The 4 Key Stages of the Business Life Cycle

Many or all of the products here are from our partners that compensate us. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.

Entrepreneurs should understand the business life cycle to strategically move to the next stage of the cycle. This guide will help you understand the stages of business growth.

Businesses differ in many ways, from what kind of products they have to what industry they serve to what their target customer looks like. But another way they differ on a fundamental level is where they stand in the business life cycle and the stages of business development. Your overall business strategy should reflect where you’re at in the stages of a business life cycle.

In the early stages, for example, it might be better to spend a little more time on product positioning or doing some workforce planning.

In a later stage, it might be more appropriate to aggressively implement an integrated marketing plan and push your product through all marketing channels.

Here’s a brief overview of what the four stages of the business life cycle look like, and how that impacts you as a business owner.

Mục Lục

Overview: What is the business life cycle?

As the name implies, the business life cycle refers to the typical arc in the life of a business, from creation to full maturity.

The company life cycle is generally broken up into stages, and while there is disagreement over what exactly these stages are, they have four common phases that most agree on: startup, growth, shake-out, and maturity.

After progressing through these four business phases, the company can then find ways to renew itself by launching new products or moving into new industries, beginning the cycle anew.

Stages of the business life cycle

The business stages can be chopped up in a number of different ways, and some insist that there are more stages than the ones listed here, but we believe those four best describe the life cycle of a business in the simplest and most understandable way.

Startup

You might refer to this stage as seeding and development, or perhaps as the launch phase of the business. Either way, it’s when your business comes to life. There are several stages of a startup within this phase, but they are interconnected and seem to us to warrant only one of the stages of business growth.

Before the launch, you are doing your research on the business idea and what it will take to get your product or service off the ground (which would represent one of those startup stages). That means identifying what the organization will look like, how you’ll do marketing, how you’ll develop the product, and what kind of funds you’ll need to get your hands on in order to make that happen. You might still be learning how to work for yourself.

Once you are confident that the business idea is sound and you are properly capitalized to take the plunge, you launch your startup and prepare to take on the challenges associated with this phase — and there will be challenges. After all, one study found that half of startups disappear after five years.

Focuses for startup

This phase will require a lot of hard work on your part, not to mention adaptability as you encounter unforeseen obstacles. So roll up your sleeves and get to work.

Work on developing a marketing proposal, do customer journey mapping, map out your workforce plan, and put down on paper all of the things you need to do to make the company succeed. Aggressively modify this list as necessary after launching.

Growth and expansion

Getting past the startup phase of your business is like a rocket finally breaking through the gravitational pull of Earth and sailing into space. At the growth stage, the business should be generating consistent income and enjoying a steady increase in customers (hopefully, an explosive increase).

As cash flow improves, you’re better able to cover expenses and your profitability starts to see an increase as well. This makes your business even more attractive to investors, so if you still have a need for more funding to get your business over the hump with more facilities or employees, this is a good time to reach out to potential investors.

Although the startup phase certainly is the most challenging for any business, the growth phase can be risky as well. Business owners often make mistakes at this phase, such as hiring the wrong people, investing in the wrong things, or just not keeping your eye on the ball due to a wide range of new demands on your time.

Focuses for growth

In order to survive this stage, you must hire good leaders who can help you establish a growth strategy and manage it successfully. Look for people who have a strong track record for guiding other businesses, and whose visions align well with yours.

This is also a good time to implement a change management plan to help your company adapt.

Shake-out

Eventually, the soaring revenue you’ve been enjoying will start to slow down due to more competitors entering the market or just saturation of your target marketing. This is what we call the “shake-out” stage in the business life cycle.

At this point, you’ve peaked as a business and your sales start a long, slow decline — or, your sales are going up, but you’re experiencing more competition. This is when businesses do a lot of consolidations and mergers with other firms.

When you reach this stage, you’ll probably be thinking about how to minimize expenses to counteract the falling sales, or explore a way to expand into a different market.

Focuses for shake-out

Now that you can no longer rely on exploding revenues to cover any waste within your company, you’ve got to go to work making the business more efficient. Conduct a full audit of your company to find areas of waste, and eliminate them or find better ways to do necessary activities.

Maturity

Soaring profits may be a thing of the past, but that doesn’t mean your business is done for. On the contrary, what comes next may be the best phase of all: maturity.

At this point, you’re pretty well set. Profits aren’t explosive, but they are solid and dependable. You know where you stand, and your business appears well positioned to last for years or even decades. If your business has adapted well, you should be experiencing slight but persistent growth each year.

The main challenge during this phase will be fending off all the competitors that will be constantly trying to knock you off your perch. There is certainly still some risk here, and it’s important to try to find ways to launch new products and expand into new market areas.

Focuses for maturity:

Look for opportunities. Remember, we are talking about a cycle here. Begin the cycle anew by looking for new products to launch, and keep that startup mentality alive. With all the resources you now have as a mature company, this should be a lot easier to do compared to when you were a startup with limited cash.

You must be focused on the right things to be successful

Starting a business is tough, but it’s a lot easier when you are able to recognize the company growth stages, where you’re at in that life cycle, and therefore what your focus should be.

If you’re launching, it’s about buckling down and putting in the hard work. If you’re growing, it’s about managing well and having the right leadership team. If you’re in the middle of the shake-out stage, it’s about making the company an efficient machine. And if your company is mature, it’s time to innovate.

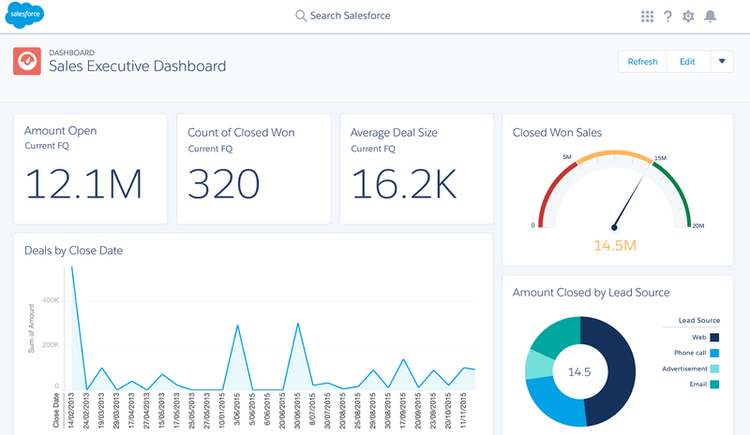

Whichever phase you’re in, it’s important to remember that you will also need the right tools to be successful. For example, CRM software can help organize your sales team. Software can also help you develop a small business marketing plan, or set some marketing KPIs (key performance indicators) to help guide your marketing team.

If you keep your eye on the ball and have the right tools at your disposal, you will maximize your chance of being a successful company that will last for years to come.

Alert: highest cash back card we’ve seen now has 0% intro APR until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes.

Read our free review

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)