Have no criminal convictions

Not be declared SORN

Not have had a previous policy of insurance declared void by an insurer

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)