Enterprise Value (EV) | Formula, Example, Analysis, Calculator

Enterprise value (EV), also known as firm value, is a measure of the total value of a company. It is an economic measure of the market value of a business. It is more comprehensive than equity market capitalization. Enterprise value is an important metric used in accounting, risk analysis, and business valuation.

Enterprise value incorporates a company’s equity market capitalization and all debt, both short-term and long-term, minority interest at market value, preferred equity at market value, unfunded pension liabilities, and cash as listed on the company’s balance sheet.

Simply put, the enterprise value of a business is what someone would pay if they were to buy the business. The person acquiring the business would pay for the value of all the equity, the debt owed by the business, any pensions outstanding, and minority interest if any. The enterprise value can be either positive or negative. Negative enterprise value is when the business has a large amount of cash not reflected in the market value of a stock.

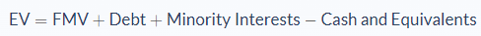

Enterprise Value Formula

For this equation, the market capitalization of a company is calculated by multiplying the price per share of the company by the total number of outstanding shares. The price per share is the amount of money someone is willing to pay to become a part-owner of the company. Market capitalization is needed in the formula because the worth of a company also depends on the amount of capital available for the company. Moreover, if someone were to buy the business, they would need to pay the market value of the company as well.

Total debt refers to all monies borrowed by the company. The debt can be long-term or short-term. Total debt is added to the formula because anyone buying the business will have to settle the creditors. The buyer will spend extra money on settling the loans, which is the same as paying for the company. Also, the more the value of a company, the more its ability to obtain loans from financial institutions.

Cash and other cash-valued items are subtracted from the formula because the buyer will see the cash as surplus money. It is money gained by the buyer for buying the business. If the cash amount is very high, the enterprise value of the business will be negative. This means that a potential buyer will gain money by simply buying the business.

There is also a more advanced enterprise value formula which is usually a better option for investors who want to look at the impact of things like the impact of preferred shares, minority interests, cash equivalents, liquid inventory and other investments.

- FMV = fair market value of common and preferred shares

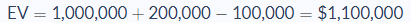

Enterprise Value Example

To demonstrate an example of enterprise value: a social media giant wants to acquire a cyber-security company, SecureSpace. To proceed with the acquisition, the social media giant wants to know the enterprise value of SecureSpace. The data from SecureSpace’s 2019 records show the following:

- Market capitalization: $1,000,000

- Total debt: $200,000

- Cash: $100,000

The enterprise value of SecureSpace is $1.1 million. Put simply, $1.1 million is the total amount of money that the media giant will have to pay to acquire SecureSpace. If they do, they would still need to pay the money owed by the company.

Enterprise Value Analysis

Enterprise value does not depend on the capital structure, which makes it very useful when comparing companies that have different capital structures. Also, unlike return on assets, which cannot be used to compare companies in different industries, because of their different assets requirement, Enterprise value can be used to compare any two companies.

Aside from acquisitions, stock market investors use enterprise value and earnings before interest, tax, depreciation and amortization to compare returns on equivalent companies on a risk-adjusted basis.

Some of the technicalities that involve using enterprise value include the following. First. equity investors may not have access to information about company debt. This is because the vast majority of corporate debt is not publicly traded. Also, a majority of corporate debt is in the form of bank financing and or other debt in which there is no universal market price.

Enterprise Value Conclusion

- Enterprise value is an economic measure of the total market value of a company.

- This calculation shows the amount of money someone would pay if they were to acquire a company.

- Enterprise value is calculated by summing the total market capitalization of the company and its total debt, minus the sum of cash and other cash-valued items.

- This equation can be used to compare the worth of different companies with different capital structures.

Enterprise Value Calculator

You can use the enterprise value calculator below to quickly calculate a company’s total value by entering the required numbers.

Total Debt

Cash

Market Capitalization

Enterprise Value

FAQs

1. What is enterprise value (EV)?

Enterprise value (EV) is the total market value of a company. This calculation shows the amount of money someone would pay if they were to acquire a company.

2. How is enterprise value (EV) calculated?

Enterprise value is calculated by summing the total market capitalization of the company and its total debt, minus the sum of cash and other cash-valued items.

3. What is a good enterprise value (EV)?

There is no definitive answer as to what constitutes a good or bad enterprise value. However, enterprise value can be used to compare the worth of different companies with different capital structures.

4. What is the difference between the enterprise value (EV) and the purchase value?

The primary difference between enterprise value and purchase value is that enterprise value includes all a company’s liabilities, while purchase value only includes the company’s assets. This makes enterprise value a more comprehensive measure of a company’s worth.

5. Why do you add debt to enterprise value (EV)?

When a company has debt, it is because it has liabilities. These liabilities represent the money that the company owes to its creditors. When you add debt to enterprise value, you are including these liabilities in the calculation. This makes enterprise value a more comprehensive measure of a company’s worth.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)