2023 Blue Chip Dividend Stocks List | See All 356 | Yields Up To 10.5%

Updated on January 10th, 2023 by Bob Ciura

Spreadsheet data updated daily

In poker, the blue chips have the highest value. We don’t like the idea of using poker analogies for investing. Investing should be far removed from gambling. With that said, the term “blue-chip stocks” has stuck for a select group of stocks….

So, what are blue-chip stocks?

Blue-chip stocks are established, safe, dividend payers. They are often market leaders and tend to have a long history of paying rising dividends. Blue-chip stocks tend to remain profitable even during recessions.

You may be wondering “how do I find blue-chip stocks?”

You can find blue-chip dividend stocks using the lists and spreadsheet below.

At Sure Dividend, we qualify blue-chip stocks as companies that are members of 1 or more of the following 3 lists:

- Dividend Achievers (10+ years of rising dividends)

- Dividend Aristocrats (25+ years of rising dividends)

- Dividend Kings (50+ years of rising dividends)

You can download the complete list of all 350+ blue-chip stocks (plus important financial metrics such as dividend yield, P/E ratios, and payout ratios) by clicking below:

In addition to the Excel spreadsheet above, this article covers our top 7 best blue-chip stock buys today as ranked using expected total returns from the Sure Analysis Research Database.

Our top 7 best blue-chip stock list excludes MLPs and REITs. The table of contents below allows for easy navigation.

Mục Lục

Table of Contents

The spreadsheet above gives the full list of blue chips. They are a good place to get ideas for your next high-quality dividend growth stock investments…

Our top 7 favorite blue-chip stocks are analyzed in detail below.

The 7 Best Blue-Chip Buys Today

The 7 best blue-chip stocks as ranked by 5-year expected annual returns from the Sure Analysis Research Database (excluding REITs and MLPs) are analyzed in detail below.

In this section, stocks were further screened for a satisfactory Dividend Risk score of ‘C’ or better.

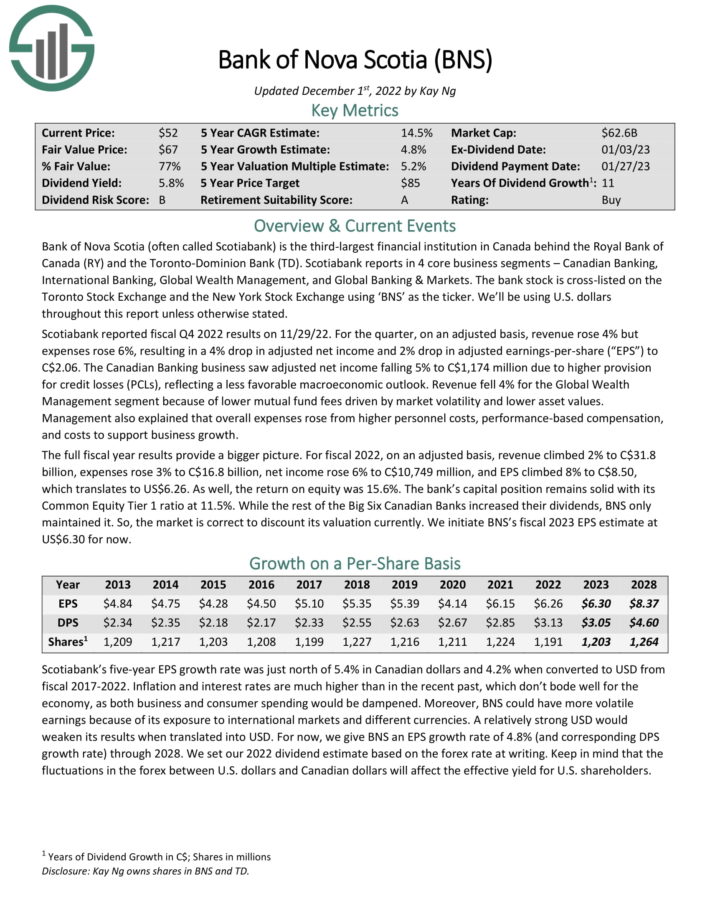

Blue-Chip Stock #7: Bank of Nova Scotia (BNS)

- Dividend History: 11 years of consecutive increases

- Dividend Yield: 6.1%

- Expected Total Return: 15.9%

Bank of Nova Scotia is one of the “Big 4” Canadian bank stocks. It is the third-largest financial institution in Canada behind the Royal Bank of Canada (RY) and the Toronto-Dominion Bank (TD). Scotiabank operates four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Scotiabank reported fiscal Q4 2022 results on 11/29/22. For the quarter, on an adjusted basis, revenue rose 4% but expenses rose 6%, resulting in a 4% drop in adjusted net income and 2% drop in adjusted earnings-per-share to

C$2.06.

For fiscal 2022, on an adjusted basis, revenue climbed 2%, net income rose 6%, and EPS climbed 8% to C$8.50, which translates to US$6.26. Return on equity was 15.6%. The bank’s capital position remains solid with its Common Equity Tier 1 ratio at 11.5%.

Click here to download our most recent Sure Analysis report on BNS (preview of page 1 of 3 shown below):

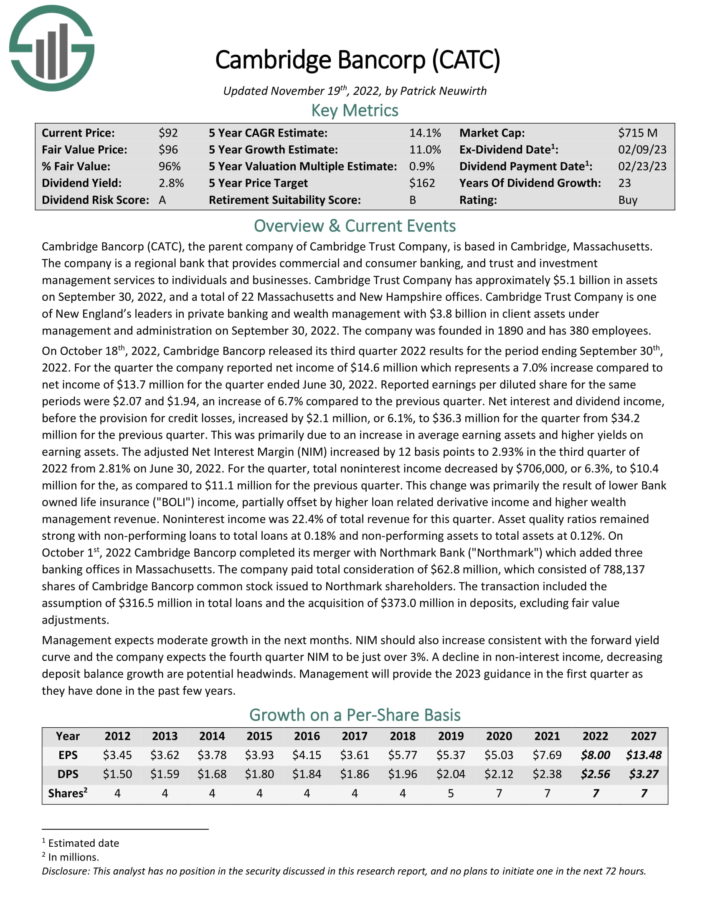

Blue-Chip Stock #6: Cambridge Bancorp (CATC)

- Dividend History: 23 years of consecutive increases

- Dividend Yield: 3.1%

- Expected Total Return: 16.1%

CATC is a regional bank that provides commercial and consumer banking, and trust and investment management services to individuals and businesses. Cambridge Trust Company has approximately $5.1 billion in assets on September 30, 2022, and a total of 22 Massachusetts and New Hampshire offices.

Cambridge Trust Company is one of New England’s leaders in private banking and wealth management with $3.8 billion in client assets under management and administration on September 30, 2022. The company was founded in 1890 and has 380 employees.

On October 18th, 2022, Cambridge Bancorp released its third quarter 2022 results for the period ending September 30th 2022. For the quarter the company reported net income of $14.6 million which represents a 7.0% increase compared to net income of $13.7 million for the quarter ended June 30, 2022.

Reported earnings per diluted share for the same periods were $2.07 and $1.94, an increase of 6.7% compared to the previous quarter. Net interest and dividend income, before the provision for credit losses, increased by $2.1 million, or 6.1%, to $36.3 million for the quarter from $34.2 million for the previous quarter. This was primarily due to an increase in average earning assets and higher yields on earning assets.

On October 1st, 2022 Cambridge Bancorp completed its merger with Northmark Bank (“Northmark”) which added three banking offices in Massachusetts. The company paid total consideration of $62.8 million, which consisted of 788,137 shares of Cambridge Bancorp common stock issued to Northmark shareholders.

Management expects moderate growth in the next months. NIM should also increase consistent with the forward yield curve and the company expects the fourth quarter NIM to be just over 3%.

Click here to download our most recent Sure Analysis report on CATC (preview of page 1 of 3 shown below):

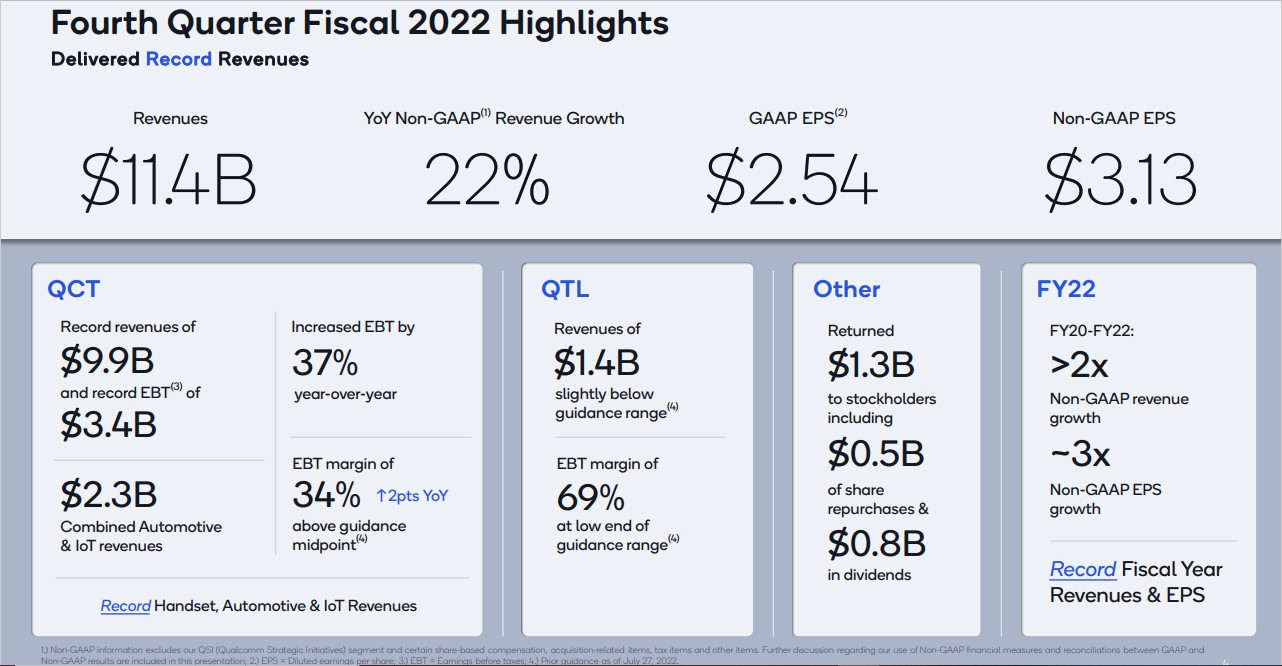

Blue-Chip Stock #5: Qualcomm Inc. (QCOM)

- Dividend History: 20 years of consecutive increases

- Dividend Yield: 2.6%

- Expected Total Return: 16.6%

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives

royalty payments for its patents used in devices that are on 3G and 4G networks. Qualcomm is a large-cap stock with a market cap above $140 billion and should generate sales of more than $44 billion this year.

On April 13th, 2022, Qualcomm increased its quarterly dividend 10.3% to $0.75, marking the company’s 20th consecutive year of dividend growth.

Qualcomm recently concluded its fiscal 2022. Results for the fourth fiscal quarter can be seen in the image below:

Source: Investor Presentation

Revenues for Qualcomm CDMA Technologies, or QCT, grew 28% to $9.9 billion. Handsets, Internet of Things, and Automotive grew 40%, 24%, and 58%, respectively. RF front-end was lower by 20%. Qualcomm Technology Licensing, or QTL, decreased 8% to $1.4 billion. Qualcomm repurchased three million shares during the period and 21 million shares during the fiscal year.

Qualcomm is projected to earn $10.23 in fiscal year 2023, which would be an 18% decline from the prior fiscal year, but the company’s second best performance in its history.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

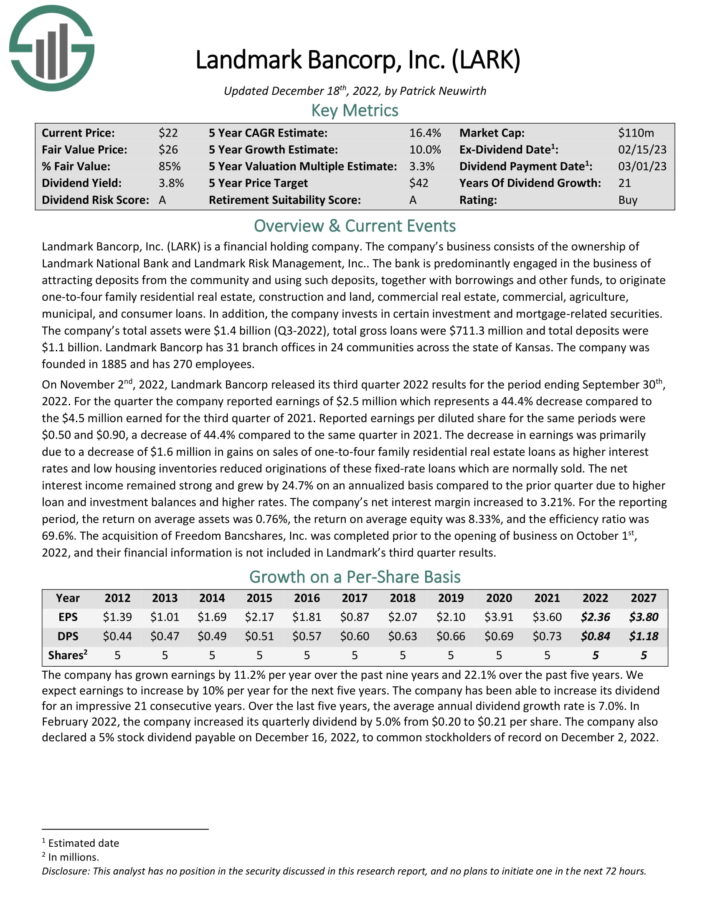

Blue-Chip Stock #4: Landmark Bancorp (LARK)

- Dividend History: 21 years of consecutive increases

- Dividend Yield: 3.9%

- Expected Total Return: 16.8%

Landmark Bancorp, Inc. is a financial holding company. The company’s business consists of the ownership of Landmark National Bank and Landmark Risk Management, Inc.. The bank is predominantly engaged in the business of attracting deposits from the community and using such deposits, together with borrowings and other funds, to originate one-to-four family residential real estate, construction and land, commercial real estate, commercial, agriculture, municipal, and consumer loans.

In addition, the company invests in certain investment and mortgage-related securities.

Landmark Bancorp has 31 branch offices in 24 communities across the state of Kansas. The company was

founded in 1885 and has 270 employees.

On November 2nd, 2022, Landmark Bancorp released its third quarter 2022 results for the period ending September 30th, 2022. For the quarter the company reported earnings of $2.5 million which represents a 44.4% decrease compared to the $4.5 million earned for the third quarter of 2021. Reported earnings per diluted share for the same periods were $0.50 and $0.90, a decrease of 44.4% compared to the same quarter in 2021.

The decrease in earnings was primarily due to a decrease of $1.6 million in gains on sales of one-to-four family residential real estate loans as higher interest rates and low housing inventories reduced originations of these fixed-rate loans which are normally sold.

The company’s net interest margin increased to 3.21%. For the reporting period, the return on average assets was 0.76%, the return on average equity was 8.33%, and the efficiency ratio was 69.6%.

Click here to download our most recent Sure Analysis report on LARK (preview of page 1 of 3 shown below):

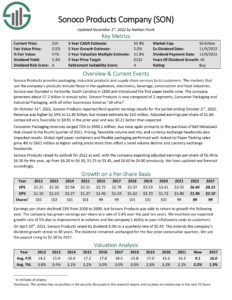

Blue-Chip Stock #3: Sonoco Products (SON)

- Dividend History: 40 years of consecutive increases

- Dividend Yield: 3.3%

- Expected Total Return: 18.9%

Sonoco manufactures consumer packaging products globally. The company makes a wide array of paper, textile, food, chemical, cable, and packaging products. Sonoco was founded in 1899 and produces about $7.3 billion in annual revenue.

Sonoco trades for 9.4 times its expected 2022 earnings. This could drive significant returns to shareholders as the valuation multiple expands over the next five years.

The stock also has a dividend yield roughly double that of the S&P 500, at 3.2%. Not only that, but Sonoco has a 40-year streak of dividend increases, putting it in a rare company on that measure as well.

We see growth at 5% annually, so we believe the stock can produce ~18.6% total returns in the years to come from its blend of valuation, yield, and growth.

Click here to download our most recent Sure Analysis report on Sonoco Products Co. (preview of page 1 of 3 shown below):

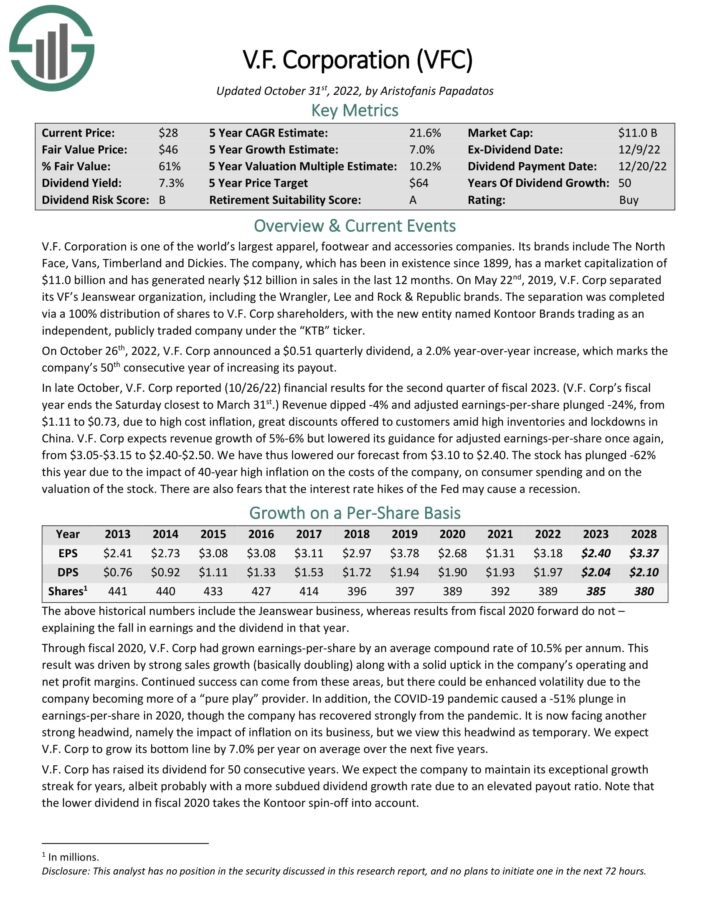

Blue-Chip Stock #2: V.F. Corp. (VFC)

- Dividend History: 50 years of consecutive increases

- Dividend Yield: 6.9%

- Expected Total Return: 19.4%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

On October 26th, 2022, V.F. Corp announced a $0.51 quarterly dividend, a 2.0% year-over-year increase, which marks the company’s 50th consecutive year of increasing its payout.

In late October, V.F. Corp reported (10/26/22) financial results for the second quarter of fiscal 2023. Revenue declined by 4% and adjusted earnings-per-share declined by 24%, from $1.11 to $0.73, due to high cost inflation, and discounts.

We expect 7% annual EPS growth over the next five years. VFC stock also has a dividend yield of 6.9%. Annual returns from an expanding P/E multiple are estimated at ~5.5%, equaling total expected annual returns of 19.4% through 2027.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

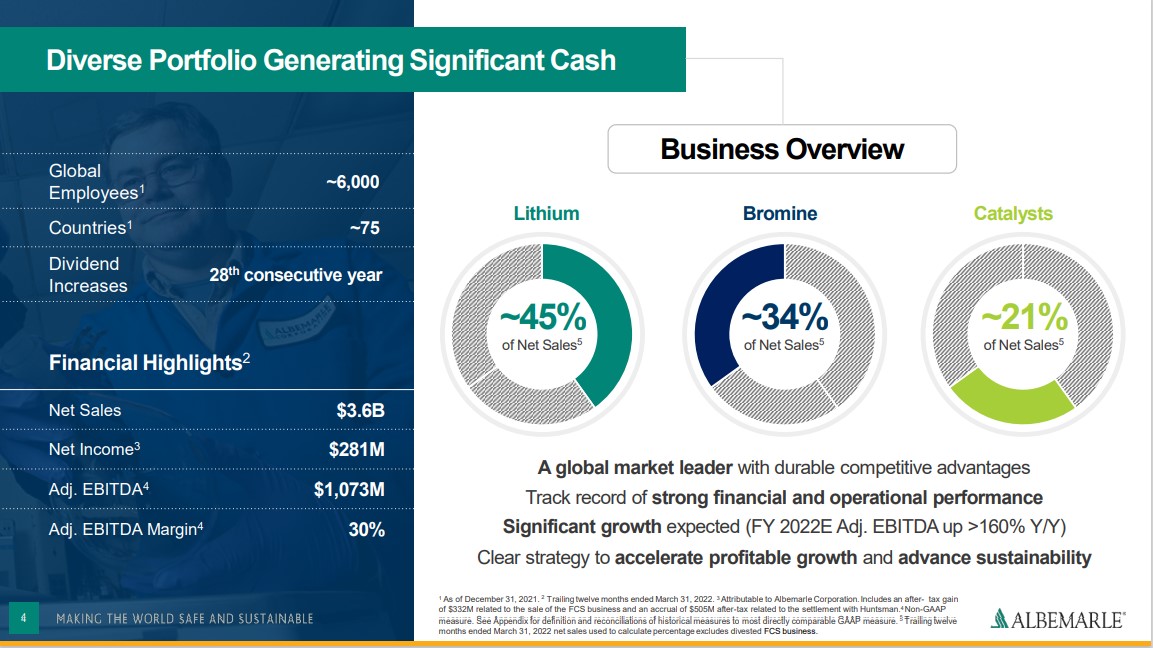

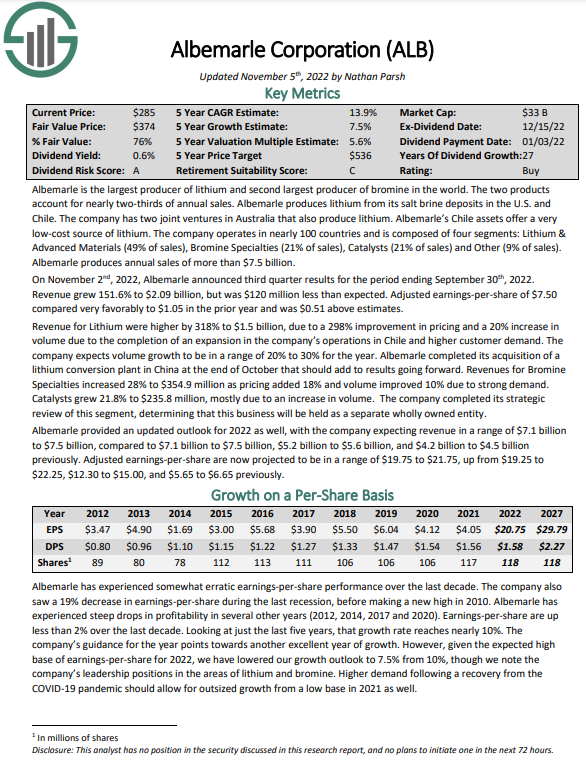

Blue-Chip Stock #1: Albemarle Corporation (ALB)

- Dividend History: 27 years of consecutive increases

- Dividend Yield: 0.7%

- Expected Total Return: 19.8%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium.

Related: 2022 Lithium Stocks List

The company operates in nearly 100 countries and is composed of four segments: Lithium & Advanced Materials (49% of sales), Bromine Specialties (21% of sales), Catalysts (21% of sales) and Other (9% of sales). Albemarle produces annual sales of more than $7.5 billion.

Source: Investor Presentation

On November 2nd, 2022, Albemarle announced third quarter results. Revenue grew 151.6% to $2.09 billion, but was $120 million less than expected. Adjusted earnings-per-share of $7.50 compared very favorably to $1.05 in the prior year and was $0.51 above estimates.

Revenue for Lithium was higher by 318% to $1.5 billion, due to a 298% improvement in pricing and a 20% increase in volume due to the completion of an expansion in the company’s operations in Chile and higher customer demand. The company expects volume growth to be in a range of 20% to 30% for the year.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

The Blue-Chip Stocks In Focus Series

You can see all Blue-Chip Stocks In Focus articles below. Each is sorted by GICS sectors and listed in alphabetical order by name. The newest Sure Analysis Research Database report for each security is included as well.

Consumer Staples

Communication Services

Consumer Discretionary

Financials

Industrials

Health Care

Information Technology

Materials

Utilities

Final Thoughts

Stocks with long histories of increasing dividends are often the best stocks to buy for long-term dividend growth and high total returns.

But just because a company has maintained a long track record of dividend increases, does not necessarily mean it will continue to do so in the future.

Investors need to individually assess a company’s fundamentals, particularly in times of economic distress.

These 7 blue-chip stocks have attractive dividend yields, and long histories of raising their dividends each year. They also have compelling valuations that make them attractive picks for investors interested in total returns.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)