Business Risk

Mục Lục

Business Risk Definition

Business risk is the risk associated with running a business. The risk can be higher or lower from time to time. But it will be there as long as you run a business or want to operate and expand.

Multi-faceted factors can influence business risk. For example, if a firm isn’t able to produce the units to make profits, there is a considerable business risk. Even if the fixed expenses are usually given before, there are costs that a business can’t avoid – e.g., electricity charges, rent, overhead costsOverhead CostsOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc.read more, labor charges, etc.

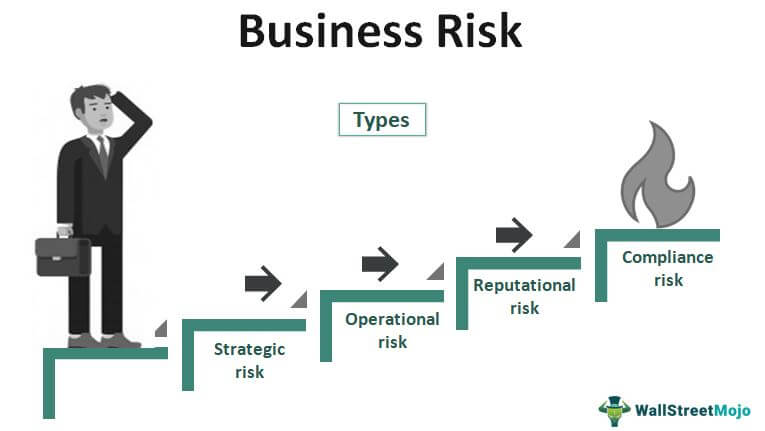

Types of business risk

Since business risk can happen in multi-faceted ways, there are many business risks. Let’s have a look at them one by one –

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Business Risk (wallstreetmojo.com)

#1 – Strategic risk:

It is the first type of business risk. Strategy is a significant part of every business. And if the top management isn’t able to decide the right strategy, there’s always a chance to fall back. For example, when a company introduces a new product to the market, the existing customers of the previous product may not accept it. The top management needs to understand that this is an issue of wrong targeting. The business needs to know which customer segment to aim at before introducing new products. If a new product doesn’t sell well, there’s always a more significant business risk of running out of business.

#2 – Operational risk:

Operational risk is the second necessary type of business risk. But it has nothing to do with external circumstances; instead, it’s all about internal failures. For example, if a business process fails or machinery stops working, the business won’t be able to produce any goods/products. As a result, the business won’t be able to sell the products and make money. While strategic risk is pretty challenging to solve, operational riskOperational RiskOperational risk is the business uncertainty a company comes across in the industry while executing its everyday business operations. Such risks arise due to internal system breakdown, technical issues, external factors, managerial problems, human errors or information gap. read more can be solved by replacing the machinery or providing the right resources to start the business process.

#3 – Reputational risk:

It is also a critical type of business risk. If a company loses its goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company’s net identifiable assets at the time of acquisition. It is determined by subtracting the fair value of the company’s net identifiable assets from the total purchase price.read more in the market, it is a big chance to lose its customer base. For example, if a car company is blamed for launching cars without proper safety features, it would be a reputational risk for the company. The best option, in that case, is to take back all the cars and return each one after installing the safety features. The more accepting the company would be, in this case, the more it would be able to save its reputation.

#4 – Compliance risk:

It is another type of business risk. To run a business, a business needs to follow certain guidelines or legislation. If a business cannot follow such norms or regulations, it is difficult for a business to exist for long. First, it’s best to check the legal and environmental practices before forming a business entity. Otherwise, the business will face unprecedented challenges and unnecessary lawsuits later on.

How do you measure business risk?

Business risk can be measured by using ratios that fit a business’s situation. For example, we can see the contribution marginContribution MarginThe contribution margin is a metric that shows how much a company’s net sales contribute to fixed expenses and net profit after covering the variable expenses. As a result, we deduct the total variable expenses from the net sales when computing the contribution.read more to find out how much sales we need to increase to increase the profit.

You can also use the operating leverageOperating LeverageOperating Leverage is an accounting metric that helps the analyst in analyzing how a company’s operations are related to the company’s revenues. The ratio gives details about how much of a revenue increase will the company have with a specific percentage of sales increase – which puts the predictability of sales into the forefront.read more ratio and degree of operating leverage to help find out the company’s business risk.

But it differs as per the situation, and not all situations will suit similar ratios. For example, if we want to know the strategic risk, we need to look at a new product’s demand vs. supply ratio. If the demand is much lesser than the supply, there’s something wrong with the strategy and vice versa.

How do we reduce business risk?

Recommended Articles

This article has been a guide to what business risk is. Here we discuss the four types of business risk, measurement of business risk, and how to reduce the same. You may also learn more about Corporate Finance from the following recommended articles –

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)