Enterprise Value (EV): What It Is & How To Calculate

stnazkul/iStock via Getty Images

Mục Lục

What Is Enterprise Value?

Enterprise value (EV) is a way to measure the actual value of a company’s business operations, without regard to its capital structure or cash on hand. It’s a more holistic way to value a company than by just looking at its market capitalization. Essentially, enterprise value is a company’s market capitalization adjusted upwards for outstanding debt and adjusted downwards by its balance of cash & equivalents.

A company’s enterprise value can increase or decrease based on its financial activities and its performance in the stock market. Enterprise value will move up and down in step with changes in a company’s market capitalization, except where changes to cash and debt balances occur.

Uses for Enterprise Value

Because enterprise value is a more accurate measure of a company’s actual business value, it is typically used to estimate its true takeover value. For example, if a company has a market cap of $22 billion, but holds $3 billion in cash, an acquirer who buys all outstanding shares at the current market price is essentially paying only $19 billion for the business. The acquirer will use $22 billion to purchase all the outstanding stock, but then inherit the $3 billion of the case.

Investors and analysts often use enterprise value to conduct comparisons of companies with varying capital structures. When combined with other financial metrics, such as EBITDA, revenues, and price/earnings, enterprise value ratios are used to measure and compare the financial performance of companies.

Key Takeaway: Enterprise value represents a company’s worth more accurately than market capitalization because it accounts for its debt obligations and liquid assets.

Enterprise Value Formula

Enterprise value is relatively easy to calculate if you know where to find the variables. The formula for calculating EV is as follows:

Enterprise Value (EV) = Market Capitalization + Total Debt – Cash and Cash Equivalents

- Market capitalization, also referred to as “market cap,” is simply the number of outstanding shares multiplied by the most recent share price.

- Total debt is the sum of all a company’s short- and long-term debt and can be found on its balance sheet under “Liabilities.”

- Cash and cash equivalents include all the company’s liquid assets listed under “Current Assets” on the balance sheet.

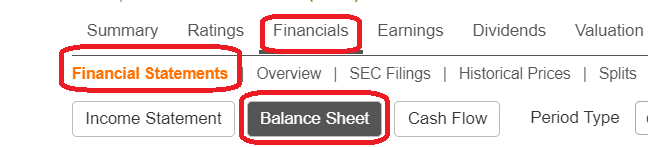

Seeking Alpha readers can find balance sheet information for individual companies by visiting the company stock page, and then selecting “Financials”, then “Financial Statements”, before then specifying “Balance Sheet” (see below). A company’s Income Statement and Cash Flow statement are also available here.

Seeking Alpha Symbol Page

Key Takeaway: The enterprise value formula is straightforward with just three components: a company’s market capitalization, total debt obligations, and liquid assets.

Debt’s Impacts to a Company’s Enterprise Value

A company’s debt is added to market capitalization because it increases the amount that would have to be paid to acquire the company. For a company to be acquired, the investor or suitor would have to cover the debt obligations of the company in addition to buying its outstanding stock.

Similarly, cash is deducted from enterprise value because, in a takeover situation, a company relinquishes its cash to the buyer, effectively lowering the cost of acquisition.

Tip: A company’s enterprise value is most often affected by changes in market capitalization. Debt issuances and debt repayments may not impact enterprise value at all, as the change in debt and change in cash can offset each other. A company’s enterprise value will rise if cash from a new debt issuance is invested in the business.

Enterprise Value Calculation Example

For a clearer picture of how a company’s enterprise value can change, consider the following example.

At the beginning of the year, Company A had $10 million in market capitalization, cash and cash equivalents of $400,000, and total debt of $500,000 for an enterprise value of $10.1 million.

$10 million + $500,000 debt – $400,000 cash = $10.1 million

By midyear, its share price had increased 5%, increasing its market cap to $10.5 million. The company decided to use $300,000 of its cash to pay down $300,000 of its debt. Its enterprise value at that point is $10.6 million.

$10.5 million + $200,000 debt – $100,000 cash = $10.6 million

EBITDA & Enterprise Value (EV)

Enterprise value is a common numerator used in many financial ratios to measure a company’s performance relative to its total value. One of the more commonly used financial ratios is the Enterprise Value/EBITDA, which compares the total enterprise value of a company to its operating profits generated from earnings before interest, taxes, depreciation, and amortization (EBITDA).

EBITDA is a widely accepted way to measure the financial performance and profitability of companies regardless of capital structure.

The formula for calculating EBITDA is straightforward:

EBITDA = Net income + interest expense + taxes + depreciation + amortization

When used together as a financial ratio, EV/EBITDA become a useful valuation tool to compare the total value of a company to the company’s cash earnings net of non-cash expenses. The ratio can be more useful than the price-earnings (P/E) ratio when comparing companies with varying amounts of debt. It’s also an especially useful ratio when valuing capital-intensive companies with high levels of depreciation and amortization.

Key Takeaway: The EV / EBITDA ratio can be useful in comparing companies with varying amounts of debt.

Bottom Line

Enterprise value isn’t followed as closely as market cap by most investors, yet is a useful measure that reflects the value of a company’s underlying business. It measures the true cost an acquirer would be paying for the business if all common shares were purchased at the current stock price.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)