Vietnam’s Business License Tax Exemption: Highlights of Decree 22

Vietnam’s Business License Tax Exemption: Highlights of Decree 22

- Vietnam’s government introduced Decree 22/2022/ND-CP (Decree 22) exempting Business License Tax (BLT) for newly established businesses in the first year.

- The regulation went into effect on February 25, 2020.

- The development bodes well for investors as well as SMEs looking to establish operations in Vietnam given the current business environment.

The Vietnamese government released Decree No 22/2022/ND-CP (Decree 22) amending the rules on business license tax (BLT). The regulations went into effect on February 25, 2020.

BLT is an indirect tax imposed on entities that conduct business activities in Vietnam and are paid by the enterprises themselves on an annual basis.

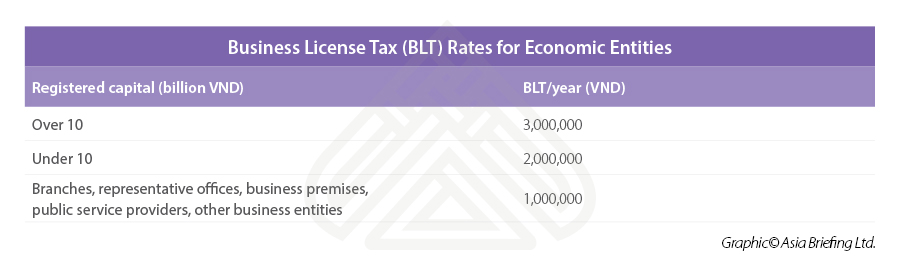

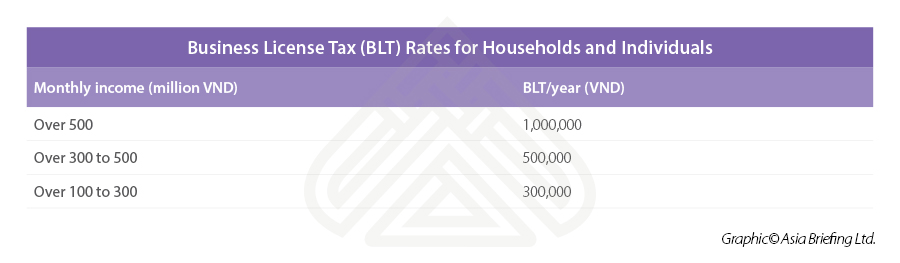

All companies, organizations or individuals (including branches, shops, and factories) and foreign investors that operate businesses in Vietnam are subject to BLT charges, and the BLT rates are different for economic entities and for households/individuals.

Decree 22 highlights

As per the Decree, BLT is exempt in the first year of business or operations for the following instances:

- New established businesses;

- Households, individuals doing business for the first time;

- Representatives Offices (ROs), branches and business locations established during the exemption period;

- Small and medium-sized businesses (SMEs) that have been converted from household businesses will be exempt from business license fee for three years from the date of their initial enterprise registration certificate (ERC); and

- General education and public preschool education establishments.

In addition, under the new regulations, businesses that have just been established can file BLT returns by January 30 of the subsequent year of establishment or operations. This can be done online and takes less than a day.

Furthermore, BLT is not required for businesses during a suspension period as long as a notification of the suspension is submitted to the tax authorities by January 30 each year.

The development will bode well for investors looking to establish new businesses particularly amid the COVID-19 outbreak and the US-China trade war.

Applicable BLT rates for businesses

The amount of BLT that a business is obligated to pay is based on the amount of their registered capital (as listed on their business registration certificates) in accordance with the accompanying table below.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)