Enterprise Value Calculation | WACC Formula | Terminal Value

Mục Lục

What Is An Enterprise Value Calculation?

In our last tutorial, we understood the market risk premium (MRP).In this article, we will see enterprise value calculation and learn about some adjustments for valuation

Before the calculation of the Final Enterprise Value Calculation, overwrite the calculated WACC Formula with our earlier assumption of a 10% discount rate

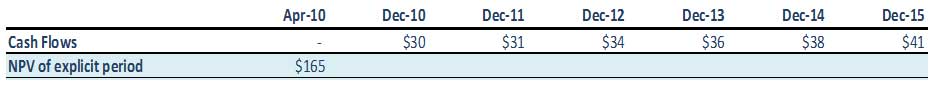

Find the present value of the projected cash flows using NPV/XNPV formulas (discussed in our excel classes).

Start Your Free Investment Banking Course

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

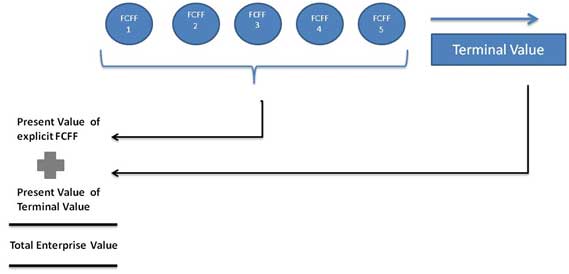

Projected cash flows of the firm are divided into two parts –

- Explicit Period (the period for which FCFF Formula was calculated – till 2013E)

- Period after the explicit period (post 2013E)

The concept of Enterprise Value Calculation

The concept of present value implies that ‘a dollar today is worth more than a dollar tomorrow (assuming a positive interest rate). For example, US$1.00 in a savings account today earning 5% will be worth US$1.05 one year from today. Similarly, Rs1.05 one year from today, assuming a 5% investment rate, is equal to Rs1.00 today.

Enterprise Value Calculation of a single cash flow

![]()

![]()

Enterprise Value Calculation of multiple cash flows

![]()

![]()

CF = Cash flows

K = discount rate

n = number of years

Step 12: Present value of the FCFF Formula for the projected years

Calculate the Present Value of the Explicit Cash Flows using WACC Formula derived above

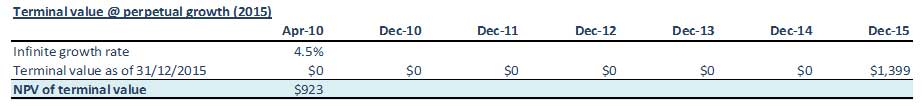

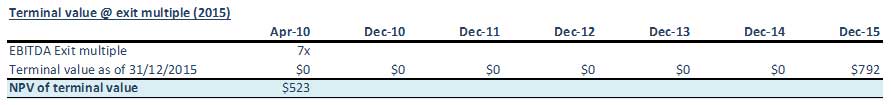

Step 13: Calculate the Enterprise Value Calculation of the Terminal Value using WACC Formula

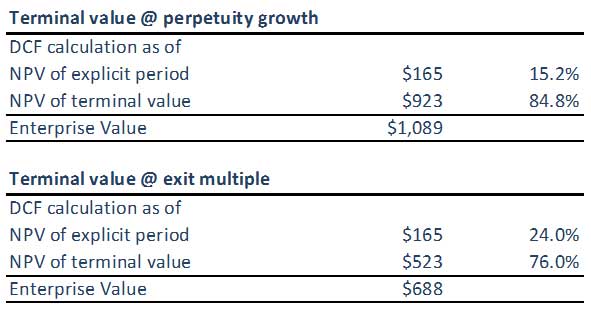

(A) Terminal Value using Perpetuity Growth Method

(B) Terminal Value using Exit Multiple Method

Please note that the Terminal Value from both approaches is not in sync. We may have to double-check our assumptions on EBITDA Exit Multiples or the WACC Formula /growth rate assumptions applied. Both approaches should ideally give similar answers.

Step 14: Calculate the Enterprise Value Calculation of the firm

By summing the (adjusted) present value of the projected free cash flows and the (adjusted) present value of the terminal value (whether calculated using the perpetuity method or multiple methods), the result is the Enterprise Value of the modeled business.

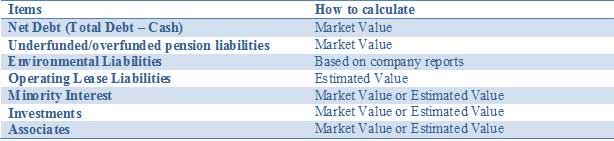

Adjust your valuation for all assets and liabilities, for example, non-core assets and liabilities, not accounted for in cash flow projections. The enterprise value may need to be adjusted by adding other unusual assets or subtracting liabilities to reflect the company’s fair value. These adjustments include:

The above list is not exhaustive and other potential adjustments relevant to specific situations should be discussed with team members. When performing a DCF analysis, it is important to properly reflect the values associated with partially-owned investments.

Net Debt Adjustments

Lacking more frequent disclosure of the fair value of debt means analysts and investors need to estimate the market value of debt. Although the market value of outstanding bonds can be monitored, this is nearly impossible for the related derivatives. So although conceptually including debt at fair value is the superior approach, this information is not always easily available. Therefore use of book value in the majority of cases; especially the difference between book value and market value of debt is only going to be material in a few cases e.g. when companies have issued fixed-rate debt and interest rates either move up or down quite significantly. Another example would be in cases where the credit ratings of the companies involved change quite dramatically. Only in these situations, estimating the fair value of debt and related derivatives to get a better proxy for the bondholders to claim than simply using book value is recommended.

Minority Interest

Minority interests are pieces of a business that are consolidated but not fully owned by the consolidating entity. Since the minority’s proportion of income is included in EBIT and free cash flow, the amount ‘owed’ to another owner must be subtracted from the DCFs Total Enterprise Value (TEV) to arrive at ‘clean’ enterprise value and then a ‘clean’ equity value. The market value of a minority interest can be derived by applying the % consolidated but not owned by a total subsidiary TEV. The subsidiary TEV can be calculated in one of three ways:

- If public, utilize existing stock price and debt information

- If private, create a separate DCF if enough information is available

- Utilize a price to book or earnings multiple of comparable companies and add associated debt

The book value of the minority interest plus the relevant portion of consolidated debt can be used as a proxy if no other information is available.

Pension Adjustments

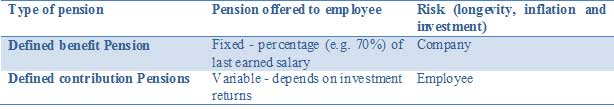

Companies generally offer a defined benefits or defined contribution pension plans.

Below we briefly summarize the two types of pension plans:

For Enterprise Value, defined contribution (DC) pension schemes are not relevant as the employer pays a fixed amount into a pension fund. The investment policy of the pension fund determines the (variable) pension for the employees. As the company has not offered a pension promise to its employees it neither recognizes pension liabilities nor pension assets on its balance sheet.

Defined benefit (DB) schemes matter for Enterprise Value as the company commits to pay a fixed amount to the employee on retirement. This puts the risk with the employer to pay the pension and hence creates an economic and accounting liability. To measure the pension liability, companies forecast the future pension payments by taking into account employee variables such as inflation, mortality, and retirement dates. These future pension payments are then discounted to the present to get a pension liability. In addition to providing pension benefits to their employees, companies, particularly with activities in the US, offer post-retirement health benefits that also have a defined benefit character. This means the total obligation to employee benefits combines defined benefit pension plans and other post-employment benefits.

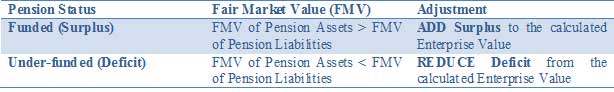

For Enterprise Value, view defined benefit obligations as a loan provided by employees to the company to be repaid upon retirement. Typically in the annual reports, Fair Market Value of Pension Assets and Pension Liabilities are mentioned.

Environmental Liabilities

Another non-debt liability that we deem to be financing in nature is environmental liabilities. These are long-term liabilities incurred by utilities, energy and mining companies to restore the environment to its original state when companies abandon a production site. Given the long-term nature, companies recognize the liability as a net present value meaning they give rise to interest accrual. The combination of long-term period and interest accrual means that they should be treated as part of Enterprise Value.

Operating Lease Adjustments

In Accounting, leases are either classified as finance (capital) leases or operating leases. Finance leases are recognized on the balance sheet as tangible assets with accompanying debt finance. Despite their similar characteristics, operating leases are not recognized on the balance sheet (off-balance sheet) with only the operating lease payment being reflected in the income statement. Operating leases should be included as an adjustment to the Enterprise Value. Present Value of Operating Lease rentals should be calculated. Sometimes due to a lack of sufficient information, Operating lease rentals are multiplied by a factor of 8x-10x to arrive at the Present Value of Operating Lease.

Investments

Investment in marketable securities, stocks and other companies should be calculated at Market Value wherever possible. For example stocks and marketable securities can be valued at Market Price. However, investment in companies that are unlisted, an estimated value should be used.

What Next

In this article, we have learned various kinds of adjustments. Now we will look at the Equity Value of the firm post Adjustments. Till then, Happy Learning!

Recommended courses

So here are some courses that will help you to get more detail about the enterprise value calculation, fcff formula, WACC formula, and the terminal value. Therefore here are some link that will get deep detail about courses so just go through the link

0

Shares

Share

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)