Enterprise Value-to-EBITDA (EV/EBITDA) | Eqvista

Enterprise value and EBITDA are important metrics of a company valuation process. Among many others, these two values are most preferred by investors and financial analysts involved in a company takeover. Apart from being standalone metrics, Enterprise value/EBITDA as a ratio is a much more reliable valuation multiple. Since acquisitions are a tricky process if not approached with care, it is best to engage professionals who can suggest the best way forward based on industry experience.

This article discusses how enterprise value and EBITDA work together as a ratio in a valuation multiple. We will look into these values individually and assess their importance in estimating the value of a business being considered for a potential takeover.

Mục Lục

Overview of Enterprise Value and EBITDA

Before looking into the Enterprise Value/EBITDA ratio, let’s discuss enterprise value and EBITDA value separately. Though both of them are company valuation metrics, they serve different purposes. Investors and analysts use enterprise values to facilitate acquisitions, while EBITDA value is used internally by the company’s management. Thus, the values they do and do not include and the calculation method play an important role in investment decisions.

Enterprise Value

Enterprise value, as the name suggests, is the complete value of an enterprise. It is often used interchangeably with market capitalization, but actually, they are not the same. Enterprise value goes way beyond simple equity-based calculations. It not only involves the market cap value of a company, but also its debt and cash components. Debts are added to the market cap, while cash reserves are deducted from the entire value. Because enterprise value provides a holistic view, its inclusion in the EV/EBITDA ratio calculator provides a realistic company valuation multiple.

Enterprise value = Market cap + Debt – Cash

Investors and financial analysts use enterprise value to understand how much money is needed to buy a company. A market cap cannot provide the real picture. Market cap is calculated by multiplying the total number of shares by the price per share. This only gives the value of company equity (common shares) held by shareholders. But a business comprises many more components such as minority stakes in other companies, preferred shares that must be treated as loans, all outstanding debts, and all cash and cash equivalents. This is why EV/EBITDA multiple by industry is a better measure to compare the actual monetary value of a company while being considered among a list of potential businesses.

EBITDA

EBITDA is an abbreviation for Earnings Before Interest, Taxes, Depreciation, and Amortization. Analysts use this value to get a better understanding of the financial health of a company. EBITDA provides a truthful picture of a company’s profitability. No special derivation is required to calculate EBITDA. All the values are readily available on a company balance sheet. This makes it easier for analysts to use EBITDA value in an EV/EBITDA ratio calculator.

EBITDA = Net profit + Interest + Tax + Depreciation + Amortization

In simple terms, EBITDA is a company’s potential to generate profits. In the early ’80s, analysts first started using EBITDA values to assess the potential of a company to pay back debts. It was specifically used to evaluate businesses operating on high-value assets. Now EBITDA is widely used in business valuations across industries, especially the ones with expensive assets. However, EBITDA is a non-GAAP compliant measure and hence used only for internal purposes. Despite this, analysts find a good EV/EBITDA value as a reliable metric to analyze a company’s profit-making potential.

Enterprise value vs EBITDA Multiple Importance

Enterprise value/EBITDA multiple is calculated by dividing the enterprise value by the EBITDA value. It is otherwise also known as the enterprise multiple. Enterprise value provides the total worth of a company, while EBITDA indicates its profitability. Together, this ratio provides a comprehensive view of a company’s potential for a profitable acquisition. Besides, it is a reliable valuation multiple as it does not account for changes in the company’s capital structure and is not affected by fluctuations in the stock market.

EV/EBITDA ratio = EV / EBITDA

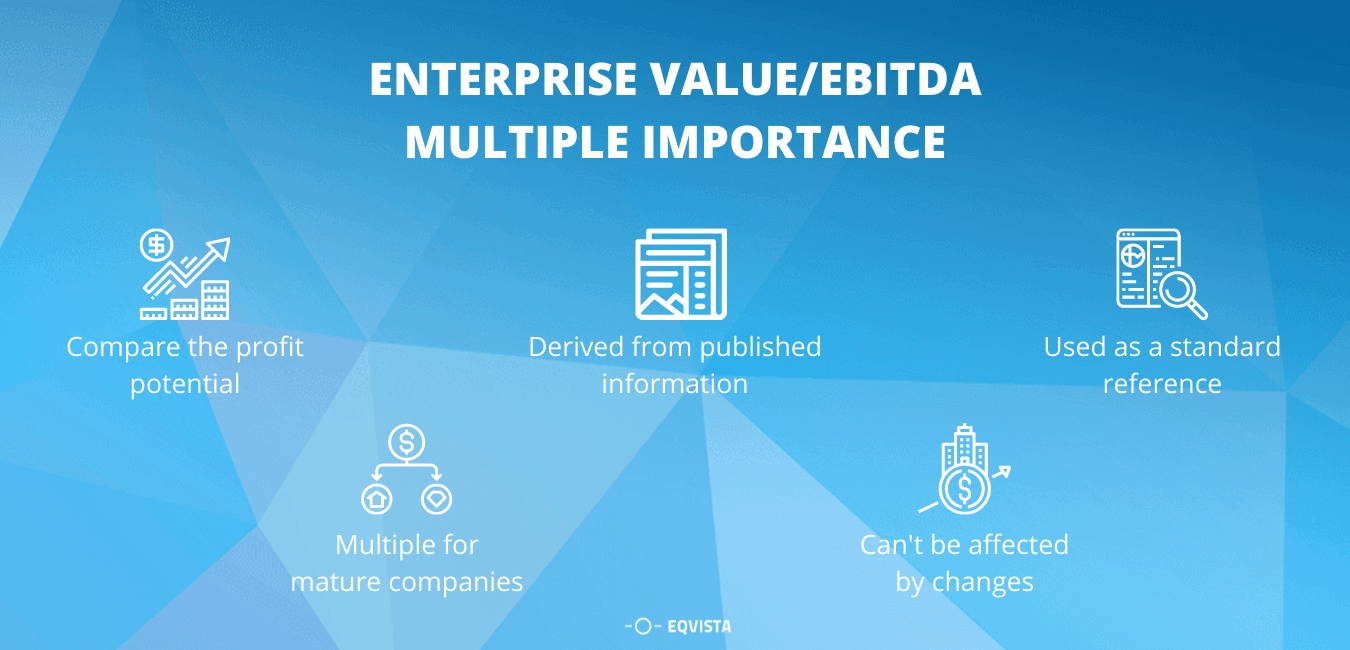

EV/EBITDA multiple by industry is an important valuation ratio because:

- It helps compare the profit potential of companies with similar cap structures. This multiple helps investors arrive at a reliable investment decision.

- It can be derived from published information made readily available to the public by the company. No background checks, calculations, or derivations are required.

- It is used as a standard reference in the finance industry. Helps standardize the process of mergers and acquisitions across valuation firms. They all use the same reference point.

- It is the best multiple to assess mature companies with minimal capital expenses.

- It is not affected by changes in a company’s capital structure.

Where is EV/EBITDA Multiple used?

Company valuation is a common conversation point among investors and analysts. It is where any decisions regarding mergers, acquisitions, and other forms of investments begin. The most casual reference is the market cap. If they need more details about the total worth of the company, they derive the enterprise value. Furthermore, if they have to check how well the company has generated profits, they will assess EBITDA. Then what is the use of an EV/EBITDA ratio calculator?

- This ratio helps differentiate between companies with similar equity values.

- This ratio helps to analyze the profitability of a company with relative values within the same industry.

- Since enterprise value is used, this ratio accounts for a holistic view of the target company, including its outstanding debts, equity that will eventually convert to stocks, preferred shares, minority interests, and cash reserves.

- This ratio indicates the current trading value of a company. For example, Company ABC Inc. is trading at 6x.

- This ratio helps compare valuations of diverse companies within the same business group. For example, Companies ABC Inc, XYZ Corp, and NYT Inc are trading at 6x, 2x, and 7.8 x respectively.

- This ratio helps to calculate the terminal value in a discounted cash flow model.

- This ratio is a reference value for investment deals. Stakeholders discuss offers in terms of Nx of EBITDA.

- This ratio is a great tool to compare multinational and trans-national companies. It is not affected by the taxation policies of individual countries.

EV/EBITDA Calculation

EV/EBITDA ratio calculator follows a simple method. But the utility of this ratio to derive the right valuation information depends on the analysts interpreting the values. It is not advisable to blindly rely on a single valuation multiple to arrive at investment decisions involving large buyouts. Professionals in the field would agree that company valuation is best done by referring to multiple metrics and a deep understanding of the operating industry.

EV/EBITDA Calculation Steps

As far as calculation of EV/EBITDA multiple by industry is concerned, one needs the enterprise value and then the EBITDA of comparable companies. On dividing EV by EBITDA, analysts find the ratio. Let’s take a closer look at the process:

- The primary step is to identify the target industry to which the company belongs. Research nuances of how the industry operates, market leaders, startups, current trends, factors affecting industry growth, market drivers, market size, and the likes.

- Next, shortlist at least 10 companies from the same industry, including the acquisition choices.

- Make sure all these companies are comparable. They must be a homogenous selection of similar company size, scale, product mix, location, markets, and other factors contributing to the brand image.

- The next step is to assimilate the financial data of all companies for the past 3 years. These are primarily available from the public finance records of the company. Ensure data is taken from reliable sources and are current.

- Collect information about company equity. Gather their total shares outstanding and price per share as per the current market value.

- Based on this information, first, calculate Enterprise Value. Add market cap and all outstanding debt components and deduct the total value of available cash.

- Next, calculate EBITDA. The easiest method to do this is by starting with the net operating profit of the company and add depreciation and amortization.

- Finally, divide the Enterprise Value/EBITDA for all 10 companies. This gives the enterprise multiple.

- Compare the enterprise multiples of each company and conclude.

- Compare this conclusion with results derived from other company valuation methods.

Interpretation to EV/EBITDA Calculation

The interpretation of EV/EBITDA multiple by industry varies based on factors such as the nature of business, competition, the demand of products, profit margins, and capital requirements of a company. The most simplified derivation is:

- Higher EV/EBITDA ratio = higher company valuation

- Lower EV/EBITDA ratio = lower company valuation

A company with a lower valuation is most suitable for acquisition because the acquirer needs to pay less compared to all other companies with a higher ratio. An analysis of the top 500 publicly traded companies (S&P 500 Index) indicates that a ratio of 10 or above indicates a financially healthy company. Enterprise value/EBITDA ratio interpretation is valid only if the companies chosen for comparison are homogeneous in nature. Otherwise, enterprise value/EBITDA value can be misleading.

Example of calculating EV/EBITDA

As seen in the earlier sections, the first step of the EV/EBITDA ratio calculator is to derive the enterprise value. Let’s consider a working example of three companies:

Components Company ACompany BCompany C

Total diluted shares1,000,0001,500,0002,000,000

Price per share$30$20$10

Market value of common shares (A)$30,000,000$30,000,000$20,000,000

Market value of preferred shares (B)$1,000,000$10,000,000$10,000,000

Market value of debt (C)$1,500,000$2,000,000$5,000,000

Market value of minority interest (D)$1,000,000$1,500,000$2,000,000

Total cash (E)$10,000,000$15,000,000$5,000,000

Enterprise value (A + B + C + D – E)$23,500,000$28,500,000$32,000,000

The enterprise values of these three companies are as follows:

- EV of Company A = $23,500,000

- EV of Company B = $28,500,000

- EV of Company C = $32,000,000

The next step is to calculate the EBITDA for these three companies:

Components Company A Company B Company C

Revenues$10,000,000$20,000,000$30,000,000

Expenses$1,000,000$5,000,000$10,000,000

Net income (A)$9,000,000$15,000,000$20,000,000

Interest (B)$500,000$100,000$550,000

Taxes (C)

$800,000$150,000$200,000

Depreciation (D)$50,000$40,000$50,000

Amortization (E)$10,000$10,000$30,000

EBITDA (A + B + C + D + E)$10,360,000$15,300,000$20,830,000

The EBITDA of these three companies are:

- EBITDA of Company A = $10,360,000

- EBITDA of Company B = $15,300,000

- EBITDA of Company C = $20,830,000

As per the EV/EBITDA ratio calculator:

- EV/EBITDA of Company A = $23,500,000/$10,360,000 = 2.27

- EV/EBITDA of Company B = $28,500,000/$15,300,000 = 1.86

- EV/EBITDA of Company C = $32,000,000/$20,830,000 = 1.53

These values indicate that Company C’s Enterprise Value/EBITDA ratio is the lowest at 1.53. This makes it the most profitable option for taking over among the three companies.

Limitations of EV/EBITDA Calculation

Analysts extensively use the enterprise value/EBITDA ratio for company valuation. However, as a standalone metric, there are some limitations:

- The biggest drawback is that EBITDA does not account for income in cash.

- It does not account for capital expenditures.

- This ratio is difficult to use in comparing businesses with different growth rates.

- It is a non-GAAP measure. Analysts may take the liberty to vary inclusions and exclusions of income and expenditure components.

- Some companies may choose to hide the reality of their earnings under an inflated EBITDA. Analysts must comb through all values and run by other valuation metrics to ensure that EV/EBITDA multiple by industry indicates the right estimation.

Which sectors are best suited for valuation using EV to EBITDA?

EV/EBITDA multiple by the industry as a valuation metric comes handy, especially in these situations:

- During mergers and acquisitions.

- To compare ROI and financial health of capital intensive businesses.

- To assess the profit potential of sub-divisions created under a large one.

- To compare international companies across different regions. This ratio helps bypass limitations of varying taxation policies across borders.

- To evaluate companies where cash flow is negative.

Data shows that a good EV/EBITDA value helps compare companies in capital intensive sectors such as:

- Oil and gas

- Automobile

- Cement

- Steel

- Energy

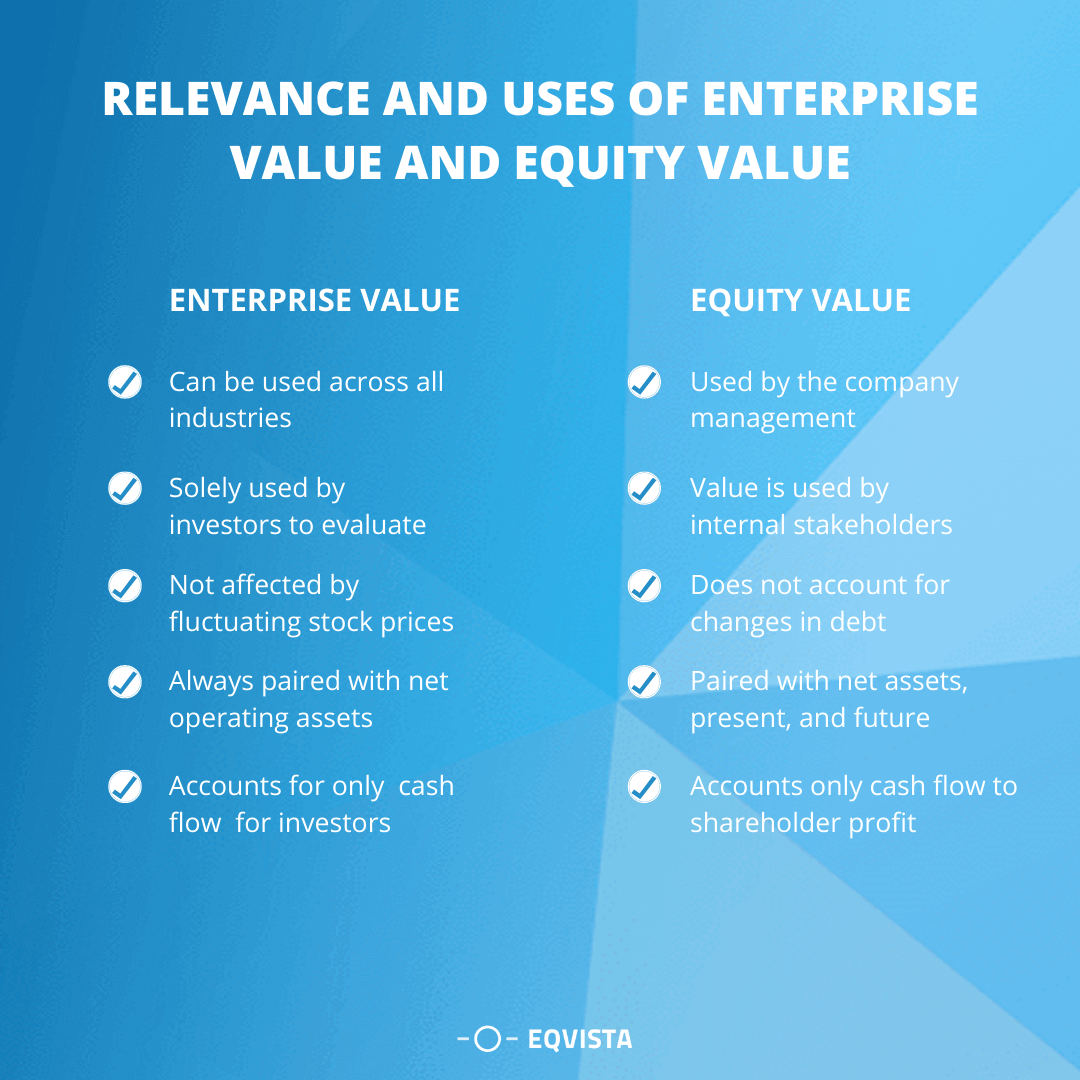

Relevance and Uses of Enterprise Value and Equity Value

Equity value is often used interchangeably with market cap, but they are not the same. Market cap only includes the total value of common shares, whereas equity value includes all types of equity issued by the company, such as preferred shares, convertible notes, warrants, bonds, etc. The direct utility of equity value is:

- Used by the company management to assess the rise and fall of their business value in the stock market and accordingly steer strategies.

- Can be used to evaluate companies across all types of industries

- The value is used as an indicator by internal stakeholders of a company

- Does not account for changes in debt and cash flows in a company

- Always paired with net assets, present, and future

- Accounts only those cash flow mechanisms that contribute to shareholder profits

Enterprise value, on the other hand, includes a wide range of components. As seen before, it includes the debt component of a company because the acquirer is responsible for paying off the acquired company’s outstanding loans. It also includes total cash reserves because the acquiring company will gain this reserve after taking over. Most often, this surplus cash is used to pay off existing loans. As a result, this is a more holistic view of the value of a company that an investor is required to pay in case they choose to buy out. The direct utility of enterprise value is:

- Can be used across all industries except those that strategically acquire heavy debts to purchase expensive assets/services to run business (e.g. banking, insurance, heavy machinery)

- Solely used by investors to evaluate companies for acquisitions

- Not affected by fluctuating stock prices

- Always paired with net operating assets only. Deals only with a current scenario for the purpose of a company takeover

- Accounts for only those cash flow mechanisms that concern investors

Do you know your company’s value?

Company valuation is a nuanced process. It is not a simple one-formula-suits-all calculation. There is a lot of paperwork and follow-ups with various stakeholders. A proper company valuation sets the tone for all investments. Both the company management and the investor must have the correct valuation numbers to make informed decisions. EV/EBITDA multiple by industry is only one valuation ratio. It is best left to the professionals to apply the right combination of valuation metrics to arrive at a reliable investment decision. The Eqvista valuation team is an expert at this. For more information, reach us today.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)