Cheapest Metals – From Least to Most Expensive + Indices

Often classic material characteristics such ductility, hardness, fatigue strength, and yield strength aren’t the primary driver of material selection. Sometimes, an engineer or designer simply wants the cheapest metal available. This article discusses the range of metals based on pricing – from most affordable to most expensive, and indices that provide up-to-date pricing information.

Mục Lục

Cheapest Metals Available in the Market

The metal’s pricing depends on its abundance level and the amount paid to get that metal from its core crust. And metals found abundantly in nature are the cheapest metals. This list includes iron, steel, aluminum, zinc, lead, manganese, and magnesium.

Iron

Iron is a chemical element with the atomic number 26 and a Fe symbol. It is the most abundant element on Earth in terms of mass, just ahead of oxygen, and it accounts for a large portion of the planet’s outer and inner core. It is the most abundant element on Earth in terms of mass, just ahead of oxygen, and it accounts for a large portion of the planet’s outer and inner core.

Iron eventually became the cheap metal on Earth. That’s because iron, as found in ores, is our most abundant element by mass. Iron makes up most of Earth’s core, producing Earth’s magnetic field, protecting us from cosmic rays and solar wind.

Carbon Steel

While not naturally occurring, the carbon steel alloy provides a few tenths of a percent of carbon and sometimes other elements to iron. The addition of carbon adds improves strength and fracture resistance over other iron types. Like all metals, the cost of steel and aluminum fluctuates depending on supply, demand, and other economic factors. Despite that caveat, steel is typically a cheaper metal (pound for pound) than its aluminum counterpart.

Aluminum

Aluminum is a chemical element with the symbol Al and atomic number 13. It has a lower density than most other metals, about one-third that of steel. When exposed to air, it has a strong affinity for oxygen and creates a protective oxide coating on the surface.

Aluminum is the most abundant and cheapest metal on the planet. Also, it is the third most abundant metal in the Earth’s crust, but it also forms strong connections with other substances.

Zinc

At room temperature, zinc is a slightly brittle metal with a silvery-greyish look when removing oxidation. It is the first element in the periodic table’s group 12.

Zinc alloys are, on average, cheaper than stainless steel. On the other hand, zinc is a heavy element that improves corrosion resistance, stability, dimensional strength, and impact strength when alloyed with other metals.

Lead

Lead is a chemical element with the symbol Pb and atomic number 82. It is a heavy metal that is denser than most common materials. Lead is soft and malleable and also has a relatively low melting point. When freshly cut, lead is silvery with a hint of blue; it tarnishes to a dull gray color when exposed to air.

Lead is cheap. Because it is widely known to be harmful and is not exceptionally rare, it no longer has many uses. A plentiful supply and limited demand mean that it’s easily accessible for manufacturers and home loaders.

Manganese

Manganese is a complicated, brittle, silvery metal frequently found in minerals with iron. It is a transition metal with a wide range of industrial alloy applications, the most common of which is stainless steel.

This metal is a very inexpensive and abundant material that is already poised to play a more significant role in lithium-ion batteries. This perceived uptick in manganese demand owes a good deal to growing worries about the availability and toxicity of cobalt and nickel.

Stainless Steel

Stainless steel is particularly corrosion resistant due to its chromium concentration. Steel with a minimum chromium concentration of 10.5% is 200 times more corrosion resistant than steel without chromium. Other favorable properties for consumers are its high strength and durability, high and low-temperature resistance, increased formability and easy fabrication, and low maintenance. This long-lasting, attractive metal also is known to be environmentally friendly and recyclable.

Stainless steels are a popular alternative to carbon steel, and while they are on the expensive side of the inexpensive metals spectrum, they are widely utilized due to their strength. The corrosion-resistant properties of stainless steel typically negate the need for secondary coating operations.

Factors That Impact Affordability

Metal prices only appear on exchanges for a few metals. Other metals trade based on market demand, with buyers and sellers determining the price. Abundance and popularity provide the main drivers of a metal’s price.

Aluminum, for example, is a reasonably cheap element based on its abundance. Aluminum deposits abound throughout the world. Amongst elements, only silicon and oxygen occur in more abundance.

On the other hand, Rhodium is the world’s most expensive precious metal. This rare precious metal provides robust and corrosion-resistant properties.It can be found in platinum or nickel ores, along with other platinum group metals. Around 80% of the world’s Rhodium is used in automobiles as one of the catalysts in a three-way catalyst converter. The current price per gram of Rhodium is $260.42 as of 2020, making it the most expensive precious metal on the planet!

Metal Indices with Price

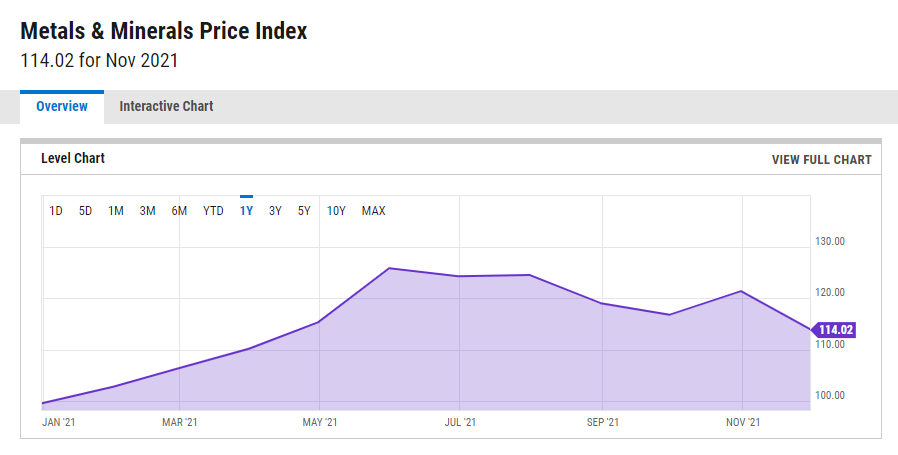

The Metals and Minerals Price Index is a tool for determining metal prices. Aluminum, copper, iron ore, lead, nickel, tin, and zinc prices are weighted in this indexed indicator.

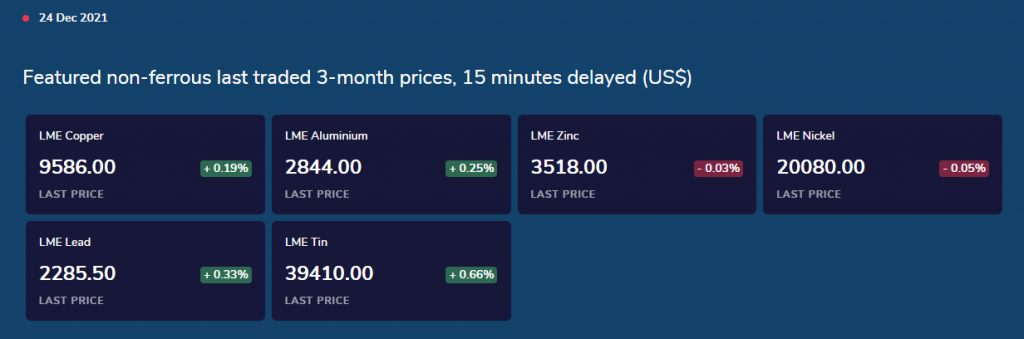

The LME is a futures and forwards exchange with the world’s largest market for standardized base metal forward contracts, futures contracts, and options. There are also contracts for ferrous metals and precious metals on the market.

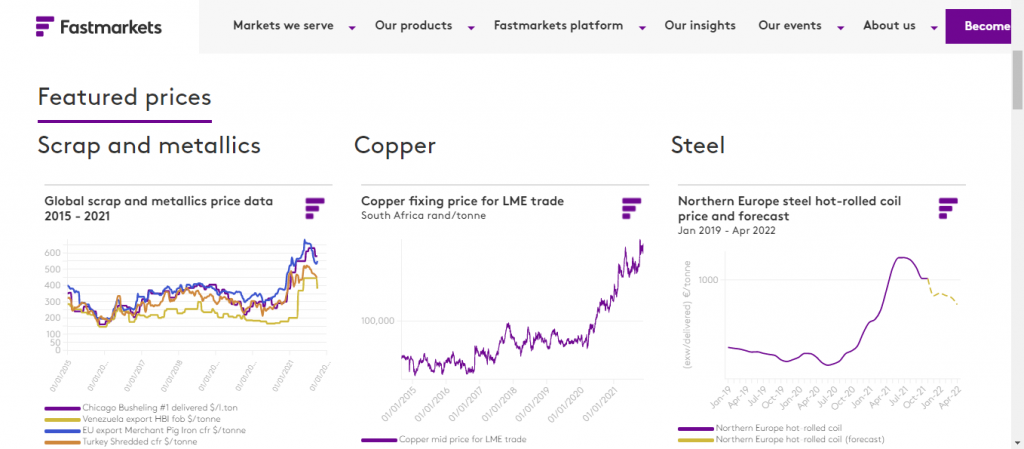

Fastmarkets provides a cross-commodity price reporting agency (PRA) in the agriculture, forest products, metals and mining, and energy transition markets. Their price data, forecasts, and market analyses give their customers a strategic advantage in complex, volatile, often opaque markets.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)