Citi (C) Closes Sale of Vietnam Consumer Banking Business

Citigroup Inc. C announced the completion of the sale of its Vietnam retail banking and consumer credit card businesses to United Overseas Bank Limited or UOB. The sale also includes the transfer of approximately 575 related staff.

The transaction is anticipated to result in a modest regulatory capital benefit to Citigroup.

The transaction was announced in January 2022 as part of a broader sale agreement covering consumer banking businesses across Malaysia, Thailand, Vietnam and Indonesia, and excluding the bank’s institutional businesses.

At the time of the announcement, the wall street biggie noted that UOB would pay Citigroup cash consideration for the net assets of the acquired businesses, subject to customary closing adjustments, along with a premium of S$915 million (US$690 million). Citigroup had expected the transaction to release $1.2 billion of allocated tangible common equity and increase tangible common equity by more than $200 million.

The Malaysia and Thailand business sales were completed on Nov 1, 2022.

Citigroup Asia Pacific CEO, Peter Babej, noted, “Today’s announcement is positive for our customers, our colleagues and our firm. Citi remains deeply committed to Vietnam, and we will invest further to support institutional clients locally and across our global network. We thank former employees and customers for their commitment and support, and wish them continued success.”

Citigroup Legacy Franchises CEO, Titi Cole, remarked, “The completed sale of our consumer business in Vietnam puts us one step closer to delivering on our divestiture mandate as part of the firm’s strategy refresh. We are confident that our former employees have a bright future at UOB, and we look forward to seeing them thrive.”

Our Take

Since the announcement of the broader strategic actions to exit consumer banking across 14 markets in Asia, Europe, the Middle East and Mexico, Citigroup has signed deals to divest consumer businesses in nine markets and completed sales in six markets, including Australia, Bahrain, Malaysia, the Philippines and Thailand, in addition to Vietnam.

Such exits will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London to stoke growth. These efforts will likely help augment the company’s profitability and efficiency over the long term.

The company is also in the process of winding down its consumer business in China and Korea, while in Russia, it is wrapping up all its business.

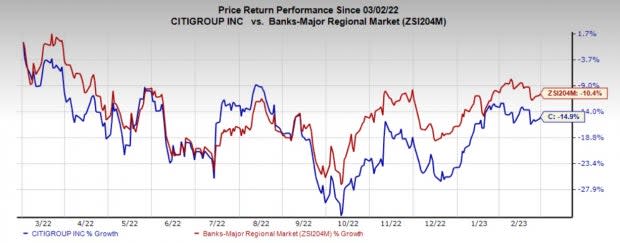

Over the past year, shares of Citigroup have lost 14.9% compared with a decline of 10.4% recorded by the industry.

Zacks Investment Research

Image Source: Zacks Investment Research

Currently, Citigroup carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Expansion Efforts by Other Banks

Amid a challenging operating backdrop due to expectations of economic slowdown, banks are undertaking expansion moves through acquisitions. Recently, Bank of Montreal BMO announced the closure of its acquisition of Bank of the West from BNP Paribas BNPQY.

With this deal, BMO expands its presence across more than 500 additional branches and commercial and wealth offices in major U.S. growth markets. For BNPQY, the sale is part of its efforts to streamline operations and enhance operating efficiency.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Bank Of Montreal (BMO) : Free Stock Analysis Report

BNP Paribas SA (BNPQY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)