Company Establishment – Vietnam Guide | Doing Business in Vietnam

In this section, we discuss the various options that a business has for market entry into Vietnam and overview the entity types, requirements, and processes, as well as some key considerations that will help ensure a company is set up for success.

WATCH

Mục Lục

All Eyes On Vietnam – Why And How To Enter The Market

There are also tips for what the procedures are if you are seeking a Vietnam presence without first setting up a legal entity, and what the procedures are for closing a business, should the need arise.

Establishing a company typically requires moderate or greater amounts of investment capital than other entry modes and can require several months to complete all steps in the process, before the company becomes operational. This is an expected risk of a fixed investment strategy, and for these reasons, it is important that investors first understand the Vietnam business, financial, consumer, or local cultural landscapes, and the options that might best help realize the goals of the investment.

Choosing a corporate structure

Vietnam permits 100% foreign ownership of a business for most sectors. Yet before choosing which type of company to open in Vietnam, it is important to consider different aspects of the target entity types, such as differences in structure, legal liability, statutory compliance requirements, time required to establish it, what types of activities it can engage in, and more. These considerations help to identify the appropriate business constraints, costs, requirements and risks, necessary to enable the company’s future targeted capabilities, developments, and growth. The below links explain these factors for each of the main entity types that can be set up in Vietnam.

There are several types of foreign-invested corporate vehicles in Vietnam, the 3 more common of these are:

Comparison of Business Structures

RO

Representative Office

BO

Branch Office

LLC

100% Foreign-Owned Enterprise

Separate legal entity

No

No

Yes

Liability

Extension of parent company

Extension of parent company

Laibility limited to capital contribution.

Naming of the Entity

Must be same as parent company

Must be same as parent company

Can be the same or different from parent company

Permitted Activities

Only market research and coordination.

No business activities that yield profit.

Commercial activity within parent company’s scope

Can be the same or different from the parent company

How many Weeks to set up this Entity Type?

6 to 8 weeks

12 weeks

8 to 16 weeks

Is an Annual Tax Return filing required?

See Audit guide

No.

Companies required to declare all employees’ Personal Income Tax (read about PIT).

Yes

Yes

Audit required?

See Audit guide

Yes

Yes

Yes

Summary of Pros

Easy registration procedure

Can remit profits abroad

· Limited liability to capital contribution

· Freely engage in any registered business lines that are not banned by local laws

Summary of Cons

- Cannot conduct revenue generating activities

- Parent company bears liability

- Limited to certain industry sectors

- Parent company bears liability

- Cannot issue shares

- Maximum of 50 shareholders

To read further details about any of these entity types, click on the FIE Structure Type to read from more in our Types of Business in Vietnam guide section.

Company set up process in Vietnam

An LLC, or 100% Foreign-Owned Enterprise, generally requires 3 to 4 months to establish in Vietnam. A Representative office can generally be set up in half that time.

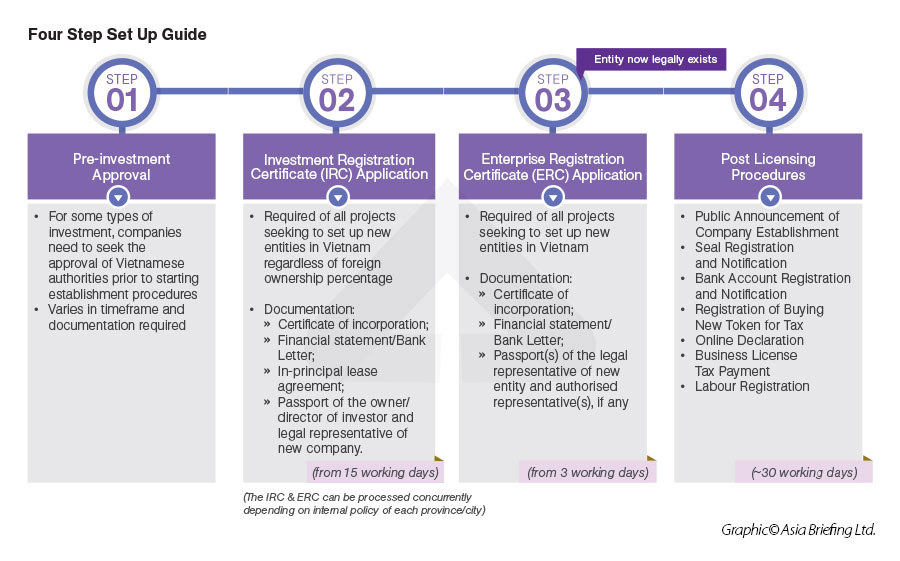

For LLCs, while some sectors may require a ‘Pre-Investment Approval’, most skip to their service provider directly applying for the required Investment Registration Certificate (IRC), which requires 15 working days, unless the sector of intended operation is not governed by the WTO, in which case it may take longer.

With the IRC in hand, an organization may pursue the subsequent steps, including securing a physical business address, applying for an Enterprise Registration Certificate (sometimes referred to as a Business Registration Certificate).

Below is a summary of the 4 main stages of set up.

Requirements for setting up a business

Minimum capital requirements

For most sectors and business lines, Vietnam requires no minimum capital requirements. However, the registered capital will be assessed by The Department of Planning and Investment for whether it is adequate to cover the expenses of the business until it generates enough revenue to cover its costs, usually for the first year or two of operation, based on the calculation of the investors. It is possible to set up a basic business services company with less than USD 10,000 in some cases, but in most cases, it would be at or above this threshold, depending on the nature of the business.

However, it is best to verify whether your business may require minimum capital investment, given that some industry sectors (business lines) do have requirements. Examples include:

- Finance, Banking, Insurance and Fin-tech;

- Language centers or Vocational schools;

- Real estate companies;

Charter capital and total investment capital

The total investment capital of the company can combine both charter capital and loan capital. Loan capital, or mobilized capital, covers shareholders’ loans or third-party finance. Charter capital, or contributed capital, together with loan capital must be registered with the license issuing authority of Vietnam.

Once approved, Investors cannot increase or decrease the charter capital amount without prior approval to make amendments from the local licensing authority.

Capital contribution schedules

Capital contribution schedules are set out in foreign-invested enterprise (FIE) charters (articles of association), joint venture contracts and/or business cooperation contracts, in addition to the FIE’s investment certificate.

Members and owners of a limited liability company (LLC) must contribute charter capital within the capital contribution schedules set out in these documents and within the contribution timeframes established by the Law on Enterprises.

Transferring capital to the FIE

To transfer capital into Vietnam, after setting up the FIE, foreign investors must open a direct investment capital account (DICA) in a legally licensed bank.

Registered address and resident director

Company registered address

A business requires a legal address in Vietnam in order to incorporate a company in the country. Most businesses require that it have its own physical location, such as an office or building leased or acquired.

Company resident director

A company is required to have a Resident Director – and may have one or more. A qualifying resident director requires a residential address in Vietnam. The residency status of the resident director is preferable but should not be a qualifying requirement during the incorporation process; Their residency status may be addressed separately.

Corporate compliance requirements

An established corporation in Vietnam will require ongoing corporate compliance, including:

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)