Crude Oil Trading Strategies: 6 Proven Steps Update (2023)

Crude Oil Trading Strategies: 6 Proven Steps to Maximize Profits | Update (2023)

Today you’re going to learn how to trade like a professional Oil trader by using our Crude Oil trading tips. The Crude Oil market is not just a high liquidity market, it’s also one of the most favored markets by professional traders who like to find opportunities to profit.

Developing an effective crude oil trading strategy can help your portfolio gain a competitive edge. Crude oil is a volatile asset that is consistently in demand. Additionally, the strong ties between crude oil and the American Dollar (USD) make it especially popular among traders.

Our team at Trading Strategy Guides has developed the Crude oil trading strategies PDF. If you want to jump straight to the PDF guide, click here. It is no secret that the Crude Oil market is dominated by commercial players and big hedge funds. That is why we designed this strategy to help you swim with the big sharks.

Without further ado, let’s jump right into crude oil trading strategies!

Crude Oil Trading Strategy: Best Timed Expert Advice at Your Fingertips From Trading Strategy Guides to Minimize Risk and Maximize Crude Oil Trading Profits

Swing Trading Report

Get Our Free Swing Trading Strategy

Get Our Free Swing Trading Report Today!

- Entry Points

- Exit Points

- Risk Managament

- Time Saving Tips

Enter your email address

Commercial players, such as big oil producers, use the Crude Oil futures market to hedge physical exposure from possible big market swings. On the other hand, the big hedge funds speculate on the short-term Oil price direction.

When you try to trade such an overcrowded market, you need a Crude Oil strategy if you want to perform at a high level and survive trading Oil. Smart money uses computers and high-frequency trading that executes multiple trades per second.

Moving forward, we’ll go through some significant aspects that a good Crude Oil strategy needs to incorporate. We will also share some Crude Oil trading tips. Out of this, you can also develop a decent day trading crude oil strategy.

Crude Oil Chart Price Trading Tips

Unlike many other asset markets, if you want to have a better reading of the Oil price action, you also need to be interested in the fundamental analysis side. The Oil supply and demand balances are critical factors that can alter and change the Oil trend.

In this regard, keeping an eye on the Oil output forecast and consumption outlook can give you an extra edge.

The Oil market is also very sensitive to geopolitical risks. Wars, trade agreements, regulations, and other political events can all directly affect the price of crude oil.

Keep this in mind when deciding to trade Brent Crude or WTI Crude.

Everything that happens in Iran, or anything that happens in terms of weather in the Gulf of Mexico, will adversely affect the Oil supply output.

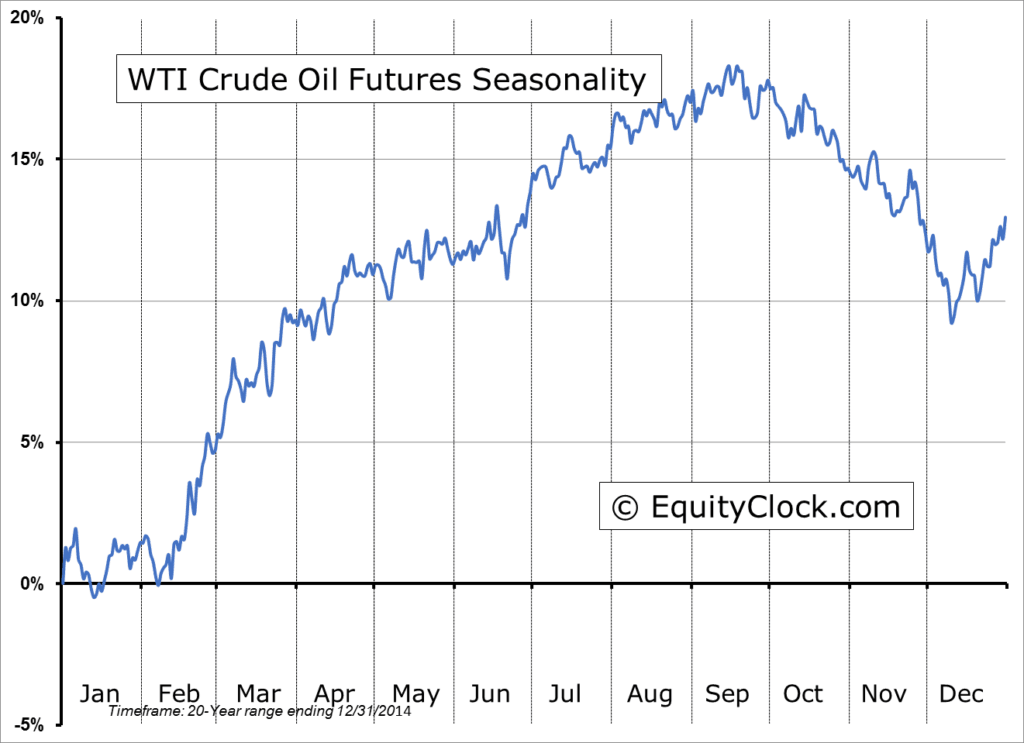

Another crude oil trading tip is that Oil prices are sensitive to the seasonal pattern. If you get into the seasonal flow of trading Oil, it can be quite rewarding.

The Crude Oil price has the tendency to rise in August due to the summer driving season. It tends to fall towards mid-September and October.

Weather and climate affect changes in oil prices much more than they affect securities such as stocks and bonds. When there is an unusually cold winter, the demand for oil (used for heating) will increase. Spring and Fall typically see the lowest petroleum values. For cyclical traders, this is often the best opportunity to enter the market.

Crude Oil Chart Price vs the US Dollar

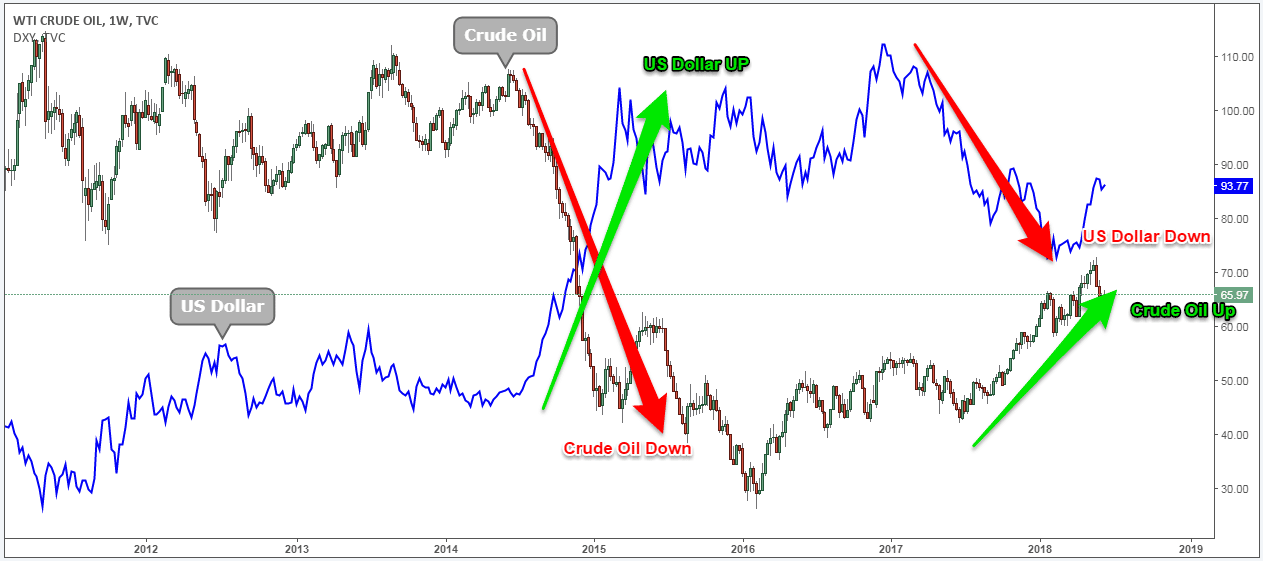

In the category of another crude oil trading tip, we mention that the US dollar will also affect crude oil prices. The strength of the dollar is a quick way to gauge the strength of Crude Oil prices.

As a general rule, crude oil prices tend to drop when the US dollar appreciates. Conversely, when the dollar is weaker, crude oil prices tend to strengthen.

If history can be used as a barometer to forecast Crude Oil chart prices, we can say the US dollar and Oil have an interesting and perhaps surprising relationship, as they tend to move in opposite directions.

The USD is more closely tied to the price of oil than any other currency. Paying attention to events affecting the value of the dollar can help make the market more predictable. Things such as announcements from the FED, the introduction of tariffs, changes in interest rates, and other events can all directly affect the dollar’s overall purchasing power.

Now, here is the best way to conquer the market using this Crude Oil trading strategy:

Crude Oil Trading Strategy

Let’s now look into what it takes to develop a consistently reliable Crude Oil strategy. We have decided to share some crude oil trading tips that have stood the test of time and that can help you trade like a professional oil trader.

This strategy can also be used as a crude oil day trading strategy if that is what you’re after. Before we go any further, we always recommend taking a piece of paper and a pen to note down the rules of this entry method.

Whether you are planning to trade light sweet crude oil or Brent Crude oil, futures contracts trade in 1,000 barrel increments.

In this article, we’re going to look at the buy-side.

Now, we are going to share our personal step-by-step guide.

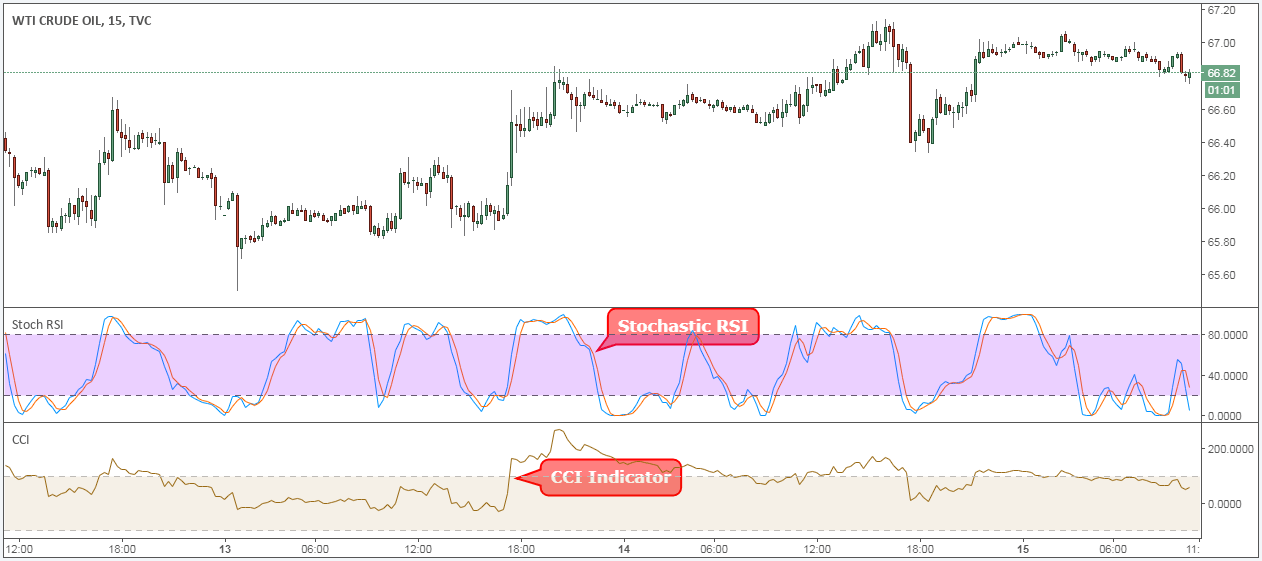

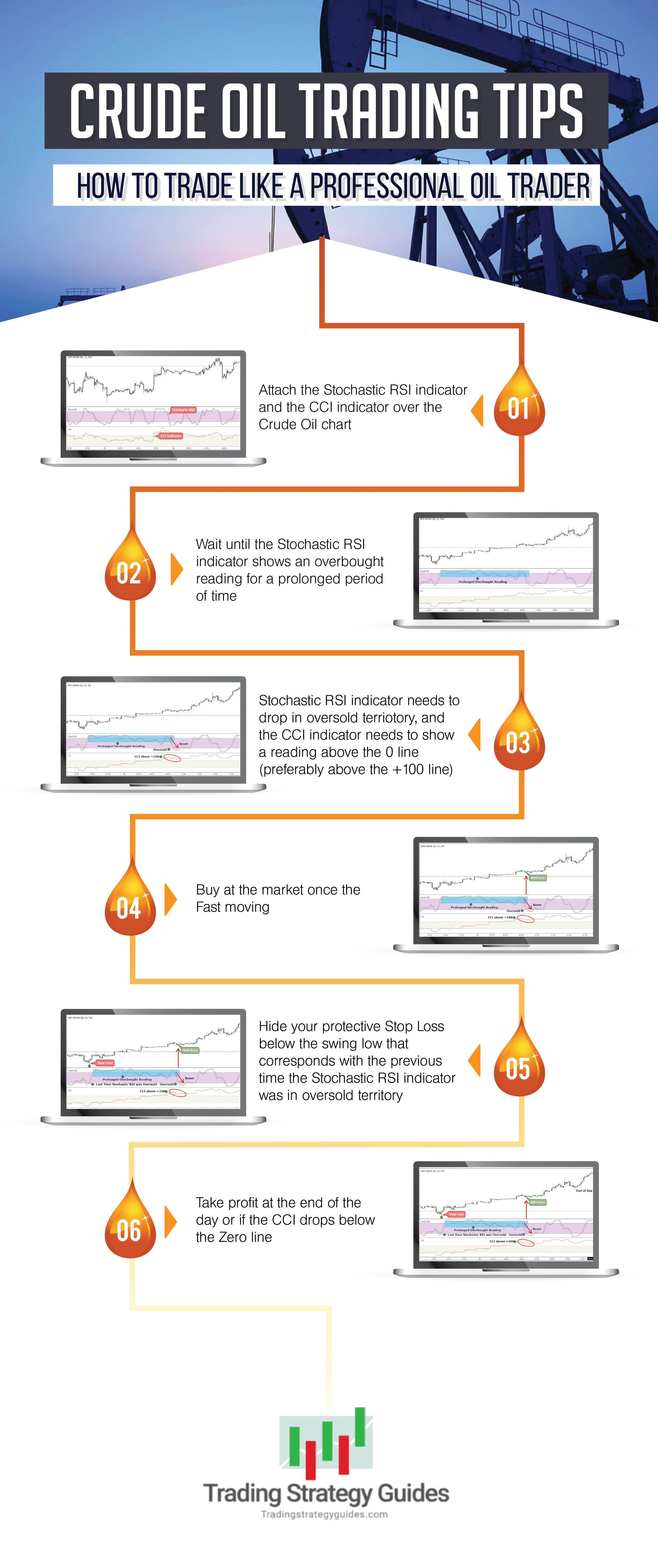

Step #1: Attach the Stochastic RSI indicator and the CCI indicator over the Crude Oil chart.

There are many technical indicators you can choose from. Picking the right one is important if you want to make good trades. The best crude oil day trading indicator is the Stochastic RSI indicator. At least that’s what we found out after trading the Oil market for many years.

The RSI indicator makes it easy to determine when an asset is overbought or oversold, which is useful in commodities markets.

Note*: the preferred Stochastic RSI settings are 20-periods.

The second technical indicator we’re going to use to spot cycles in the commodity market is the CCI indicator.

The CCI indicator was really designed to find cyclical trends in the Oil market and to be used as a bearish or bullish filter.

Note: The preferred CCI setting is the 200-period.

Technically, the best way to interpret the Commodity Channel indicator is as follows. A positive reading above the zero line is a bullish signal and a start of an uptrend, while a negative reading below the zero line is a bearish signal.

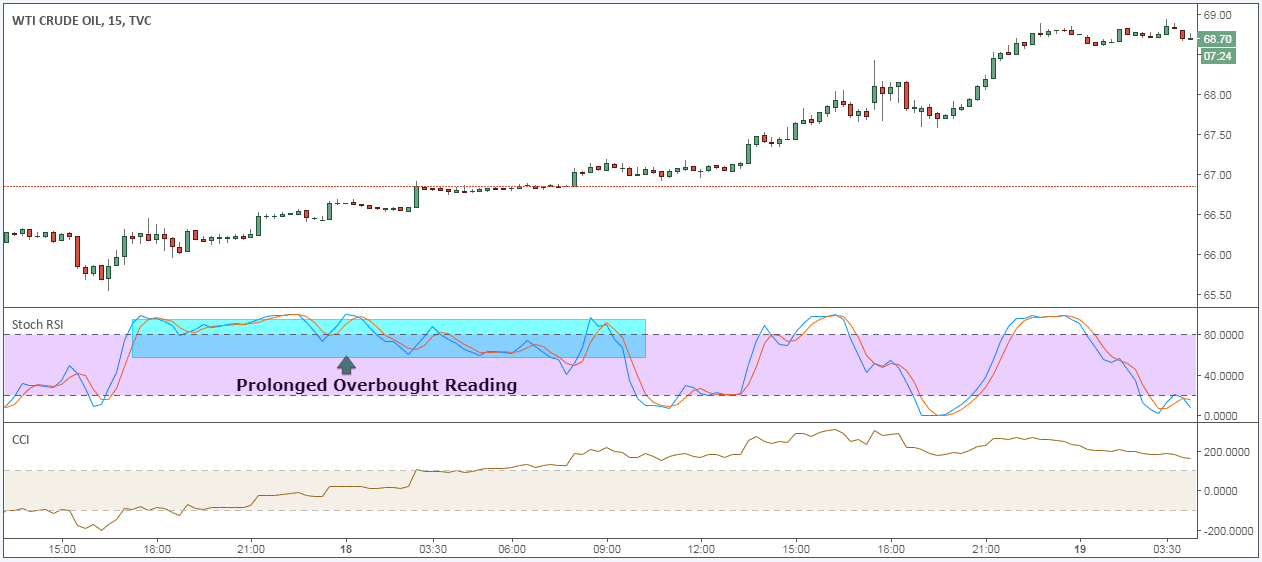

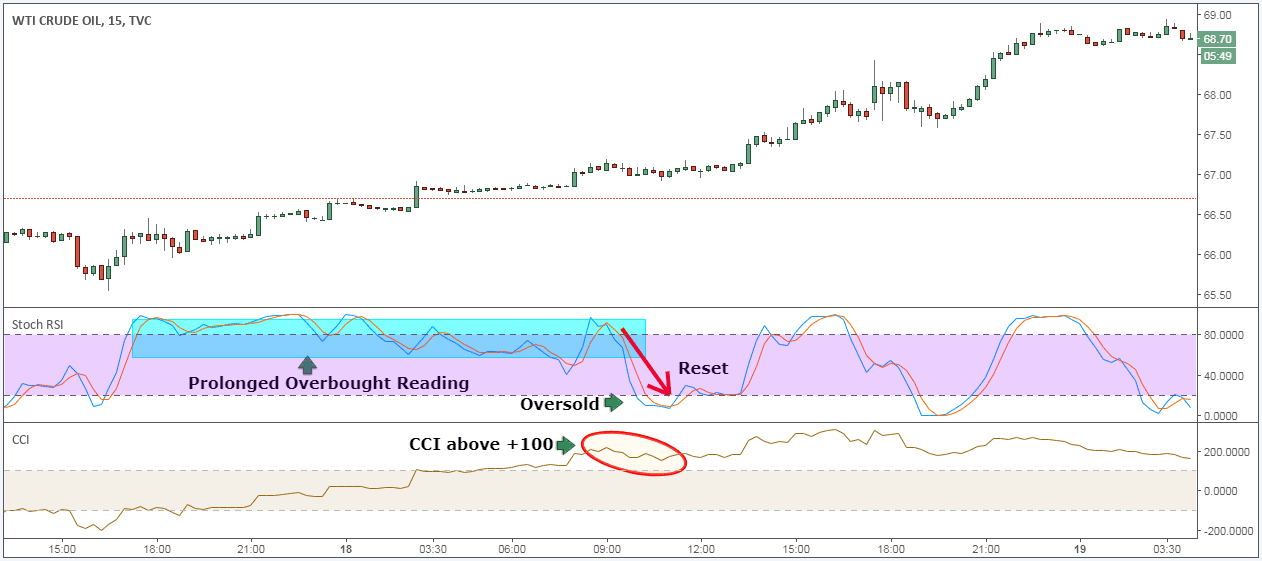

Step #2: Wait until the Stochastic RSI indicator shows an overbought reading for a prolonged period of time.

A good crude oil trading strategy only looks to buy on strong up days. And contrary to the popular belief, when a market shows an overbought reading for a prolonged period of time, that’s a strong bullish signal.

As the saying goes, a market can stay in overbought and oversold territory longer than you can remain solvent.

Oil prices are very dynamic. That’s the reason why we don’t want to constrain how much time it needs to stay in overbought territory for a valid trading signal. However, as a general rule, the Stochastic RSI indicator needs to stay above the 50 line during this time. Preferably, we want to see strong readings in the region of the 80 level. We’re still not ready to pull the trigger. There are still two more trading conditions that need to be satisfied.

See below:

Step #3: Stochastic RSI indicator needs to drop in oversold territory and the CCI indicator needs to show a reading above the 0 line (preferably above the +100 line).

Now that we know that a prolonged overbought reading means we have the smart money buying power, we can assume that once the Oil market reaches oversold reading, the smart money will show up again to keep Oil prices up.

To guard ourselves against the possibility of a false signal, we’ve added the CCI as our best indicator for crude oil trading, to confirm the Crude Oil cycle.

In this regard, during the time the Stochastic RSI resets, we need to see the CCI holding above the 0 line. Preferably, we want the CCI indicator to hold above the +100 line. A CCI reading above the +100 level will ensure a higher probability of the trade to succeed.

Now that the Crude Oil price chart is satisfying these new technical requirements, we can lay down a simple entry strategy to buy Crude Oil.

See below:

Swing Trading Report

Get Our Free Swing Trading Strategy

Get Our Free Swing Trading Report Today!

- Entry Points

- Exit Points

- Risk Managament

- Time Saving Tips

Enter your email address

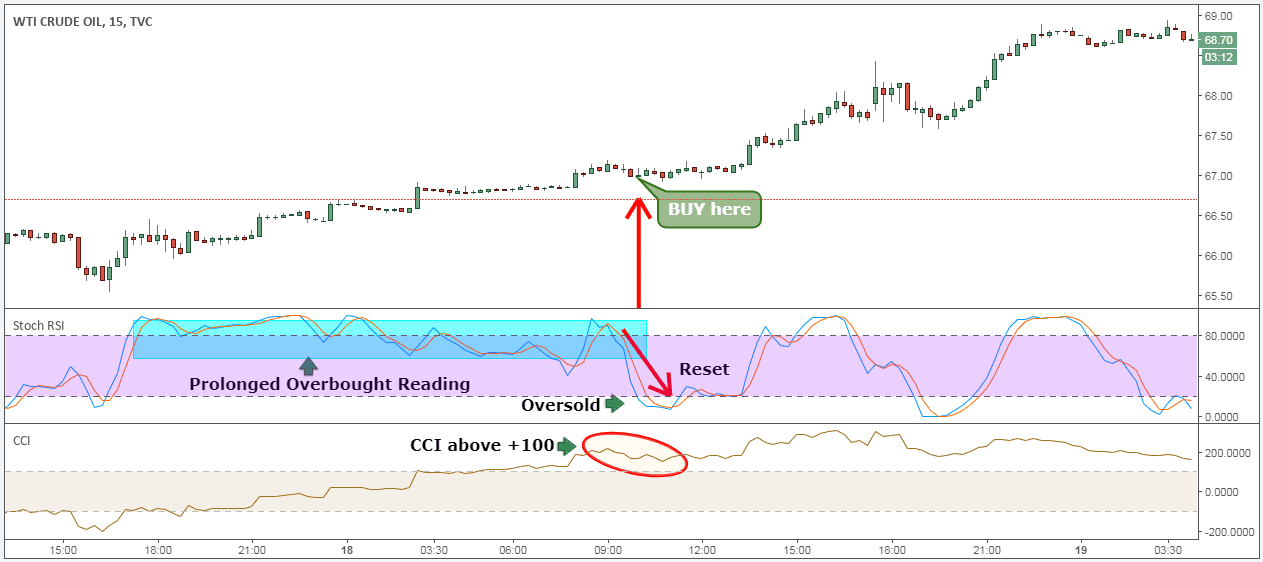

Step #4: Buy at the market once the Fast Moving Average (Stochastic RSI) crosses below the 20 level.

This Crude Oil entry strategy is easy to implement.

We only need the fast-moving average of the Stochastic RSI indicator to cross below the 20 level. Usually, the blue line is the fast-moving average. You can easily identify the fast-moving average because it’s the one moving average that it’s in front.

This is a quick trade that enables all traders that took that trade to walk away from the trading screens for the rest of the day.

This brings us to the next important step we need to for executing the best Crude oil trading strategies, which is where to place our protective stop loss.

See below:

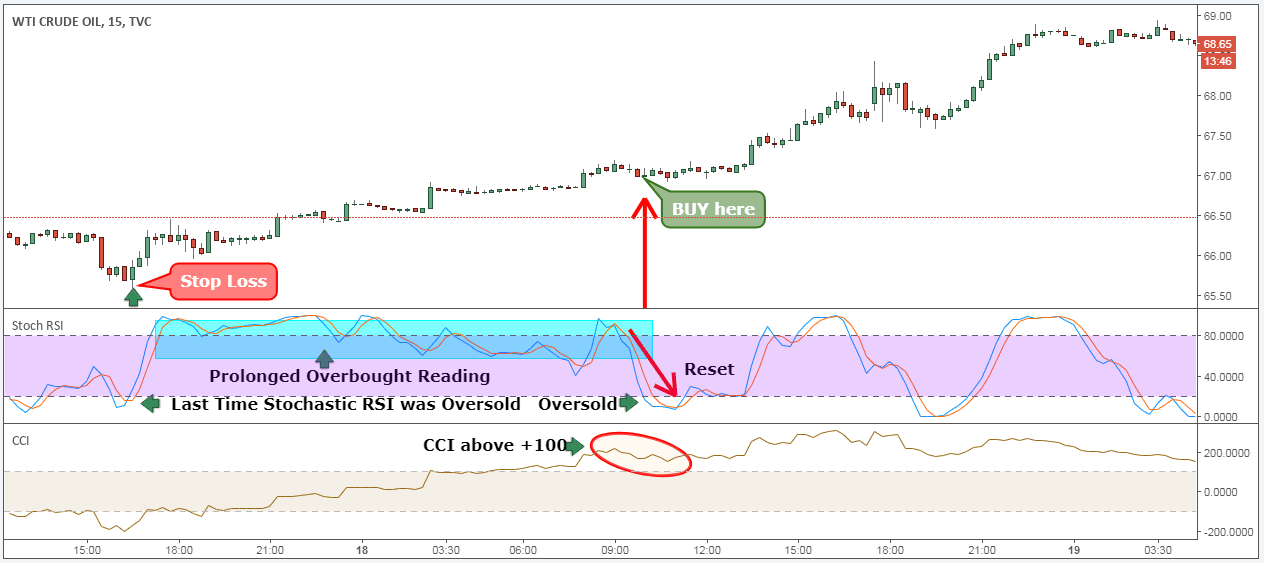

Step #5: Hide your protective Stop Loss below the swing low that corresponds with the previous time the Stochastic RSI indicator was in oversold territory.

Simply identify when was the last time the Stochastic RSI indicator was in oversold territory. Next, locate the corresponding swing low on the price chart.

Once you’ve identified that point on the Crude Oil price chart, use it to place your protective stop loss.

Last but not least, we also need to define where we take profits when trading Oil.

See below:

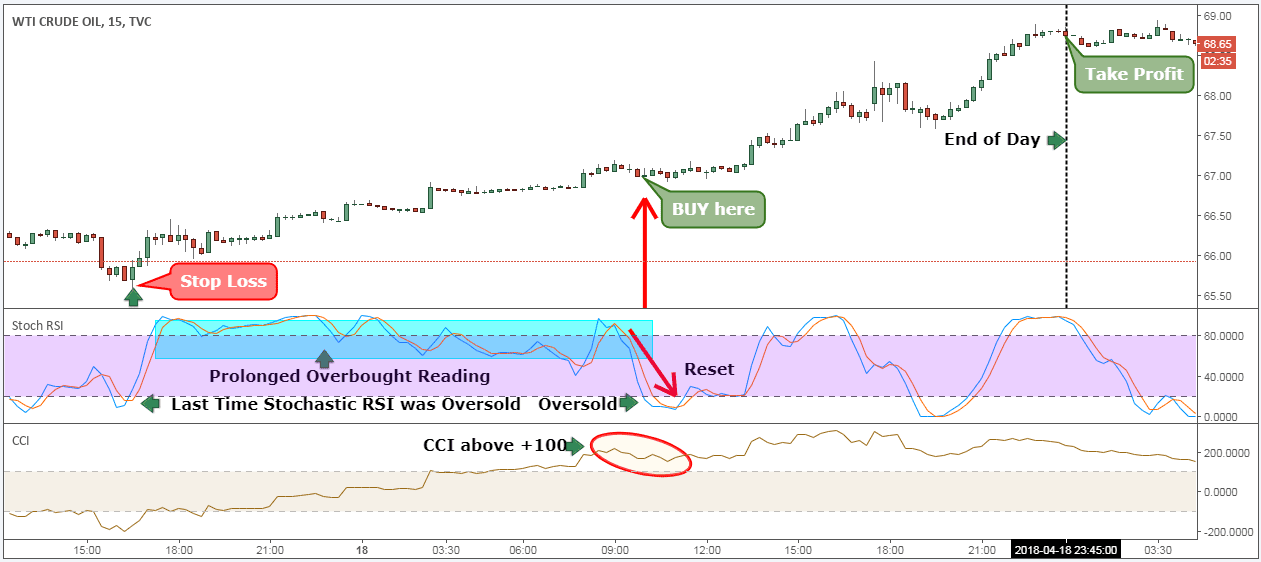

Step #6: Take profit at the end of the day or if the CCI drops below the zero line.

The Crude Oil price chart has high volatility and great potential to profit from the intraday trends. Our favorite crude oil exit strategy is to let the trade run until the end of the day or when the CCI indicator drops below the zero line, whichever comes first.

We’re going to incorporate this valuable resource into our exit strategy which is the Commodity Channel Index. The CCI indicator can spot in advance when an Oil cycle has ended or when a new one has started.

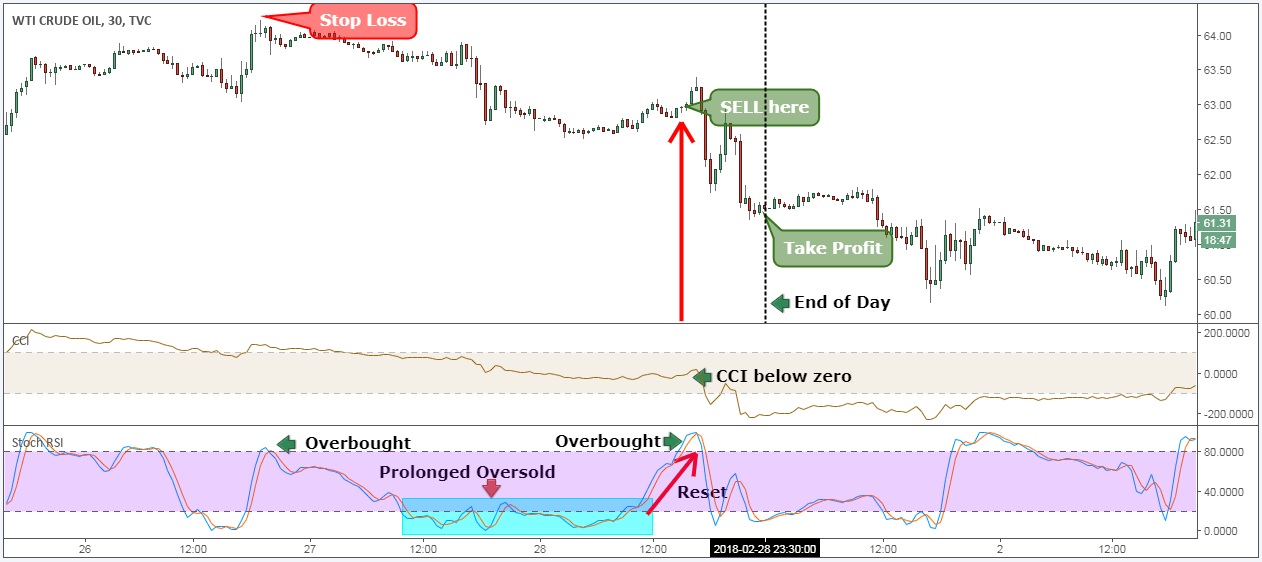

**Note: The above was an example of a BUY trade using our crude oil strategy. Use the same rules for a SELL trade – but in reverse. In the figure below, you can see an actual SELL trade example.

Conclusion – Crude Oil Trading Strategy

The big trading volume that pours into the Oil market can generate some freakish trading opportunities for the prepared trader. It’s important to have a commodity trading strategy because no crude oil trading tips can substitute the necessary trading skills you need to survive in the commodity market.

The bottom line is that traders can benefit from volatile WTI Crude Oil prices by using our trading tips. Whether you are trading oil funds with natural gas, WTI, Brent, or light sweet crude, remember one thing: you need to exercise a great amount of discipline because the Oil market is infested with the big sharks that want your money!

Thank you for reading!

Interested in more in-depth crude oil trading strategies? Then Check Out This Oil Boom Strategy Here!

- Want more commodities trading strategies? Be sure to check out our soybean trading strategy here, or gold and silver ratio trading here.

- Please leave a comment below if you have any questions about the Best Crude Oil Trading Strategy!

- Also, please give this strategy a 5-star rating if you enjoyed it!

Crude Oil Trading Strategy PDF

Please share this Crude Oil Trading Strategy Below and keep it for your own personal use! Thanks, Traders!

Frequently Asked Questions (FAQs) about Crude Oil Trading Strategies:

Q: What is crude oil trading and why is it popular?

A: Crude oil trading involves buying and selling contracts for crude oil, usually through futures or options. It’s popular because of the potential for significant profits due to the volatility of the crude oil market.

Q: What are some common strategies for crude oil trading?

A: There are many different strategies for crude oil trading, such as trend following, breakouts, and swing trading. We’ve compiled a list of 10 proven strategies in our comprehensive guide.

Q: How can I minimize risk in crude oil trading?

A: You can minimize risk in crude oil trading by using proper risk management techniques, such as setting stop-loss orders and position sizing. Our guide covers these techniques in detail.

A: Some of the best tools for crude oil trading include charting software, news sources, and market analysis tools. Our guide lists some of the most useful tools for successful crude oil trading.

A: There are many sources of crude oil market news and analysis, such as financial news websites, market analysis reports, and social media. Our guide provides some useful resources for staying informed about the crude oil market.

Q: What are the crude oil trading hours?

A: Crude oil futures trade on the CME Globex and NYMEX exchanges from Sunday to Friday, 6:00 pm to 5:00 pm ET, with a one-hour break from 5:00 pm to 6:00 pm ET each day.

Q: Where can I track crude oil prices?

A: There are many sources of crude oil price data, such as financial news websites, commodity price tracking websites, and trading platforms. Our guide includes some useful resources for tracking crude oil prices.

Q: What is the best time to trade crude oil?

A: The best time to trade crude oil depends on several factors, such as market volatility, economic news releases, and trading volumes. Our guide covers some of the key considerations for choosing the best time to trade crude oil.

Q: What is the best indicator for crude oil trading?

A: There are many indicators that can be useful for crude oil trading, such as moving averages, MACD, and RSI. Our guide discusses several indicators in detail and provides recommendations for their use in different trading strategies.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)