How to Start a Business: A Startup Guide for Entrepreneurs [Template]

Learning how to start a business is no small task, but it’s necessary if you want to successfully get your venture off the ground. To help, I’ve put together a complete guide that walks you through the steps of starting a business.

The guide covers every requirement to start a business: from the paperwork and finances to creating your business plan and growing your business online. At the bottom, you’ll find a library of the best free tools and resources to start selling and marketing your products and services.

Use the links below to navigate to each section of the guide.

Let’s get started.

Free Resource

Free Business Plan Template

Fill out the form to access the template.

What Do You Need to Start a Business?

- Business Plan: Your plan is a document that provides in-depth detail about your business and its short- and long-term strategies.

- Business Name: Your name is what you’ll call your company on all official documentation and licenses.

- Business Structure: Your structure refers to the type of leadership and ownership your business will operate under.

- Business Registration: Your registration is a credential with state authorities that allows your business to operate legally.

- Legal Requirements: Your other legal requirements include business licenses and permits beyond the initial registration.

- Funding: Your sources of funding refer to business grants, loans, and personal savings.

Every budding entrepreneur wants more visitors, more qualified leads, and more revenue. But starting a business isn’t one of those “if you build it, they will come” situations. So much of getting a startup off the ground has to do with timing, planning, and the market, so consider if the economic conditions are right to start a company and whether you can successfully penetrate the market with your solution.

In order to build and run a successful company, you’ll also need to create and fine-tune a business plan, assess your finances, complete all the legal paperwork, pick your partners, research apps for startups growth, choose the best tools and systems to help you get your marketing and sales off the ground … and a whole lot more.

This process may feel overwhelming, so we’ll walk you through it step-by-step. But first, let’s summarize what we’ve just learned.

Requirements for Starting a Business

To summarize, the requirements for starting a business are:

- A business plan

- A business name

- An ownership or business structure

- A business registration certificate

- A legal license or seller’s permit (as well as other legal documents)

- A source of funding

Without these elements in place, you unnecessarily risk your new business’s future.

Now that you know what you need, let’s go over the basic steps for starting a business.

How to Start a Business

- Write a business plan.

- Choose a business name.

- Choose an ownership structure.

- Register your business.

- Review and comply with legal requirements.

- Apply for funding.

Having a great business idea is only part of the journey. In order to be successful, you’ll need to take a few steps to get it off the ground. In order to refine your business idea and set yourself up for success, consider doing the following:

1. Write a business plan.

Your business plan maps out the details of your business, including how it’s structured, what product or service you’ll sell, and how you’ll be selling it. Creating a business plan will help you find any obstacles on the horizon before you jump into running a business.

Jump to: How to Start a Business Plan →

2. Choose a business name.

Your business name is an essential part of your new business. It determines what you’ll call it on official documentation and on the business plan you’ll share with investors. Because your name will stem off your business plan and offerings, it’s best to create it after you’ve written a plan.

Jump to: How to Decide on a Company Name →

3. Choose an ownership structure.

Your business’ legal structure can impact what you’re liable for and the taxes you pay. The most common types of business structures are sole proprietorship, partnership, limited liability company, and corporation. In the process of starting a business, you’ll need to choose the most appropriate one for you.

Jump to: How to Choose an Ownership Structure →

4. Register your business.

Registering your business is the next step after choosing an ownership structure. That way, you can ensure you’re operating within the most essential legal constraints.

Jump to: How to Register Your Business →

5. Review and comply with legal requirements.

In addition to choosing a legal structure and registering your business, there are other requirements to follow to ensure your business is operating legally, including acquiring any business licenses and permits. Licensure requirements depend on industry — for instance, if you’re planning to found a construction firm, you’ll need the appropriate construction permits.

Jump to: How to Comply with Legal Requirements →

6. Apply for funding.

When you’re starting a small business, getting loans from family and friends may suffice. However, larger ventures will require more capital.

Startup funding is essential regardless of the type of business you’re creating. Whether you leverage loans, grants, or family and friends, having solid funds will allow you to more effectively and economically launch your business.

Jump to: How to Find Funding for Your New Business →

As evidenced by this list, starting a business involves a whole lot of moving pieces, some more exciting than others. Brainstorming business names? Fun! Filing taxes? … Not so fun. The trick to successfully getting your business off the ground is to meticulously plan and organize your materials, prioritize properly, and stay on top of the status and performance of each one of these moving parts.

From registering with the government to getting the word out about your business to making key financial decisions, you’ll need to take a wide range of steps to start a successful business.

Now that we’ve gone over an overview of the steps, let’s go over each one in detail.

How to Start a Business Plan

- Use a business plan template.

- Narrow down what makes you different.

- Keep it short.

- Write an executive summary.

- Describe your company and business model.

- Analyze your market’s conditions.

- Explain your product and/or service.

- Outline all operations and management roles.

- Design a marketing and sales strategy.

- Detail a financial plan with business costs, funding, and revenue projections.

- Summarize the above with an appendix.

- Review section examples for inspiration.

Having a solid business plan can help your business stay on track, especially when obstacles arise. But before we go over the steps of writing one, let’s answer an essential question first: What exactly is a business plan?

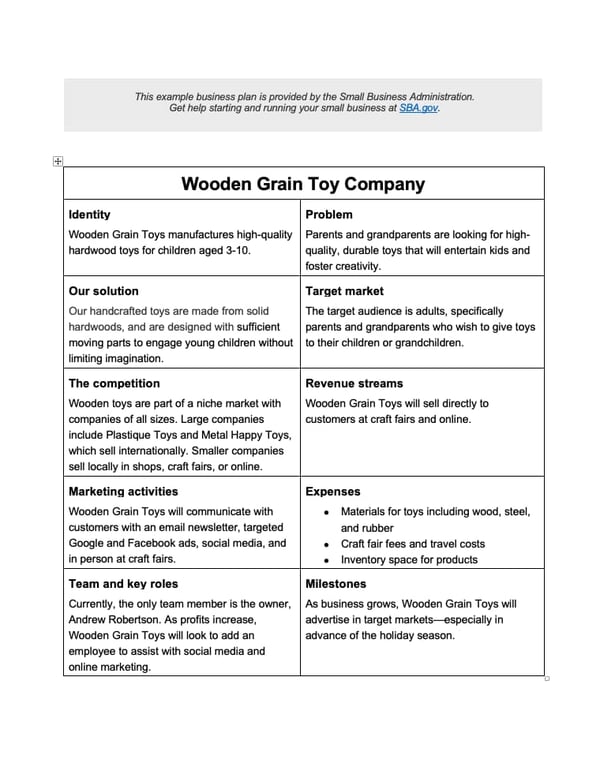

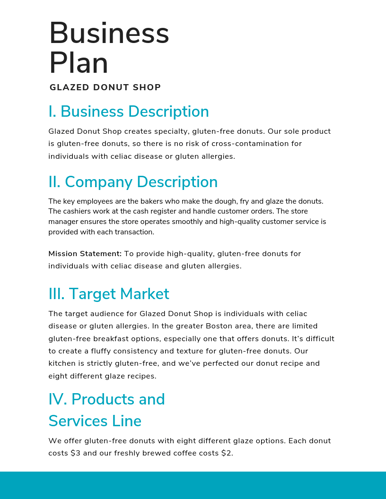

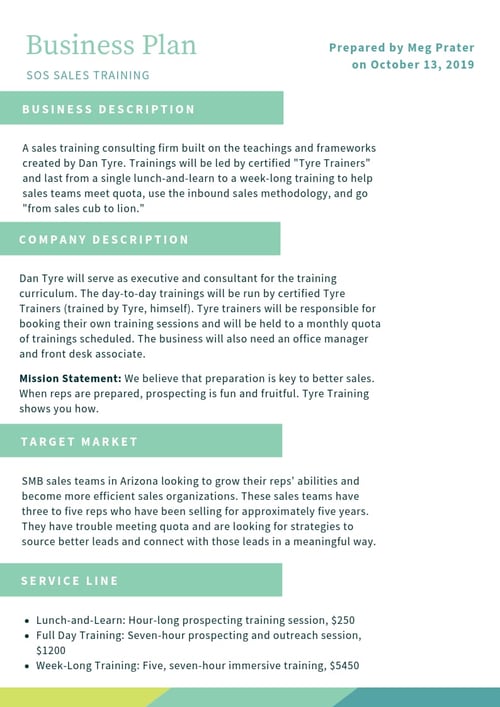

A business plan is a living document that maps out the details of your business. It covers what your business will sell, how it will be structured, what the market looks like, how you plan to sell your product or service, what funding you’ll need, what your financial projections are, and which permits, leases, and other documentation will be required.

Image Source

Image Source

At its core, a business plan helps you prove to yourself and others whether your business idea is worth pursuing. It’s the best way to take a step back, look at your idea holistically, and solve for issues years down the road before you start getting into the weeds.

Below are the key elements in a business plan template, details about what goes into each of them, and example sections at the bottom. You’ll also learn tips for writing a business plan.

1. Use a business plan template.

Before you begin your business plan, download this business plan template. It provides an outline for you to follow and simplifies the process.

The first steps are to create a cover page, and write a description of your business that outlines your product or service and how it solves a need for your customers. The next step is to work on the company description, which provides detail on how your company will be organized and includes the mission statement.

In the next section of the business plan template, you’ll identify your target audience or buyer personas. Through research, surveys, and interviews, you’ll understand who wants your product, why they’re interested, and what problem your offering solves for them.

The next step is to describe your line of products and services in detail, including the pricing model, and the advantage you have over competitors.

From there, you’ll write down your plan to market and sell your product or service. You’ll also identify your growth plan and set targets and measures for your marketing and sales activities.

Then, you’ll determine which legal structure your business will have (LLP, sole proprietorship, etc.), and if there are any other legal factors you need to consider (e.g., permits, licenses, health codes).

Finally, financial projections will be made, and short-term and long-term goals will be set for the business.

2. Narrow down what makes you different.

Before you start whipping up a business plan, think carefully about what makes your business unique first. If you’re planning to start a new athletic clothing business, for example, then you’ll need to differentiate yourself from the numerous other athletic clothing brands out there.

What makes yours stand out from the others? Are you planning to make clothing for specific sports or athletic activities, like yoga or hiking or tennis? Do you use environmentally friendly material? Does a certain percentage of your proceeds go to charity? Does your brand promote positive body image?

Understanding your brand’s positioning in the market will help you generate awareness and sales.

Remember: You’re not just selling your product or service — you’re selling a combination of product, value, and brand experience. Think through these big questions and outline them before you dive into the nitty-gritty of your business plan research.

3. Keep it short.

Business plans are more short and concise nowadays than they used to be. While it might be tempting to include all the results of your market research, flesh out every single product you plan to sell, and outline exactly what your website will look like, that’s actually not helpful in the format of a business plan.

Know these details and keep them elsewhere, but exclude everything but the meat and potatoes from the business plan itself. Your business plan shouldn’t just be a quick(ish) read — it should be easy to skim, too, like the example below.

Now that we’ve gone over the first essential steps of building your business plan, it’s time to jump into the creation process.

4. Write an executive summary.

The purpose of the executive summary is to give readers a high-level view of the company and the market before delving in to the details.

Pro Tip: Sometimes it’s helpful to write the executive summary after you’ve put together the rest of the plan so you can draw out the key takeaways more easily.

The executive summary should be about a page long. It should cover:

- Overview: Briefly explain what the company is, where you’ll be located, what you’ll sell, and who you’ll sell to.

- Company Profile: Briefly explain the business structure, who owns it and what prior experience/skills they’ll bring to the table, and who the first hires might be.

- Products or Services: Briefly explain what you’ll sell.

- The Market: Briefly explain your main findings from your market analysis and product market fit.

- Financial Considerations: Briefly explain how you plan to fund the business and what your financial projections are.

5. Describe your company and business model.

Next, you’ll have your company description. Here’s where you have the chance to provide the following information:

- A summary of what your company does

- A mission statement

- A description of your business structure and business owner

- A description of your location

- A list of the marketplace needs that your business is trying to meet

- A detailed account of how your products or services actually meet those needs

6. Analyze your market’s conditions.

One of the first questions to ask yourself when you’re testing your business idea is whether it has a place in the market. The market will ultimately dictate how successful your business will be. What’s your target market, and why would they be interested in buying from you?

Get specific here. For example, if you’re selling bedding, you can’t just include everyone who sleeps in a bed in your target market. You need to target a smaller group of customers first, like teenagers from middle-income families.

From there, you might answer questions like:

- How many teenagers from middle-income families are currently in your country?

- What bedding do they typically need?

- Is the market growing or stagnant?

Include both an analysis of research that others have done, as well as primary research that you’ve collected yourself — whether by customer surveys, interviews, or other methods.

This is also where you’ll include a competitive analysis. In our example, we’d be answering the question: how many other bedding companies already have a share of the market, and who are they?

Outline the strengths and weaknesses of your potential competitors, as well as strategies that will give you a competitive advantage.

7. Explain your product and/or service.

Here’s where you can go into detail about what you’re selling and how it benefits your customers. If you aren’t able to articulate how you’ll help your customers, then your business idea may not be a good one.

Start by describing the problem you’re solving. Then, go into how you plan to solve it and where your product or service fits into the mix. Finally, talk about the competitive landscape: What other companies are providing solutions to this particular problem, and what sets your solution apart from theirs?

8. Outline all operations and management roles.

Use this section to outline your business’ unique organization and management structure, while keeping in mind that you may change it later. Who will be responsible for what? How will tasks and responsibilities be assigned to each person or each team?

Includes brief bios of each team member and highlight any relevant experience and education to help make the case for why they’re the right person for the job. If you haven’t hired people for the planned roles yet, that’s OK — just make sure you identify those gaps and explain what the people in those roles will be responsible for.

9. Design a marketing and sales strategy.

This is where you can plan out your comprehensive marketing and sales strategies that’ll cover how you actually plan to sell your product. Before you work on your marketing and sales plan, you’ll need to have your market analysis completely fleshed out, and choose your target buyer personas, i.e., your ideal customers. (Learn how to create buyer personas here.)

On the marketing side, you’ll want to cover answers to questions like:

- How do you plan to penetrate the market?

- How will you grow your business?

- Which channels will you focus on for distribution?

- How will you communicate with your customers?

On the sales side, you’ll need to cover answers to questions like:

- What’s your sales strategy?

- What will your sales team look like, and how do you plan to grow it over time?

- How do you plan to scale for growth?

- How many sales calls will you need to make to make a sale?

- What’s the average price per sale?

Speaking of average price per sale, you’ll want to go into your pricing strategy as well.

10. Detail a financial plan with business costs, funding, and revenue projections.

Outline your financial model in detail, including your start-up cost, financial projections, and a funding request if you’re pitching to investors.

Your start-up cost refers to the resources you’ll need to get your business started — and an estimate of how much each of those resources will cost. Are you leasing an office space? Do you need a computer? A phone? List out these needs and how much they’ll cost, and be honest and conservative in your estimates. The last thing you want to do is run out of money.

Once you’ve outlined your costs, you’ll need to justify them by detailing your financial projections. This is especially important if you’re looking for funding for your business. Make sure your financial model is 100% accurate for the best chance of convincing investors and loan sources to support your business.

11. Summarize the above with an appendix.

Finally, consider closing out your business plan with an appendix. The appendix is optional, but it’s a helpful place to include your resume and the resume(s) of your co-founder(s), as well as any permits, leases, and other legal information you want to include.

12. Review section examples for inspiration.

Let’s go over examples of the sections in a business plan, so that you have an idea of how to approach your own. We’ll use a business plan for a fictional art supply store named NALB Creative Center.

Executive Summary Example

“NALB Creative Center (NCC) is the place where artists meet. NALB is an acronym for “No Artist Left Behind,” with our company by-line stating: “Live Your Art.” NCC is a specialty retail store offering a large array of artists’ materials and supplies, crafters’ needs, a gallery, and an education center. NCC will provide a pleasant facility that will inspire and support amateurs, professionals and crafters in the Big Island art community. NALB will sponsor art shows and competitions, art and craft fairs, scholarships for artists to continue their formal education, and other community events. NALB will facilitate, organize and offer creative workshops and classes in a variety of techniques and media.”

Company Summary Example

“NALB Creative Center is a startup, to go into business in the summer of this year. We will offer a large variety of art and craft supplies, focusing on those items that are currently unavailable on this island. The Internet will continue to be a competitor, as artists use websites to buy familiar products. We will stock products that artists don’t necessarily have experience with. We will maintain our price comparisons to include those available online.”

Market Analysis Example

“In West Hawaii, the mauka community of Holualoa in Kona, Kealakekua and South Kona, as well as Waimea and Hawi in Kohala are three communities with large artist populations and galleries. In West Hawaii, the Holualoa Foundation for Arts and Culture, the Society for Kona’s Education and Art, the Kailua Village Artists, the Kona Arts Center, the Waimea Arts Center and other well-established non-profit groups offer arts classes and instruction in various media year-round to children and adults.

“NALB Creative Center will market to four primary customers:

- Professional artists.

- Amateur artists and crafters, including hobbyists.

- Businesses, such as architects, graphic designers, interior designers, or direct mail advertisers.

- Teachers and students.”

Products and Services Example

“NALB Creative Center will provide a wide variety of products of interest to artists and crafters. Our wholesale suppliers will include: Grumbacher, Liquitex, Windsor and Newton, Mabef Easels, Duncan, PrismaColor, Speedball, Masterpiece, Fredrix, Holbein, Rembrandt, and Strathmore. Vendors will include MacPherson and Herr’s. There are thousands of products available, we will offer many that are unusual, or new, as well as the basics that every artist needs on a regular basis. We will offer lines to include bargain, mid-range and professional quality products.”

Personnel Plan Example

“NCC will be operated in the first few years by the owners. Additional part-time help will be provided by family members. As NALB grows over the next years, we will need two additional full-time sales clerks, and two part-time clerks. This will free the owners to concentrate on building the business, and expanding into the other areas of NALB’s vision (tours, competitions, music, gallery, special events, etc.).”

Marketing Plan Example

“Our marketing strategy will focus heavily on customer service with loyalty and retention in sales; on sales promotion, and on niche positioning in the market.

“In addition to price and item promotional announcements, NALB Creative Center will focus its marketing efforts via several key direct-to-consumer advertising vehicles:

“Local and Regional Magazine Publications: (West Hawaii Today, Hilo Tribune-Herald, Hawai’i Island Journal). Each of these papers provide a demographic base that lines up nicely with that of NALB’s.

“Direct Mail Postcards: NALB will look to increase consumer awareness, retain the existing customer base and promote increased sales via postcard mailings. These mailings will be targeted around special events, and are intended to liquidate slow moving products or showcase vendor negotiated specials.”

Financial Plan Example

“The growth of NALB will be moderate and the cash balance will always be positive.

- Being a retail environment, we will not be selling on credit. We will accept cash, checks, Visa and MasterCard.

- Marketing and advertising will remain at or below 5% of sales.

- We will finance growth mainly through cash flow. We recognize that this means we will have to grow slowly.

- It should be noted that the owners of NALB Creative Center do not intend to take any profits out of the business until the long-term debt has been satisfied. Whatever profits remain after the debt payments will be used to finance growth, mainly through the acquisition of additional inventory.”

Check out more business plan examples here.

After you create your business plan, you will likely have a good idea of your business’s strengths, weaknesses, opportunities, and threats. You can therefore strategically create a name for your business that differentiates you from your competition, while still making it clear what you offer to customers and prospects.

That’s why creating a business name often comes after you create your plan.

How to Decide on a Company Name

Naming your business is a little more complicated than making a list and picking your favorite. If you’re using a name other than your personal name, then you need to register it with your state government so they know you’re doing business with a name other than your given name.

To that end, here’s how to decide on a business name and register it with the appropriate authorities.

1. Brainstorm business name ideas.

Strategically choosing the right business name starts with a traditional brainstorming session. For some businesses, this may be a simple, straightforward process, such as simply choosing “[city name] + [service]”, i.e. Atlanta Dentist. This is a good idea for local businesses because it will ensure you’re more visible in local search results.

However, you might want to come up with a unique brand name if you’re running an innovative startup or otherwise launching a business that would benefit from a unique name. No matter what, we recommend coming up with a short, memorable name that’s easy to say and simple to write.

2. Conduct a trademark search.

Next, do a trademark search of your desired name to avoid expensive issues down the road. The search will tell you if another business has registered or applied for the name you’d like to use. Remember: A trademark owner can sue you on reasonable grounds if you use their trademark unlawfully.

3. Make sure the name you want is available in your state.

Before you register, you need to make sure the name you want is available in your state. Business names are registered on a state-by-state basis, so it’s possible that a company in another state could have the same name as yours. This is only concerning if there’s a trademark on the name.

4. Make sure the domain name is available online.

During the name choosing process, you’ll want to envision how the name will look like as a website domain. That’s an easy way to test whether the name is short and memorable enough for someone to recite the website address off the top of their head. For instance, “Carlo’s Homemade Chocolate & Sweets” might sound like a good idea, but that translates to carloshomemadechocolate.com, and that’s not even the full name.

After you’ve envisioned the name as a domain, it’s time to check domain name registrars for availability. There’s nothing worse than coming up with a great business name, and then having to get an adjusted domain, such as “businessname-1.com”, “business-name.com”, or “therealbusinessname.com”. While these aren’t poor choices, it’s best to stick to “businessname.com” for readability and memorability.

Once you’ve found a name that suits you and is available in an unaltered state, register your domain name to ensure no one gets it before you do.

6. File for a trademark if you’ve chosen an original name.

If you’d like, you can trademark your business name for extra protection. A trademark protects words, names, symbols, and logos that distinguish goods and services. Filing for a trademark costs less than $300, and you can learn how to do it here.

7. Register your business name (optional).

You likely won’t need to take an additional step to register your business name. Most times, it will happen automatically.

If you are a new corporation or LLC, your business name will automatically be registered with your state when you register your business, so you don’t have to go through a separate process. There are rules for naming a corporation and LLC, which you can read about here.

If you are a sole proprietorship, partnership, or existing corporation or LLC, register a “Doing Business As” (DBA) name if you want to do business with a name other than your registered name. You can do so either by going to your county clerk office or with your state government, depending on which state you’re in. Learn how to do that here.

If you’re confused about the LLC, corporation, and partnership stuff, not to worry. These are called business structures, and they determine how your business operates from the top-down. Below, we cover how to choose between them.

How to Choose an Ownership Structure

Choosing an ownership structure, also known as your business legal structure or business entity, is one of the key legal requirements you’ll need to fulfill when starting your business.

The four most common business structures are:

1. Sole Proprietorship

A sole proprietorship is a business that’s owned and run by one person, where the government makes no legal distinction between the person who owns the business and the business itself. It’s the simplest way to operate the business. You don’t have to name your business anything other than your own, personal name, but if you want to, you can give it its own distinctive name by registering what’s called a Doing Business As (DBA) name.

Example

A freelance graphic designer running their own business without additional help or with legally outsourced work.

Pros

- It’s easy and inexpensive to create a sole proprietorship because there’s only one owner.

- The owner has complete control over all business decisions.

- Tax preparation is also simple, since a sole proprietorship is not taxed separately from its owner.

Cons

- It can be dramatically more difficult to raise money and get investors or loans because there’s no legal structure that promises repayment if the business fails.

- Since the owner and the business are legally the same, the owner is personally liable for all the debts and obligations of the business.

How Taxes Work

The individual proprietor owns and manages the business and is responsible for all transactions, including debts and liabilities. Income and losses are taxed on the individual’s personal income tax return at ordinary rates. In addition, you are also subject to payroll taxes, or self-employment taxes, on the money you earn. Find IRS tax forms here.

Questions to Determine If It’s Right For You

Will you be the only employee, at least for the foreseeable future?

✅ If yes, this is an excellent option for you.

Are you all right with assuming full liability for the business?

✅ If so, this is a good choice. If not, consider an LLC or corporation instead, which will afford you more protection if the business fails.

2. Partnership

A partnership is a single business where two or more people share ownership, and each owner contributes to all aspects of the business, including shares in the profits and losses of the business.

Example

Multiple doctors maintaining separate practices in the same building.

Pros

- It’s generally pretty easy to form a business partnership, and it doesn’t tend to be super expensive, either.

- Having two or more people equally invested in the business’ success allows you to pool resources.

- You’ll have access to more than one person’s skillset and expertise.

Cons

- Just like a sole proprietor, partners have full, shared liability if the business goes south. Note: There is a variant on partnerships called a limited liability partnership, or LLP, that protects against that.

- Partners aren’t just liable for their own actions, but also the actions of their partner(s).

- When more than one person is involved in decisions, there’s room for disagreement — which means it’s important to have an explicit agreement over how the obligations and earnings will be split.

How Taxes Work

To form a partnership, you have to register your business with your state, a process generally done through your Secretary of State’s office. You will also need to file self-employment taxes for each partner. Find IRS tax forms here.

Questions to Determine If It’s Right For You

Will you be founding the business with any other person, including a family member?

✅ If yes, this is an excellent option for you. A partnership structure is especially beneficial if the other stakeholder is a family member, so that no one goes back on their word.

Are you all right with assuming half liability for the business?

✅ If so, this is a good choice. If not, consider an LLP (limited liability partnership), LLC, or corporation instead, which will afford you more protection if the business fails.

Do you consider yourself to have strong conflict resolution and collaborative skills?

✅ Working in a team and resolving conflicts is an essential aspect of starting a business with a partner. If you’re more of a lone wolf, consider a sole proprietorship instead.

3. Limited Liability Company (LLC)

Limited liability companies (LLCs) are a type of business structure that’s more complex than sole proprietorships and partnerships, but less complex than corporations. They are called “pass-through entities” because they’re not subject to a separate level of tax.

Most states don’t restrict ownership on LLCs, and so members can include individuals, corporations, and even other LLCs and foreign entities. Most states also permit “single-member” LLCs — those having only one owner.

Example

A small design firm owned by one president and staffed by multiple designers and other employees.

Pros

- Owners of an LLC have limited liability, meaning that they personally are not responsible for any financial or legal faults of the business. This reduction in risk is what makes an LLC a very popular business structure.

- They’re simpler to operate than a corporation because they aren’t subject to as many formalities and regulations.

Cons

- LLCs are often more complex than sole proprietorships or partnerships, which means higher initial costs.

- Certain venture capital funds are hesitant to invest in LLCs because of tax considerations and the aforementioned complexity.

How Taxes Work

LLCs have the benefit of a “flow-through” tax treatment, meaning that the owners — not the LLC — are the ones who are taxed. Having only one level of tax imposed makes taxes easier. Find IRS tax forms here.

Questions to Determine If It’s Right For You

Would you prefer to be held minimally liable for the business and its financial outcomes?

✅ If so, an LLC is an excellent choice to protect your personal assets and finances. This is a good choice even if you’re starting a freelance business on your own.

Do you have the budget to pay LLC fees?

✅ LLC registration fees aren’t high, but they’re still an additional expense your business will need to budget for.

4. Corporation

A corporation is a legal entity that is separate and distinct from its owners, and has most of the rights and responsibilities that an individual possesses (to enter into contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes). It’s more complex than the other business structures, and it’s generally suggested for larger, established companies with multiple employees.

Example

Microsoft, Coca-Cola, Toyota Motor, and almost all well-known businesses.

Pros

- They make seeking venture financing easy.

- They provide the best protection for personal assets.

- Founders, directors, and stockholders are (usually) not liable for the company’s debts and obligations — only the money and resources they’ve personally invested.

Cons

- Because they’re much more complex than other business structures, they can have costly administrative fees.

- They have more complicated tax and legal requirements.

How Taxes Work

Corporations are required to pay federal, state, and in some cases, local taxes. There are two different types of corporations: “C corporations” and “S corporations.” C corporations are subject to double taxation. Any profit a C corporation makes is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends.

The corporation does not get a tax deduction when it distributes dividends to shareholders. Shareholders cannot deduct any loss of the corporation, but they are also not responsible directly for taxes on their earnings — just on the dividends they give to shareholders.

S corporations, on the other hand, have only one level of taxation. Learn more about the difference between “C corporations” and “S corporations” here, and find IRS tax forms here.

Questions to Determine If It’s Right For You

Have you secured enough venture capital to scale your small business into a full corporation?

✅ Corporations can start small, but they need to have enough funds to grow. If you have a list of investors who’ve invested $1M+ in your small business, then it may be time to think about becoming a corporation.

Do you have an internal accounting team that can handle tax matters?

✅ The tax requirements for corporations can be complicated, which requires the expertise of dedicated accountants. If you have a team or are planning to start one, a corporation may be right for you.

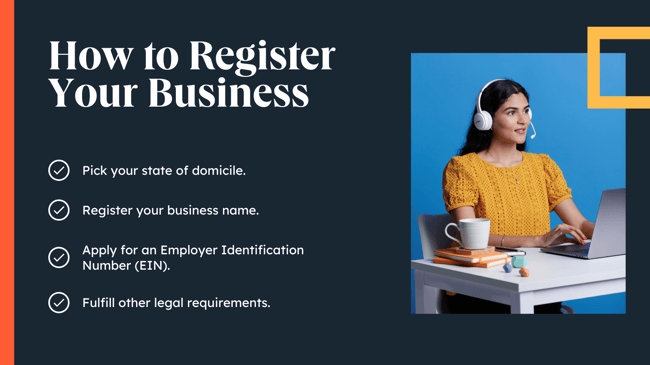

How to Register Your Business

Once the business plan, business name, and business structure is in place, you get to move on to the even less romantic part — the paperwork and legal activities. This includes things like registering with the government, and — depending on your business structure and industry — getting a tax code, a business license, and/or a seller’s permit.

We go into more detail about how to register your business here. In summary, you’ll want to take the following steps to register your business:

Step 1: Pick your state of domicile.

Where are you operating? Georgia? New York? Choose the state where your business location will operate from.

Step 2: Register your business name.

Business name registration is automatic when you register as an LLC or sole proprietorship. Remember that you can always choose a DBA (Doing Business As) name.

The registration authority will vary by state. For instance, in Georgia, you register your business at the Department of Revenue, while in New York state, you register at the Department of State. Be sure to find the appropriate registration authority of your state.

Step 3: Apply for an Employer Identification Number (EIN), if needed.

You’ll need to apply for an Employer Identification Number if you’re not running a sole proprietorship or a single-member LLC. Otherwise, the IRS will use your personal SSN for tax purposes.

Step 4: Fulfill other legal requirements.

These may include obtaining a business license or a seller’s permit.

Below, you’ll find an explanation of what goes into that last step, along with links to helpful resources where you can dig into the details. (Note: These steps are for fulfilling legal requirements for a business in the U.S. only.)

How to Comply with Legal Requirements

Businesses are regulated on the federal, the state, and sometimes even local level. It’s important to check what’s required on all three of those levels. Your business won’t be a legal entity without checking these boxes, so it’s essential to fulfill them all.

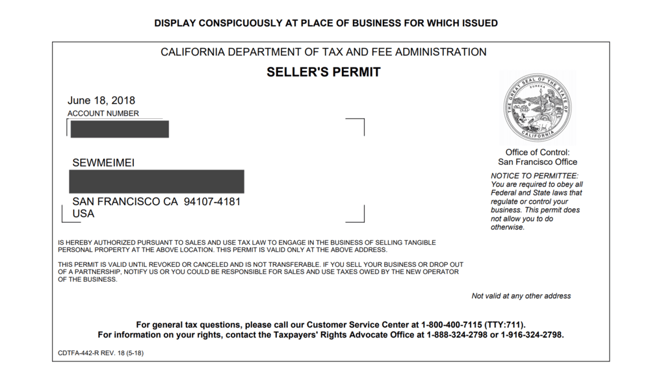

1. Get a seller’s permit, if needed.

Image Source

If your business sells tangible property to the public either as a wholesaler or retailer, then in most states, you need to apply for a seller’s permit. ‘Tangible property’ simply means physical items, like clothing, vehicles, toys, construction materials, and so on. In some states, a seller’s permit is required for service-oriented business, too, such as accountants, lawyers, and therapists.

The seller’s permit allows you to collect sales tax from buyers. You’ll then pay that sales tax to the state each quarter by putting the sales tax permit number on the state’s tax payment form.

You can register for a seller’s permit through your state’s Board of Equalization, Sales Tax Commission, or Franchise Tax Board. To help you find the appropriate offices, find your state on this IRS website.

Alternatively, search for “seller’s permit [state name]” to find out how to apply at your local office.

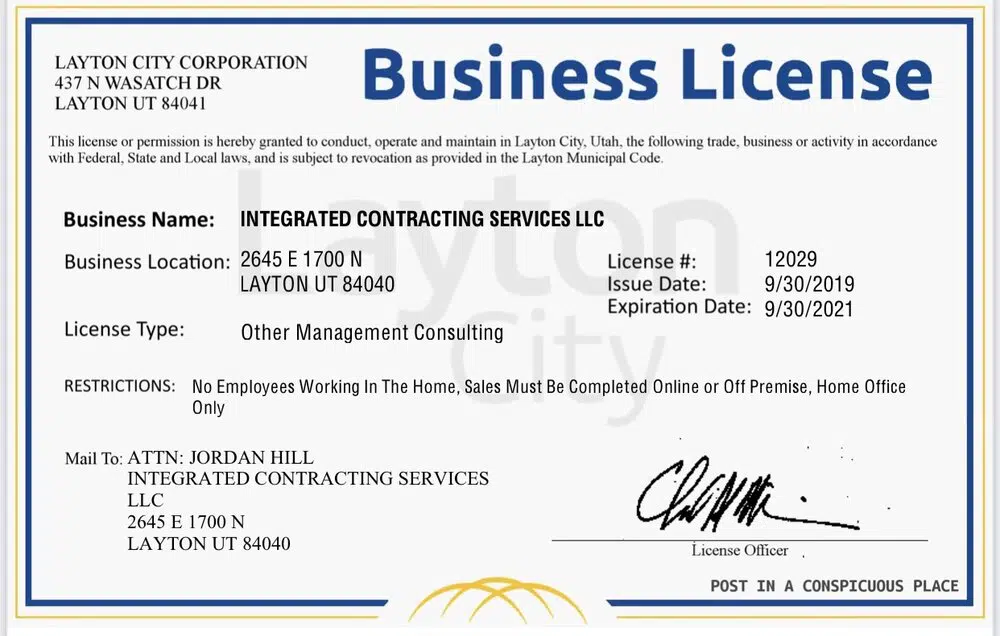

2. Apply for a federal business license, if needed.

Image Source

Almost every business needs some form of license or permit to operate legally — but the requirements vary, which can get confusing. Which specific licenses or permits does your business need? This is determined mainly by what industry you’re in. For example, construction firms need a contractor’s license.

To figure out if your business needs a specific license, go to this SBA.gov website and select the state from which you’re operating your business. It’ll tell you the specific license and permit requirements in that state.

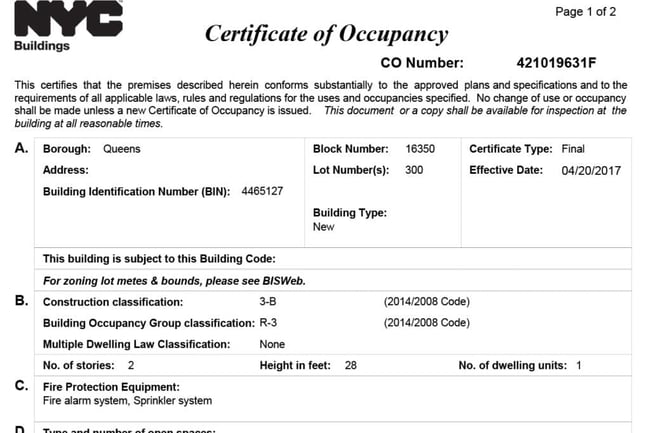

3. Apply for state licenses.

Image Source

Most states have specific licensure requirements for occupying a retail space, operating out of a warehouse, and even operating out of your home. According to Chase Bank, these can include:

- Operating licenses

- Building permits

- Zoning and land use permits

- Signage licenses

Keep in mind that these requirements will vary by state. For instance, in Georgia, you’ll need an Occupational Tax Certificate if you have a brick-and-mortar store, while in New York state, you’ll need a General Vendor license, even if you don’t have a physical store.

4. Apply for professional licenses and renew them.

Image Source

Some fields require a professional license, which are separate from the federal business licenses you use to operate legally. Rather, this type of license ensures that you’re qualified to provide the services you’re advertising.

Professionals that may need a license include:

- Hair stylists

- Therapists

- Architects

- Lawyers

- Insurance agents

- Real estate agents

- Educators

Be sure to double-check the requirements with your state, and remember to renew your license every year.

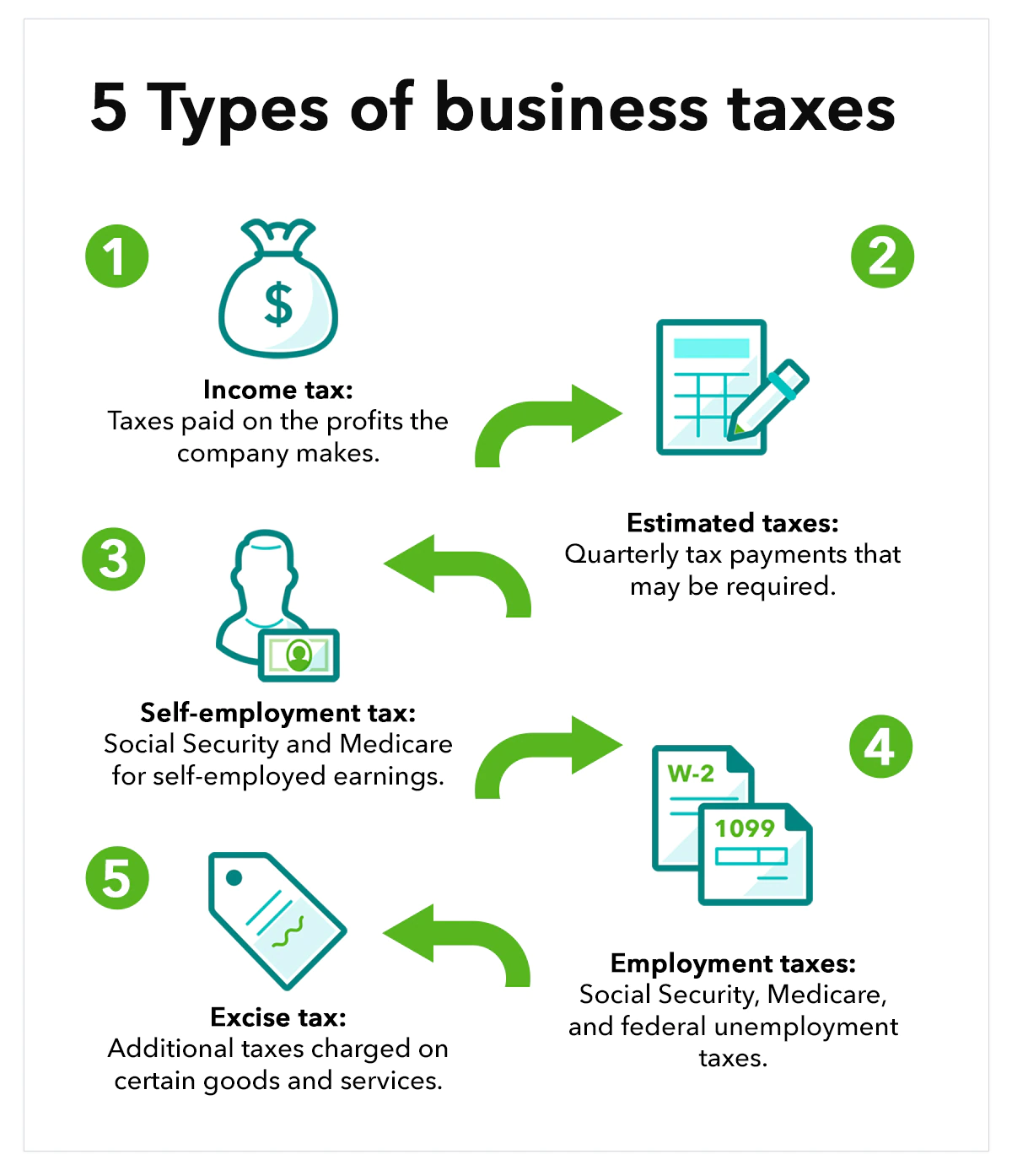

5. Understand small business tax requirements.

Image Source

Business owners are obligated to pay specific federal taxes, and the amount of those taxes is determined by the business entity that you establish. All businesses except for partnerships need to file an annual income tax return. Partnerships file what’s called an information return.

As mentioned, a business that’s owned and operated as an LLC or corporation needs an Employer Identification Number (EIN), which you can apply for on the IRS’ website here. Even if you operate as a sole proprietor under your SSN, you’ll still need to play self-employment tax.

Once you’re registered, it’s time to figure out which taxes you’ll be responsible for. Here are the three types:

Self-Employment Tax (SE Tax)

Self-employment tax refers to a Social Security and Medicare tax for people who work for themselves, i.e. business owners. SE taxes require filing Schedule SE (Form 1040) if your net earnings from self-employment were $400 or more. (Note: There are special rules and exceptions for fishing crew members, notary publics, and more.)

You can learn more here.

Employment Tax

When you have employees, you (as the employer) have certain employment tax responsibilities that you need to pay, as well as forms you need to file. Employment taxes include Social Security and Medicare taxes, federal income tax withholding, and federal unemployment (FUTA) tax.

You can learn more here.

Excise Tax

Excise taxes are also something you need to consider, depending on what you sell, where you operate, and so on. For example, in the U.S., there’s a federal excise tax on certain trucks, truck tractors, and buses used on public highways.

You can learn more here.

Let’s summarize what we’ve learned about the legal requirements to start a business.

Legal Requirements to Start a Business

- Pick your state of domicile.

- Register your business name.

- Apply for an Employer Identification Number (EIN).

- Get a seller’s permit.

- Apply for a federal business license.

- Apply for state licenses.

- Apply for professional licenses and renew them.

- Understand small business tax requirements.

How to Find Funding for Your New Business

From the day you start building your business until the point where you can make a consistent profit, you need to finance your operation and growth with start-up capital. Some founders can finance their business entirely on their own dime or through friends and family, which is called “bootstrapping.”

This obviously gives the business owners a ton of flexibility for running the business, although it means taking on a larger financial risk — and when family’s involved, it can lead to awkward holiday dinner conversations if things go wrong.

Many founders need external start-up capital to get their business off the ground. If that sounds like you, keep on reading to learn about the most common kinds of external capital you can raise.

1. Seed Financing

If you’re looking for a relatively small amount of money, say, the investigation of a market opportunity or the development of the initial version of a product or service, then Seed financing might be for you.

There are many different kinds of seed financing, but the one you’ve probably heard of most is called Seed-round financing. In this case, someone will invest in your company in exchange for preferred stock. If your company gets sold or liquidated, then investors who hold preferred stock often have the right to get their investment back — and, in most cases, an additional return, called “preferred dividends” or “liquidation preferences” — before holders of common stock are paid.

2. Accelerator

Accelerators are highly competitive programs that typically involve applying and then competing against other startups in a public pitch event or demo day. In addition to winning funding and seed capital, winners of these programs are also rewarded with mentorship and educational programs.

Although accelerators were originally mostly tech companies and centered around Silicon Valley, you can now find them all over the country and in all different industries. If this sounds like something you’d be interested in, here’s a list of the top accelerators in the United States to get you started.

3. Small Business Loan

If you have a really rock-solid plan for how you’ll spend the money in place, then you might be able to convince a bank, a lender, a community development organization, or a micro-lending institution to grant you a loan.

There are many different types of loans, including loans with the bank, real estate loans, equipment loans, and more. To successfully get one, you’re going to need to articulate exactly how you’ll spend every single penny — so make sure you have a solid business plan in place before you apply. You can learn more about SBA.gov’s loan programs here.

4. Crowdfunding

You might ask yourself, what about companies that get funding through platforms like Kickstarter and Indiegogo? That’s called crowdfunding, which is a newer way of funding a business.

More importantly, it typically doesn’t entail giving partial ownership of the business away. Instead, it’s a way of getting funding not from potential co-owners, but from potential fans and customers who want to support the business idea, but not necessarily own it.

What you give donors in exchange is entirely up to you — and typically, people will come away with early access to a product, or a special version of a product, or a meet-and-greet with the founders. Learn more about crowdfunding here.

5. Venture Capital Financing

Only a very small percentage of businesses are either fit for venture capital or have access to it. All the other methods described earlier are available to the vast majority of new businesses.

If you’re looking for a significant amount of money to start your company and can prove you can quickly grow its value, then venture capital financing is probably the right move for you.

Venture capital financing usually means one or more venture capital firms make large investments in your company in exchange for preferred stock of the company — but, in addition to getting that preferred return as they would in series seed financing, venture capital investors also usually get governance rights, like a seat on the Board of Directors or approval rights on certain transactions.

VC financing typically occurs when a company can demonstrate a significant business opportunity to quickly grow the value of the company but requires significant capital to do so.

Tips for Starting a Business

Ready to dive into a life of entrepreneurship? Here are the best tips for becoming successful in your small business niche.

1. Create a customer acquisition strategy.

Once you’ve registered your new business with the government and gotten the legal paperwork squared away, how do you go about, you know … acquiring customers?

Here’s the truth: A new company needs to start drumming up interest for its product or service even before it’s ready to ship. But there are a million different platforms and avenues you can use to drive awareness … so where on earth do you start?

It all comes down to your target customer. You won’t be able to acquire customers without knowing who they are. One of the very first questions you need to ask yourself is: Who wants what I’m selling? Who would find it useful? Who would love it?

To create a strong customer acquisition strategy, you’ll need to narrow down your target audience as much as possible.

2. Narrow down your target customer.

To find your target customer, you need to dig in to whom that person is and what kind of messaging would resonate with them. Using research, surveys, and interviews, try to find out:

- Their backgrounds, interests, goals, and challenges

- How old they are

- What they do every day

- Which social platforms they use

And much more.

Creating very specific buyer personas can dramatically improve your customer acquisition efforts. Read this step-by-step guide on how to create buyer personas, which includes buyer persona templates you can customize yourself. Once you’ve picked a buyer persona or two, print them out, tack them onto your wall, and think about their interests and needs before making every business decision.

3. Develop a brand identity.

In addition to researching your target customer, when you’re first starting a business, you’ll need to build the foundation for a strong brand identity. Your brand identity is about your values, how you communicate concepts, and which emotions you want your customers to feel when they interact with your business. Having a consistent brand identity to promote your business will make you look more professional and help you attract new customers.

4. Build your online presence.

With your target customer and your brand identity under your belt, you can begin building the core marketing elements of your small business, which includes your website, your blog, your email tool, your conversion tool, and your social media accounts. To dive deeper into these topics, read our beginner’s guide to small business marketing here.

5. Generate and nurture leads.

Once you’ve started building an online presence and creating awareness for your business, you need to generate the leads that will close into customers. Lead generation is the process of attracting and converting strangers and prospects into leads, and if you build a successful lead generation engine, you’ll be able to keep your funnel full of sales prospects while you sleep.

What does a successful lead generation process look like? Learn more about lead generation here, and don’t forget to try HubSpot’s free marketing tools, our free lead generation tool that lets you track your website visitors and leads in a single contact database.

6. Set up your sales infrastructure.

By taking the time to set up your sales process from the get-go, you’ll avoid painful headaches that come with lost data down the line. Start with a CRM, which is a central database where you can keep track of all your clients and prospective clients in one place. There are loads of options out there, and you’ll want to evaluate the CRMs that cater to small businesses. (Excel doesn’t count!)

7. Identify your sales goals.

Don’t get intimidated by sales lingo such as KPIs and ROI. All this means is that you need to figure out what you need to make ends meet and grow: how much revenue do you need, and how many products do you need to sell to hit that target?

8. Hire a sales rep.

When you’re starting your business, it’s tempting to do everything yourself, including taking on sales. However, making that first sales hire is crucial to scaling — you need someone dedicated to understanding your buyer and selling to them full-time. When looking for that first sales hire, seniority should be less of a priority than how much sales experience they have on the front lines and whether they understand your business’ target buyer. From there, you’ll want a plan for building your sales development team.

9. Get more out of your sales activities.

Efficiency is key. Put together a sales process, such as this helpful 7-step sales process framework, which works regardless of your business size. You’ll also want to automate sales tasks (such as data entry), or set up notifications when a prospective customer takes an action. That way, you spend less time poring through records and calling the wrong prospects and more on strategy and actual selling.

10. Keep your customers happy.

Getting new customers in the door is important, but retaining them is just as important. You can’t ignore customers once you’ve closed them — you have to take care of them, give them stellar customer service, and nurture them to become fans of (and even evangelists for) your business.

While inbound marketing and sales are both critical to your funnel, the funnel doesn’t end there: The reality is that the amount of time and effort that you spend perfecting your strategy in those areas will amount to very little if you’re unable to retain happy customers.

This means that building a model for customer success should be central to your organization.

Think for a second about all the different ways reviews, social media, and online aggregators spread information about your products.

They’re all quick and effective, for better or for worse. While your marketing and sales playbooks are within your control and yours to perfect, a large chunk of your prospects are evaluating your company based on the content and materials that other people are circulating about your brand.

11. React quickly to customer issues.

People expect fast resolution times (some faster than others depending on the channel), so it’s essential to be nimble and efficiently keep up with requests so that you’re consistently providing excellent service to avoid losing trust with your customers.

Pay attention to the volume of your company mentions on different channels. Identify where your customers spend the most time and are asking the most questions, and then meet them there, whether it’s on a social network, on Yelp, or somewhere else.

12. Keep track of touchpoints with individual customers.

Interactions with your customers are best informed by context. Keep track of all the touchpoints you’ve had with individual customers, because having a view into their experience with your company will pay dividends in the long run.

How long have they been a customer? What was their experience in the sales process? How many purchases have they made? Have they given positive/critical feedback about your support experience or products? Knowing the answers to these questions will give you a more complete picture when you respond to inquiries and will help you have more productive conversations with customers.

13. Create feedback loops.

From the moment you have your first customer, you should be actively seeking out insights from them. As your business grows, this will become harder — but remember that your customer-facing employees are a valuable source of information because they are most in tune with your buyers and potential buyers.

14. Create a FAQ page on your website.

Give customers the tools to help themselves, and scale this program as you grow. When you’re starting out, this might take the form of a simple FAQ page. Over time, as your customer base grows, turn your website into a resource for your customers and enable them to self-service — such as evolving that FAQ page into a knowledge base or library that answers common questions and/or gives customers instructions.

Resources to Start a Business

Here are some helpful resources to help you spread awareness, build your online presence, and get the leads you need for free. In addition, we’ve listed additional templates and sales tools to help you build an efficient sales engine, reach prospects, and close customers for free.

How to Start a Business Online

Starting a business online is a little different from starting a traditional business. Here are some important steps for starting and scaling your business online.

1. Determine your niche and business idea.

Your business niche is your target focus area for your product or service. It’s important to choose a niche because customers like brands and businesses that specifically cater to their needs. Most customers are more likely to purchase products or services from a brand that provides personalized experiences.

When determining your niche and business idea, first identify your target audience and specify everything from their age to their interests. Then, use that information to figure out their principal need. If your product doesn’t resolve a specific need, your business will fail to get off the ground.

2. Conduct market research.

Conduct market research to understand what product or service you should offer, whom you should serve, and where you face the stiffest competition. From physical goods to digital downloads, understanding your target market and competitors will help you determine how to best position your product.

Your research should help you create a strong selling proposition. In other words, what makes your business unique? Why should someone buy from you?

3. Learn online business laws.

While online businesses may require fewer licenses and permits than traditional businesses, there are still legal requirements that you will need to adhere to. Be sure to check:

- What kind of business license (if any) do you need to start operations?

- What legal structure makes the most sense for your company?

- Are there any permits that you need to obtain?

- Are there any inspections that you need to pass?

- Do you need a sales tax license?

- Are there any specific regulations applicable to online businesses only?

- What are the laws regarding hiring contractors and hiring employees?

4. Create a website.

After handling the research, taking care of legalities, and honing in your products or services, it is time to create your website. When creating your website, you will need to choose a strong ecommerce platform that will allow you to sell products online.

5. Set up shop.

Once your website is complete, it’s time to add products or services to your store. When adding your products, pay attention to product images and descriptions. Having a crisp image and a detailed but concise description will help your audience maneuver your website smoothly.

After you have finished setting up your store, it’s critical to ensure you offer a seamless shipping or delivery experience to your buyers. For example, you can use HubSpot to manage quality control before you ship products out.

Finally, you want to make sure everything is working before you hit the live button on your website. Make sure that everything is clickable and that all pages look good across all devices and browsers. Once you’ve checked that, you are ready to go live.

6. Grow your business.

You’ve created an awesome product and now it’s time to get the word out. In other words, it’s time to grow your audience. There are numerous ways to reach your target customer, including:

- Social media: Use hashtags and paid ads to expand your reach.

- Influencer marketing: Send free samples to “celebrities” in your niche.

- Facebook groups: Connect with your target market on this platform.

- Google advertising: Put your products in front of people all over the web.

- Content marketing: Publish blog posts to bring organic traffic to your site.

- Word-of-mouth: Encourage customers to spread the word.

- YouTube videos: Start a channel to showcase your products.

Next Steps: Getting Ready to Launch Your Business

Being a small business owner isn’t easy, but with the right plan, you can set up your business for success. Be sure to check and know your requirements, have a solid business plan, and submit your legal paperwork before you take your business live. Once you have a solid business plan and the financing to execute your goals, you’ll be well on the path to launching a successful enterprise.

Editor’s note: This post was originally published in August 2019 and has been updated for comprehensiveness.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)