Business Life Cycle

Mục Lục

Business Life Cycle Definition

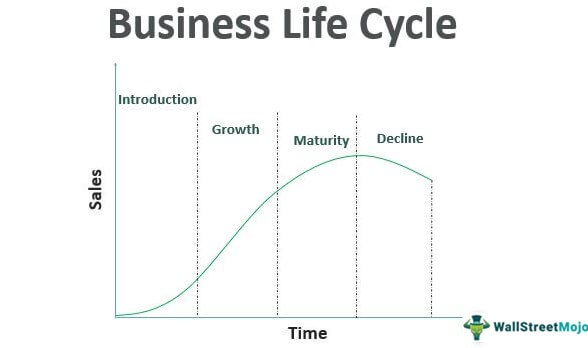

Business Life Cycle is a natural way of business progression. It shows the gradual and slow and steady stages through which business progress begins with developing a prototype idea to gaining traction, moving from the initial phase of slow growth to high growth. Usually, it is divided into four stages – Introduction Stage, Growth Stage, Maturity Stage, and Decline Stage.

Stages of the Business Life Cycle (Graph)

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Business Life Cycle (wallstreetmojo.com)

Business Life Cycle comprises of multiple stages as depicted through the graph below and explanation henceforth:

#1 – Introduction Stage

It is marked by the initiation of the business life cycle characterized by the evolution of product testing, understanding the product’s commercial viability. This period involves the nascent stage for business characterized by no revenue visibility and cash outflow. Investors, during this stage, commit a small portion of money normally in the form of Seed funding. The purpose during this stage is to check the product/service viability and acceptability in the market. The majority of the business fails to go beyond this stage.

#2 – Growth Stage

This stage separates men from boys. Businesses that reach this stage have achieved market acceptability and revenue visibility. Cash flowCash FlowCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. read more generation accelerates at this stage, along with heavy investments in the business. During the business life cycle, various investors and financial institutions also undertake a large amount of investment in the business. It is a high growth stage of the business and results in phenomenal growth in financial metrics before any competitor arrives or the business loses its mojo.

#3 – Maturity Stage

Stable markets characterize this stage for the business, stable revenue generation, and a highly acceptable customer base. It is the stage where revenue and profits are at their peak. The business has a streamlined process and a stable source of income for its various investors. Normally businesses spend a lot of years in this stage. The majority of the world’s long-standing FMCGFMCGFast-moving consumer goods (FMCG) are non-durable consumer goods that sell like hotcakes as they usually come with a low price and high usability. Their examples include toothpaste, ready-to-make food, soap, cookie, notebook, chocolate, etc.read more companies fall into this category.

#4 – Decline/Saturation Stage

This stage is characterized by the end of the business cycleBusiness CycleThe business cycle refers to the alternating phases of economic growth and decline.read more, falling revenuesRevenuesRevenue is the amount of money that a business can earn in its normal course of business by selling its goods and services. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions.read more, profits, customer movement, and the slow and gradual closure of the business. Not all business reaches this stage, and once a business reaches this stage, it’s the end of the cycle for it. This stage is characterized by customer disinterest and outdated product/service of the business.

Features of the Business Life Cycle

- Business Life Cycle is depicted through multiple stages, which can either be one at a time or multiple, and majorly every business starting from scratch to reaching heights observe these stages.

- Stages of the trade cycle require businesses to formulate an altogether different strategy. Business at the start stage follows a different policy than a business at the maturity stage.

- They are natural and not forced ones. It is a gradual development of a business depicted through this cycle.

- Another important feature is its irregular period. Some stages last for a few months to a year (For example, Development Stage, during which a business tries to develop the idea into a commercially successful venture) while some run for a decade.

- Trade cycles are common across industries; however, their impact varies across companies within the same industry.

Advantages

- Understanding the Business Life Cycle stage helps various stakeholders, especially investors, fund the business properly.

- It also enables businesses to adopt a different approach based on the life cycle stage.

Disadvantages

- Various stages have different periods that make business static and lead to longer time cycles.

- Some business life cycles result in job losses, falling revenues, and declining stock prices, such as the maturity/saturation stage.

Conclusion

Business Life Cycle is a structural pattern that shows the evolution of a business. It is an important concept that has held its practical value since time immemorial. Management needs to understand the business cycle well to generate positive returns, which are in the best interest of the shareholders at large. The different business cycles will result in varying financial metrics, both Top LineTop LineThe top line is the revenue earned by the business by selling goods or services, reported in the income statement for a defined period. read more (Revenues) and Bottom line (Net Profit) for the business and, as such, holds equal relevance for various stakeholders such as Financial InstitutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more (who lend to the business), Customers, suppliers and so on.

Recommended Articles

This has been a guide to the Business Life Cycle and its definition. Here we discuss features and their various stages along with advantages and disadvantages. You may learn more about financing from the following articles –

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)