Technical Analysis News | Articles | StockCharts.com

Mục Lục

Latest News

DecisionPoint

DP Trading Room: Energy Ready to Heat Up?

On this week’s edition of The DecisionPoint Trading Room, Carl and Erin cover the indicators and live market action. Erin takes a deep dive into the Energy sector, among others that appear promising Read More

Mish’s Market Minute

Expectations, Implications and Possible Impacts on the Market

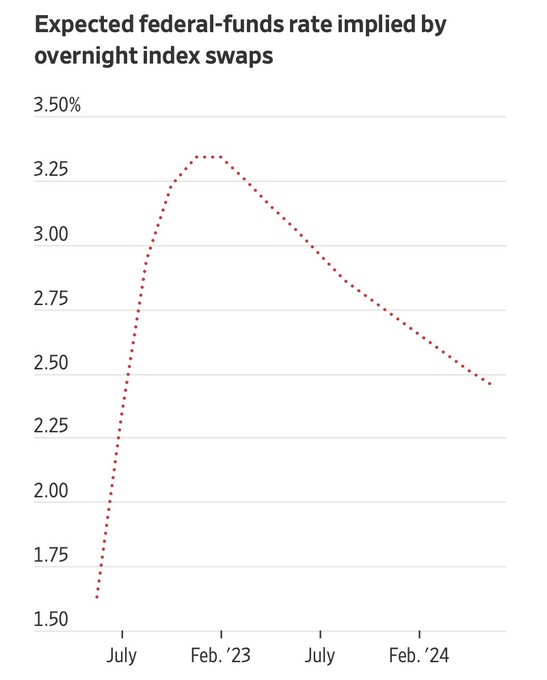

The chart posted is all about expectations. Regardless of the talk on the new and stretched definition of recession, departing from the textbook definition, investors believe that the Fed Funds rate is close to peaking and will begin to decline into 2023 and 2024 Read More

Members Only

STOCKS SHOW MODEST WEEKLY GAINS

MODEST WEEKLY GAINS Stock indexes gained some ground this week, but not enough to reverse major downtrends. And they remain below overhead resistance levels Read More

The MEM Edge

MEM TV: The Key Traits of a True Market Bottom

In this special presentation courtesy of StockCharts TV’s The MEM Edge, Mary Ellen shares a rules based system to help you identify when a new bull cycle has come in to play. This proven system, “A Follow-Through Day”, has identified every market bottom going back over 100 years Read More

The Mindful Investor

It’s All About That 50-Day Moving Average

For the last couple months, when someone would bring up some bullish argument, my response would usually be something like, “Sure, but we’re still below the 50-day moving average Read More

Moxie Indicator Minutes

The First Part of the Rally

On this week’s edition of Moxie Indicator Minutes, TG discusses how the market and many names have done well over the last week or two, but are now reaching areas of resistance Read More

The Canadian Technician

The Sector Rotation Model is Working Nicely

The market is a moving target, where something new is starting to run and something that was working starts to fail. It’s very frustrating for the buy and hold investor, but, for the technical world using risk management techniques, it is a continuously morphing event Read More

Trading Places with Tom Bowley

These 3 Earnings Massacres Last Night Had 1 Thing in Common

Trying to predict how Wall Street might react to an earnings report is no simple task. Sometimes, a stock has a big run into its earnings report, but then sells off after delivering solid results. It’s the old adage, “buy on rumor, sell on news Read More

GoNoGo Charts

GNG TV: Constructive Evidence for Risk-On Markets

In this week’s edition of the GoNoGo Charts show, Alex and Tyler explain some risk-on behavior this week as U.S. domestic equities paint a first aqua “Go” bar Read More

RRG Charts

5 Interesting Industries In Industrials

In this article, I’d like to dig a bit deeper into the Industrial sector. Starting at the sector level, we find the tail for XLI inside the weakening quadrant and moving towards lagging. So definitely not one of the better sectors Read More

Stock Talk with Joe Rabil

Why I Love MACD

On this week’s edition of Stock Talk with Joe Rabil, Joe shows how he uses MACD in conjunction with ADX to improve confidence on your entry points Read More

Top Advisors Corner

A Subtle Message in the Volume Summation Index

If we look at the classic version of the McClellan Volume Summation Index in this week’s chart, then there is some reason for the bulls to have hope Read More

Mish’s Market Minute

Mish’s Daily: The Modern Family Will Not Let You Down

The disconnect between Fed tightening and the rebound in the tech sector leaves many investors wondering what will happen next. The Fed is raising interest rates, which is frequently a precursor to a stock market decline, but growth stocks are rallying Read More

Members Only

Martin Pring’s Market Roundup

Housing Data Disappoints, But Housing ETFs Rally

Due to its sensitivity to interest rates, housing has the greatest average lead time going into recessions than any other economic (as opposed to financial) indicator. For that reason alone, it is worth examining amid the constant talk of recession. The HMI vs Read More

Dave Landry’s Trading Simplified

What You Must Know in a Bear Market

On this week’s edition of Trading Simplified, Dave discusses the things that you must know during a bear market. He then goes on to discuss simple ways to determine market trends and signs to watch for when the market is turning Read More

Mish’s Market Minute

Mish’s Daily: All About Netflix

As investors are looking at the earnings and guidance closely for the individual leading companies reporting, I thought I would highlight the leader in the multi-billion-dollar TV streaming industry. First off, Netflix (NFLX) reported: Revenue: $7.97 billion, est: $8 Read More

RRG Charts

Sector Spotlight: Growth Takes Over (for Now)

In this edition of StockCharts TV’s Sector Spotlight, I assess the current rotation in asset classes and sectors, highlighting the rotation for commodities, which are going through a setback but are likely to come back as the leading asset class Read More

DecisionPoint

The DP Trading Room: Bear Market Special!

On this week’s edition of The DecisionPoint Trading Room, Carl opens the session with his market overview, spending extra time on Crude Oil. He answers quite a few viewer questions, including a discussion of his famous P/E chart, and elaborates on questions regarding Energy Read More

Mish’s Market Minute

Mish’s Daily: Things Over Paper – Why Real Assets are Best

In today’s economy, investing in assets that will hold their value to or near the rate of inflation is more important than ever. These types of investments offer protection from inflation and can provide a hedge against other economic downturns Read More

RRG Charts

Sector Rotation (Model) vs Seasonality

Those of you who regularly watch Sector Spotlight on StockchartsTV will know that I have a few segments that come back on a regular basis Read More

The Mindful Investor

Financials Rallied on Friday, But Is It Enough?

The top gainer in the S&P 500 index on Friday was Citigroup (C), up over 13% on a strong earnings report. So the chart is obviously bullish, right? Not so fast. It is very easy to get drawn into short-term signals like one-day price movements Read More

The MEM Edge

MEM TV: Earnings Season Starts with a Bang

On this episode of StockCharts TV’s The MEM Edge, Mary Ellen reviews the rally in QCOM and other Semiconductor stocks as select Technology stocks begin to firm up. She also shares insights into top stocks due to report earnings next week Read More

Top Advisors Corner

Earnings Season Just Might Offer Big-Time Profit Opportunities

In my article last week, I made the case that the market reward-to-risk has shifted to the upside and that 3740 on the S&P looked like it had strong support on any pullback. As you can see in the chart below, that level was indeed challenged on Thursday and held like a champ Read More

Members Only

ONE VERSION OF YIELD CURVE INVERTS

TEN YEAR – TWO YEAR YIELD CURVE INVERTS Chart 1 shows the spread between the ten year and two year Treasury yields falling below the zero line which signals an inverted yield curve Read More

Top Advisors Corner

Wild Times for the Copper/Gold Ratio

The once very stable relationship between the copper/gold ratio and T-Note yields is starting to wobble into an increasingly unstable situation. For many years, there has been a really reliable relationship between bond yields and the ratio of copper prices to gold prices Read More

Moxie Indicator Minutes

Inflation, Interest Rates and Chop

On this week’s edition of Moxie Indicator Minutes, TG discusses how inflation is higher than expected across the board and how, even though the market didn’t like it, things managed to stay afloat Read More

The Canadian Technician

Can Oil Start To Rally?

One area that has sold off extremely hard is energy, but many of the stocks are holding near their 200-DMA. If this was a long-term rally, with a deep low down at the 200-DMA, this is where we would expect a bounce. Here’s an example of the oil chart on the 60-minute time frame Read More

GoNoGo Charts

GNG TV: Open to All Outcomes

GoNoGo Charts combine a broad scope of the most widely used technical indicators to provide a weight of the evidence perspective on Trend, Momentum, Volume and Volatility Read More

Stock Talk with Joe Rabil

3 Criteria to Help You Avoid Losing Trades

On this week’s edition of Stock Talk with Joe Rabil, Joe illustrates 3 criteria that will help to avoid losing trades. The current market environment is difficult, which means we need more strict criteria before investing Read More

Mish’s Market Minute

Mish’s Daily: USD & EUR — Is This the Dollar’s Last Hurrah?

US Dollar and Euro at Parity Again Investors are flocking to the US Dollar as Europe braces for a potential energy crisis in the Fall. The euro has been under pressure recently, with investors pulling their money out in favor of the haven currency—the Dollar Read More

Dave Landry’s Trading Simplified

Trading Psychology in a Nutshell

On this week’s edition of Trading Simplified, Dave continues his discussion of his methodology in action by revealing a mystery chart and walking viewers through the next two of his 100 trades Read More

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)