Real-Time Payments: Everything You Need to Know

Mục Lục

What are real-time payments?

Real-time payments (RTP) are payments that are initiated and settled nearly instantaneously. A real-time payments rail is the digital infrastructure that facilitates real-time payments. Ideally, real-time payment networks provide 24x7x365 access, which means they are always online to process transfers. This includes weekends and holidays.

In the United States, the most prominent example of a real-time payments network is The Clearing House’s RTP network. FedNow, the Federal Reserve’s anticipated real-time solution, will also fall under the definition of a real-time network. The Federal Reserve is projecting to launch FedNow in 2023.

Real-time payments vs. faster payments

It is important to note that the term real-time payments should not be used interchangeably with the term faster payments. While they are similar, there are some key differences. Faster payments solutions, such as Nacha’s Same Day ACH, post and settle payments faster than traditional payment rails, but faster does not mean instantaneously.

Other payment solutions, like Mastercard’s and Visa’s push payment solutions will message transactions within seconds or minutes. However, because they do not also settle transactions quickly, push payments are considered a faster but not real-time payments.

While all real-time payments can be considered a form of faster payments, not all faster payments are conducted in real time.

The value that real-time payments bring

Real-time payments bring value in a number of ways. The first is obvious: they are fast. Really fast. Payments that settle instantaneously are available just as quickly. For individuals or businesses that need the funds ASAP, instant access can be a game changer.

Real-time payment rails also bring end-to-end communication. Historically, communication has flowed in one direction: from the payer to the payee. If the two parties want to exchange information back and forth, they have to do so outside of the payments system. Real-time payments connect the payment with payment data together in a single transaction.

Additionally, lag times and a lack of transparency surrounding the arrival of the funds can hinder communication. All in all, a fragmented communication process comes with challenges that impact everything from business flow to liquidity and risk management.

Fortunately, payments made in real time solve these challenges. Bilateral communication through integrated information flows, instant payment confirmation notifications, and settlement finality result in a more efficient payment journey. With real-time payments, financial control, cash positioning, and liquidity management are now in reach.

Beyond communication improvements, The Clearing House’s (TCH) real-time payments rail has shown that a number of use cases exist for making payments in real time.

Real-time payments are also irrefutable, meaning that once payments are received, they cannot be taken back or reclaimed by the sender.

Key players in the RTP space

Real-time payments are not a new concept. In fact, Japan developed the first RTP system in 1970s. By 2010, other countries including the United Kingdom, China, and India had their own RTP rails. In 2019, FIS calculated that 54 countries had activated real-time payment systems—a fourfold increase since 2014.

The United States lagged behind many others in real-time payment implementation. As a result, there are only two major players to-date that fall under the umbrella of real-time payments: The Clearing House’s RTP and The Federal Reserve’s FedNow (which is still in its pilot stage).

The Clearing House’s RTP network

In 2017, The Clearing House launched its RTP network. It was the first new payments system launched in the U.S. in 40 years. Today, TCH RTP delivers efficient real-time payments for several use cases, including:

- B2B real-time transactions

- P2P real-time transactions

- Payroll

- Request for pay (RfP)

- And more

Technology Providers

Banks interested in connecting to the RTP network typically work with a technology provider with a streamlined process that enables them to do so. Providers such as FIS, Sherpa Technologies, PayFi, ACI Worldwide, Fiserv, Volante, Jack Henry and Alacriti have been instrumental in making this integration happen

“If you can enable those providers, you can effectively enable all of those banks that use those providers,” said Matt Richardson, Head of Product Solutions at Citizens Bank, in an interview with PaymentsJournal.

The Federal Reserve’s upcoming FedNow service

A second key player in the world of real-time payments is the Federal Reserve. In August 2019, The Federal Reserve Board announced that the Federal Reserve banks were developing an RTP rail: FedNow. The original notice claimed FedNow would launch sometime in 2023 or 2024. Subsequently, the launch timeline was updated to 2023.

In January 2021, the Federal Reserve launched a FedNow pilot program. The FedNow pilot program consists of more than 200 financial institutions and processors that will help support the development, testing, and adoption of FedNow.

According to a press release announcing the pilot program, a “key objective in selecting participants for the pilot was to ensure diverse representation across financial institutions and service providers, connection types, settlement arrangements and experience levels.”

Mercator Advisory Group’s Director of Debit and Alternative Products Advisory Service, Sarah Grotta, wrote in response to the announcement that, “of particular importance…is the list of processors who will be working to develop the integration tools to help their financial institutions with the technology requirements to connect to FedNow and take advantage of the opportunities of real-time payments.”

Among those processors are ACI Worldwide, Finastra, Finxact, Fiserv, Jack Henry, and Shazam. For those interested, here is a full list of FedNow pilot program participants.

Real-time payments and P2P payment apps

In recent years, peer to peer (P2P) payments have been on the rise, with apps such as Zelle, Venmo, and PayPal replacing cash, checks, and IOUs. Now, individuals who want to split the cost of dinner, a ride share, or rent and utilities can send payments to one another in an instant.

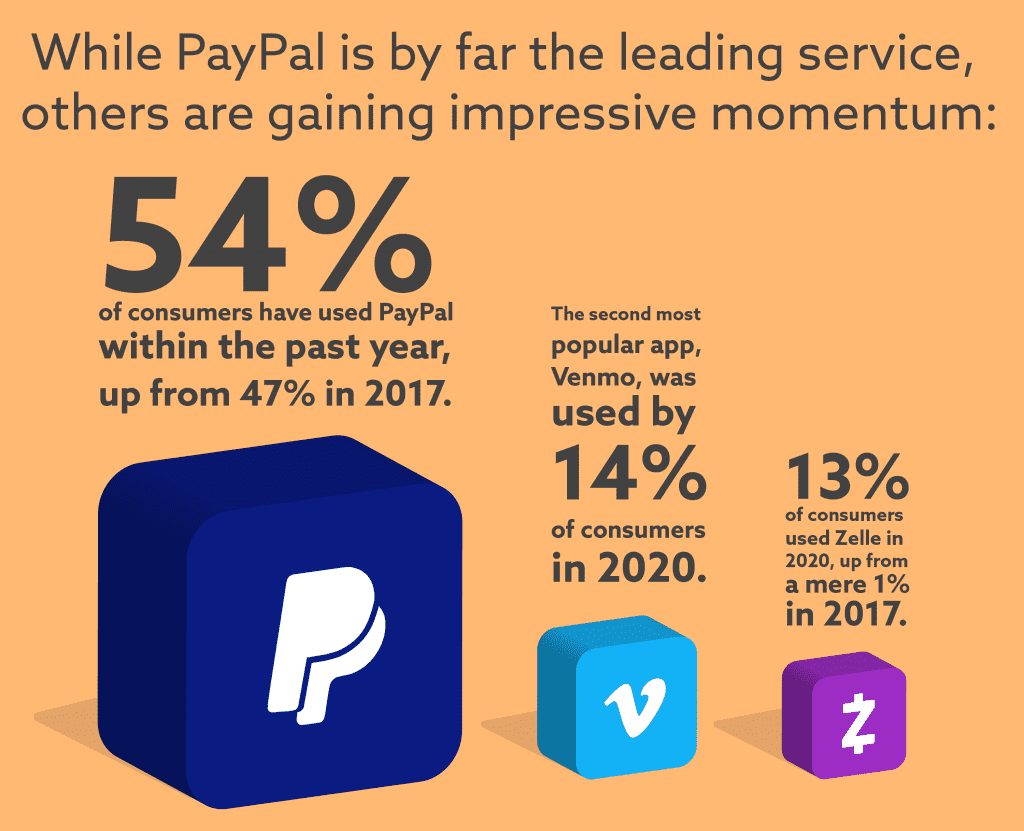

According to Mercator Advisory Group findings, consumers are increasingly adopting P2P payment apps. While PayPal is by far the leading service, others are gaining impressive momentum:

- 54% of consumers have used PayPal within the past year, up from 47% in 2017.

- The second most popular app, Venmo, was used by 14% of consumers in 2020.

- 13% of consumers used Zelle in 2020, up from a mere 1% in 2017.

What does this have to do with real-time payments? Due to their integration with The Clearing House’s RTP network, multiple P2P payment apps can transfer money instantaneously from the app to a bank account. For instance, instant transfers routed through the TCH RTP network became available on PayPal’s Venmo in August 2019.

“This new option will have the individual input their checking account details and the transaction will route through The Clearing House’s RTP network [as] one of the most visible applications of the network,” wrote Mercator’s Sarah Grotta, shortly after the partnership was announced.

Meanwhile, in February 2021, Early Warning Services and The Clearing House announced that Zelle transactions can officially be cleared and settled over the RTP network. Bank of America and PNC Bank were the first to send Zelle payments over the RTP network.

Emerging B2B use cases for real-time payments

The implications for the integration of The Clearing House’s RTP network with applications such as Zelle ripple well beyond P2P payments alone. Companies relying on outdated manual processes to make business to business (B2B) payments are now finding motivation through the RTPs available on P2P apps.

For example, a Mercator Advisory Group Viewpoint on the B2B faster payments space found that 60% of respondents surveyed by the Association for Financial Professionals (AFPs) for its 2019 payments study said that, when compared with other types of transactions, B2B transactions will benefit the most from faster and RTP systems.

There are several B2B use cases and perks for RTPs:

- The ability to move rich data (via ISO 20022 adoption) that can provide actionable insights into corporate client needs

- Confirmation of payment

- Improved control over payments timing

- Liquidity management

- Instant bill payment

- Remittance data availability

Companies of all types recognize the value of real-time payments

As merchants, businesses, and banks recognize the value of real-time payments, adoption will continue to increase and use cases will continue to emerge.

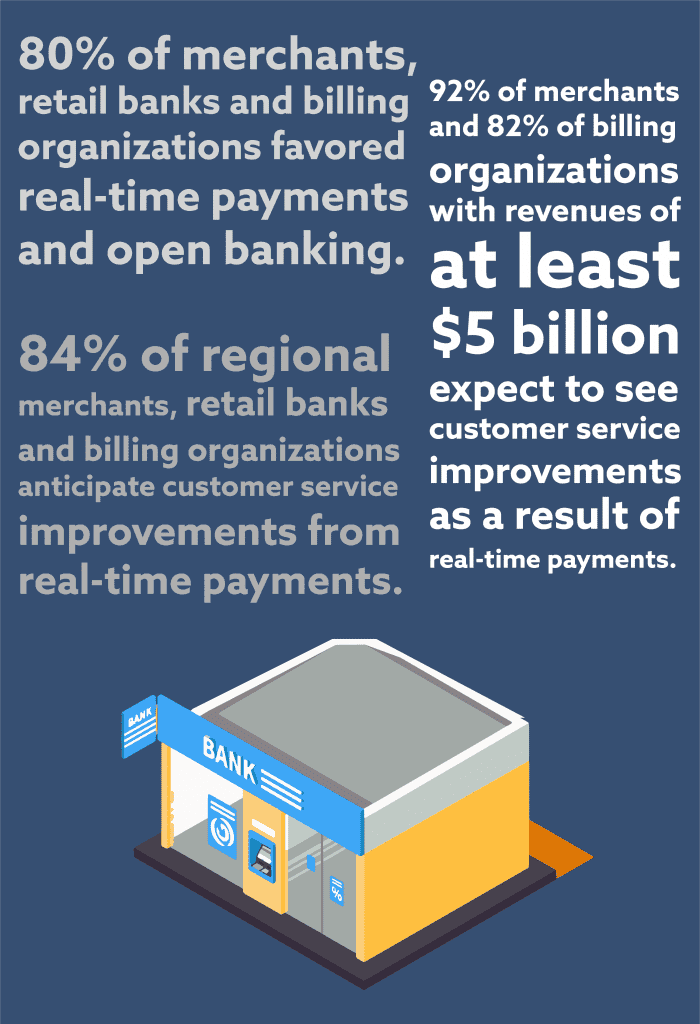

In fact, companies already recognize the value. Citizens Bank’s second annual Real-Time Payments Outlook found that around 90% of business leaders are interested in real-time payments. A 2018 Global Payments Insight Survey from Ovum and ACI Worldwide found that:

- 80% of merchants, retail banks and billing organizations favored real-time payments and open banking.

- 92% of merchants and 82% of billing organizations with revenues of at least $5 billion expect to see customer service improvements as a result of real-time payments.

- 84% of regional merchants, retail banks, and billing organizations anticipate customer service improvements from real-time payments.

In other words, organizations of different types and sizes see real-time payments in a positive light and are eager to adopt them.

Real-time payments surged during COVID-19

We can’t talk about payments without talking about COVID-19. No part of the world was left untouched by the pandemic, and real-time payments are no exception.

In fact, the results of the 7th annual FIS global RTP trends report, Flavors of Fast, found that adoption of real-time payments accelerated during the pandemic. The report includes meta-analysis of global payments data research conducted in April and May of 2020.

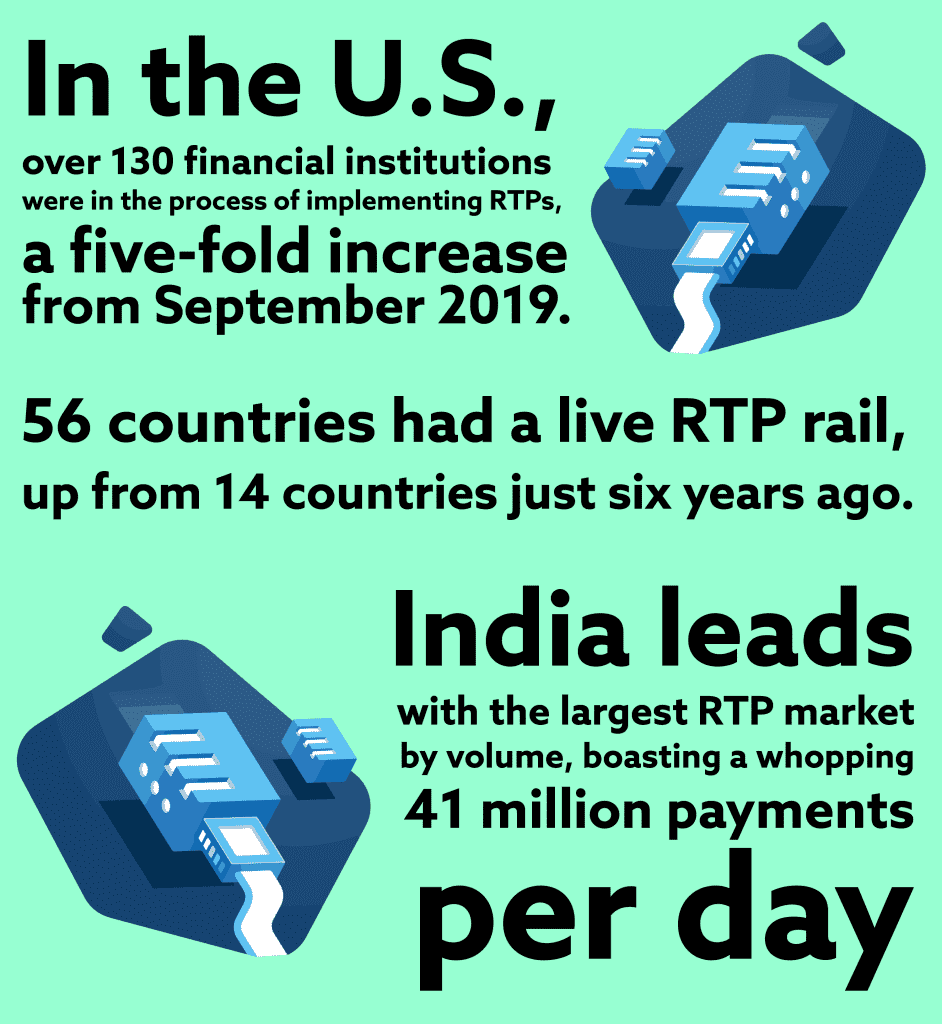

Noteworthy findings of the FIS report include:

- In the U.S., over 130 financial institutions were in the process of implementing RTPs, a five-fold increase from September 2019.

- Half of demand deposit accounts in the U.S. are now connected to The Clearing House’s RTP network.

- 56 countries had a live RTP rail, up from 14 countries just six years ago.

- India boasted the largest RTP market by volume, with 41 million payments per day.

- At 482%, the Philippines saw the highest annual percentage value growth.

- At a staggering 657%, Bahrain saw the highest annual percentage volume growth.

FIS Head of Global Real-Time Payments, Raja Gopalakrishnan, explained that “[t]he continued adoption and evolution of real-time capabilities all over the world signals that real time is no longer a nice-to-have or an afterthought; it must be a priority.”

What does the future hold for real-time payments?

The Federal Reserve’s anticipated launch of FedNow is only the beginning of the innovation and competition to come. The question of interoperability between The Clearing House’s RTP network and FedNow has yet to be answered. New players have yet to enter the space and new use cases have yet to be developed.

The United States may have been late to the game, but the 2017 launch of TCH’s RTP network triggered a snowball effect that is continuing to accelerate. Although it is impossible to predict everything to come for real-time payments, exciting developments are undoubtedly on the horizon.

In the meantime, there are a number of developments on the roadmap to real-time payments modernization that organizations should be looking out for when it comes to implementing different use cases on the existing (and upcoming) RTP rails.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)