6 Steps to Create a Small Business Budget (+Templates)

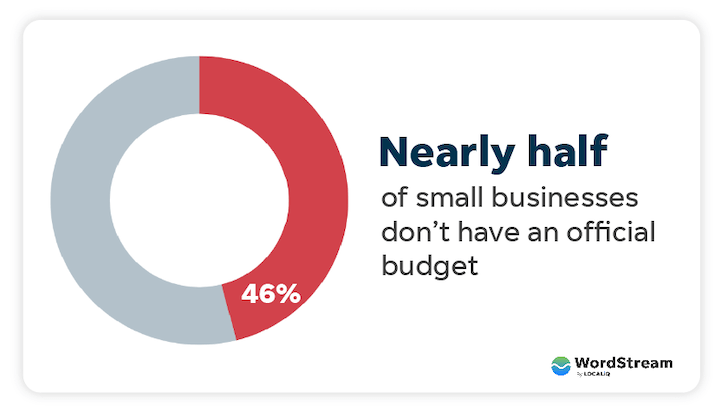

If you want to be successful in business, then you need to know where every dollar goes. It’s not enough to have a rough idea—it needs to be on paper. That’s where a business budget comes in. But according to a study by Clutch, 46% of small businesses don’t have a declared budget. That’s almost half 😮.

Budgeting can be intimidating, but don’t worry—you don’t need a financial or accounting background to create a small business budget. In this post, I’m going to cover all of the budgeting basics you need to know, show you how to create a small business budget, and then provide templates so you’re not starting from scratch.

Mục Lục

Table of contents

Why you need a small business budget

In a nutshell, budgeting forces you to focus on your business objectives and serves as a compass to know if you’re headed in the right direction. Plus, every business goes through financial fluctuations over time. Budgeting helps you navigate these, from late payments to getting the rug pulled out from under you. Here are the key benefits of having a small business budget:

- Financial health check. It lets you know if you have enough funds for generating revenue, operating expenses, and expansion.

- Achieve long-term goals. Know whether you need to cut expenses or increase revenue to achieve your strategic, operational, and financial goals.

- Grow your business. Investors or lenders will first look at your income and expenses before investing in you.

- Maintain financial security. It helps keep the doors open in case of a recession, off month, a downturn, slow payments, and delayed checks.

- Capitalize on opportunities. With a budget in place, you won’t miss out on any valuable opportunities for profitability.

Knowing how much money is coming in and going out allows you to give every penny a “job” and use every dollar to your business’s greatest benefit.

How to create a small business budget in 6 steps

Now that you understand how important a budget is, here’s how you can create one so you can ensure smooth business operation and facilitate efficient cash flow:

1. Separate your business finances from your personal finances

This is one of the cardinal rules to succeed in business. It’s tempting for small business owners to mix business and personal finances, but it almost always leads to disaster. Disaster in three forms:

- Stagnation: Without an accurate view of your financial position—that is, how the business is performing with regard to its objective, you’re not likely to progress.

- Taxation: It helps you manage things like business expenses for taxation purposes

- Litigation: Mixing budgets blurs the legal line between you (the business owner) and your business. It protects you from liabilities and your personal assets in case of litigation

But how do you do that? Here are a couple of steps you can take when creating your budget.

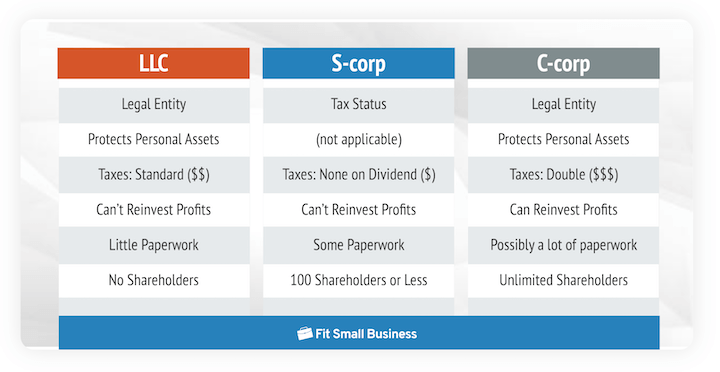

- Incorporate your business as an S Corp, C Corp, or LLC. Then, after LLC formation, you can get your federal tax ID number and register for taxes. (More tips on how to name a business here.)

Image source

- Apply for a business checking account and credit card.

- Use separate accounting systems for personal budgets and business finance

Separating the two helps you treat your small business like an independent entity. Aside from tax advantages, you set your business up for higher profit margins. Note also that minority-owned businesses can register as a minority business enterprise to receive additional support.

2. Set aside a contingency fund for emergencies

Murphy’s law states, “Anything that can go wrong will go wrong.” That’s why you should set aside a contingency fund for your business.

If this isn’t the first business you’ve started, you know you’ll always get surprise expenses when you least expect it. For example, let’s say you operate a printing business. Then right after getting a life-changing contract, your main printer breaks down before you even start. That’s when a contingency fund saves the day.

A contingency fund for emergencies will safeguard your business when these unexpected costs arise. So while it’s tempting to spend that extra income to buy that new MacBook you don’t need, don’t do it. For now, set aside some of that money. A good rule of thumb is to set aside three to six months of your small business operating expenses.

It will prepare you and your business in case one of your pieces of equipment breaks down, or you need to replace it. Of course, you could always take out a loan, but it wouldn’t hurt to have more options.

3. Identify your revenue streams

Grant Cardone likes to say “Cash flow is king.” Where does your money come from? How much and how often does it come in? For small business budgeting to work, you must have the answers to these questions.

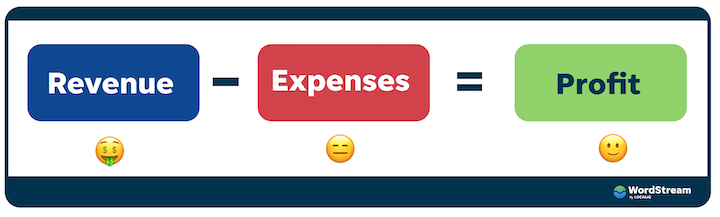

That means tallying all your revenue (not profit) sources every month. In case you don’t know the difference between revenue and profit, revenue is all the money your business generates before expenses. After subtracting expenses, then you’re left with a profit.

Sum up your revenue for the year and divide it by 12 to find your monthly income or revenue. Using this information, you can look at how your revenue changes over time. This will help you find and manage seasonal patterns and downturns.

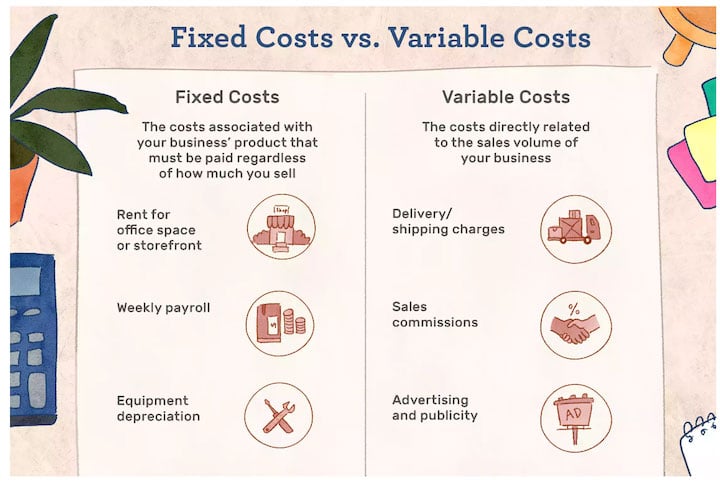

4. Determine your fixed costs

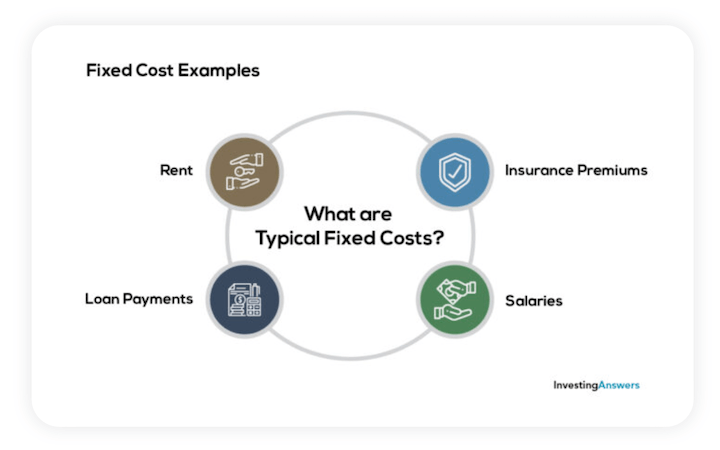

The next step in creating a small business budget is to include all your fixed costs. Fixed costs are recurring costs that are vital for your business operations. These operating costs either come up every day, week, month, or year. That includes everything from rent, debts, utilities, and payroll costs to taxes and insurance.

Image source

That said, no two businesses are the same. So take some time to identify any other fixed costs necessary to run your business. Once you’ve identified them, sum them up to get a precise figure of your fixed costs on a month-to-month basis. If your business is new, then you can project these values.

But ensure you factor in these monthly expenses as part of your business budget. That way, you can set aside money to cover them. Once you’ve done that, the next step is subtracting them from your revenue.

5. Determine your variable costs

As you went through your fixed costs, you probably noticed other inconsistent expenses in your business. These inconsistent costs are known as variable costs or expenses because they change depending on how you use them. They include utilities, advertising costs, professional development , supplies, your salary, etc.

Image source

For example, you might increase production costs to get more raw materials to match the increasing popularity of certain products. Or if you are running a SaaS business, you might need to invest more budget in certain seasons to get more clients.

Discretionary expenses

Discretionary expenses are also considered variable expenses because while they are nice to have, they’re not essential for your business. These include things like education, consulting, etc., which might help increase profitability.

You want to lower your variable costs in lean months, starting with discretionary expenses. And when your profits are on the uptrend, you can allocate more money to variable expenses to help you grow faster.

Tally all your variable expenses at the end of each month. This paints a clear picture of how they fluctuate depending on business performance so you can make accurate predictions.

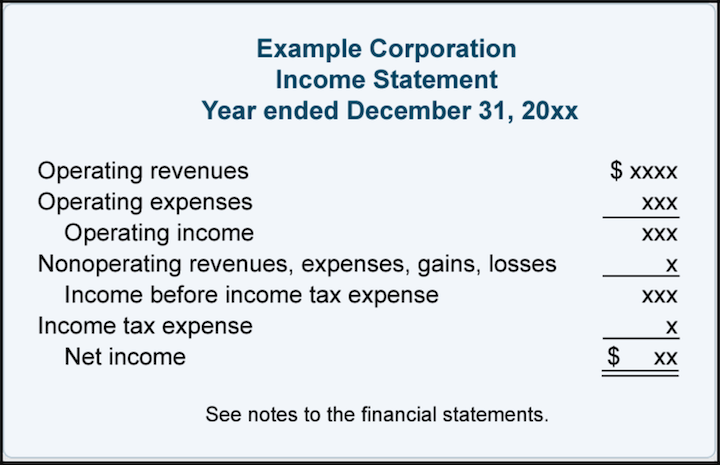

6. Create a profit and loss statement

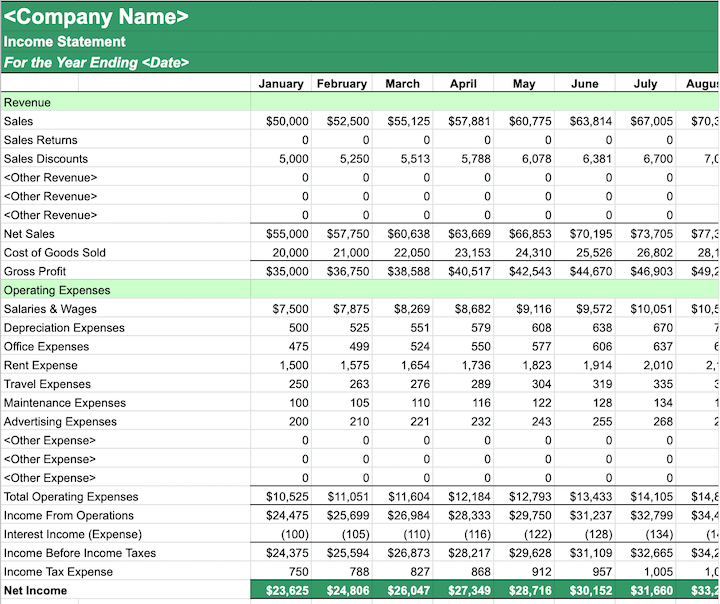

After gathering all the data above, it’s time to assemble all the pieces of the jigsaw puzzle to make sense of it all. That means creating a profit and loss (P&L) or income statement, like the one shown below.

Image source

You’ve probably heard of a P&L statement, and it’s probably giving you a headache just thinking about it. But it doesn’t have to be that way. That’s because you’ve already done the heavy lifting by collecting all the data points. All that’s left is to sum up your revenue streams and subtract the total of all your expenses for the month.

Hopefully, you’ll get a positive figure in the end—in which case, congratulations because you’re making a profit. If you get a negative figure, don’t worry about it. Why? You now know where your money is going and can make the necessary adjustments to turn a profit.

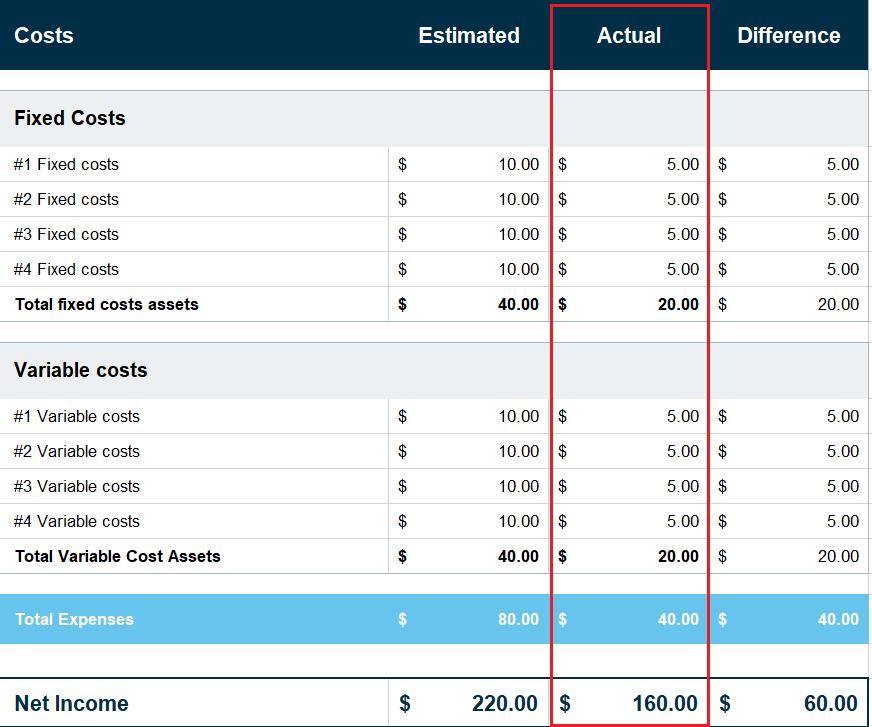

Small business budget templates

Whether you’re looking to optimize a small marketing budget or get a firm grasp on all of your expenses, there’s something in this list of small business marketing budget templates for everyone.

Capterra

Capterra’s small business budget template is easy to use and employs all of the components we defined above, like fixed costs, variable costs, revenue, and profit. You can use it in Excel or Google Sheets.

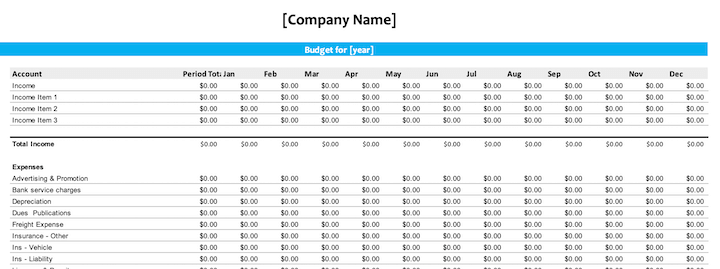

Template Lab

Template Lab’s small business budget template section gives you a few different templates to work with, in word document and spreadsheet format. These templates are useful for itemizing your expenses.

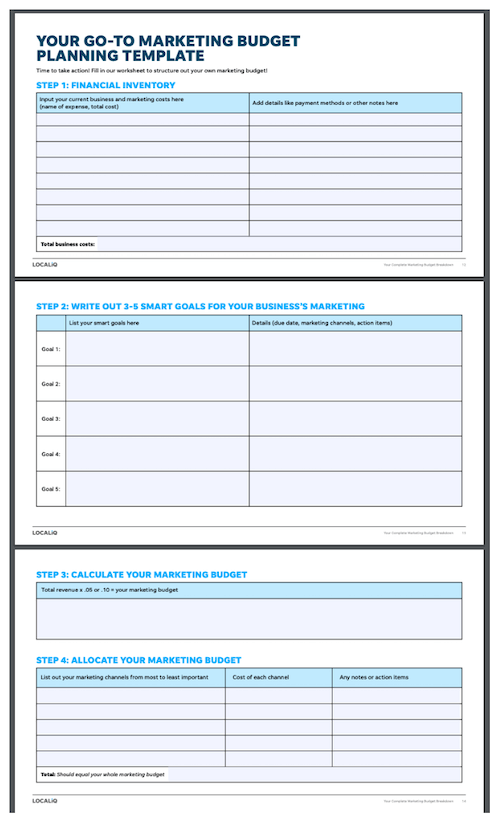

LocaliQ’s marketing budget template

LocaliQ’s Complete Guide to Marketing Budgets not only provides you with a marketing budget template, but also walks you through the marketing budget basics.

Practical Spreadsheets’ Income statement template

To generate an income statement, you can use this income statement Google Sheet template to input your revenue and expenses.

Create your small business budget today

Whether it’s your first or second business, mastering small business budgeting basics is the key to success. Follow these steps to create a small business budget:

- Create separate business and personal accounts.

- Set aside money for an emergency fund.

- Identify your revenue streams.

- Determine your fixed costs.

- Determine your variable costs.

- Create a profit/loss income statement.

With a small business budget, you’ll have insight into how your business is performing, which will then help you make the right financial decisions to thrive. Good luck!

About the author

Jon Morgan is the founder of two successful e-commerce and SaaS businesses. He’s passionate about sharing what he has learned from working with business owners through Venture Smarter.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)