Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn how to create a business budget.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You’d need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

Image Source

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

Image Source

You may also opt to make a spreadsheet with custom rows and columns based on your business.

2. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

3. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

4. Consider variable costs.

Variable costs will change from time to time. Examples include utility bills, advertising costs, office supplies, and new software or technology. You may always need to pay some variable costs, like utility bills. You can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

5. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs. Once completed, you can determine how much money you can save.

It’s wise to create multiple savings accounts. One should be used for emergencies. The other holds money that can be spent on the business to drive growth.

How to Manage a Business Budget

There are a few key components to managing a healthy business budget.

Budget Preparation

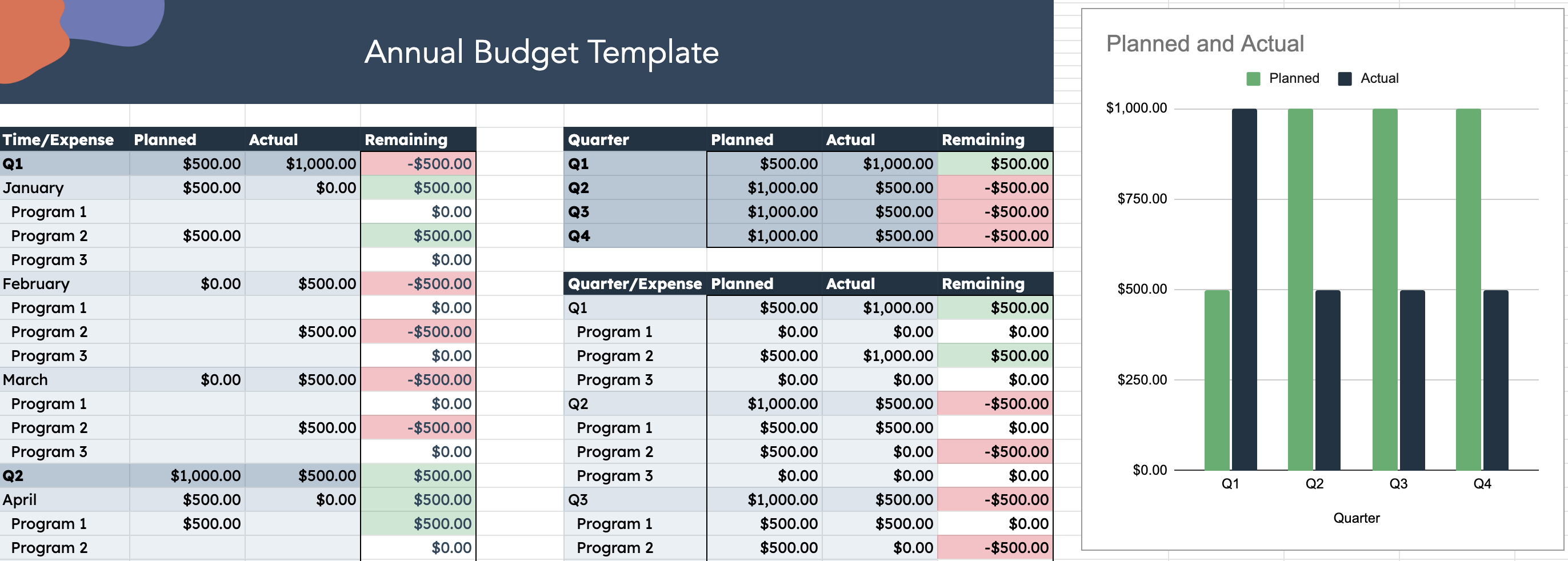

The process all starts with properly preparing and planning the budget at the beginning of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

In larger businesses, you might delegate budget tracking to multiple supervisors. But even if you’re a one-person show, keep a close eye on your budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses. Be sure to compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you always know how your business is doing. Check in regularly to determine how you are doing in terms of revenue and where you have losses. Find where you can minimize expenses and how you can move more money into savings.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review your budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Free Resource

Free Business Budget Templates

Fill out the form to get the free templates.

Best Free Business Budget Templates

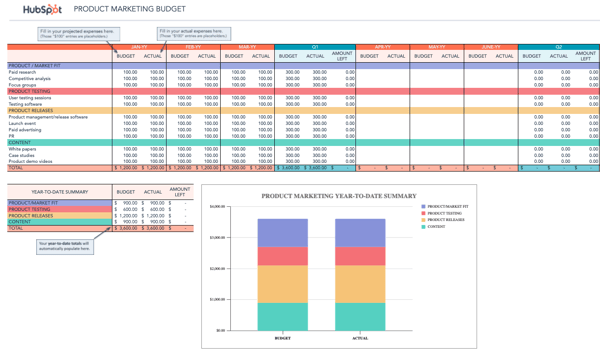

Image Source

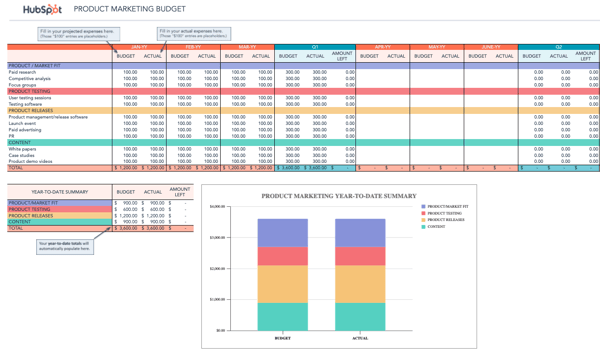

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle, you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment.

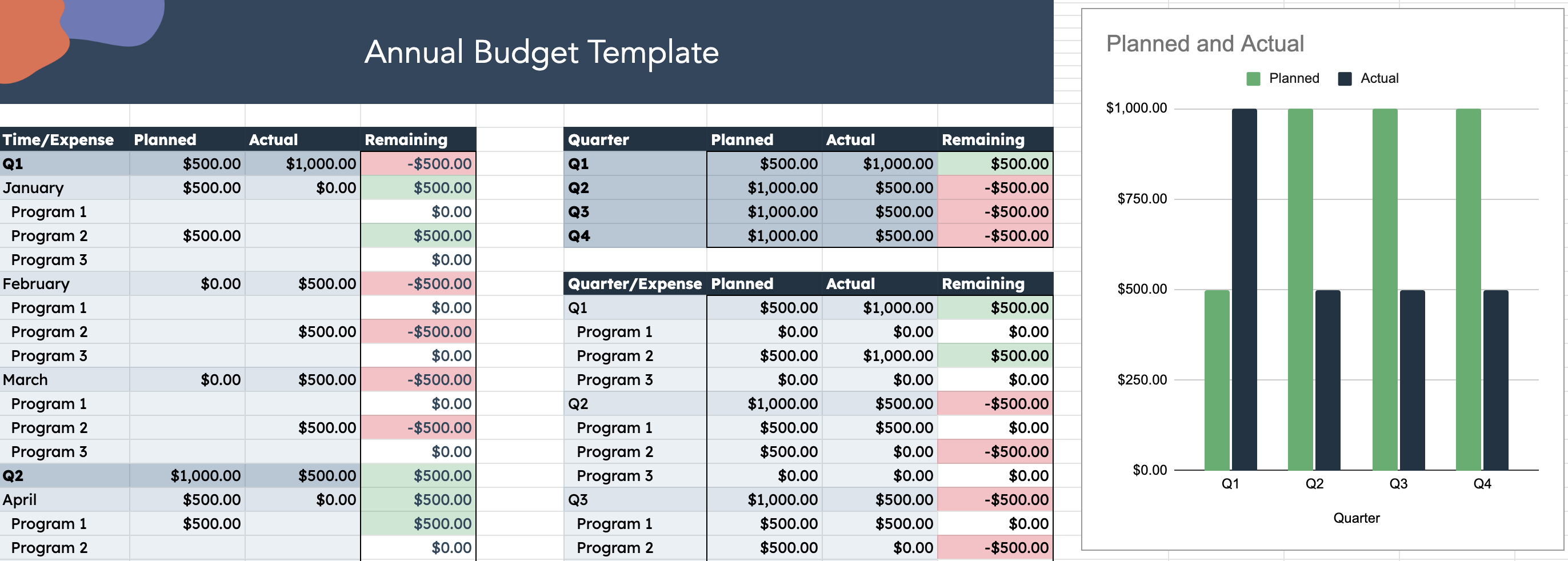

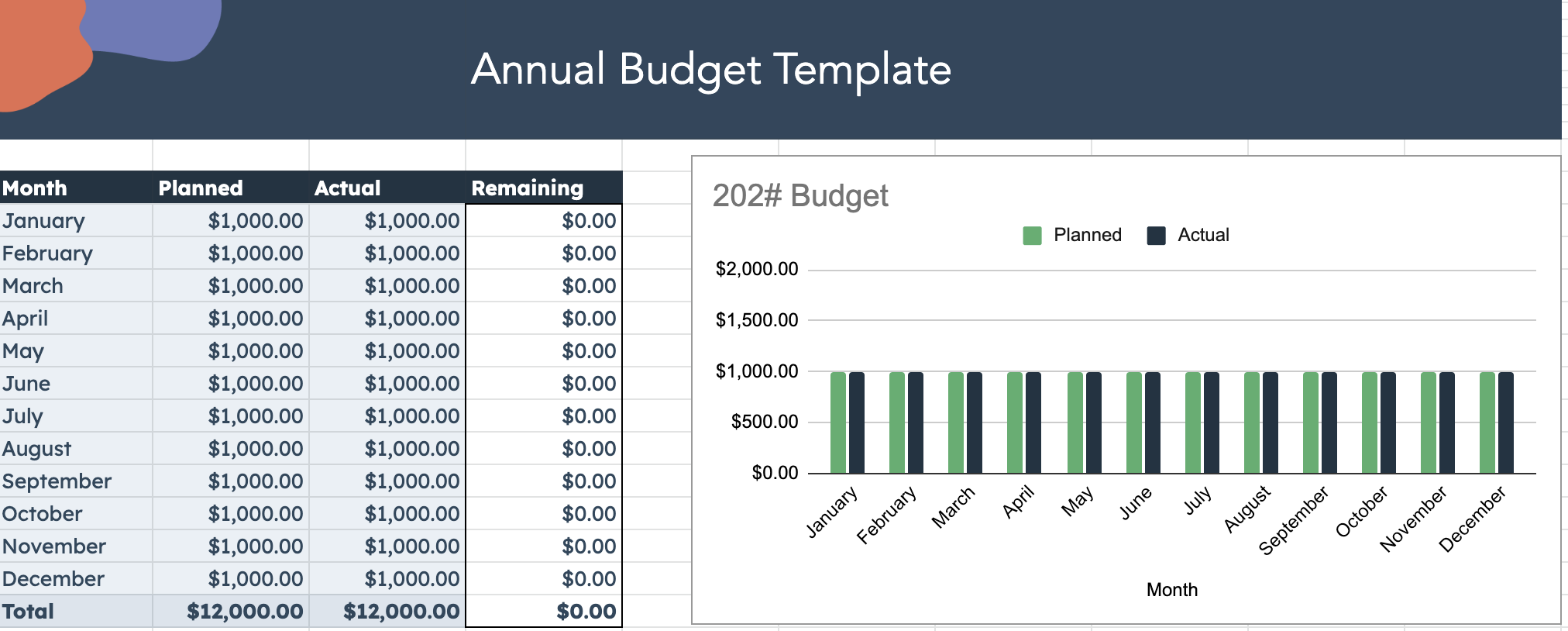

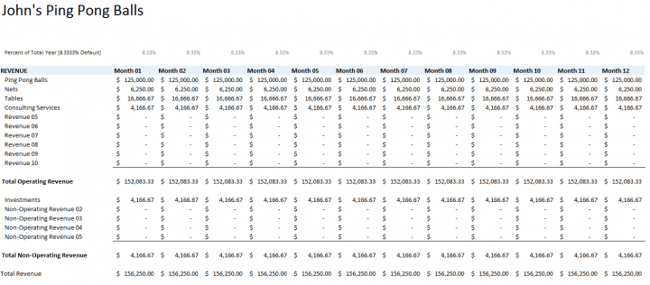

Image Source

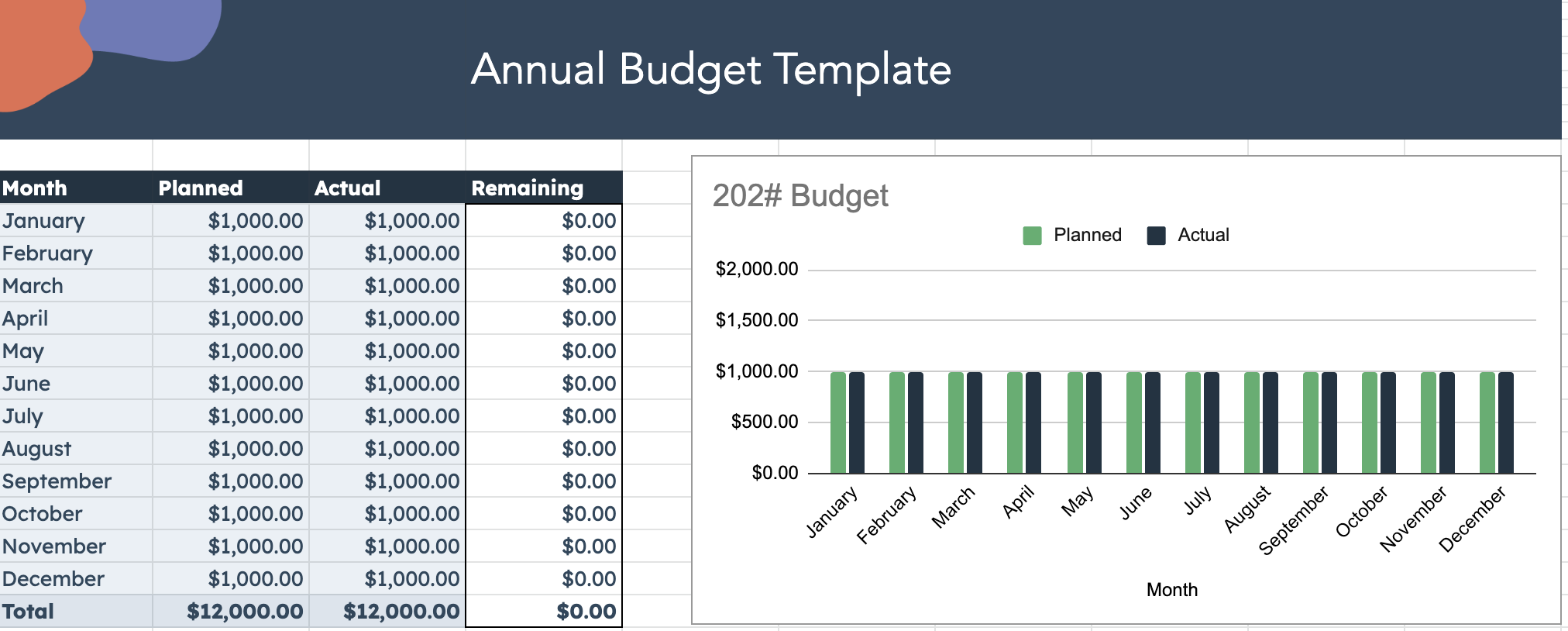

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. Plus, this template works with Excel. Start by inputting projections for the year. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

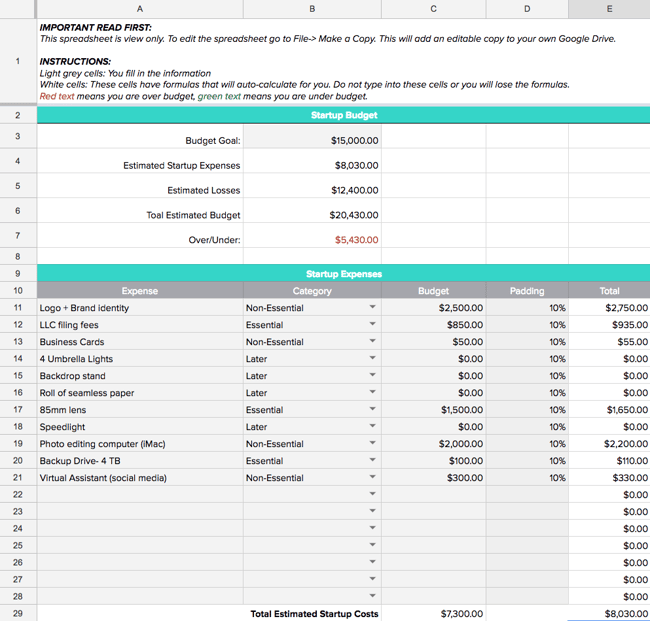

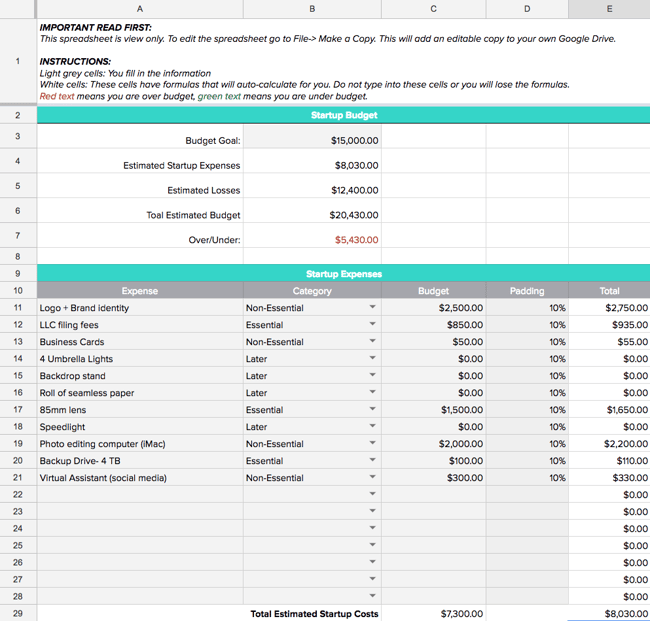

Image Source

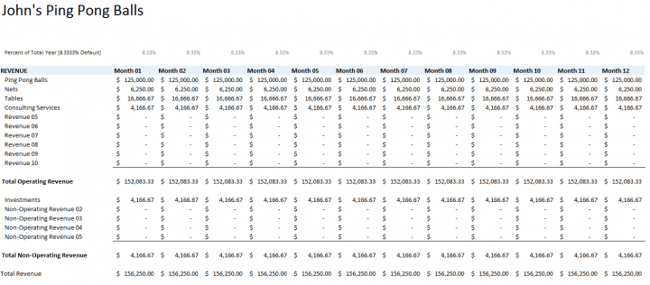

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

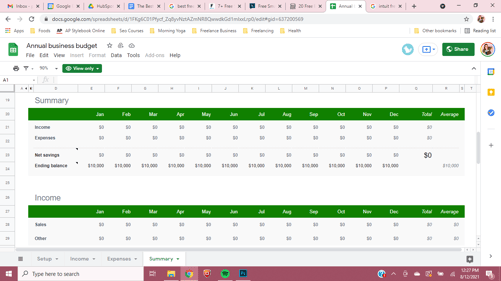

Image Source

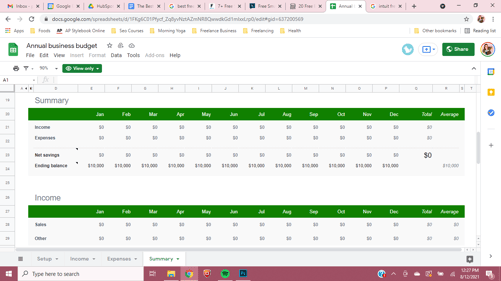

You might be familiar with Intuit. Many companies, big and small, rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template, which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information. This template can even determine net savings and the ending balance.

Image Source

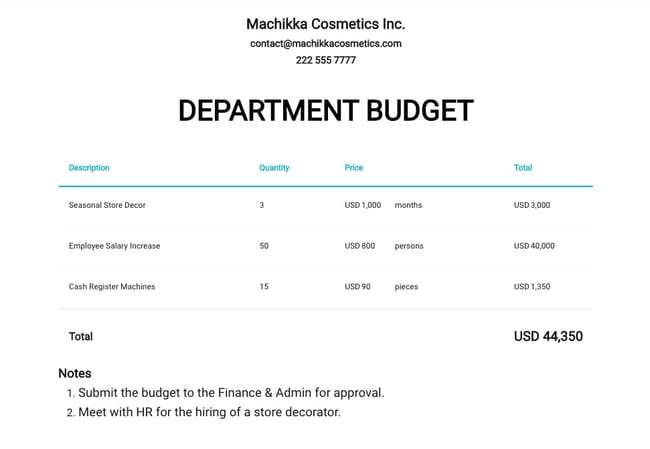

Image Source

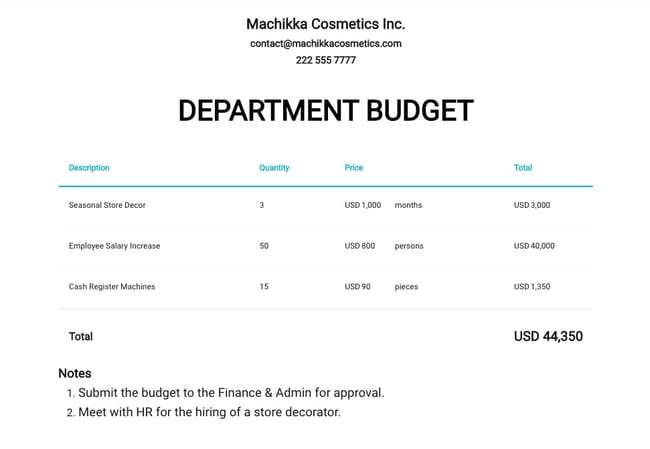

A mid- to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be consolidated into a massive, company-wide budget sheet. Having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats. This budget template can help different departments keep track of their income and spending.

Image Source

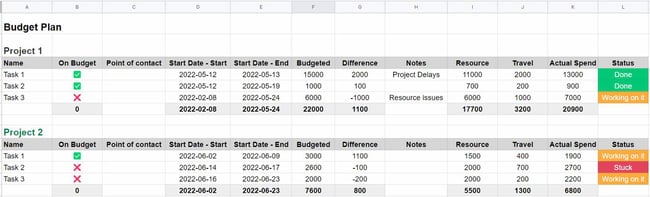

Image Source

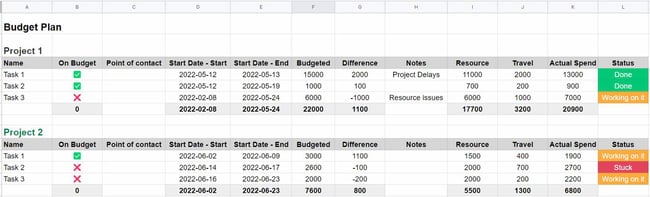

Every new project comes with expenses. This free budget template from Monday will help your team estimate costs before undertaking a project. You can easily spot if you’re going over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

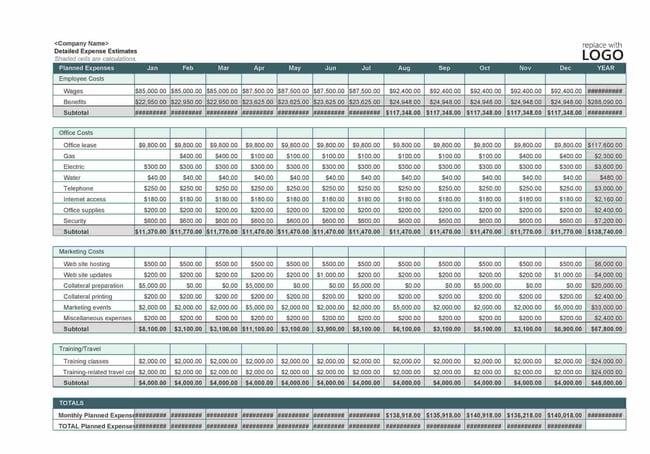

Image Source

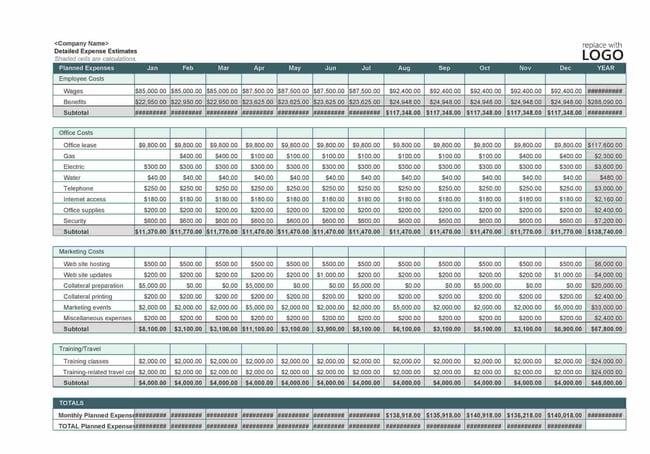

Want to keep track of every penny? Use this template from TemplateLab to draw up a detailed budget. The list of expenses includes fixed costs, employee costs, and variable costs. This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. Using a budget template can make getting started easy. And, once you get it set up, these templates are simple to replicate.

With little planning and regular monitoring, you can plan for the future of your business.

Editor’s note: This post was originally published in September 2021 and has been updated for comprehensiveness.

Image Source

Image Source Image Source

Image Source

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)