A Small Business Owner’s Guide to Accounting in 2023

Many or all of the products here are from our partners that compensate us. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.

Accounting for your small business can be intimidating. We make it easier for you, breaking it down step-by-step, so you can get started today.

As a business owner, the thought of doing accounting for your business may be more intimidating than the prospect of owning a business. But accounting doesn’t have to be intimidating.

By knowing what you need to do and getting some guidance on how to do those things, you can be performing accounting tasks for your business in no time.

Mục Lục

Overview: What is small business accounting?

While most larger businesses have an accounting staff that takes care of financial transactions, as a small business owner, the job of accountant typically falls to you. For business owners without a bookkeeping or accounting background, the prospect can be overwhelming.

To make it easy to get started, we’ve created a guide with the 10 essential steps necessary for accounting for small business.

How to do accounting for your small business

Though not a recommended method, all you need to start doing accounting for your business is a pencil and paper, and a lot of patience. To start properly, though, accounting software is the way to go.

If you’re still not sure what the difference is between a debit or a credit, and couldn’t tell an asset from a liability, accounting software can make your life a lot easier.

But even if you’re ready to find an accounting software application that’s right for your business, there are a few other things you need to do first.

Step 1: Choose a business structure

First on the list is choosing a business structure. Since everything you do will be affected by your business structure, choose wisely. There are four basic business structures:

- Sole proprietorship: A sole proprietorship is essentially what it sounds like. Popular with consultants and freelancers, a sole proprietorship has a single owner and requires little setup. The downside is that there is no legal differentiation between you and your business, making you liable for anything the business owes.

- Partnership: If you’re going into business with one or more people, ownership of the business can be shared equally through a partnership. Each partner is responsible for contributing to the business, with the details of their responsibilities included in a partnership agreement.

- Limited Liability Company (LLC): An LLC is similar to a sole proprietorship, except you are not responsible for business debt. Another upside to an LLC is that you can be the sole owner or have multiple partners, giving you flexibility when filing business taxes as well.

- Corporation: A corporation is the most complex business structure and is considered a separate entity from its owners for tax purposes. While there are benefits such as added legal protection and lower corporate taxes, corporation structure is complicated and can be expensive.

Step 2: Open a business bank account

Even if you’re a sole proprietor, it’s a good idea to open a business bank account. In fact, the other three business structures require it.

Having a business bank account makes it much easier to file business taxes, it keeps business income separate from your personal funds, and it provides you with a way to pay your vendors.

Step 3: Choose an accounting method

If your accounting experience is limited to reconciling your checking account at the end of the month, you might not understand the difference between the cash accounting method and the accrual accounting method.

- Cash method: The cash method is the simpler of the two methods and requires you to recognize revenue and expenses when money changes hands. Cash accounting is frequently used by freelancers with limited accounting activity.

- Accrual method: The method recommended by CPAs, the accrual method recognizes revenue when earned and expenses when they occur. This method provides you with a more accurate picture of your business health, but it’s more complicated than the cash method.

Choose wisely, as once you choose an accounting method, you’ll need authorization from the IRS to change it.

Step 4: Find the right accounting software

Yes, you can keep track of your accounting transactions using spreadsheets or manual ledgers, but why should you when there are so many good, affordable, and sometimes free accounting programs on the market?

A good place to start is by reading The Ascent’s accounting tools reviews to get an idea of what’s available. Be sure to download some demos and try out an application for yourself before you buy it.

Step 5: Set up your chart of accounts

Before you can start recording any financial transactions, you’ll need to create a chart of accounts for your company. The chart of accounts is a list of accounts in your general ledger that will be used to record financial transactions.

But before you start, be sure to familiarize yourself with the five account types that will be used in your chart of accounts:

- Assets: Anything of value that your business owns is considered an asset. Assets include the money in your bank account, your accounts receivable balance (what your customers owe you), your inventory, computers, and furniture.

- Liabilities: Liabilities are anything your business owes. Liabilities include your accounts payable balance (what you owe vendors) as well as any loans or notes the business owes.

- Revenue / Income: Revenue is the money your business earns from goods solds or services rendered.

- Expenses: This is one category you’re probably familiar with; expenses are considered the cost of doing business. Common business expenses include employee wages, the rent on your storefront, and your electric bill.

- Equity: After subtracting your business liabilities from your business assets, you’re left with equity, which represents the financial interest you hold in your business.

Accounting software applications always include a default chart of accounts that you can use immediately.

Step 6: Familiarize yourself with accounting basics

Now that you know the five main account types, you should begin to familiarize yourself with some other accounting basics. If you’re using accrual, or double-entry accounting, you will need to understand the accounting equation and debits and credits, which are the backbone of any accounting system.

The accounting equation is:

Asset = Liabilities + Owners’ Equity

In order to follow the accounting equation, all entries made into your general ledger need to have a debit entry and a corresponding credit entry.

- A debit entry will increase an asset account or an expense account. Debits are always recorded on the left side of an entry.

- A credit entry increases liabilities, revenue, or equity accounts. Credits are always recorded on the right side of an entry.

Let’s say you receive a payment on an invoice in the amount of $200. This is what the journal entry looks like when using double-entry accounting:

Date

Account

Debit

Credit

6-1-2020

Cash

$200

6-1-2020

Accounts Receivable

$200

Both the cash account and the accounts receivable account are assets. Because we’re increasing the bank balance, we enter the $200 as a debit to the Cash account, while we credit the accounts receivable account for $200 because the balance will decrease.

Remember, any time you record a journal entry, there always needs to be a debit and a credit entry.

Another thing you’ll want to familiarize yourself with is the accounting cycle. The accounting cycle includes nine steps that all bookkeepers or accountants should adhere to in order to ensure that all processes are completed:

If you’re using accounting software, the accounting cycle is automated, reducing the number of steps drastically.

Step 7: Set up payroll

You can skip this step if you’re not planning on hiring any employees. However, even if you’re only hiring an occasional contractor, you should have your payroll system set up.

There are numerous payroll software choices on the market designed specifically for small businesses. These applications can help you through the entire payroll process. However, there are a few things you’ll need to complete before you can get payroll up and running:

- Obtain an EIN (Employer Identification Number) from the IRS.

- Obtain state and local ID numbers from the appropriate agencies.

- Decide whether to hire employees or use contractors instead.

Once you have this information in place, find a good payroll service provider, and get ready to hire your first employee.

Step 8: Learn how to manage income and expenses

The majority of your financial transactions will have to do with income and expenses. Knowing how to handle these two items will ensure that your business runs smoothly.

- Learn how to invoice. The most important thing for small business owners is learning how to write an invoice. The second most important thing is providing your customers with an easy way to pay the invoice. In many cases, you can include a link to online payment options right on your invoice, making it easy for your customers to pay you.

- Pay your vendors on time. Good credit is important for small businesses, so you’ll want to be sure to pay your bills on time.

- Record all of your expenses. In order to pay accurate taxes at the end of the year, you’ll want to be sure to record all of your business expenses properly. While the IRS doesn’t care if you skip expenses, your tax bill will be lower if you include all business-related expenses.

- Be sure to enter all financial transactions regularly. Whether you’re using accounting software or a manual accounting system, be sure your transactions are properly entered, or your financial statements (see step 10) will be inaccurate.

Step 9: Reconcile bank accounts

With electronic banking making it much easier to manage your bank accounts, you may be tempted to skip this step. Please don’t. Reconciling your bank accounts each month is important and should be done regularly.

Not only does completing a bank reconciliation help you identify items that need to be entered into your general ledger, it also pinpoints any bank errors. Yes, banks make mistakes, too, and they can be costly for you if they’re not caught. They won’t be caught if you don’t reconcile your accounts.

Step 10: Run financial statements

When all of your transactions have been entered, you’re ready to run your financial statements. Start with an unadjusted trial balance, which can help locate any out-of-balance accounts. This also gives you the opportunity to enter any adjusting entries.

Once this is completed, run financial statements for the month, and take a bit of time to look over those statements to see how your business is performing. The three financial statements you should run at the end of the month are:

The best accounting software for small business

With the help of good software, accounting for a small business can be much easier than you think. No matter your situation, here are some good choices to get you started.

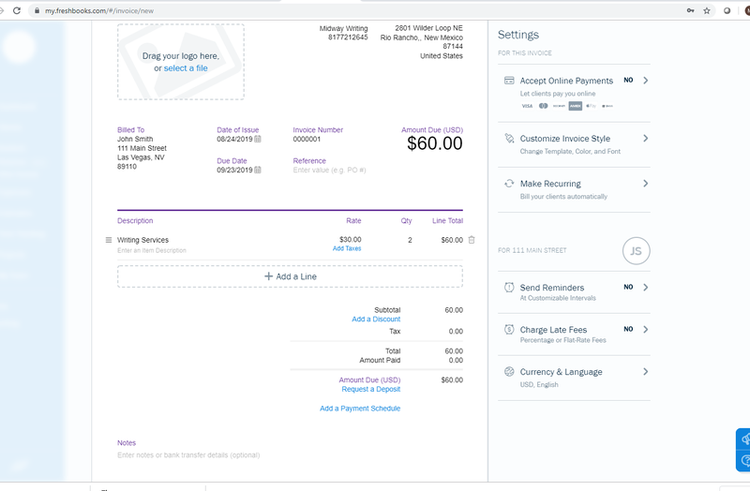

1. FreshBooks

If you’re self-employed, check out FreshBooks. A user-friendly option for small business accounting, FreshBooks makes it easy to track income and expenses and includes a self-employed version just for you.

FreshBooks pricing starts at $15/month for the Lite version, which is perfect for freelancers and contractors, with the option to move up to the popular Plus plan at $25/month at any time.

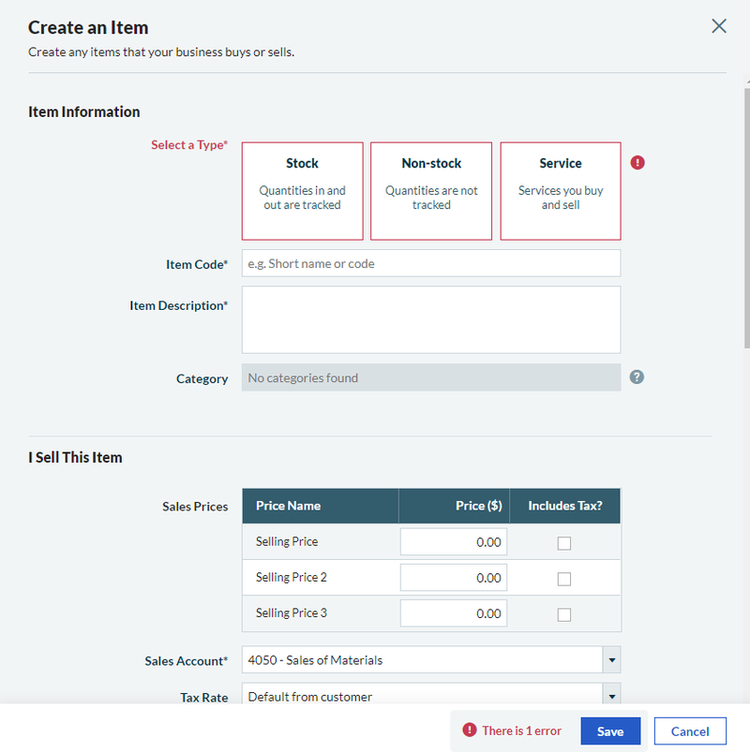

2. Sage Business Cloud Accounting

If you’re not entirely comfortable using a software application, Sage Business Cloud Accounting is designed for you. A good fit for sole proprietors, Sage Business Cloud Accounting makes it easy to track inventory sales and services.

Sage Business Cloud Accounting starts at $10/ month, but for complete accounting functionality, you’ll want to choose the full-service plan at $25/month.

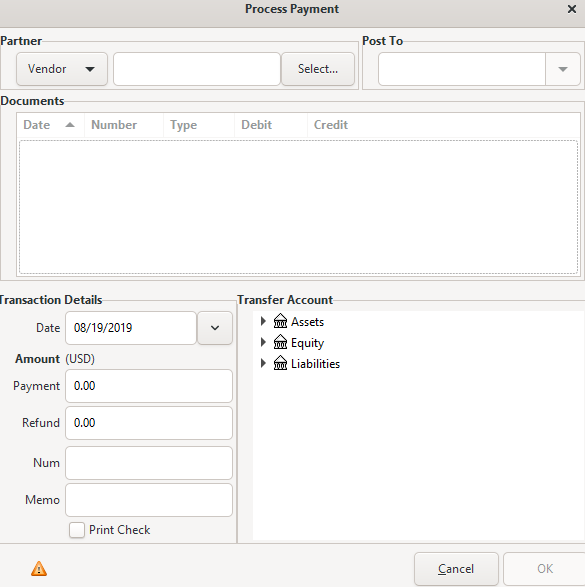

3. GnuCash

If you’re a traditionalist and are more interested in tracking income and expenses than bank connectivity or cloud access, check out GnuCash. Easy to set up, GnuCash is also free accounting software.

GnuCash is a single-user system, so you won’t be able to network the product to accommodate additional users. But if you plan on being the only user, you can download this small business accounting application anytime at no cost.

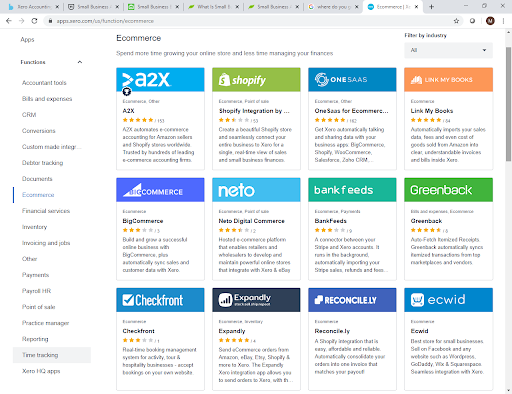

4. Xero

If you absolutely want to be connected with hundreds of apps that offer hundreds of tasks, Xero may be right for you. A great fit for e-commerce startups and small businesses, Xero has added a ton of features in recent years, and it offers excellent integration across the board.

Xero starts at $9/month for the Early plan, though most small businesses will find the Growing plan, at $30/month, more suitable.

Small business accounting doesn’t have to be difficult

With a little bit of preparation, even novices will be able to take on bookkeeping or accounting tasks for their business. Whether you choose the manual method or opt for accounting software, there are tons of accounting tools available for you to take advantage of.

Remember, the easier you make the accounting process, the more time you can spend on your business. So take a deep breath, study the basics, and get started today.

Alert: highest cash back card we’ve seen now has 0% intro APR until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes.

Read our free review

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)