What is a business budget and why is it important?

How much money in sales will we make this year?

How much will we need to invest this year?

The answers to these questions are difficult to decipher, and can feel akin to sticking your finger in the air to guess which way the wind is blowing. However, the process of putting together a business budget is scientific, and if constructed correctly, can provide a degree of clarity as to your expected turnover and expenditure.

That’s why we’ve put together this blog post, to help you understand what a budget is, manage the process of creating one, and help you monitor the key metrics against projections in your plan. You’ll then see how operating a budget enables you to allocate specific use of your available resources to achieve your objectives, efficiently and effectively.

What is budgeting in business?

A business budget is a financial plan, typically for the year ahead, that is often put together based on historical income and expenditure. It will pinpoint all available resource to calculate spending and turnover accordingly.

The budget is used as part of the planning process in terms of setting goals, implementing activities, and the expenditure that is likely to be incurred. Formulating a budget is therefore essential to owner managers to help you understand how well your business is performing.

The budget ensures you know:

- The revenue you need to make

- What you have allocated for expenditure to generate revenue

- How much you have actually spent

- How much money you have left over, if any

- The amount of money you will need in the future based on sales, profit, and your cash position

A budget, and adherence to it, ensures you can make informed business decisions regarding new equipment, office premises, expenses, staff, and much more. Furthermore it assists in helping you manage debt, reduce loans, or obtain finance.

In this sense a business budget is used to help you assess the progress you make in the short and long term, towards your vision.

How to manage a budget

The likelihood is your business will need a budget for each department, division, and/or office, depending on size. This then requires decision makers (if you have more than 1), to buy into the process, the targets set, and to consult the budget regularly in their spending decisions.

Budgets should not therefore be held solely in the finance team, of by a financial controller. It has to be fully integrated throughout your organisation. This means many people are responsible or involved in managing a budget, feeding into it, updating it, and staying informed as to progress in the business.

The budget must therefore be reviewed regularly to ensure it feeds into the goals and requirements of your business. Some of the different teams involved in a budget include:

- The finance team

- Directors

- Heads of departments

- Heads of offices

- Office administrator

The budgeting process

Creating a budget works as follows:

1. Preparation

Your budget should guide what turnover will be, and the amount of spending needed to achieve it. This means it has to detail what that spending goes on. You can have short-term budgets over a year for example, mid-terms budgets over 2-3 years, and longer term budgets of 5+ years.

Your budget can guide day-to-day operations as well as significant, big purchase items, such as new IT infrastructure. The key is to analyse historical spending, resource requirements, turnover, and cash flow, where that is available. From that data and intelligence, you can then begin to allocate target revenue and expenditure accordingly.

To gauge what the different areas of the business want to spend money on, you need to set deadline dates usually well prior to the end of the current calendar year. You may for example commence the budget process in November with a view to discussing the findings by the mid-point of that month.

The deadlines centre around producing plans for:

- Revenue

- Headcount

-

Expenses

Creating these plans well in advance of the end of the year ensures that after the discussions off the back of them with various relevant parties, you then have sufficient time to make adjustments where necessary.

Creating these plans well in advance of the end of the year ensures that after the discussions off the back of them with various relevant parties, you then have sufficient time to make adjustments where necessary.

Following adjustments, you then produce a draft budget for review and comments by senior leadership. This would allow for further changes with a view to finalising the budget by the end of November. The amount of time to allocate to this process depends on the size of your business and the number of people it employs.

Remember, your budget needs to be comprehensive but flexible, for circumstances can change quickly, and often best laid plans may need to pivot to accommodate them.

2. Sales and revenue projections

As your business makes sales, so this data can be collected to make revenue projections from one year to the next. This can potentially even be broken down to week by week, monthly, and quarterly.

Projections then work as targets for the relevant salespeople and teams to work towards. Data regarding sales should therefore be amassed in real time so that you can gauge how well your business is performing compared to the designated goals.

It is essential to use the data from prior years of trading to come up with realistic forecasts and targets. The closer your budget compares to actual results, the greater credibility with which it will be held by people working in your business.

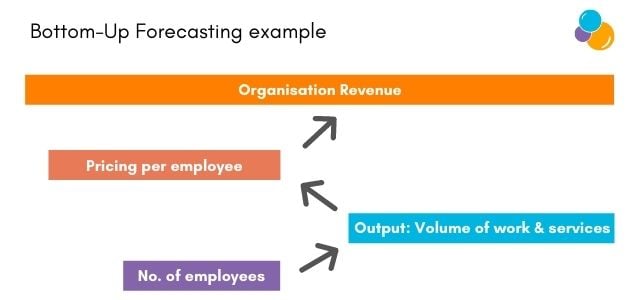

There are 2 methods you can employ for revenue forecasting. The first is bottom-up forecasting, a method whereby you estimate future performance based on low-level customer and/or product information. You then use this to build up to a revenue figure. A service business might for example, look at the number of employees and the amount of work and fees they’re likely to generate at full capacity, per person.

Top-down forecasting tends to start with high level market data, the big picture, and works from there down to revenue. As an example, you might analyse the total value of the markets, or sectors, that your business operates in. Then you’d consider your market share, and how much you’ll capture moving forward as a percentage. Your revenue projection is calculated by multiplying the market value by your market share percentage.

Top-down forecasting tends to start with high level market data, the big picture, and works from there down to revenue. As an example, you might analyse the total value of the markets, or sectors, that your business operates in. Then you’d consider your market share, and how much you’ll capture moving forward as a percentage. Your revenue projection is calculated by multiplying the market value by your market share percentage.

Achieving accuracy in projections can be very difficult in a new business as there can be little to no data to base a forecast on. This is where market research in the business idea and concept phase can be very useful.

Achieving accuracy in projections can be very difficult in a new business as there can be little to no data to base a forecast on. This is where market research in the business idea and concept phase can be very useful.

Questioning your potential customers about what they would spend on your offering, and even looking at competitors’ sales (where available) will provide useful intelligence for making realistic projections in the early days.

3. Identifying fixed, variable, and sunk costs

First you need to identify and categorise expenses into fixed and variable costs. Fixed costs are those that occur regularly at a constant price. They tend to include things such as:

- Insurance

- Leasing equipment

- Rent on premises

- Property related taxes

Once you have identified them, add your fixed costs up to obtain a total. Of note, businesses that produce items and things, such as in engineering, tend to have higher fixed costs due to the need for factory space and the leasing of equipment.

Your variable costs are those that will vary depending on the volume of goods, or services, your business produces. Typically, these costs will increase as the amount of activity in your organisation grows. Examples include:

- Utilities – electricity, gas, water, internet, and phones

- Commissions – payments based on sales

- Raw materials – goods/inventory to manufacture products such as steel, fuel, oil, and plastic

You also need to consider sunk costs. These will be one-time items of expenditure that are very infrequent. Sunk costs tend to be particularly prevalent during the start-up and early phases in the business lifecycle. Set up costs such as purchasing IT equipment and servers being examples.

Of note, not all one-time items of expenditure can be predicted. It is therefore wise to set money aside for such matters, akin to saving for a rainy day. How much more resource is needed in terms of people to hit your sales targets? You should break this down specifically to each area, or division of your business.

4. Headcount planning

Headcount planning works by looking at how many employees you have today. Then you have to consider how many more employees you’ll need to take on to help you achieve your revenue goals. How many more people do you need to employ to hit your sales targets?

This work needs to be broken to the specific areas and divisions of your business. It means working with the people in charge of these areas and challenging their assumptions to ascertain if additional recruitment is really needed. After all recruitment is a potentially significant investment for your business, and you’ll want all investment decisions to be made in a well informed manner.

5. Assessing profit margins

Tracking income versus your projections, and expenditure compared to the budget means you can then assess your profit margins. These asses how much profit your business makes from its sales, and how much profit can be obtained from every pound of revenue generated.

Gross profit margin can inform you as to what your business is making after paying for the direct cost of doing business. It is calculated using this formula:

.jpg?width=640&name=Blog%20Image%20Template(7).jpg)

Direct expenses are the costs of the materials and expenses associated specifically with the creation of your product or service. They don’t include overhead costs such as insurance, rent, and utilities.

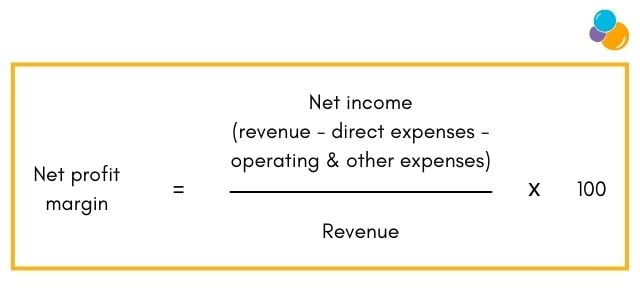

Net Profit Margin calculates the percentage of profit your business produces from total revenue and all costs of doing business. It is calculated using this formula:

Operating expenses include costs incurred through normal business operations. Think of overheads, marketing, and payroll.

Operating expenses include costs incurred through normal business operations. Think of overheads, marketing, and payroll.

Interest refers to debt payments and the interest paid on them. Tax refers to all taxation deducted from income.

These percentages will inform you if your sales are improving but expenses are rising faster for example. In such a scenario your profit margins will erode over time, and if not addressed, impact on your future potential profitability.

6. The Profit & Loss statement

Totalling all your earnings and then expenses ensures you can then construct a Profit & Loss Statement. This works by subtracting total expenses from earnings to establish if your business is in profit, or not. A positive number from this calculation means your business is making a profit, a negative number represents a loss.

All of this can be critical in feeding into future budgets and assessing if costs need to be cut, revenue improved to maintain current profit margins.

7. Trends and seasonal trading

Your business may be prone to seasonal trading, periods of high sales followed by much slower demand. It is important to identify this in the revenue projections of your budget. This then helps pinpoint what your likely cash position will be at various points throughout the year based upon likely revenue and expenditure for that time frame.

This level of intelligence means during periods of high trade, money can be set aside for various items of expenditure that may need to be purchased during an off season. It will also inform how much resource is likely to be needed when periods of peak trade take place.

You can then factor in how many additional employees or product materials are needed to satisfy peak customer demand.

Allocating tasks throughout the business

Targets should be set in conjunction with the people who will be responsible for meeting them. This should then also feed into reporting so that expenditure plans are monitored and adhered to. Budgets are no good unless they are reviewed regularly.

Monitoring

Revisiting the budget often means overspending or underspending can be noted, and corrective adjustment made if absolutely necessary. Doing this feeds into your management accounts and can help you obtain a detailed understanding of your cash flow and overall cash position.

Clarity as to your cash position ensures you can understand the financial health of your business in real time. Knowing where you are then provides a clear picture of what needs to be done to get you to where you’re looking to head to.

Finally, as noted earlier, all this insightful data can then be used at the end of the year to re-start the process by informing future budgets, operational requirements, and the various forecasts.

The content of this post was created on 15/02/2022 and updated on 17/02/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)