How to Calculate Enterprise Value: 3 Excel Examples + Video

This tutorial will explain how to calculate Enterprise Value – but let’s start with the basics and explain what Enterprise Value is before getting into the numbers:

Mục Lục

What is Enterprise Value?

Enterprise Value is the value of the company’s core business operations (i.e., Net Operating Assets), but to ALL INVESTORS (Equity, Debt, Preferred, and possibly others) in the company.

By contrast, Equity Value (also known as the Market Capitalization or “Market Cap”) is the value of EVERYTHING the company has (i.e., Net Assets), but only to the EQUITY INVESTORS (common shareholders).

You use both these concepts in company valuations, and you often move between them in analyses.

For example, Unlevered Free Cash Flow in a DCF pairs with Enterprise Value, and you calculate the company’s implied Enterprise Value first and then back into its implied Equity Value and implied share price from that.

And in comparable company analysis, you use metrics and multiples that are based on Enterprise Value, such as the TEV / EBITDA multiple.

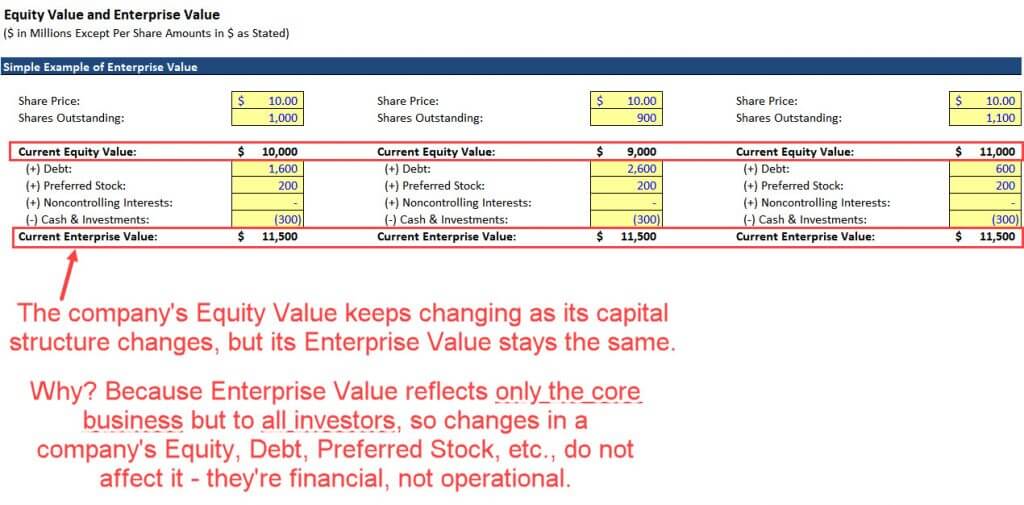

Enterprise Value is important because it is not affected by a company’s capital structure – only by its core-business operations.

Here’s a simple example of how to calculate Enterprise Value:

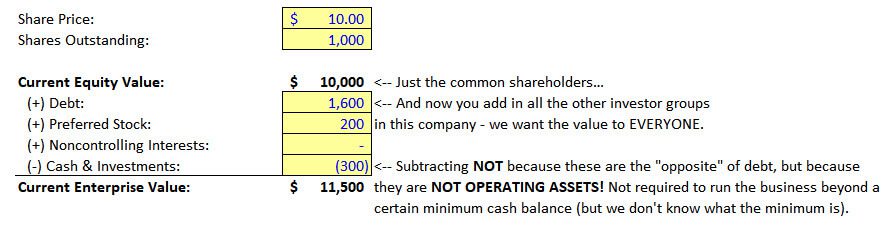

The calculations for both Equity Value and Enterprise Value are shown above:

The calculations for both Equity Value and Enterprise Value are shown above:

- Equity Value = Share Price * Shares Outstanding

- Enterprise Value = Equity Value + Debt + Preferred Stock + Noncontrolling Interests – Cash

The calculations for both Equity Value and Enterprise Value are shown above:

To calculate Enterprise Value, you subtract Non-Operating Assets – just Cash in this case – and you add Liability & Equity line items that represent other investor groups – Debt and Preferred Stock in this case.

Many people do not understand this idea at all.

They incorrectly claim that you add Debt because it “makes the company more expensive,” or that you subtract Cash because it “makes the company cheaper to acquire.”

No, no, and no! Please see the notes below:

Enterprise Value would change only if the company’s Net Operating Assets changed.

Enterprise Value would change only if the company’s Net Operating Assets changed.

For example, if the company bought a new factory using its Cash balance, that would affect its PP&E (Plants, Property & Equipment) and Cash.

PP&E is considered an Operating Asset, so it affects Enterprise Value, but Cash is a Non-Operating Asset, so it does not affect Enterprise Value.

Cash decreases and PP&E increases, so the company’s Net Operating Assets increase as a result.

Therefore, the company’s Enterprise Value also increases.

However, the company’s Equity Value does not change because Operating vs. Non-Operating Assets do not affect the Equity Value calculation. Only the company’s Net Assets matter.

For more on this concept, please see our coverage of Equity Value vs. Enterprise Value.

How to Calculate Enterprise Value for Real Companies

We receive many questions about Enterprise Value vs. Equity Value, but we also get many questions about how to calculate Enterprise Value.

When you’re analyzing public companies, you normally start by calculating the Equity Value for each company and then creating a “bridge” to Enterprise Value.

This process should not be difficult if you follow the standard formula for Enterprise Value:

- Enterprise Value = Equity Value – Non-Operating Assets + Liability and Equity Items That Represent Other Investor Groups (i.e., ones besides Common Shareholders)

Ideally, you will use the market values of these items, but if they’re not available, the book values fine for everything except Equity Value.

Common examples of items in each category include:

- Non-Operating Assets: Cash, Financial Investments, Rental Properties (if it’s not a real estate company), Side Businesses, Assets Held for Sale, Discontinued Operations, Equity Investments or Associate Companies, and Net Operating Losses (NOLs) (a component of the Deferred Tax Asset).

- Liability and Equity Items That Represent Other Investor Groups (i.e., ones beyond common shareholders): Debt, Preferred Stock, Finance or Capital Leases, Noncontrolling Interests, Unfunded Pensions, and (potentially) Operating Leases.

If you find something not on this list that you want to add or subtract, you should proceed very carefully because there are not that many “special items.”

The company’s Balance Sheet is your starting point for this exercise, but you’ll need to go beyond it to find items like the Fair Market Value of Debt, details on the Pension Plans, and the Net Operating Losses embedded in the Deferred Tax Asset.

How to Calculate Enterprise Value: Example Calculations for Target, Zendesk, and Vivendi

Here are examples of how to calculate Enterprise Value for Target, Zendesk, and Vivendi, starting with Target:

This Enterprise Value calculation for Target is a fairly standard bridge. A few notes:

- Debt: The company initially grouped Debt and Capital/Finance Leases on its Balance Sheet, so we separated them and found the Fair Market Value of the Debt portion, which is used in this bridge.

- Pensions: We count only the unfunded or underfunded portion, which equals MAX(0, Pension Liabilities – Pension Assets). We also multiply by (1 – Tax Rate) since contributions into pension plans are tax-deductible in the U.S.

- Operating Leases: We choose not to count this item as “another investor group” here; it could go either way under U.S. GAAP, as long as you’re consistent in the valuation multiples.

For Zendesk, we use the following Enterprise Value bridge:

- Net Operating Losses: We found these by searching for the Deferred Tax Asset disclosures. They’re considered “non-operating” because they’re not required to run the business and do not flow through the statements automatically, as other components of the DTA do. Technically, we should adjust the NOLs and remove the portion that is unlikely to be utilized, but this is not necessary in a quick analysis.

- Total Debt: The company’s Convertible Bonds do not create dilution in this case because the company’s current share price is below the conversion price. Therefore, we count the entire Fair Market Value of the Convertible Bonds as Debt in the Enterprise Value calculation.

Finally, we use this Enterprise Value calculation for Vivendi:

- Equity Investments and Noncontrolling Interests: We took both of these directly from the Balance Sheet because the company did not disclose their Fair Market Values in a straightforward way. For more on these, please see our tutorial to the equity method of accounting.

- Total Debt: We took the Balance Sheet number and replaced portions of it with the Fair Market Value numbers the company disclosed.

- Unfunded Pensions: Similar to Target, this is MAX(0, Pension Liabilities – Pension Assets). But we do not multiply by (1 – Tax Rate) here, under the assumption that contributions into most European pension plans are not tax-deductible.

- Operating Leases: We count them as “another investor group” here. The reason is that under IFRS, companies must split the rental expense into Interest and Depreciation elements on the Income Statement, so Operating Leases must be included in Enterprise Value – or multiples such as TEV / EBITDA will be inconsistent. For more, please see our lease accounting tutorial.

We sometimes get questions about other items that might potentially be counted in the Enterprise Value calculations, but there’s rarely a good reason to go outside the standard set.

Goodwill & Other Intangibles should never be in here, nor should DTAs (except for the NOLs) or DTLs; Industry-Specific Assets (such as “Content Assets” for media companies like Vivendi and Netflix) are Operating Assets, so they should also not be here.

Sometimes people add items like Legal and Restructuring Liabilities, and you may need to look at an item like “Provisions” in more detail to see what’s in it.

We cover some of these items and more advanced, special cases in the full courses on this site.

Video Transcript

Welcome to our next lesson in this module on Equity Value, Enterprise Value and Valuation Multiples. We are going to go into the equity value to enterprise value bridge in this lesson and look at it for Target, for Vivendi and for Zendesk. The one for Zendesk we won’t spend that much time on because it’s very similar to the one for Target. They’re both US-based companies. The one for Vivendi will a bit different because it uses IFRS, so slightly different accounting rules than the ones under US GAAP. But we’ll start with Target and branch out from there. I’m not going to go through a slide presentation for this one, because it’s just the type of thing that you need to see in Excel and see when you go through the company’s filings and highlight different items and figure out which of them, if any, to pull in.

Now, you should already know the idea for the bridge because you saw it in the first few lessons of this module, where equity value represents the value of net assets to common shareholders. So we always start by calculating the market value of equity. The diluted shares outstanding times the share price. Then enterprise value represents net operating assets to all investors. So we subtract non-operating or non-core assets, and then we add liability and equity line items that represent different investor groups in the company. And we went over some common examples of what you add and subtract in this calculation. Now we’re going to see it executed in real life for these companies. As always, I have some detailed notes under each company’s example that explains why we are adding, subtracting, or ignoring certain things.

So at a high level, normally when you do this exercise you want to start with the company’s balance sheet. So for Target, we can pull up their extracts. For all these I’m going to be using the extracts, not the full filing, because it’s just too cumbersome to jump around and scroll to different areas when it’s a hundred pages long. So I’ll search for balance sheets. And it’s not actually listed as the title anywhere, but if we just scroll around a little bit we can see it right here: consolidated statements of financial position. So we have cash, which we always want to subtract in this calculation. And briefly looking at this, it doesn’t really look like anything else here is a non-core asset. Property and equipment inventory are certainly core business assets. Operating lease assets are core business assets as well. Other non-current assets might have something. Other current assets might have something. But at first glance it seems like it’s really just cash here.

So let’s go and enter that right now. I’ll enter a negative 2.577, a really negative 2,577, which in this context really means 2,577,000,000. So that’s what we have there. And then looking at some of these other items. Financial investments, equity investments, other non-core assets, net operating losses, for the most part, the company doesn’t really have these items. If we wanted to, we could dig in and try to find other current assets or other non-current assets and see exactly what’s listed in there, just in case they have something like that. Usually though, major investments will be listed as assets on the balance sheet, so most likely they’re probably not going to have much of anything here. If we go to other current assets, these are all operational. Income tax and vendor receivables, prepaid expenses. So nothing here really qualifies. And then if we search for other non-current assets. It’s not even in the extract, but I’ll just tell you right now, there’s nothing in there that qualifies.

If you want to go down and look up the company’s tax information to see if there might be a net operating loss somewhere here. If you go to where it says net deferred tax asset or liability, under gross deferred tax assets they have a couple different items, but there’s nothing here about any type of net operating loss that the company has from prior periods [inaudible 00:03:52] loss money that it can now apply in the future. So we are going to say nothing for all of these. So I’ll just say zero, zero, zero and zero. And that’s that.

Now moving to the liabilities and equity side. Again, usually the starting point here is the company’s balance sheet or statement of financial position, as they call it. So scrolling down, we can see that they have accounts payable, accrued liabilities, which are both operational. And then the current portion of long term debt, which is non-operational. Long term debt, which is also non-operational. And then non-current operating lease liabilities, which could be operational, but which also might not be. Deferred income taxes and other non-current liabilities. Deferred income taxes we generally do not count at all in this calculation. Other non-current liabilities, it depends what’s in them. So we’ll have to do some more digging there.

Now before just adding these balance sheet items you have to be really careful, because if you’ve been through module four of this course you’ve seen some of the issues with doing that. Oftentimes companies have discounts or premiums to their debt or unamortized issuance fees or other items that affect the balance sheet values, even though they don’t affect the amount that the company’s actually paying interest on. Also another issue is that the fair market value of the debt might be different and often is different from what’s listed on the balance sheet. So ideally we want to go down and try to find the fair market value of debt, wherever it’s listed,

Let’s search for fair value. And okay, there we have it. So in this note, significant financial instruments not measured at fair value. What this means is that they’re listed on the balance sheet at the carrying amount, even though the fair value is different. So a significant portion of the long term debt falls into this category. It’s shown on the balance sheet at around 9,992, but in reality the fair value is 11,864. And these are in millions. So of course this is really 11 or 12 billion nine or 10 billion. Let’s enter that as a starting point here. So 11,864. And then we need to find the other components of this debt balance and see how they’re listed on the balance sheet. So I’m going to search for the 9,992 here. And we see it down here. So we have a couple different things. We have swap valuation adjustments, we have finance lease liabilities, and then we have amounts due within one year.

We should add in the swap valuation adjustments right here. So I’ll say plus 137. The finance lease liabilities, these are also known as capital leases, which we covered in the accounting module. Essentially, these are debt-like items that have interests and principle repayments, and they let a company own a specific piece of equipment or property or something like that, a factory maybe, for a period of time. So we count those as debt as well. And I’ll go down to capital leases down here and enter the 1,370.

Now for the total of debt right here, you have to be really careful. Because yes, we do want to include the current portion and the long term portion. But if you think about the numbers, or just look at how they’re doing this here, if we’re taking the 9,992 and adjusting it up to fair value, that already includes the current amount, the amounts due within one year. So therefore we don’t need to add this because the fair market value estimate that we already found, the 11,864, already includes everything in this amount because the current portion has not yet been subtracted. Also, keep in mind that on the balance sheet, this whole amount is shown together, the lump sum amount. And then they subtract that, the 161 here. So you just have to be a bit careful about how the company is presenting this and then how you choose to present it when you add up these numbers.

This company does not have any preferred stocks. We’ll just enter zero. They also don’t have any non-controlling interests, so I’ll enter zero. For the operating leases here, in 2019 the rules changed, and companies started showing operating leases on their balance sheets. However, if we add this as a debt-like item here and say that it’s another investor group, it will create problems later on because we won’t be able to use certain metrics and multiples. So we’re not going to factor this in. We will factor it in for Vivendi for reasons that we’ll cover in a little bit. But we’re not going to factor it in for companies that follow US GAAP. So I’ll say zero for this one.

And then for the unfunded pensions, let’s go back to the extracts and see what we have. If we go down to pension plans under note 23, we have the funded or underfunded status. And for the qualified plan, it’s 62 million. For the non-qualified international one, it’s 55 million. And if we keep scrolling down we can find some of their other pension related items. We’ll get into more of that later on. But for now, what really matters are these two, the 62 million and the 55 million. So we’re going to add these. 62 plus 55. The logic being what I have down here, that the unfunded pensions represent another investor group, because the employees are acting as the investors. They provide the company with funding by accepting lower pay today in exchange for pension payments later on. So we’re effectively saying that the employees are lending the company money. Maybe not directly, but indirectly. And that’s the logic for adding these. If the plan is funded or overfunded, you do not count that as a non-core asset. You don’t give the company any benefit. You only count this if pension liabilities exceed pension assets.

And for US pensions, contributions are tax deductible. So you normally multiply by one minus the tax rate. The treatment in other countries varies. And in a lot of cases the expense is deductible but the contributions are not, so you will not be multiplying by one minus the tax rate. In terms of getting this tax rate, if we just search Target’s filing for tax rates, we can see that it was 22%, then 20%, then 19 or 20% before that. I’m just going to go with 22% here. It looks like the most normalized rate that has the fewest adjustments to it. And we actually already have it entered here. So now I’ll adjust this unfunded pension liability by multiplying by one minus the 22%. We have that. Let’s add everything up. And so we get to an enterprise value of 60,477,000,000.

So that is Target. As always I have some notes down here if you want more on any of this. And again, we’ll be getting into some of these items like the net operating losses, equity investments, leases, non-controlling interests and unfunded pensions in more detail in the last few lessons of this module.

Let’s move over to Vivendi now and see what we have to do for them. Again, I have notes here for a lot of this. So you can certainly refer to these. Let’s go to Vivendi’s extracts for now and see what we can pull in from there. And as with companies that follow US GAAP, for IFRS-based companies we also generally want to start with their balance sheets and then see what we need to add or adjust from these.

So cash and cash equivalents are down here and you can almost always take the cash directly from the balance sheet. So I’ll enter the negative 2,130 here. And then for the financial investments, they have current financial assets and then non-current financial assets. And we want to include both of these. These are both non-core assets, because investing in stocks or bonds or other securities has nothing to do with Vivendi’s core business of the delivering media products and telecom services for customers. So I’ll say negative 2,263, and then negative 255. So we have that. For equity investments, we see it right here, investments in equity affiliates. 3,520, and I’ll subtract that. And then for other non-core assets, Vivendi doesn’t really have anything. And we could go through its filing and you could look at everything yourself, but I’ll just tell you right now, they don’t really have anything that qualifies. Goodwill, content assets, intangibles, PP&E, rate of use assets related to leases. These are all clearly operational. And then the same for things like inventory, current content assets, accounts receivable. These are all clearly operational.

An example of a non-core or other non-core asset, in this case might be something like a discontinued operation, where the company still holds the assets but plans on selling them off very soon. Something like that might show up here as an other non-core asset. But I’m going to say zero. Net operating losses. Again, we could go through and look at the company’s tax treatment. And I’m actually going to do a search for tax attributes. That’s what they sometimes call it for European in companies or non-US companies. And they do give us components of deferred tax assets and liabilities, but there’s nothing here that really qualifies as a net operating loss. These tax attributes usually refer to things like tax credits or R&D credits, or other types of favorable tax treatment that don’t necessarily represent losses in prior periods that are going to be applied to offset future income. Therefore, I’m going to say zero for this one.

Let’s go back to Vivendi’s balance sheet now and go to the liabilities and equity side. So first off we see that they do have non-controlling interests. They don’t have preferred stock, but they do have non-controlling interest, which represent the stake of majority-owned companies that they don’t own. So if they own 70% or 80%, these represent the 20% or 30% they don’t own. I will go and add the 222 right there. For total debt. So we have long term borrowings and other financial liabilities, and then we have short term borrowings and other financial liabilities. And we want both of these. So I will take 5,160 and then add the 1,777 to it. They have no preferred stock, nothing listed on that balance sheet. Operating leases, we are going to list the long-term lease liabilities and the short-term lease abilities here. So I’ll say 1,223 plus 236. And we have that.

Now of course, once again, we’re going to run into some issues here because ideally we should be adjusting these for their fair market value. So we’ll get into that in a little bit. But let’s finish with what’s actually on the balance sheet first. It doesn’t look like the company actually has any capital or finance leases here. And although they do have pensions, they don’t list the pensions on their balance sheet. Which means that to finish this off, we’re going to have to go searching through the filing and see if we can find some of that additional information. So let’s go down. They have some information on their tax rates here. We already looked at the deferred acts assets and liabilities.

Now for the investments and equity affiliates, the equity investments here, they do attempt to give some estimates of the fair market value, but it’s not clear exactly how these relate to the numbers shown on the balance sheet. If these were a lot bigger, we might want to pay more attention to this or try to value these separately, but we’re not going to bother in this case. We’re just going to go with the numbers shown on the balance sheet.

For the employee benefits, let’s keep scrolling down and see where they actually list the whole thing together. Okay. So here in this note, 18.2.3, they have changes in value of benefit obligations, fair value of planned assets and funded status. And here they give it to us directly. It’s 8 07, which means that their liabilities, there are benefit obligation, exceeds the fair value of planned assets by a good amount. So I’m just going to take this 807 and input it right here. The company doesn’t have any capital leases we could go through and look at that, but I’ll just enter zero. One other quick thing is that we’re not tax adjusting the unfunded pension here, because as I say down here, it’s usually a safe assumption for European companies that contributions into the plan are not tax deductible. We don’t know for sure here. It is an international conglomerate company, which makes things more complicated. So we don’t really know. Maybe parts of this are tax deductible, maybe parts are not. But our default assumption is that for this type of company they’re probably not. So therefore we’re not going to list anything there.

Let’s see if we can find something more on the total debt. And I’m going to do this by searching for one component of the debt, the 5,160. And so right here we have fair market value of borrowings and other liabilities. And again, the way they’re listing it is a little bit confusing. So they have a bunch of different liabilities that are included in the total debt number here. The problem though, is that they’re only adjusting to fair market value, a smaller portion of that. So what they’re doing here is saying that on the balance sheet they have a debt amount of 6,398, but the actual fair market value is 6,512. But this is clearly only a portion of the company’s total amount of debt, which we have at 6,937. So to factor this in, we are going to take the fair market value of that one part, the 6,512, and then subtract the carrying value of it. And that gives us a reasonable estimate of how much the total debt here might be worth. Let’s add up everything, and we get to the enterprise value for Vivendi.

As always, I have some notes down here if you want more on this. The reason why we are adding the operating leases as a debt-like item here is because of the way the associated and expenses are shown on the income statement. IFRS-based companies split the lease expense into interest and depreciation, even though it doesn’t really represent traditional depreciation or interest. So a metric like EBITDA already excludes the entire interest expense. Therefore, in a metric like enterprise value that we pair with EBITDA, we need to include the entire balance sheet line item, otherwise it’s not going to pair properly with EBITDA. So this is just an accounting system limitation and a difference between US GAAP and IFRS. We could do the same thing under US GAAP, but we don’t necessarily have to. Whereas we pretty much have to do this under IFRS. We don’t even need the effective tax rate here, but if we have to enter something, let’s just do a search for tax rates.

And they have the French statutory rate. And their restated effective tax rate is around 23 or 24%. So I’m just going to say 24% right here. That’s it for Vivendi.

Now for Zendesk, the last one here, in some ways this is the easiest one, because it’s the simplest company, the youngest company with the simplest capital structure. As always though, we like to start on the balance sheet. So they have cash and they have marketable securities. Let’s subtract both of these. So I’ll go in and for cash I’ll say negative 196.591. For financial investments we want both short term and long term marketable securities. So 286.958 minus 361.948. We have that. Equity investments, they don’t have anything. I’ve already searched through the filing. There’s no reference. Same for non-core assets.

Net operating losses though, a company like this, if you think about it, if you just take a look at their income statement and see the fact that they’re recording gigantic losses of hundreds of millions of dollars per year, and extremely negative net income, it’s a good guess that they probably have net operating losses. So if you do a quick search for net operating loss, sure enough we find it within deferred tax assets, about 230 million here. So I’m going to subtract this for now, 230.446. This will not be the final number. As I say in my notes here, we will need to adjust this for something called the valuation adjustment applied to the deferred tax asset. But this is a more advance topic that we don’t really have time to get into right now. So I’ll list this number for now, but we will end up adjusting this later on in this module.

Let’s keep going here. And let’s go back to their balance sheet and look at the other side and try to get some of these liability and equity line items. So they don’t have any preferred stock. They don’t have any non-controlling interest. You can tell that just by looking at it. So let’s go in and just say zero for non-controlling interest, zero for preferred stock. And then they don’t have any capital leases. They don’t have any unfunded pensions. It’s a very new company, and new companies tend not to have defined benefit pensions at all. For operating leases, the same treatment applies. These are shown on their balance sheets as liabilities. However, under US GAAP we don’t have to consider these another investor group or another source of capital, and we’re not going to so that some financial metrics are still valid. So we’re not going to count these since it is a US-based company.

And then finally for total debt. So this one you have to be really careful, because we have one amount that’s shown on the balance sheet. All they have for debt is the convertible notes. But then if you search for this elsewhere, remember we saw this problem in the less non-convertible bonds, that there’s this principle amount here, which is what the conversion to shares is based on. But then there’s also the fair value of the convertible bonds. And for this type of exercise we really want the fair value of the bonds. So let’s just go into the beginning and search for fair value. And it’s 793 million. So what we want to do in this case is the following. If the convertible bonds actually turn into dilutive shares, because the share price goes above the conversion price, then we’re going to say zero. So if we have any convertible shares we’ll count this as zero and say that it’s no longer debt, and that the diluted equity value is now higher.

On the other hand, if this is not convertible to shares, we will count this as 793 million of debt. We have that. Let’s add up everything here, and that gives us the enterprise value for Zendesk. And that’s about all we have to do. It’s a fairly simple company, but I wanted to show you a quick example of how this differs for a high growth startup versus a mature company, both in the US, and then a company outside the US that follows IFRS. With that done, we’re at the end. So let’s do a quick recap and summary.

The normal starting point for this is a company’s balance sheet. And you can go through and add many of the items, like cash and financial investments. And those are pretty safe to just take direct from the balance sheet.

Equity investments, non-core assets and net operating losses you might have to search a bit more for through the filings. If you can get the market values for these items, great. Go ahead and do it. If not, it’s not the end of the world. For total debt, you have to be careful because sometimes companies will list the fair value for part of it, but not all of it. Do what you can, but don’t kill yourself. You could just take the balance sheet number and it’s not really going to make a massive difference, but it’s a little bit better to get the fair value if you can. Preferred stock, same. You can get the balance sheet number. Operating leases we do not count in this calculation for US-based companies, but we do count it for companies like Vivendi that follow IFRS.

Non-controlling interests also come from the balance sheet. For the unfunded pensions, take only the unfunded portion, tax adjust it for US companies. For IFRS-based international companies you can just take the unfunded portion, and you don’t have to tax adjust it because contributions tend not to be tax deductible. And then capital leases also come from the balance sheet or the debt disclosures for the company. Vivendi was a little bit more complicated because the filings are not laid out in the same way, but we still follow the same basic process and try to adjust for fair market value the components of debt that we could. And then for Zendesk we had the NOL to look up. And then we have the convertible bond where, if it converts into shares we do not count it as debt. But if it does not, we count it as debt.

That’s it for this lesson. Coming up next we will get into valuation metrics and multiples. And you’ll learn how to calculate some key ones that are based on the income statements of companies.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)