Shopify’s $1 billion fulfillment network could pose competition for Amazon

Shopify Inc.’s plans to roll out a $1 billion physical distribution network across the U.S. could eventually pose a competitive threat to e-commerce rival Amazon.com Inc. but only if the Canadian company is successful in providing fast, affordable delivery service to

small and mid-sized businesses over the next five years, experts say.

Ottawa-based Shopify is allocating $1 billion over five years for an ambitious fulfillment network that will include warehouse technology and third-party shipping and delivery vendors. Shopify COO Harley Finkelstein claims the network will help Shopify’s pool of independent merchants get orders to customers faster and cheaper than any other option available.

Shopify’s cloud-based platform allows small to mid-sized businesses to create custom websites and manage various sales channels, including mobile storefronts and marketplaces. The company announced plans in June 2019 to add delivery and distribution offerings to its merchants.

The move puts Shopify in direct competition with Amazon and a growing number of e-commerce companies exploring how to expand fulfillment capabilities. Experts say Shopify could pull merchants from Amazon or other players if the company provides a more efficient and lower-cost service, though the platforms are likely to coexist and feed off one another in the meantime.

“It’s going to be a thorn in Amazon’s side,” within a three to seven-year horizon, said Jim Barnes, CEO of enVista, a global software solutions and consulting services firm, in an interview. “If Shopify has a much better service than Amazon and can provide the same type of distribution network, then why not? They are going to look for alternatives.”

Shopify is amping up its network at a time when Amazon is heavily investing in the buildout of a one-day delivery program for its Prime members, which cuts delivery times from two days to one.

Amazon and Shopify did not respond to requests for comment.

Shopify is planning to invest $1 billion into a fulfillment work that it says will provide cheaper and faster delivery for businesses.

Source: Shopify

Rapid growth

While Amazon remains the larger e-commerce player by far, Shopify’s move into the fulfillment market underscores the company’s rapid growth since its founding in 2004 and growing credibility as a business platform.

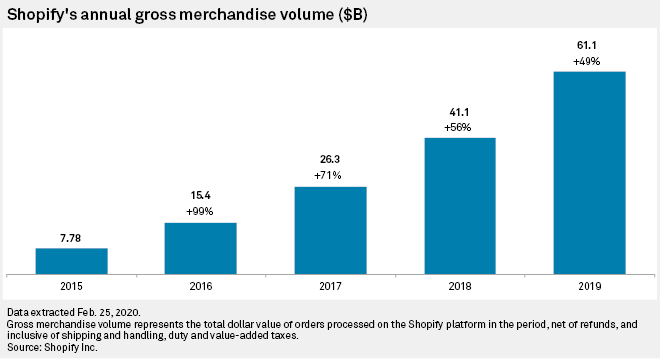

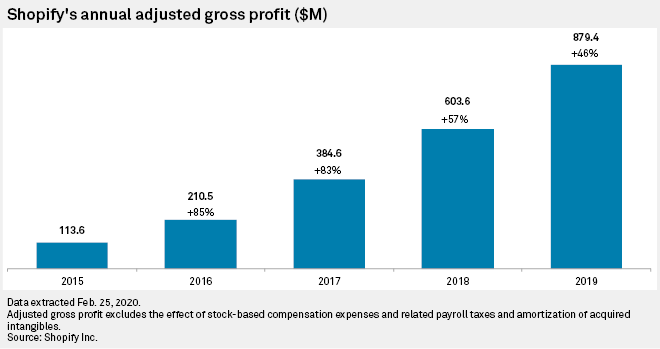

In 2019, Shopify’s gross merchandise volume reached $61.14 billion in its fiscal year ending Dec. 31, 2019, a roughly 49% increase from $41.10 billion in the year ending Dec. 31, 2018. The company’s adjusted gross profit, excluding the effect of stock-based compensation expenses and related payroll taxes and amortization of acquired intangibles, reached $879.4 million in 2019, up 46% from $603.6 million in 2018.

The company also beat fourth-quarter analysts’ expectations and predicted that 2020 revenue would range between $2.13 billion to $2.16 billion from $1.58 billion in 2019.

Meanwhile, Amazon expects net sales to grow between $69.0 billion and $73.0 billion in the first quarter of 2020 alone, growing between 16% and 22% compared with the first quarter of 2019.

That said, analysts believe Shopify has the potential to be successful in the fulfillment arena, especially now that it has a critical mass of business customers. Shopify’s cloud-based e-commerce platform now powers over 1 million merchants across more than 175 countries including footwear company Allbirds Inc. and fashion brand Rebecca Minkoff LLC. Shopify software allows merchants to manage their online storefronts across multiple sales channels, including mobile, web, social media and marketplaces such as California-based e-commerce company eBay Inc. and Amazon.

“They have grown very quickly from nothing to processing $61 billion worth of merchandise on Shopify-powered websites,” Dan Romanoff, a Morningstar analyst, said in an interview.

Businesses may find the ability to create and maintain their own branded websites with Shopify an appealing alternative to Amazon, given the latter company’s issues with counterfeit items, Romanoff said. Nike Inc. and other retailers have severed ties with Amazon in recent years in favor of their own digital channels.

Businesses may be thinking “we can keep control of our brand” if we work with Shopify, Romanoff said. “You can make it look however you want, as simple or as complicated as you want it to be.”

Meanwhile, with Amazon, businesses get what essentially amounts to a product listing online but access to a marketplace with millions of buyers, Romanoff said.

“The point of Amazon is I go to one website and buy whatever I want there, rather than having to go to 10 different websites to buy a bunch of stuff,” he said.

Shopify’s software, combined with the company’s new logistics and fulfillment capabilities, could be a powerful combination that lures merchants away from Amazon, which relies heavily on its third-party sales, Ygal Arounian, an equity analyst with Wedbush Securities, said in an interview.

According to Amazon, the percentage of physical gross merchandise sold by independent third-party merchants on its site grew to 58% in 2018 from 3% in 1999. Amazon operates a global platform with nearly 3 million active sellers, 1.1 million of whom are based in the U.S. as of 2019, according to Marketplace Pulse, an e-commerce intelligence firm.

“If the experience on Shopify is so great that a brand feels like they can live without Amazon and can control their customer experience better, maybe they chose to sell on their own website and dump Amazon,” Arounian said.

Ultimately, it will be up to an individual business to determine whether it’s more cost-effective to fulfill orders with Shopify or Amazon.

Shopify did not respond to inquiries about its shipping prices, but setting up a basic Shopify store costs $29 per month and ranges up to $299 per month for a business that wants additional features to scale operations. Amazon sellers who plan to sell fewer than 40 items per month do not pay a monthly fee while sellers who plan to sell more than 40 items monthly pay $39.99 for a professional account. Amazon also takes a cut of each sale made by its third-party sellers.

The company’s “Fulfillment by Amazon” service charges sellers fulfillment fees ranging from $2.50 for a packaged item whose longest side is 15 inches or less up to $137.32 for a packaged unit that exceeds 151 pounds. That is on top of monthly inventory storage fees based on the volume of space a business’ inventory occupies in Amazon fulfillment centers.

Quality over scale

Finkelstein said during a Feb. 12 conference call with analysts that Shopify will focus on performance and quality over scale as it rolls out its $1 billion fulfillment network, a measured approach that experts say will behoove the company.

Similar to Amazon’s approach, Shopify intends to rely on a network of third-party warehouse providers to carry out its plan with fulfillment centers in states including California, Ohio, Pennsylvania, and Texas. The company plans to use warehouse technology from 6 River Systems, which Shopify purchased in the fourth quarter of 2019, to help track inventory and route orders. Since the network’s launch, Shopify has added dozens of merchants to the fulfillment network’s “early access” program and worked with warehouse partners to bring more fulfillment nodes online.

It is unclear whether Shopify intends to expand the network internationally, although the company does offer its platform in 20 languages. The goal, for now, is to expand across the U.S. without investing capital in building physical brick and mortar facilities, a less expensive option, Romanoff said.

If the program’s rollout is successful, Shopify will likely add a second phase of investment of several billion dollars after the first $1 billion is exhausted, Romanoff said. He also said he would not be surprised if the company eventually ends up building its own warehouses. “I think it’s a matter of time so that they can test the third-party locations they bring up, how many merchants sign up, what the growth is, what works and what doesn’t,” Romanoff said.

Crowded market

While Amazon remains the dominant player, several other companies are trying to get into the fulfillment game.

United Parcel Service Inc. in 2019 launched its eFulfillment platform that offers shipping and fulfillment services to small businesses in the U.S. and Canada. And Walmart Inc. is ramping up its own fulfillment service, which allows small businesses to stock items at Walmart warehouses.

“The entire retail and commerce ecosystem is fighting to catch up to the standards that Amazon set,” Arounian said. “Every year Amazon raises that bar.”

Until Shopify significantly scales its fulfillment operations, the two e-commerce companies are likely to coexist. “Even if Shopify gets its fulfillment act together, the Amazon portion will still end up being much much bigger for most brands,” said James Thomson, a former Amazon executive, in an interview. “There are 200 million people on the Amazon site.”

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)