15 First-Time Homebuyer Tips You Should Know | LendingTree

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Before you buy your first home, it’s helpful to have some first-time homebuyer tips handy to help you navigate the process. A little extra knowledge will go a long way to saving you money and avoiding mistakes that could derail your homebuying plans.

Mục Lục

Before you buy tips

1. Make sure you’re ready for homeownership

Most aspiring homeowners understand the financial investment it takes to own a home, but might not consider the unexpected. Ask yourself these questions:

- Are you ready to take on home repairs? That rainy-day roof leak or summertime air-conditioning breakdown is your responsibility as a homeowner.

- Do you have a home maintenance expense buffer? Experts recommend setting aside 1% of your home’s value to cover unexpected repairs and ongoing maintenance.

- Have you set a maximum housing expense budget? Set a mortgage payment limit ahead of time that leaves some wiggle room in your budget.

THINGS TO KNOW

Lenders may approve you for total debt that equals up to 50% of your before-tax income (a measure known as your debt-to-income or DTI ratio) but that might leave you with very little extra money to accomplish other financial goals like saving for retirement or building an education fund for your children.

2. Check your credit early

Your credit score has the biggest impact on the mortgage interest rate lenders offer. Check yours at least two to three months before you apply for a mortgage to see if there’s anything you can do to boost it to 740 or higher to get the lowest interest rates and easiest path to approval. Three quick tips that may help:

-

Pay your bills on time.

Late payments pull your scores down quickly.

-

Pay your credit card balances off.

Keep in mind it may take 60 to 90 days to update your credit report after you’ve paid, so plan to pay these balances off ahead of house hunting.

-

Don’t open new credit accounts.

New credit cards, retail store cards and car loans may ding your score, so avoid any new credit applications while you’re in the homebuying zone.

3. Save for a down payment and costs

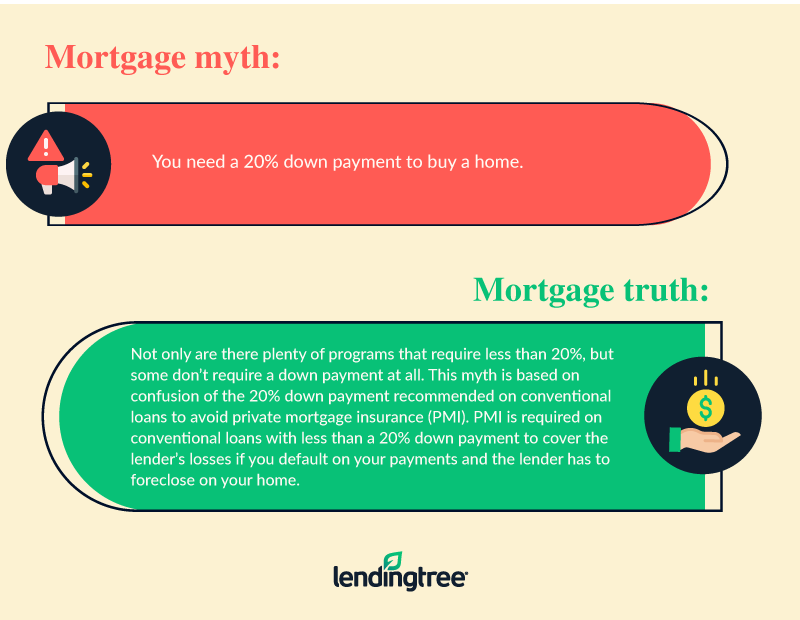

First-time homebuyers are often surprised to learn there are a number of programs that only require a 3% down payment. However, a larger down payment gives you a lower monthly payment and allows you to buy a more expensive home.

You should also budget closing costs, which typically equal between 2% and 6% of your loan amount, depending on the loan’s size. There are some do’s and don’ts worth knowing when it comes to money to buy a home.

THINGS TO KNOW

Some loan programs require mortgage reserves, which is cash set aside to cover a set amount of mortgage payments. Lenders may require reserves if you have a low credit score and a lot of debt compared to your income.

4. Check for first-time homebuyer down payment assistance

You may be eligible for down payment assistance depending on your income and the location of the home you’re buying. Some state and local government housing programs cover both your down payment and closing costs. Most of these programs have strict income limits and may require you live in the home for a set amount of time to avoid paying the assistance back.

5. Know your first-time homebuyer mortgage options

Picking the right mortgage option could make the difference between a quick preapproval

or a frustrating mortgage denial. Several government agencies offer loan programs that cater to borrowers with low credit scores, military borrowers or low-income buyers looking for homes in rural parts of the country. Conventional loans are the most popular loan type, but they also come with the strictest qualifying requirements.

Conventional loans. Lenders follow rules set by Fannie Mae and Freddie Mac

to approve conventional loans. The Fannie Mae HomeReady® and Freddie Mac Home Possible® loans loans are designed for first-time homebuyers, and borrowers may qualify with down payments as low as 3% and credit scores as low as 620. Income limits apply.

FHA loans. Backed by the Federal Housing Administration, FHA loans only require a 3.5% down payment with credit scores as low as 580. The program allows for scores as low as 500 with a 10% down payment. FHA mortgage insurance premiums are usually more expensive than conventional PMI and can’t be avoided regardless of your down payment. There are no income limits on FHA loans.

VA loans. Current and retired military service members and eligible surviving spouses may be eligible for no-down-payment loans guaranteed by the U.S. Department of Veterans Affairs (VA). VA loan guidelines don’t require mortgage insurance or a credit score minimum, although many lenders set their minimum credit score at 620.

USDA loans. The U.S. Department of Agriculture (USDA) backs loans that don’t require down payments for consumers looking to buy in rural neighborhoods. Income limits apply, and the home must be located in an eligible rural area designated by the USDA.

Mortgage preapproval tips

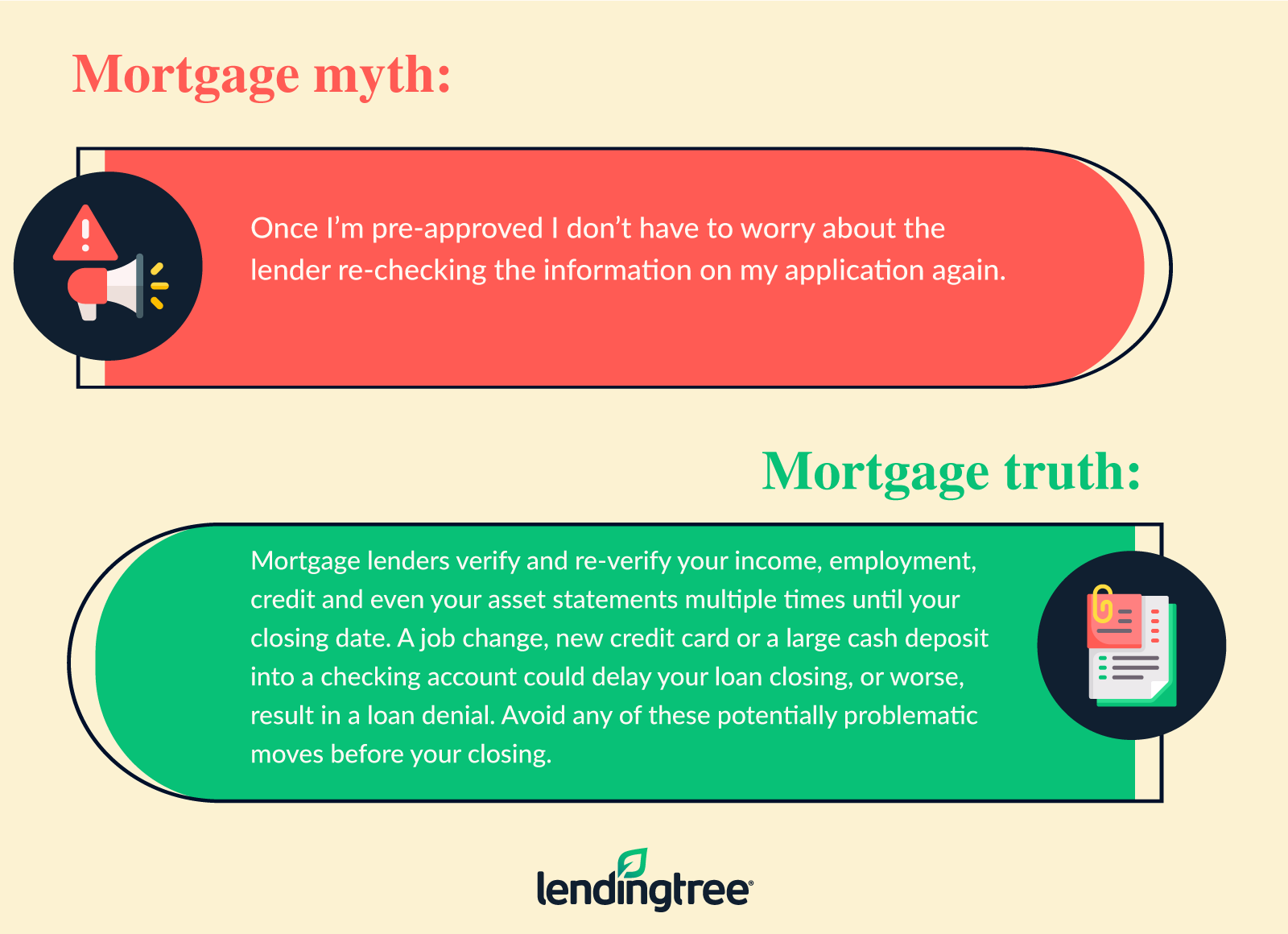

Once you’ve done the legwork to get your finances ready for homeownership, it’s time to start the mortgage preapproval process. Most sellers won’t even accept an offer without a mortgage preapproval letter, so don’t skip these steps or you may end up with a string of rejected offers.

6. Have your paperwork ready

Although many lenders offer digital loan applications, your preapproval is only as solid as the information you provide. To get the most accurate preapproval have these documents handy:

- A current month’s worth of paystubs

- Last two years of W-2s

- Two months of recent bank statements

THINGS TO KNOW

Be sure to let your loan officer know if you have a bankruptcy or foreclosure within the last 10 years. You’ll have to wait longer to get a conventional loan if you have any major derogatory credit in your history. Government-backed loans allow more flexibility for these types of issues than conventional loans.

7. Shop for a mortgage lender

A recent LendingTree study found that borrowers who shopped for a mortgage saved over $63,000 on average over the life of their loans. Contact mortgage brokers, mortgage banks and even your local bank or credit union to see what they offer. A few additional tips before you make your final decision:

-

Gather your quotes on the same day.

Rates change daily, so make the dates the same on all of the loan estimates you review or you won’t be making an apples-to-apples comparison.

-

Ask about rate-lock options.

Most lenders won’t let you get a mortgage rate lock until you’ve found a home, while others offer “lock-and-shop” programs that allow a lock-in while you’re househunting.

-

Ask about available DPA programs.

Not all lenders are approved to offer down payment assistance. You may need to shop a few extra lenders if you’re applying for a specific DPA program in your area.

8. Get your preapproval letter

Once you’ve selected a lender, it’s time to get your preapproval letter. The letter should provide details about the type of loan you’re qualified for, including the loan amount, interest rate and maximum PITI (principal, interest, taxes and insurance) payment.

Remember: If you don’t tell the lender ahead of time what your payment budget is, the preapproval letter will reflect the maximum you qualify for based on your loan application. Ask the lender to adjust the amount down if the max doesn’t fit with your spending plans.

First-time homebuyer house hunting tips

With your preapproval in hand, you’re ready to get serious about your home search.

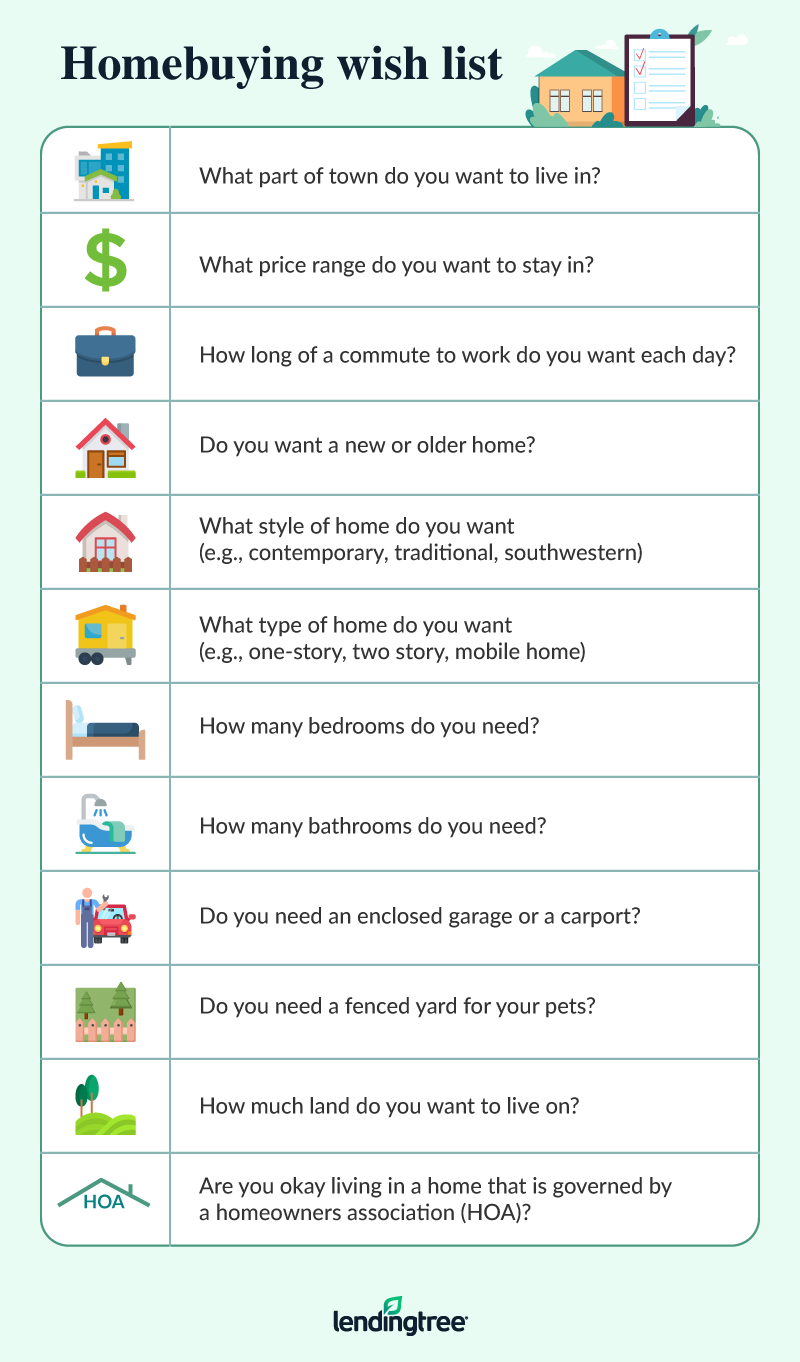

9. Make a homebuying wish list

This step is where you start turning your homebuying vision into reality. As a first-time homebuyer, it’s best to focus on your “needs” versus your “wants.” You might want a gazebo or swimming pool, but you need enough rooms for your family size, a neighborhood close to schools you want your children to attend and a reasonable distance from where you work every day. Answer the questions below to figure what’s most important on your house-hunting list:

10. Choose the right real estate agent for you

A real estate agent’s job is to help you find a home that fits your needs at the best price possible. An experienced real estate agent has the expertise, communication skills and personal touch to set realistic expectations based on your local housing market.

Ask family members, co-workers or friends for recommendations and interview at least two or three agents to see if your personalities are a good match. Make sure you understand how the agent will stay in touch with you, whether it’s by text, phone call or email.

THINGS YOU SHOULD KNOW

A word of caution about for sale by owner (FSBO) homes: Even if you’re related to the person you’re buying a FSBO home from, have the contract reviewed by an attorney so you understand the terms of the contract. The sales price, timeline for closing and details about who is paying which costs should be clearly spelled out to avoid legal problems down the road. You should also pay for a title insurance policy to protect yourself against any potential claims against the owner of the home you’re buying.

Home buying tips

11. Lock in your interest rate

Once your home is under contract, you should lock in your rate if you haven’t already. This is especially important if mortgage rates are on the rise. Make sure you understand the terms of the lock in including:

- How many days the lock is for

- What your lock expiration date is

- What the cost is to lock the loan

12. Get a home inspection

Even if you’re buying a fixer-upper or have agreed to purchase the home “as-is,” which means you’re willing to go through with the transaction even if the home isn’t move-in ready, you should always get a home inspection for a top-to-bottom deep dive on the condition of the home. You may want to consider a Fannie Mae HomeStyle® Renovation or FHA 203(k) loan if the home is in need of major renovations.

These fixer-upper loan programs allow you to roll the cost of repairs and renovations into one loan to buy the home. An added bonus: The loan is based on the fixed-up value of your home, which gives you extra borrowing power.

13. Don’t be afraid to negotiate with the seller

There are a number of ways to haggle with a seller to get the best terms for your home purchase. Talk to your real estate agent about any of these options:

-

Ask for closing-cost credits instead of repairs.

Depending on the type of loan you take out, you may be able to get the seller to pay up to 6% of your sales price toward closing costs. Unless there are major problems with the home inspection, it may be worth it to ask the seller to pay a portion of your costs instead of adding home repairs to your contract.

-

Negotiate for a lower price.

If the seller won’t pay closing costs, you can request a reduction in the sales price.

-

Be prepared to walk away.

An unreasonable seller may not be worth the headache. If the seller won’t budge on closing costs or repairs, it may be time to start your home search over.

14. Shop for homeowners insurance

Homeowners insurance is generally required if you have a mortgage, and the lower your premium is, the lower your total monthly mortgage payment will be. You can compare homeowners insurance quotes from several companies and consider bundling your auto insurance and homeowners insurance together for a potential discount.

15. Review your closing disclosure and walk through your home

Once you’ve satisfied all the conditions of your loan, you’ll receive a closing disclosure

at least three business days before closing. Check it to make sure the rates and costs look correct and that you’re being credited for any costs the seller agreed to pay for.

Your real estate agent will usually schedule a walk-through to make sure your home is move-in ready, and then you’ll sign your closing papers. Once the lender funds your mortgage, the title is transferred into your name and you become an official homeowner.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)