Enterprise Value (EV)

Mục Lục

What is Enterprise Value?

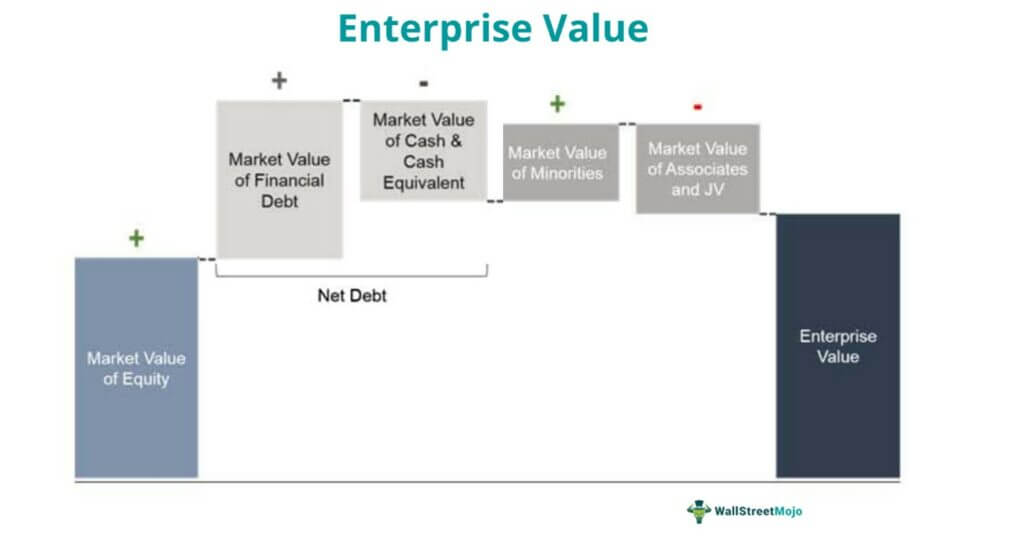

Enterprise value (EV) is the corporate valuation of a company, determined by using market capitalization and total debt. The market cap comprises preference stocks, common stocks, and minority interest; total debt comprises short-term and long-term liabilities of the company.

EV accurately evaluates the cost of acquiring a business by equally considering equityEquityEquity refers to investor’s ownership of a company representing the amount they would receive after liquidating assets and paying off the liabilities and debts. It is the difference between the assets and liabilities shown on a company’s balance sheet.read more and debtDebtDebt is the practice of borrowing a tangible item, primarily money by an individual, business, or government, from another person, financial institution, or state.read more. In a takeover,Takeover,A takeover is a transaction where the bidder company acquires the target company with or without the management’s mutual agreement. Typically, a larger company expresses an interest to acquire a smaller company. Takeovers are frequent events in the current competitive business world disguised as friendly mergers.read more the acquirer will be liable to pay the corporate liabilities of the target company; therefore, relying upon market capitalizationMarket CapitalizationMarket capitalization is the market value of a company’s outstanding shares. It is computed as the product of the total number of outstanding shares and the price of each share.read more won’t be enough.

Key Takeaways

- Enterprise value (EV) refers to the overall valuation—equity, debt, cash, and cash equivalents. In other words, it is the cost of acquiring a firm.

- The EV/EBITDA is an enterprise multiple. It correlates EV with earnings before interest, taxes, depreciation, and amortization. The metric determines whether the firm is undervalued or overvalued.

- EV is computed using the following formula:

EV = Market Capitalization + Market Value of Debt – Cash and Equivalents.

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Enterprise Value (EV) (wallstreetmojo.com)

Enterprise Value Explained

Enterprise value (EV) is a financial metric used in business valuation, financial modelingFinancial ModelingFinancial modeling refers to the use of excel-based models to reflect a company’s projected financial performance. Such models represent the financial situation by taking into account risks and future assumptions, which are critical for making significant decisions in the future, such as raising capital or valuing a business, and interpreting their impact.read more, accountingAccountingAccounting is the process of processing and recording financial information on behalf of a business, and it serves as the foundation for all subsequent financial statements.read more, portfolio analysisPortfolio AnalysisPortfolio analysis is one of the areas of investment management that enables market participants to analyze and assess the performance of a portfolio to measure performance on a relative and absolute basis along with its associated risks.read more, and risk analysis Risk AnalysisRisk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business. There are two types of risk analysis – quantitative and qualitative risk analysis.read more. EV is more accurate than market capitalization when representing real corporate value.

EV accounts for other significant implications faced by an acquirer. Along with the current assetsCurrent AssetsCurrent assets refer to those short-term assets which can be efficiently utilized for business operations, sold for immediate cash or liquidated within a year. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc.read more and non-current assets Non-current Assets Non-current assets are long-term assets bought to use in the business, and their benefits are likely to accrue for many years. These Assets reveal information about the company’s investing activities and can be tangible or intangible. Examples include property, plant, equipment, land & building, bonds and stocks, patents, trademark.read more, a new acquirer acquires debt liabilities as well. Short-term debts, long-term debts Long-term DebtsLong-term debt is the debt taken by the company that gets due or is payable after one year on the date of the balance sheet. It is recorded on the liabilities side of the company’s balance sheet as the non-current liability.read more, and outstanding interest payments add to the acquisitionAcquisitionAcquisition refers to the strategic move of one company buying another company by acquiring major stakes of the firm. Usually, companies acquire an existing business to share its customer base, operations and market presence. It is one of the popular ways of business expansion.read more cost.

Similarly, an acquirer will take over the target firm’s cash balance and other liquid assetsLiquid AssetsLiquid Assets are the business assets that can be converted into cash within a short period, such as cash, marketable securities, and money market instruments. They are recorded on the asset side of the company’s balance sheet.read more, which can be used to clear liabilities. Therefore, these costs are subtracted to arrive at the correct theoretical value of a target company.

Given below are the primary components of EV calculation:

Formula

The following formula represents the enterprise value:

![]()

or,

In the above formula, market capitalization is the product of each current stock’s price and the number of outstanding sharesOutstanding SharesOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased. It is shown as a part of the owner’s equity in the liability side of the company’s balance sheet.read more. The current stock comprises all the outstanding preferred shares and common shares in the market.

Also, the market value of debt refers to total liabilities—short-term and long-term obligations of the company.

Enterprise Value Examples with Calculation

Let us understand Enterprise Value calculation using examples.

Example #1

Let us assume ABC Ltd. is considering the acquisition of XYZ Corp. Then, based on the following financial details, determine the correct market value of XYZ Corp.

Solution:

EV = Market Cap + Market value of debt – Cash and cash equivalents

Market Cap = Price Per Share × Total Outstanding Shares

Market Cap = 20.18 × 1579500 = $31874310

EV = 31874310 + 9365400 – 8280700 = $32959010

Comparing the XYZ Corp.’s enterprise value with its market capitalization:

Premium = [(EV – MC) / MC] × 100

Premium = 3.4%

Therefore, based on EV, the price per share will be $20.87.

XYZ Corp’s value is 3.4% higher than its market capitalization. Therefore, if ABC Ltd. buys XYZ Corp., it will be paying 3.4% more than the current stock price. This implies that ABC Ltd. will be paying $20.87 per share to buy XYZ Corp., although its stock price is only $20.18 per share.

Example #2

Further, let us assume ABC Ltd. gets access to the following financial insights about the XYZ Corp.:

- Common Stocks = $20074000

- Preference Stocks = $9800310

- Minority Interest = $2000000

- Market value of debt = $9365400

- Cash and cash equivalents = $8280700

Based on the given data, determine the enterprise value of XYZ Corp.

Solution:

EV = Common Stock + Preference Stock + Minority Interest + Market Value of Debt – Cash and Equivalents

EV = 20074000 + 9800310 + 2000000 + 9365400 – 8280700 = $32959010

Hence, to acquire XYZ Corp. ABC will have to pay $32959010.

Enterprise Value of Amazon & Apple Stock

Let us have a look at top market players and their EVs.

#1 – Amazon.com Inc

On February 2, 2022, the company’s EV was $1.485T; by February 3, 2022, the company’s EV dropped to $1.366T. Also, in February 2022, the firm’s market capitalization was $1.598T. Amazon’s market cap is higher than its enterprise value—Amazon’s external liabilities are less than its cash and equivalents.

Source

#2 – Apple Inc.

As of February 4, 2022, Apple had an EV of $2.872T. However, its February 2022 market capitalization was $2.861T, slightly less than its EV. This means a takeover will cost $11B more than its market cap.

Source

Enterprise Value Multiple

EVs can be used to derive some integral multiples—enterprise multiples. EV multiples are used very often in equity researchEquity ResearchEquity Research refers to the study of a business, i.e., analyzing a company’s financials, performing Ratio Analysis, Financial forecasting in Excel (Financial Modeling), & exploring scenarios to make insightful BUY/HOLD/SELL stock investment recommendations. Moreover, the Equity Research Analysts discuss their findings & details in the Equity Research Reports. read more and investment banking for performing the following relative valuations:

Thus, EV multiple is chosen over the PE ratioPE RatioThe price to earnings (PE) ratio measures the relative value of the corporate stocks, i.e., whether it is undervalued or overvalued. It is calculated as the proportion of the current price per share to the earnings per share. read more when firms with different degrees of financial leverage (DFL)Degrees Of Financial Leverage (DFL)The degree of financial leverage formula computes the change in net income caused by a change in the company’s earnings before interest and taxes. It aids in determining how sensitive the company’s profit is to changes in capital structure.read more need to be compared.

Frequently Asked Questions (FAQs)

How to calculate enterprise value?

The firm’s EV can be calculated with the help of the following formulas:

EV = Market Cap + Market Value of Debt – Cash and Equivalents

EV = Common Stock + Preference Stock + Minority Interest

+ Market Value of Debt – Cash and Equivalents.

What is a good enterprise value?

The analyst cannot conclude by considering the EV alone. But, when EV is used as enterprise multiples, it becomes meaningful. Thus, a company with an inferior enterprise multiple like EV/EBITDA is considered more valuable than one with a higher EV/EBITDA.

What if enterprise value is negative?

A negative EV reflects the firm’s strong net cash position, whereby its cash and cash equivalents are more than enough to meet all its liabilities or debts. Such a firm can repurchase all its outstanding shares in the market.

Enterprise Value Video

Recommended Articles

This article was a Guide to what enterprise value is & its meaning. Here we discuss enterprise value multiples, formulas, and calculations using examples. You may also have a look at the articles below to learn more about valuation –

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)