6G wireless: What it is and when it’s coming

Though U.S. players in the wireless industry have started thinking about 6G, analysts say

the next-generation technology is at least a decade away.

Source: zf L/Moment via Getty Images

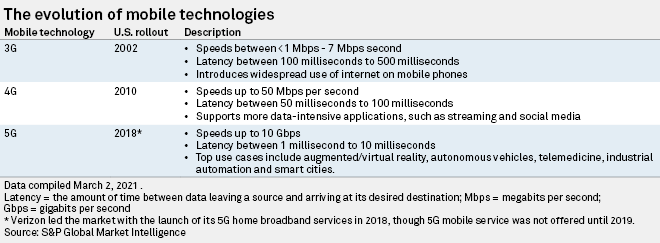

Although it is still early days for 5G wireless technology, top industry players are already busy working on its successor.

Apple Inc. recently posted job ads seeking wireless research systems engineers for its sixth-generation, or 6G, cellular technology, just months after the company debuted its first slate of 5G-capable iPhones. Other industry leaders like AT&T Inc., Facebook Inc. and QUALCOMM Inc. are teaming up to craft 6G industry standards, from research and development to deployment. While 5G promises download speeds many times faster than current 4G LTE networks and significantly lower latency times, 6G is set to raise the bar even higher, with speeds estimated at 100x faster than 5G and upped bandwidth to keep consumers more connected than ever before.

But analysts say 6G is at least a decade out, noting it will take time to develop the necessary infrastructure to support the new technology while also ironing out kinks in existing 5G networks.

Getting a jump on 6G

“We’ve got a long way to go,” said John Byrne, a telecom analyst at research firm GlobalData, in an interview. “From a standards perspective, it’s going to be 2030 or almost 2030 before actual products being built on what we would call a 6G standard … are here.”

In October 2020, the Alliance for Telecommunications Industry Solutions, a Washington, D.C.-based standards group that develops technical and operational standards for mobile technologies, formed a Next G Alliance, which includes companies like AT&T, Facebook, Qualcomm, T-Mobile US Inc. and Samsung Electronics Co. Ltd. The alliance is aimed at advancing U.S. leadership in the rollout of 6G. Specifically, the group is focused on aligning the U.S. tech industry throughout the entire lifecycle of 6G deployment, from R&D and manufacturing to standardization and market readiness.

“As countries around the globe progress ambitious 6G research and development initiatives, it is critical that North American industry steps forward to develop a collaborative roadmap to advance its position as a global leader over the next decade,” ATIS President and CEO Susan Miller said in a recent statement.

Notably, China formed a working group and expert team to begin research into 6G technology in 2019.

6G applications

According to GlobalData’s Byrne, 6G, when fully implemented, will usher in things like holographic technology, which utilizes diffraction to add depth and dimension to everyday objects, as well as smart city applications and technological advancements in the areas of environmental monitoring and crop management. 6G is also expected to place a greater emphasis on wearable technologies in order to amplify people’s day-to-day routines.

“There’s going to be plenty of applications where that stuff is going to be delivered to you in a more immersive way — that kind of is an augment to and not a replacement for your smartphone, which will still be around,” Byrne said.

Still waiting on 5G

A major selling point for 5G has been its ability to enable a new era of the internet of things — a network of interconnected electronics, vehicles and home appliances that interact and exchange data. However, many of these applications have been seen as at least a few years away, as they rely on 5G specifications that have yet to be finalized.

Another sticking point for 5G has been the speed vs. distance conundrum of high-frequency or millimeter-wave spectrum, which can carry massive amounts of data at high speeds but has trouble traveling long distances and penetrating certain surfaces due to its shorter wavelengths.

Verizon Communications Inc., which technically led the U.S. rollout of 5G in 2018 with its launch of 5G home internet service, has seen the reach of its mobile 5G rollout hampered by its heavy reliance on millimeter wave spectrum. That is in part why the telco giant spent so heavily in the Federal Communications Commission’s C-band spectrum auction, covering mid-band spectrum considered crucial for 5G. Specifically, the FCC auctioned 280 MHz of spectrum in the 3.7 GHz-3.98 GHz band, a portion of the C-band.

Mid-band spectrum has been seen as important for 5G networks because high-band spectrum cannot travel long distances or penetrate certain surfaces and low-band spectrum has become crowded due to 4G wireless services.

Verizon’s Cellco Partnership shelled out $45.45 billion to win 3,511 licenses in the auction, which will eventually boost the company’s 5G reach. But the majority of the spectrum will not be cleared and available for 5G use in 2021.

The long, long wait for 6G

6G, meanwhile, doubles down on high-band spectrum, operating in the terahertz frequency range, a block of ultra-high radio frequencies aimed at accommodating more energy-intensive applications.

In 2019, the FCC sought to encourage experimentation with this spectrum by creating a new category of experimental licenses for use of frequencies between 95 GHz and 3 THz. At the time, Jessica Rosenworcel, currently the acting FCC chair, called it “the far frontier of spectrum policy.” But she also noted the hurdles ahead.

“The propagation challenges with spectrum above 95 GHz are real. At the upper bounds, signals over these airwaves may not travel much further than from one end of this dais to the other before losing their strength,” she said.

Looking ahead, Rich Karpinski, an analyst at 451 Research who analyzes mobile operators’ strategies, expects 6G to be used in more enterprise settings versus in consumer applications initially. He added that even though the industry is already setting standards and determining use cases for 6G, much of how the technology is ultimately received will depend greatly on marketplace dynamics 10 years from now.

“We’re a decade out. A decade’s a long time,” Karpinski said.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)