Real-time payment networks grow, but banks still search for uses

The future success of real-time payments platforms owned by the Federal Reserve and the largest U.S. banks hinges on whether financial institutions and fintechs can find real-world uses for the technology.

Real-time payments are still in their infancy in the U.S.: The Clearing House, a company owned by Bank of America Corp.; JPMorgan Chase & Co.; Citigroup Inc.; Wells Fargo & Co.; and other large banks launched the nation’s first real-time payment platform, or RTP, in 2017, while the Fed has scheduled a production rollout of its own planned platform, the FedNow Service, for May to July 2023.

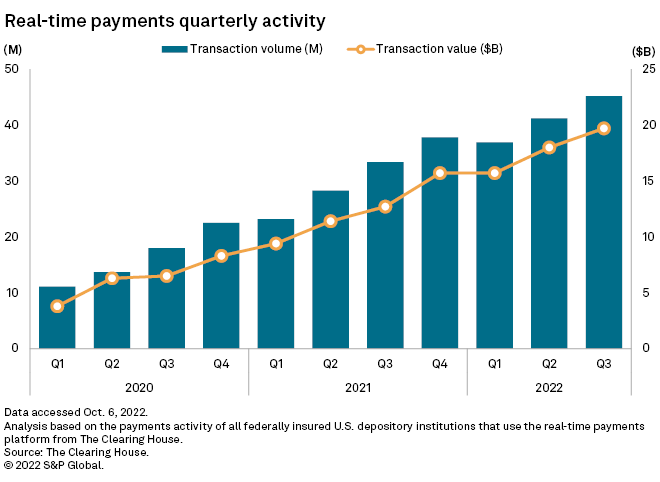

RTP has shown steady growth since its launch, but its $19.7 billion of processed payments during the third quarter were a tiny portion of the trillion-dollar U.S. payment market.

The planned launch of FedNow has rekindled banks’ discussions about faster payment offerings, but many banks, especially smaller ones with limited resources, are unsure about the operational setup and the potential for monetization, Mark Majeske, senior vice president at payments company Alacriti Inc., said in an interview.

“I think that there is hesitancy in the market right now,” Majeske said. “For the first time, the bank might be looking at doing transactions 24/7. So their first question is, ‘Do I have to hire people for the weekend?'”

In fact, The Clearing House and the Fed both work directly with financial institutions, or reach them through emerging fintech vendors such as Alacriti and Volante Technologies Inc. or through core banking software providers.

Most implementation efforts and liquidity management outside of business hours can be assisted by those technology vendors, Majeske said. Once the payment platforms are running, the banks’ main work would be to settle transaction records in their internal accounts against their sub-accounts on the platforms.

From connectivity to usage

Despite some banks’ hesitancy, The Clearing House has been pushing for connectivity. It has 274 participating banks and credit unions — 85% of which have under $10 billion in assets — and has plugged 62% of checking accounts in the U.S. into the RTP network. As a result, those accounts are live with RTP and are able to receive real-time transactions.

But connectivity is not the same as actual usage, said Majeske, who previously worked at the Clearing House on the launch of RTP. For banks, investing in real-time payments is about setting up the technology for data transmission and managing the ledgers for credits and debits. For consumers and businesses, meanwhile, the most successful payments applications are often presented as a button to click at checkout.

“Adoption really doesn’t happen until meaningful value-added use cases get built on top of that infrastructure, and beyond that, they have to be measurably better than what already exists today,” said Jordan McKee, director of fintech research and advisory group at S&P Global Market Intelligence’s 451 Research.

“To me, speed isn’t necessarily a value proposition in and of itself,” McKee said. “It has to be even bigger than that.”

Exploration taking off

To develop use cases of real-time payments, one strategy is to identify scenarios in which customers are willing to pay for the convenience of faster payments.

“I call that the FedEx model,” Majeske said. “If I go to FedEx, and I want to ship a box right to you and it has to be there the next day, I’m willing to pay for that because of the convenience. I think you have to look at payments the same way.”

The Clearing House has started seeing value-added services growing quickly on the RTP network, including some in niches other than the uses for which the platform was originally built, Elena Whisler, senior vice president of sales and relationship management at The Clearing House, said in an interview.

Instant payroll for workers at gig economy companies is such an example, she said, adding that the service addresses a trend in the gig economy in which workers expect to have access to earned wages on demand, rather than on a traditional biweekly cycle. During the second quarter, instant payroll accounted for 15% of the total volume on RTP and grew 104% compared to the prior quarter.

The launch of FedNow could also enhance blockchain-enabled payment systems, to let banks settle payments using blockchain instantly at all times, said Kevin Greene, CEO of Tassat Group Inc.

“FedNow will simply be a messaging protocol. The banks then have to figure out how to connect to the FedNow. And then they have to figure out how to connect that to their customers,” Greene said.

Lengthy process

The last time U.S. banks embraced ubiquitous, electronic payment rails was the launch of the automated clearinghouse, or ACH, network in the 1970s.

The platform, which handles direct deposits and direct payments, took seven to 10 years to build up volume, and banks had to learn about security and fraudulence prevention, Majeske said. Similarly, the penetration of real-time payments is set to be a major overhaul, but the market today accepts changes faster thanks to technology companies that cater to the technology-savvy users, he added.

Since RTP and FedNow do not interoperate, most banks would need to implement both over time. The two have nearly identical pricing structures, but an advantage of FedNow is that it can draw payments from banks’ master accounts with the Fed.

In a survey by 451 Research released in September, 45.6% of the 1,670 respondents said they are likely to open a new account with a banking service provider that supports real-time payments.

“I don’t expect actually half of consumers to just overnight open up a new account to gain access to real-time payments, but it does indicate that there is some consumer interests in this experience,” 451’s McKee said.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)