2023-2024 CSS Profile Dos, Don’ts, and Updates – College Aid Pro – B2C

The 2023-2024 CSS Profile is available on October 1, 2022. Before you dive headfirst into filling out this beast, let’s break it down with some basic information and tips to make your life easier.

What is the

CSS Profile

?

The College Scholarship Service financial aid application is required at over 200 colleges and universities that follow the Consensus methodology. So for these schools, if you want to be considered for need-based aid, and in some cases, merit-based scholarships, you have to complete both the CSS profile AND the FAFSA. The CSS profile determines institutional aid from the school, not federal aid (that’s what the FAFSA does).

The CSS profile digs deeper into a family’s financial situation than the FAFSA does, with 17 sections and hundreds of questions, including asking about home equity. Consider it like the FAFSA on steroids. It’s going to require more information and take more time to complete, so be sure to carve out more time to sit and complete it.

Learn how home equity affects the CSS Profile: How Home Equity Affects The CSS Profile

Where

is the CSS Profile required

?

Now you’re probably wondering where is the CSS profile required. The College Board (who is in charge of the CSS profile) has a complete listing of all colleges, universities, and scholarship programs that use it. You can find the list of CSS profile schools here.

When is the

CSS Profile deadline

?

Unlike the FAFSA, the CSS profile deadline varies from school to school. Generally, it’s January 1 – March 31 your child’s senior year or the year they plan to attend college in the Fall. Please check the school website or contact the institution’s financial aid office for more information and specific due dates.

How much does the

CSS Profile cost

?

The CSS profile can cost some families money. There are a few ways the CSS profile doesn’t cost anything:

-

Families with an adjusted gross income up to $100,000

-

Students who qualify for an SAT fee waiver

-

Children who are an orphan or ward of the court under the age of 24

If your family or student doesn’t fall under any of these categories, then the price is $25 for the first application and $16 for each additional one. You will fill out the FAFSA and CSS profile every year your student attends college, so keep in mind this cost as you budget for the year ahead.

What’s different from last year?

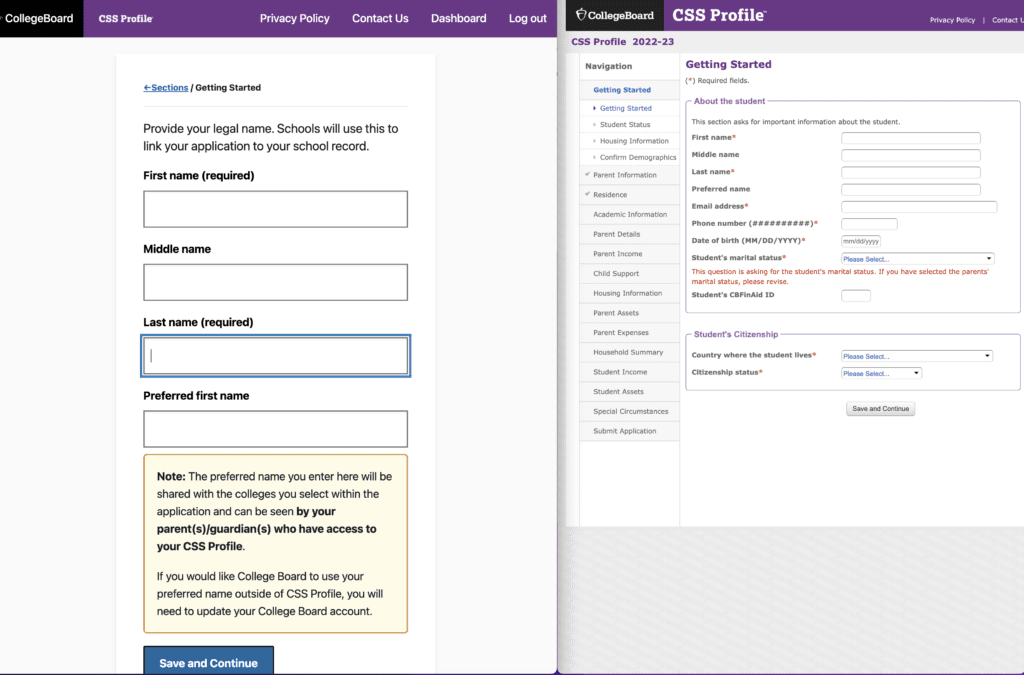

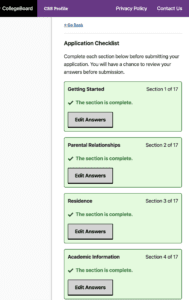

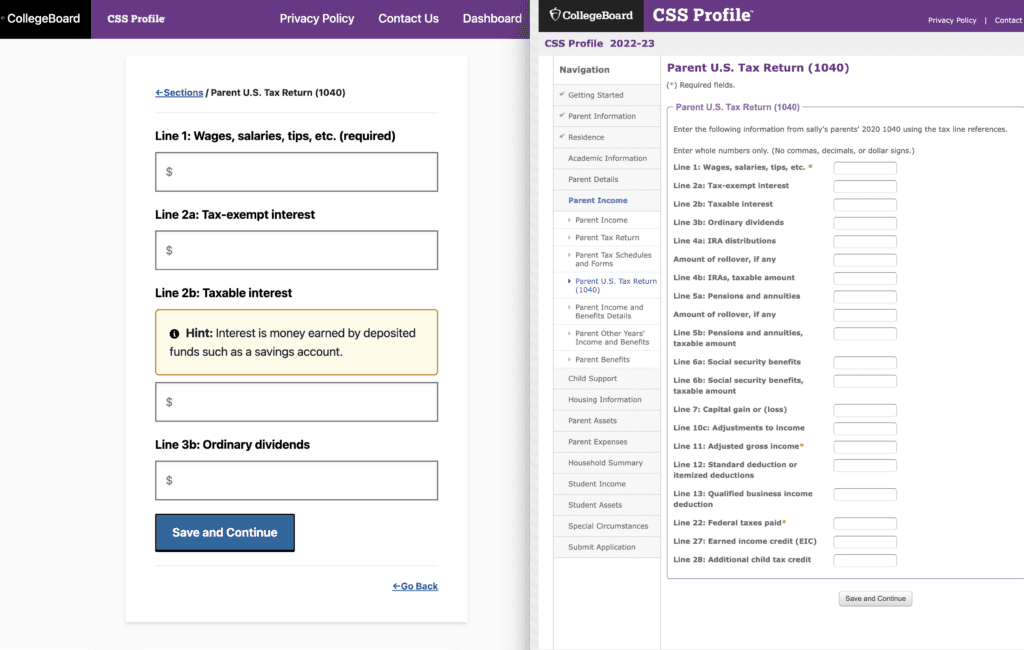

If you’ve had the pleasure of filling out the CSS profile before, you may notice this year’s version looks a little different. The questions are basically all the same, but the layout and feel as you progress through the profile is not.

Fewer Questions per Page

Instead of 10-15 questions per page, you will now only see 2-4 questions. The font is much bigger and the text color is darker as well.

No Navigation Bar

In addition, there is no navigation bar on the left side of your screen showing the different sections and your progress through the application. Now, you must click on the Sections hyperlink in the upper left-hand corner of your screen to see the individual sections and your progress.

Less questions per page, more clicks on Save and Continue, and no navigation bar to track your progress to the finish line makes it feel longer.

Learn more about applying for financial aid: Applying for Financial Aid: FAFSA and CSS Profile

Do I have to answer every question on the

CSS Profile

?

You are not required to answer every question on the CSS profile. Only answer what is required and what will benefit your personal situation.

This year, if a question must be answered, you will see the word required in parentheses after the question. You might notice this is different than years past when there was a red asterisk at the end of the question for ones that were required. There’s an example of that below

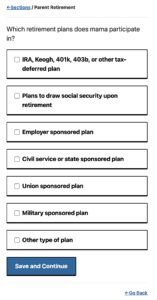

We strongly encourage you to NOT answer questions about retirement or social security because you will have to disclose your retirement account balances. Retirement assets are NOT included in the institutional need calculation, so there is no need to share it.

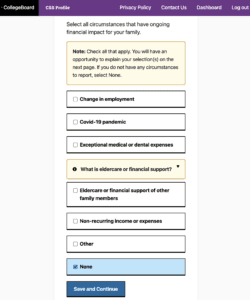

We also recommend that you select the “None” option in the Special Circumstances section, even if other options apply. Keep this information as a bargaining tool for later on in the financial aid appeals process. Always be honest, but less is more when filling out the CSS Profile. There is no need to overshare information if it isn’t required. You will more than likely have an actual conversation with the school’s financial aid department later down the line and can provide more information to help your case if needed.

Learn more about financial aid appeals: How to Navigate Financial Aid Appeals with Your College-Bound Student

What other things do we recommend when filling out the CSS profile? Check out the full financial aid survival guide: 7 Critical FAFSA & CSS Profile Mistakes to Avoid

What if I’m Divorced or Separated?

If you are a two-household family, most colleges require BOTH households to fill out the CSS profile. You will complete two separate applications. If you can’t get information from one parent, reach out to the school requiring the CSS profile and communicate that directly with the financial aid department. They will walk you through the process of requesting a noncustodial parent waiver.

Learn more about what divorced/separated families should know about the financial aid applications: What Divorced, Separated and Two Household Families Need To Know About the FAFSA and CSS Profile

The CSS profile is a necessary evil when applying for financial aid from certain schools. Be sure to set aside some time and patience to knock it out. Most importantly, we are here to help.

Have more questions about the

CSS Profile

? We have answers!

Still stuck on how to make college affordable or what to do when filling out the CSS profile? Join our FREE bi-weekly Office Hours. This live Q&A format is hosted by one of our CAP Experts and is designed to answer any college planning questions you have. Register here today: Sign Up For Office Hours

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)