Starting a business: A license and permit checklist

Once your business gets funding, it’s tempting to jump at the chance to sell goods or provide services. But forming a company is only half the battle. You may need business licenses to operate depending on your location and field. Business permits give owners the right to work legally in their city, county, or state.

The licenses you’ll need vary wildly from place to place and between industries. While applying for permits may sound daunting, you stand to gain from the legal and financial benefits they afford. To help get your business started, we’ll explain how to get a business license and provide a checklist of standard permits.

Mục Lục

What is a business license?

Business licenses secure a company’s right to operate. Most permits come from local, state, or federal agencies. In other cases, universities and professional training programs issue certifications.

To break it down further, going through a business license application means:

- You can legally run your business.

- You’re up to date on health and safety guidelines.

- You meet the legal and educational standards in your area.

How do you get a business license?

No two businesses share the same legal requirements. Even the same licenses come with different criteria across state or county lines. But by following these five steps, you can set yourself up to earn any certifications.

1. Register your business

Before getting a license, you must establish your business as a legal entity. If you apply too early, you may have to prematurely replace or amend the permits you applied for. To get a company off the ground, you should choose its structure and register with government agencies.

Common business structures include:

- Sole proprietorships

- General partnerships

- Limited liability companies (LLCs)

- Corporations

- Nonprofit corporations

LLCs, corporations, and nonprofits have to file with their state governments. Sole-proprietor and general partnership guidelines vary on a state-by-state basis. Your city and county may request separate registration as well. Check-in with your Secretary of State’s office to learn your requirements.

2. Apply for a tax ID

Companies can’t run without a tax ID. Sole proprietors can file taxes with a Social Security number (SSN) or an Employer Identification Number (EIN). Any business with more than one owner or employee must file with an EIN. You can apply via mail or the IRS website.

3. Research the permits you need

Some counties and states let sole proprietors and general partnerships run without a permit. But more often than not, you’ll at least need a general business license. Contact your state’s secretary of state or local Small Business Administration office for more details.

Many fields go further and request licenses from universities or professional institutions. You’ll need certification to practice in these fields, among others:

- Medical care

- Auto repair

- Real estate sales

- Tax services

- Insurance sales

- Cosmetology

- Law

4. Prepare your business documents

There’s no tried and true list of materials for every permit application. So before you apply for a business license, gather your firm’s documents. From there, most applications request these forms and items:

- The filing fee

- Your business tax ID

- A description of the company, its location, and its activities

- Founding documents

- Copies of corporate records, including bylaws and articles of incorporation

- A list of owners, investors, or managers allowed to sign agreements on the business’s behalf

- Audited financial statements

- Relevant insurance information

- The educational or professional certifications needed to perform your service

5. Apply for your license

You may have to apply for multiple licenses with different local, state, and federal agencies. Your secretary of state’s office and local SBA office can direct you to mailing addresses and online portals for filing.

At this stage, you may wonder:

- How much is a business license?

- How long does it take to get a business license?

- Do I need a business license?

Across permits, you’ll get different answers. Application response times range from two weeks to a few months. And while some licenses come at no cost, others go for thousands of dollars.

Finally, depending on where you work, some permits aren’t necessary. Plan the order of your applications with this in mind.

Common types of business licenses

While no business license is universally needed, these permits are some of the most common. Many business owners treat these business license types as a baseline. By getting these certifications, entrepreneurs have room to grow while following legal guidelines.

General business license

Needed for: Legally operating a business in your city, county, or state. Depending on the structure and location of your business, you may not need this license. Not having one, however, could reduce your reach across state lines and funding opportunities.

Where to apply: Your secretary of state’s office, your state’s department of revenue, or a local agency that regulates business in your city or county

Application fee: $50-$300

‘Doing business as’ license or permit

Needed for: Running your company under a fictitious business name (also known as a DBA). DBAs are nicknames for your business. While they don’t serve a legal purpose, they can improve marketing and brand identity.

Where to apply: Your secretary of state’s office, your state’s Department of Revenue, or the county clerk’s office

Application fee: $10-$100

Business tax ID

Needed for: Filing a business tax return. So proprietorships can file with a Social Security number. Multi-person companies need to use an employer identification number (EIN). The IRS offers extra tax deductions to businesses that file with an EIN.

Where to apply: Via mail or the IRS website

Application fee: No fee

Sales tax permit

Needed for: Selling goods and collecting sales tax. In states with no sales tax, you can sell goods and services without this permit. It is also known as a seller’s permit.

Where to apply: Your state’s Department of Revenue

Application fee: $0-$100

Location and land use permits

Some local municipalities require permits to operate out of a specific area. By applying for these permits, you reserve the right to work from your location of choice. Most of these permits come from city or county officials. You can request more specific information from your local city hall.

Zoning permit

Needed for: Operating your business in a designated area. Some owners apply to run out of an area zoned for different types of business. In these cases, you may have to apply for a variance or a conditional-use permit.

Where to apply: Your local building department, zoning authority, land-use agency, city council, or municipal building office

Application fee: $20-$100

Home occupation license

Needed for: Running a business from your home or residential area. Depending on your local and state laws, you may need a home occupation permit to list a home as your primary business location. In other cases, you may need one just to work from home.

Where to apply: Your local building department, zoning authority, land-use agency, city council, or municipal building office

Application fee: A one-time or recurring fee of $25-250 or a percentage of your earnings

Building or construction permit

Needed for: Making any changes to the place where you’ll run your business. Local entities tend to issue these permits more than states. Additionally, each jurisdiction sets unique criteria for what changes call for a license.

Where to apply: Your local building department, zoning authority, land-use agency, city council, or municipal building office

Application fee: $50-$2,000

Sign permit

Needed for: Setting up a sign for your business. Local authorities may also stipulate specific requirements, such as the size of your sign and where you can place it.

Where to apply: Your local building department, zoning authority, land-use agency, city council, or municipal building office

Application fee: $50-$250

Health and safety licenses

You may need additional licenses if your business deals with safety or environmental hazards. Read over these entries to ensure you’re following safety compliance standards. Bear in mind that states tend to offer these permits more than cities or counties.

Health permits

Needed for: Operating a business that involves preparing and handling food. Restaurants, hotels, and hospitals need certification showing they exceed basic health and safety standards.

Where to apply: Your city, county, or state’s local health authority

Application fee: $50-$1,000

Fire department permits

Needed for: Using flammable materials or assembling customers in one enclosed location. Even if your business doesn’t need a license, it should still pass inspections by your local fire department.

Where to apply: Your local fire department

Application fee: $50-$1,000

Environmental licenses

Needed for: Any activities that discharge an environmental contaminant into the air or water. In addition to permit fees, many states impose extra fines based on the cost-per-ton of waste produced.

Where to apply: Your city, county, or state’s local environmental agency

Application fee: An annual fee of hundreds to thousands of dollars

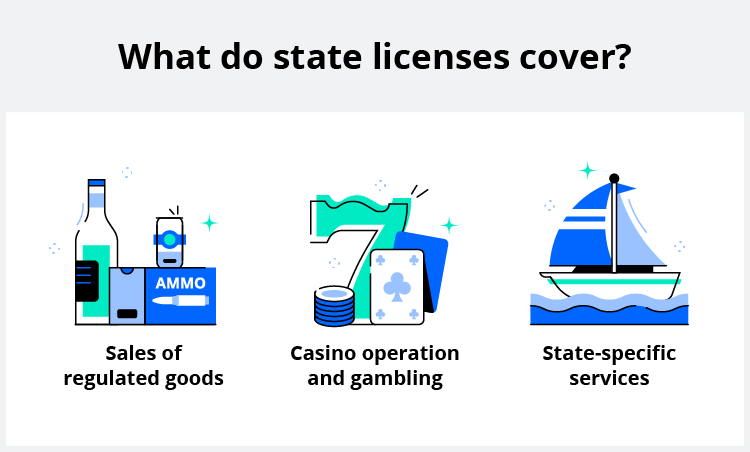

Special state permits and licenses

Many states oversee businesses that sell regulated substances like alcohol, firearms, and lottery tickets. These licenses often show that your business has met specific state-regulated standards. To learn about your state’s special licenses, look into the U.S. Small Business Association or your local small business development center.

Alcohol sales and production

Needed for: Selling alcohol at a bar, restaurant, or retail storefront. Production and transport may also require a permit. On top of your state guidelines, you will also need federal approval to operate your business.

Where to apply: Your state’s alcohol commission or liquor authority

Application fee: $20-$5,00

Casino operation

Needed for: Owning, overseeing, or working at a casino. Some states offer a general license that applies to all casino operations. In other states like Nevada, you need a permit for every individual game and activity.

Where to apply: Your state’s gambling commission

Application fee: $0-$6,000

Special federal permits and licenses

You may need a federal license or permit if your business conducts an activity federal agencies regulate. Examples include the sale or manufacture of firearms, commercial fishing, and the import or export of wildlife.

We’ll outline the most common federal licenses below. Keep in mind that federal agencies offer different permits with varying costs depending on the exact nature of your work.

Agriculture

Needed for: Transporting or producing animals, animal byproducts, biologics, or plants. Even if you aren’t a farmer or rancher, professionals who work with plants or animals in any capacity may need this license.

Where to apply: U.S. Department of Agriculture

Application fee: $100-$250

Alcohol

Needed for: Operating a business that produces, transports, or sells alcohol. You need this federal license in addition to any required state permits.

Where to apply: Alcohol and Tobacco Tax and Trade Bureau

Application fee: No fee

Aviation

Needed for: Operating an aircraft, transporting passengers or cargo via air, and performing maintenance on an aircraft.

Where to apply: Federal Aviation Administration

Application fee: $20-$350

Broadcasting

Needed for: Broadcasting entertainment or information via television, radio, wire, cable, or satellite.

Where to apply: Federal Communications Commission

Application fee: $35-$70

Pharmaceutical drugs

Needed for: Operating or owning a facility that manufactures FDA-approved pharmaceuticals. Selling pharmaceuticals requires additional local permits.

Where to apply: Food and Drug Administration

Application fee: $30,000-$45,000

Fish and wildlife

Needed for: Engaging in wildlife-related activities for your business. These include hunting, transporting animals, and shipping wildlife byproducts.

Where to apply: U.S. Fish and Wildlife Service

Application fee: $50-$150

Firearms, explosives, and ammunition

Needed for: Manufacturing, selling, or shipping firearms, explosives, and ammunition.

Where to apply: Bureau of Alcohol, Tobacco, Firearms, and Explosives

Application fee: $25-$200

Investment advising

Needed for: Providing financial advice on securities to clients.

Where to apply: U.S. Securities and Exchange Commission

Application fee: $40-$225

Maritime transportation

Needed for: Transporting passengers or cargo via sea travel.

Where to apply: Federal Maritime Commission

Application fee: $525-825

Mining and drilling

Needed for: Mining and drilling operations that yield or distribute coal, oil, and other power sources.

Where to apply: Bureau of Safety and Environmental Enforcement

Application fee: $145-$25,000

Nuclear energy

Needed for: Operating a facility that deals with nuclear reactors, materials, or waste.

Where to apply: U.S. Nuclear Regulatory Commission

Application fee: $1,200-$65,000

Preparation of meat products

Needed for: Preparing, handling, or serving meat products at a restaurant or grocery store.

Where to apply: Food and Drug Administration

Application fee: $5,672 per establishment

Transportation and logistics

Needed for: Operating or overseeing the use of overweight vehicles to transport passengers or cargo.

Where to apply: U.S. Department of Transportation and Federal Motor Carrier Safety Administration

Application fee: $0-$300

Leverage your permits

While the time and money needed to apply for business licenses can be steep, the return on investment is even greater. Even if you don’t need a permit to operate, certifications open the door to extra-legal protections, improved credibility, and more funding opportunities.

Remember that most business permits expire after one to three years. So staying on top of licensure will avoid legal trouble or damage to your reputation. At the end of the day, business licenses do more than help you avoid fines. They hold your service to the highest possible standard.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)