TradingView Review: Why I switched to Tradingview from MT4

Finally!

I’ve made the switch to TradingView.

It was a long and deliberate decision, but I’ve finally taken the plunge and switch to TradingView — and it’s the best trading decision I’ve made this year.

Here’s why…

If you have known me long enough, I’ve been a huge fan of MT4 (otherwise known as Metatrader 4). After all, what’s there not to like about it… it’s free, it has many indicators, and it loads fast.

But after using it for years… I realised there are issues that won’t go away and you’ll either have to suck it up or find something else (I’ll explain later).

So in today’s TradingView review, you’ll learn:

Are you ready?

Then let’s get started…

Note: This post contains affiliate links. This means if you sign up with TradingView pro, I’ll earn a referral fee.

Mục Lục

Do you face these problems with MT4?

They are:

- The flying trendline

- You lose all your data if your system crash

- You have access to a limited number of markets

- You need to re-register your account every 30 days

- You have no support

Let me explain…

The flying trendline

If you’ve used MT4 long enough, you’ll realise the trendlines on your chart are as reliable as trying to withdraw your funds from a Forex broker based in Cyprus — you never know if it’s there or not.

Imagine:

You’ve spent hours drawing trendlines on your charts. The next moment, when you got down to the lower timeframe, the same trendline (that you’ve drawn earlier) has shifted by itself… like some voodoo magic taking place.

Now, if your trading approach requires you to use trendlines, then the MT4 platform is not something you’ll want to trade with — especially on a live account.

You lose all your data if your system crash

Here’s the thing:

The MT4 platform must be installed on your local device. This means if your computer crash, there goes everything along with it — and that includes all the settings you have in MT4.

Also, if you want to trade while you’re overseas, it will be a problem because you can’t bring your computer over, right?

Don’t tell me you can trade on your phone, I’ll smack you.

Sure you can use a laptop, but the MT4 settings on your laptop will not be the same as the one on your computer. So you must adjust the settings, re-draw your charts, and plot your indicators again. Ouch.

You have access to a limited number of markets

This statement is biased because MT4 is created for Forex traders. Thus, the markets offered are mainly currency pairs.

However, some brokers may offer CFDs so you can trade indices and some of the popular stocks. But largely, you’re limited to the Forex markets.

So…

If you’re a Trend Follower (like me) who trades across many markets, then MT4 is a severe limitation. You’ll have to open different MT4 brokerage accounts just to access a full spectrum of markets.

And if you’re a stock trader, options trader, or futures trader, don’t bother with MT4 — it’s not for you.

I would say MT4 only makes sense if you’re solely a Forex trader and nothing else.

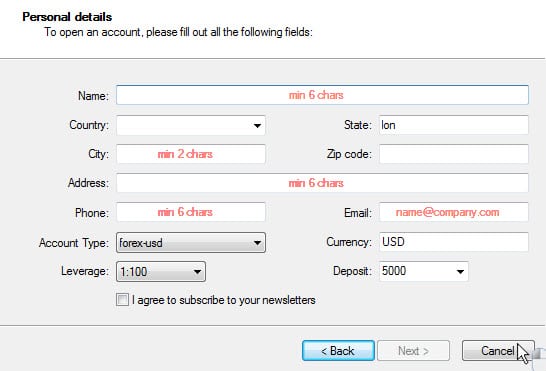

You need to re-register your MT4 account every 30 days

Here’s the thing:

If you sign up for a live MT4 account, then you can use the platform indefinitely.

But if you’re on a demo then you must register the account every 30 days or you can’t access it anymore.

You’ll get a message popping up every 30 days saying “invalid account” and you need to register your particulars all over again. It gets annoying over time.

And you can’t blame the broker because it’s their way of “kicking” those who are not serious about funding an account and just want to use the platform for free.

So, if you’re like me using multiple MT4 brokers to track many markets, then be prepared to face this issue.

There is no support for MT4

Clearly, there are limitations in the MT4 platform as I’ve mentioned earlier (like the flying trendline, the MACD indicator looks weird, and etc.).

But do you know what the worst thing is?

You’re on your own.

Yup, you read that right.

If you find any issues, problems, or bugs on the MT4 platform, don’t expect it to get resolved —it won’t.

Why?

Because MT4 is a free platform. Who’s going to pay a team of support staff to answer your queries or fix your issues?

Nobody.

So whatever issues you face, just assume it will be there permanently and you must either accept it or move onto something else.

Now…

Those are the biggest issue I’ve faced with MT4 and that’s why I’ve switched to TradingView.

Next, I’ll explain to you how TradingView solved all my problems and what are the benefits of using it…

Why I love TradingView and the benefits of it

The reason is simple.

TradingView solves all the issues I listed earlier.

For example:

It doesn’t have the flying trendline problem on MT4.

It’s based on the cloud you so don’t lose your data even if your computer crash — and it syncs across your computer, laptop, and mobile so you have a smooth experience.

You have access to a huge range of markets like Stocks, Forex, Commodities, Agriculture, Indices, Bonds, Metals, and etc. which is a dream for a Trend Follower like me.

You don’t have to register an account every 30 days because it doesn’t expire (which means you have lifetime access to it).

You have a team of Support that answers your questions and will fix any bugs or issues you come across.

And that’s not all…

TradingView has many useful features that will improve your trading experience.

Now go watch this TradingView tutorial below which will help you master it — in less than 20minutes.

Note: In this TradingView Review, I’m using TradingView Pro (which cost $9.95/month) and some features listed might not be available for the free account.

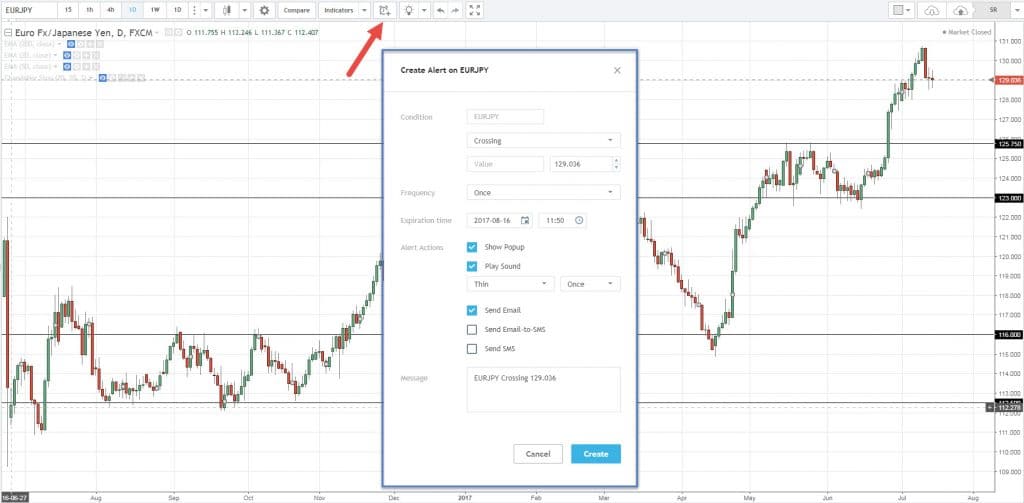

TradingView Alerts: You don’t have to watch the markets 24/5

If you’re a swing trader or a position trader, you spend most of the time staying on the sidelines — waiting for a trading opportunity.

You’ll usually check your charts every few hours to see if there are any trading setups or not. But sometimes the market may have a sudden “spike” that comes into your level and because you’re away, you end up missing the move.

So, what can you do?

You can use an “alert” to inform you the price has come to your level so you won’t miss a trading setup or spend 24/5 watching the markets.

Here’s how you can do it on TradingView…

- Click the “Alert” icon at the top of your page

- Set your price level

It looks something like this:

Now…

Once you’ve set it up, you’ll be alerted via email when the price comes to your level so you’ll never miss another trading setup — and still, have the freedom to do the things you love.

TradingView offers custom trading indicators — for free

There are many trading indicators out there and sometimes, you have to pay money for indicators to be custom coded.

So…

TradingView developed a programming language called “Pine Script” where users can develop their own custom indicators and upload it to TradingView.

This means you can find almost any trading indicators all in one place — for free!

And unlike MT4 where you’ll have to search forums or websites for custom indicators, TradingView has them all in one place — which saves you plenty of time.

Here’s how you can access it:

- Click the “Indicators” button at the top

- Select the indicator you want

An example:

Then, you’ll see the different category of indicators. Let me explain…

Built-ins – Popular indicators built into the TradingView platform (like MACD, RSI, Stochastic, and etc.)

Public Library – Custom indicators created by TradingView’s users

Fundamentals – Indicators related to the fundamentals of a company (like earnings, revenue, price to book, and etc.)

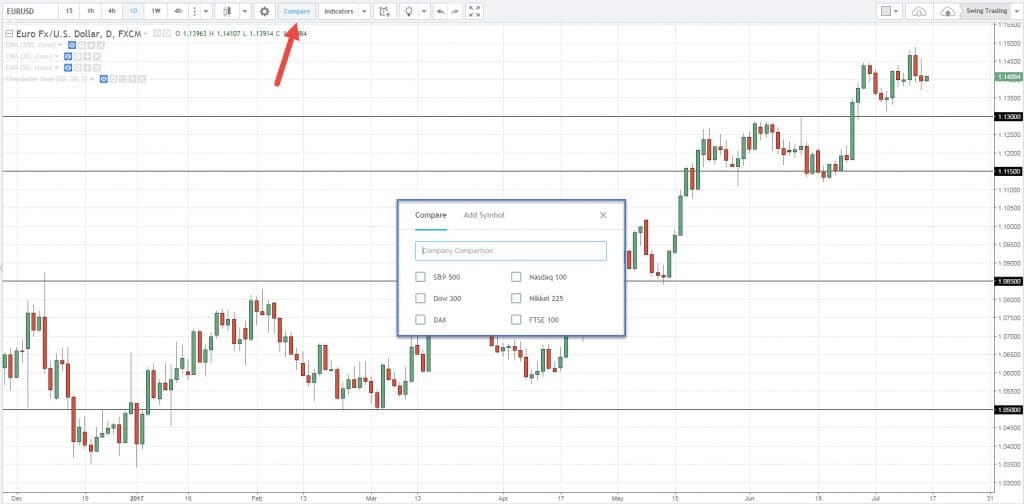

You can use relative strength to find high probability trading setups

You’re probably wondering:

“What’s relative strength?”

Relative strength refers to how strong an instrument is relative to its sector (otherwise known as cross-sectional momentum).

For example:

In the currency markets, how strong is the Euro currency relative to the USD, CAD, JPY and etc.?

In the stock markets, how strong is a stock relative to the S&P?

This is useful information because you want to go long on the instrument which is relatively stronger and short the ones which are relatively weaker.

Why?

Because a relatively strong market tends to move further in your favor and have shallower pullbacks. This means your trade have a greater odds of success.

So, here’s how to identify relative strength on Tradingview:

- Click on the “Compare” button at the top

- Insert the relevant market (sector or index)

An example:

Now, you must compare the correct instrument to its sector (or index).

For example:

If I’m identifying the relative strength of the Euro, then I’ll compare it to EUR/USD, EUR/CAD, EUR/JPY, EURAUD, and etc.

And not compare it with the S&P or the Treasury bonds because is irrelevant to the Euro.

Similarly…

If I want to know how strong the S&P is, then I’ll compare it with the other indices around the world.

Make sense?

Good. Let’s move on…

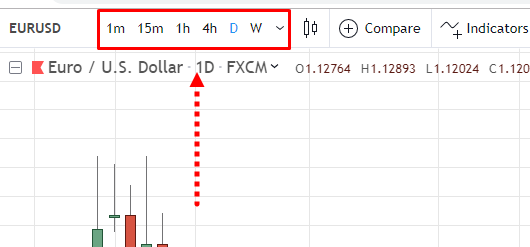

You can trade with multiple timeframes like a pro

I’m sure you’ll agree with me when I say…

Most charting platforms have default timeframes you can choose from. It’s usually the Daily, 4-hour, 1-hour, 30-mins, 15mins, 5mins, and 1min — and that’s it.

But, what if you want an uncommon timeframe like the 7-hour charts?

Well, you probably need to hire someone to custom code it for you — and that’s if the platform allows it.

Now the good news is…

TradingView allows you to customize the timeframe in any way you want… whether it’s 7-minutes, 7-hours, 7-days, 7 weeks — or even 7 months.

Here’s how to do it:

- Click the “Arrow” beside the timeframe panel

- Select your desired timeframe

Here’s what I mean:

And wait, that’s not all…

You can also layout the different timeframes (side by side) and see the price action on the different timeframes. This is useful especially for day traders who want to know what the price is currently doing relative to the higher timeframe.

Here’s how to do it:

- Select the “dual panel” at the top

- Choose your desired chart layout

An example:

Now, you’ll see different options you can choose for your chart. Let me explain…

Link symbol to all charts – This lets you have both charts showing the same market

Link interval to all charts – This lets you have both charts showing the same timeframe

Sync crosshair on all charts – This synchronizes your crosshair across the different timeframes

Track time on all charts – This shows you how the chart on the lower timeframe looks like when you’re pointing your crosshair on a candle (from the higher timeframe chart)

This is insane, right?

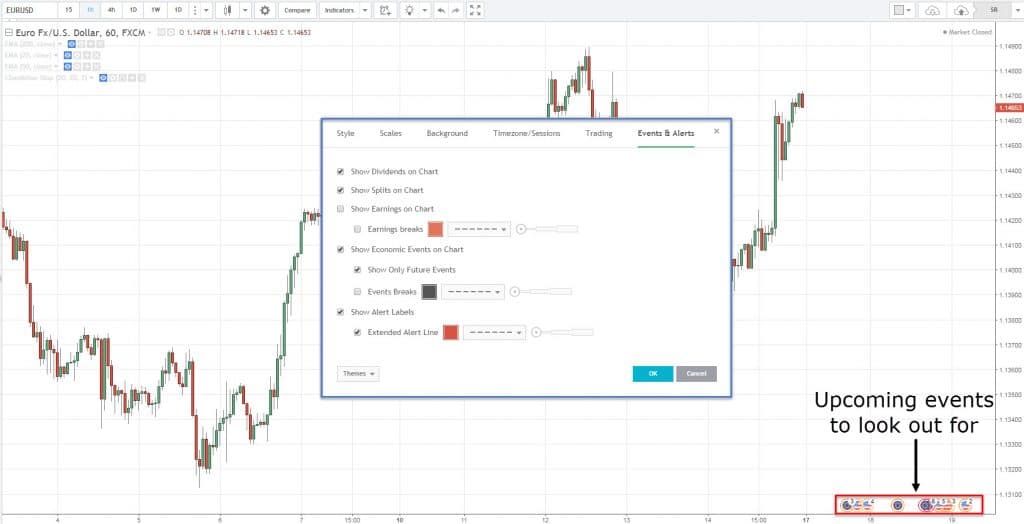

Economic calendar at your fingertips so you don’t get caught off guard — and lose a chunk of your capital

Let me ask you…

How often have you got stopped out of a trade because you weren’t aware there’s a news event coming out?

It sucks right, I know.

So do yourself a favour and pay attention to the economic calendar on TradingView.

Here’s how to do it:

- Select the “Economic Calendar” button on the right

- Click on “Settings” and choose your news preference

An example:

Here are a few things to take note…

High Importance – These are news releases which have a high impact on the financial markets. I suggest you check this box

Medium Importance – These are news releases which have a medium impact on the financial markets. You can uncheck this if you want

Low Importance – These are news releases which have a low impact on the financial markets. You can uncheck this if you want

Finally, you can select the news from the respective countries you want (like USD, EURO, CAD, and etc.).

And that’s not all…

You can also have news events to appear at the bottom of your chart so you’ll not get caught off guard.

Here’s how to do it:

- Right-click and select “Properties” on your chart

- Go to the “Events & Alerts” Tab

- Check the box “Show Economic Events on Chart”

You’ll see something like this:

So…

As the new candles are formed closer to the “events symbol” below, it means the news release is approaching closer.

But there’s a catch…

Here’s the thing:

If you want to use the features I’ve mentioned above, then you must get at least the TradingView pro account.

You might be wondering:

“What about the free account on TradingView?”

Sure, you can use it but it has limitations and comes with annoying popups (every few minutes).

And it’s not their fault because they are running a business and they need cash flow to maintain their software developers, computer servers, technical support, and etc.

Or else…

Who’s going to pay for their research & development?

Who’s going to cover their business expenses?

Who’s going to pay their employees?

Clearly, you can expect to get everything for free — just look what happened to MT4 and you get my point.

Now, let’s move on to my final point…

TradingView Review — Is TradingView for you?

As much as I would like to say you should use TradingView so I can earn some referral fees, that’s not how I roll.

So here are my thoughts on whether you should use TradingView.

TradingView is not for you if:

- You’re an options trader

- You have low capital

- You’re a scalper

Let me explain…

1. You’re an options trader

TradingView is not meant for options trader because they don’t provide market data for options.

2. You have a small trading account

Here’s the thing:

If your account size is less than $1000, then it doesn’t make sense to subscribe to TradingView.

Why?

Because the yearly subscription is $120.

That’s 12% of your trading capital on a $1000 account. This means you need to make 12% a year to break even which puts you at a severe disadvantage. You’re better off using other free trading tools in the meantime.

3. You’re a scalper who trades the order flow of the markets

For a scalper, speed is of the essence because you need to make split second’s decision.

However, TradingView isn’t built for speed unlike some of the other established platforms (like CQG or TT) — so it’s not for you.

Now you’re probably wondering:

“Who should use TradingView?”

TradingView is for you if:

- You have a decent account size

- You trade in different markets

- You’re a swing or position trader

Let me explain…

1. You have a decent account size

Earlier, I mentioned that if you have a $1000 account, it doesn’t make sense to subscribe to TradingView because you need to generate a return of 12%/year to breakeven.

But, if your account is larger (let’s say $5000), then it makes sense since you only need 2.4%/year to breakeven.

2. You trade in different markets

TradingView offers data on Stocks, Futures, Forex, Indices, ETFs, and etc.

So if you trade across many sectors, then TradingView will make your life easier without having to use multiple charting platforms.

3. You’re a swing or position trader

Swing and position traders rely on technical analysis to make their trading decisions. And TradingView offers one of the best charting capabilities out there.

It can be used for day traders as well if speed is not of the essence to you.

Next…

TradingView Plans and Pricing

Now, TradingView comes with three different plans:

- Pro ($14.95/month)

- Pro+ ($24.95/month)

- Premium ($49.95/month)

Note: You get a discount when you sign up for a yearly subscription instead of monthly.

The difference between them is the amount of “bells and whistles” you get.

For example:

The higher-tiered plans allow you to have more indicators on your chart, more historical data, use multiple devices, priority support, etc.

If you want to compare the full difference, then check it out here.

Now you might be thinking:

“So which plan do I go for?”

My suggestion is to go for TradingView Pro because if you want to upgrade, you can do so from your dashboard.

But if you’re on TradingView Premium, it’s not possible to downgrade and you’re stuck with something you don’t want.

So, go with the lowest tier plan and then upgrade (if you wish to).

Pro Tip:

TradingView offers a discount during Black Friday.

And whether you’re a free or paid subscriber, you get access to the same deal (so keep a lookout for it).

TradingView brokers

Here’s the thing:

TradingView started as a charting platform (not a brokerage) so in the early days, you weren’t able to place trades directly on TradingView.

But things are changing as they are integrating their platform with brokers.

So here’s a list of brokers that you can trade with on TradingView:

- CQG

- AMP

- Oanda

- Forex.com

- Poloniex

- iBroker

- Saxo

- Tradovate

Bonus TradingView Tips

Now let me share with you 4 TradingView features I use regularly…

1. Highlight the markets of your interest

In the past, I used to go through every market in my watchlist to make sure I don’t miss any trading opportunities.

But I realized it’s a huge waste of time to scan every market because some of them simply don’t present any trading opportunity (at least not in the near future).

So here’s what I did…

Every weekend I’ll do my “homework” and highlight the markets of my interest.

Then I “mark” them on my TradingView watchlist so I don’t miss these opportunities for the coming week.

Here’s how to do it…

- Bring your cursor to the symbol in your watchlist

- Put the cursor to the left of the symbol and click on it

- Select the colour you want and “mark” the symbol

Here’s an example…

This way, you save time as you don’t have to go through every market in your watchlist.

Sweet!

2. Undo your “mistakes” easily

You might not know this but, TradingView allows you to undo your “mistakes” easily.

Just press “CTRL Z” and it will reset the previous action you did.

For example:

If you accidentally shift your Support & Resistance, CTRL Z.

If you add a weird indicator by mistake, CTRL Z.

If you did something wrong but you’re not sure what it is, CTRL Z.

You get my point.

3. Duplicate your drawings easily

This is useful if you want to draw multiple Support & Resistance, Trendlines, Channels, etc.

Here’s how…

- Click on the drawing you want

- Press CTRL C

- Then CTRL V

Tada!

Your drawing duplicated.

4. Bookmark your favourite timeframe

This way, you can switch between timeframes in just a mouse click.

Here’s how…

- Click on the timeframe tab

- “Star” your favourite timeframe

An example:

And that’s it!

Your favorite timeframe will now appear on the main tab.

Here’s what it looks like…

This is cool stuff, right?

TradingView Review — Conclusion

So, here’s what you’ve learned in this TradingView review:

- The 5 biggest problems I’ve faced with MT4 that made me abandoned it

- The benefits and features of TradingView that you’re probably unaware of

- The downside to TradingView depending how you look at it

- How to decide if TradingView is right for you

And if you want to try out TradingView, you can sign up for a free trial here.

Now here’s a question for you…

What’s your experience with TradingView?

Leave a comment below and let me know your thoughts.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)