How to Start a Freelance Business in 2023 – Step By Step Business

Tired of your day job? If you have a marketable skill, such as writing or web design, you could start your own freelance business and work at home instead of going to a dreary office every day. You’d have flexible hours, and you might even be able to make more than you do now. The possibilities are endless – you could be a freelance writer, virtual assistant, web developer, graphic designer or jill-of-all-trades.

Starting a business, though, takes a certain kind of knowledge. Fortunately, this step-by-step guide will teach you everything you need to know to launch your freelance career.

![]()

Looking to form an LLC?

Check out the Best LLC Formation Services.

Mục Lục

Step 1: Decide if the Business Is Right for You

Pros and cons

Starting a freelance business has pros and cons to consider before deciding if it’s right for you.

Pros

-

Flexibility – Work from home, control your own time

-

Follow Your Passion – Do what you’re good at every day

-

Low Startup Costs – For most freelancing all you need is a computer

Cons

-

Inconsistent Work – Need to work hard to get regular clients

-

Massive Competition – Compete with freelancers around the world

Freelance industry trends

Industry size and growth

- Industry size and past growth – The freelance industry was worth a whopping $1.2 trillion in 2020.((https://www.zippia.com/advice/freelancing-statistics/))

- Growth forecast – Freelancing is expected to grow 14% by 2026.((https://www.statista.com/statistics/685468/amount-of-people-freelancing-us/))

- Number of businesses – In 2020, 59 million freelancers were working in the U.S.

Trends and challenges

Trends in the freelance industry include:

- Freelance IT consultants are increasingly in demand.

- Some 82% of freelancers are writers.

Challenges in the freelance industry include:

- Freelancing is becoming competitive, with the proliferation of less experienced freelancers who are willing to work for lower pay.

- Sometimes when working for global clients, cultural differences and varying expectations may present a challenge.

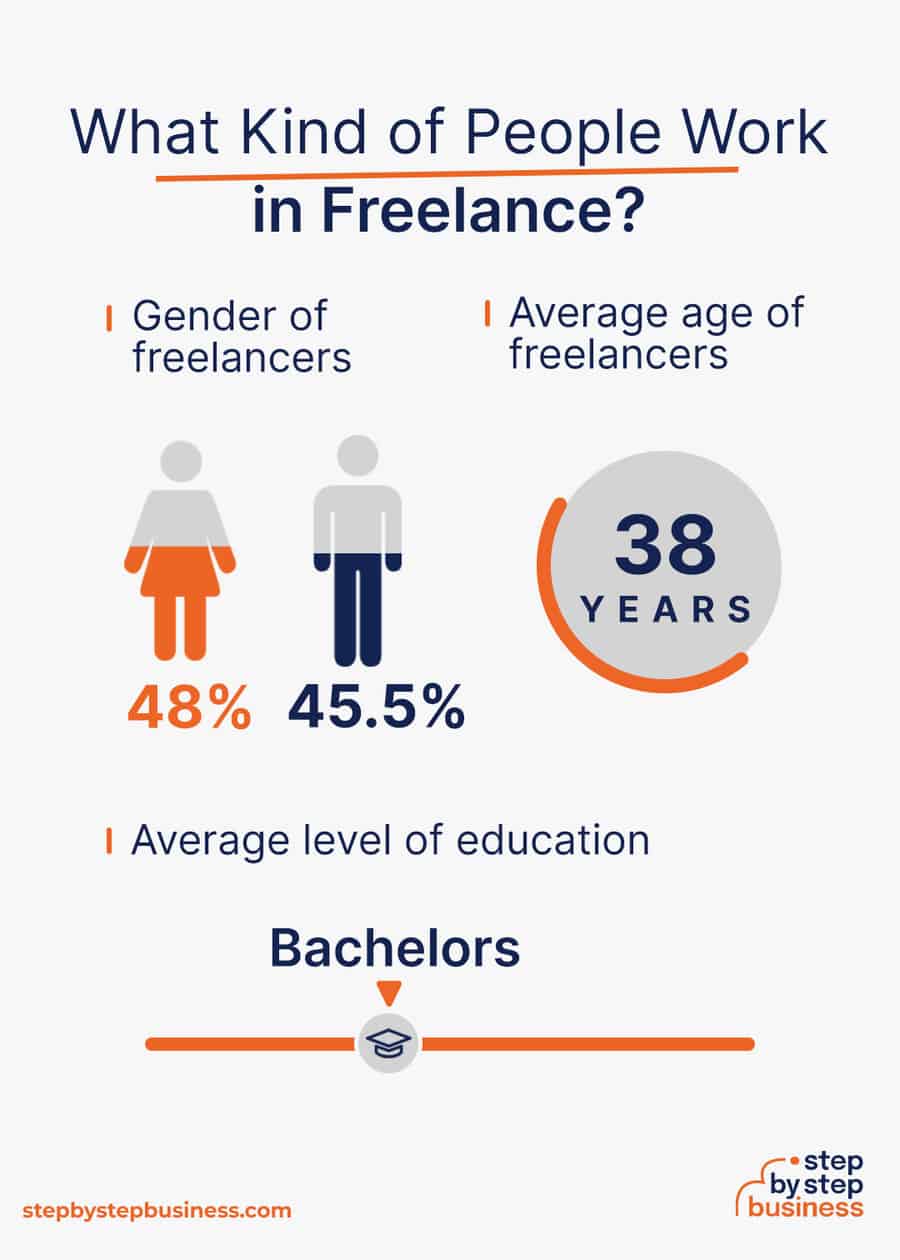

What kind of people work in freelancing?

- Gender – 48% of freelancers are female, while 45.5% are male.((https://www.zippia.com/freelancer-jobs/demographics/))

- Average level of education – The average freelancer has a bachelor’s degree.

- Average age – The average freelancer in the US is 38 years old.

How much does it cost to start a freelance business?

Startup costs for a freelance business range from $3,000 to $7,000. Costs include a website, a computer, and an initial marketing budget. But if you already have a computer, you’re way ahead.

Start-up CostsBallpark RangeAverage

Setting up a business name and corporation$150 – $200$175

Business licenses and permits$100 – $300$200

Insurance$100-$300$200

Business cards and brochures$200 – $300$250

Website setup$1,000 – $3,000$2,000

Computer$1,000 – $2,000$1,500

Initial marketing budget$500 – $1,000$750

Total$3,050 – $7,100$5,075

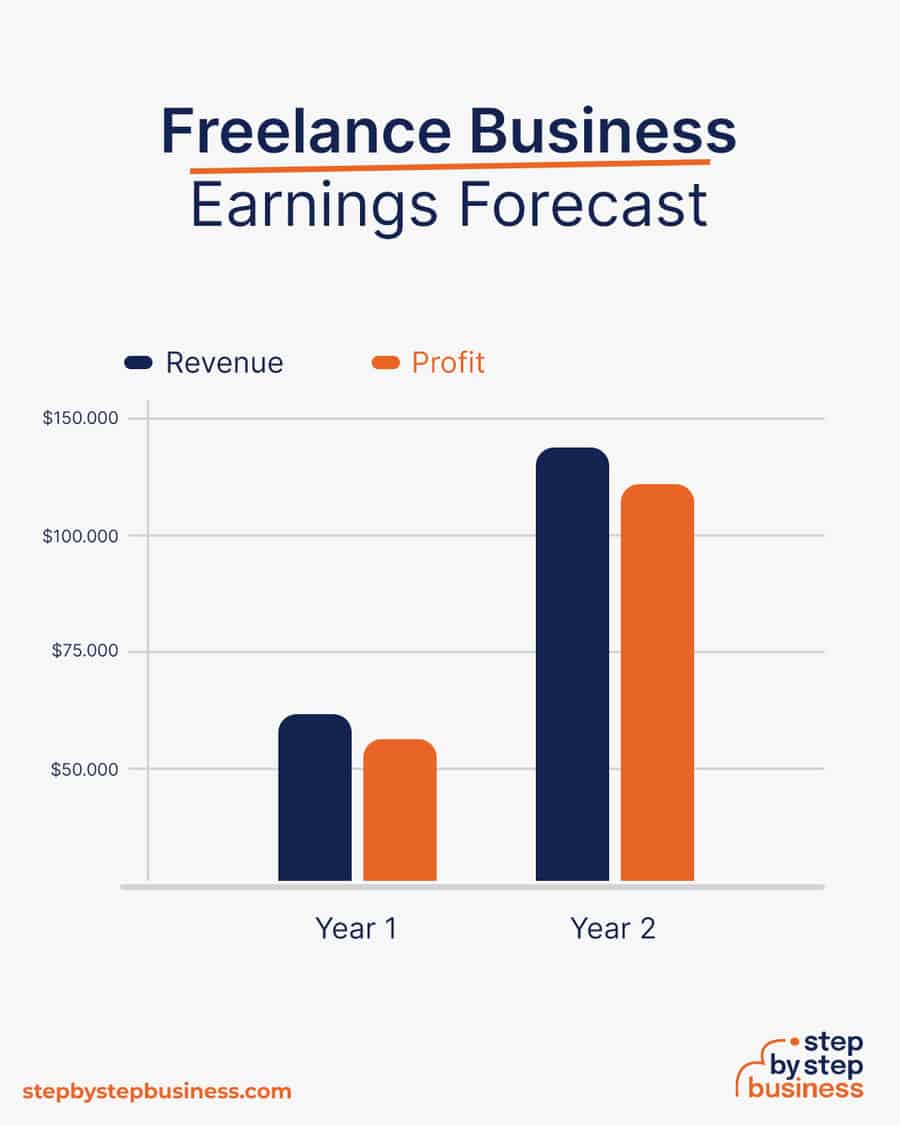

How much can you earn from a freelance business?

Rates for freelancers can vary based on experience and the type of work and can range from $25 for virtual assistants up to $100 or more for coders. These calculations assume an average hourly rate of $50. Your profit margin after marketing costs should be around 90%.

In your first year or two, you could work 25 hours a week, bringing in $65,000 in annual revenue. This would mean nearly $60,000 in profit, assuming that 90% margin. As you build up a regular clientele, you could get to 40 hours per week and up your rate to $70 per hour. With annual revenue of more than $145,000, you’d make more than $130,000.

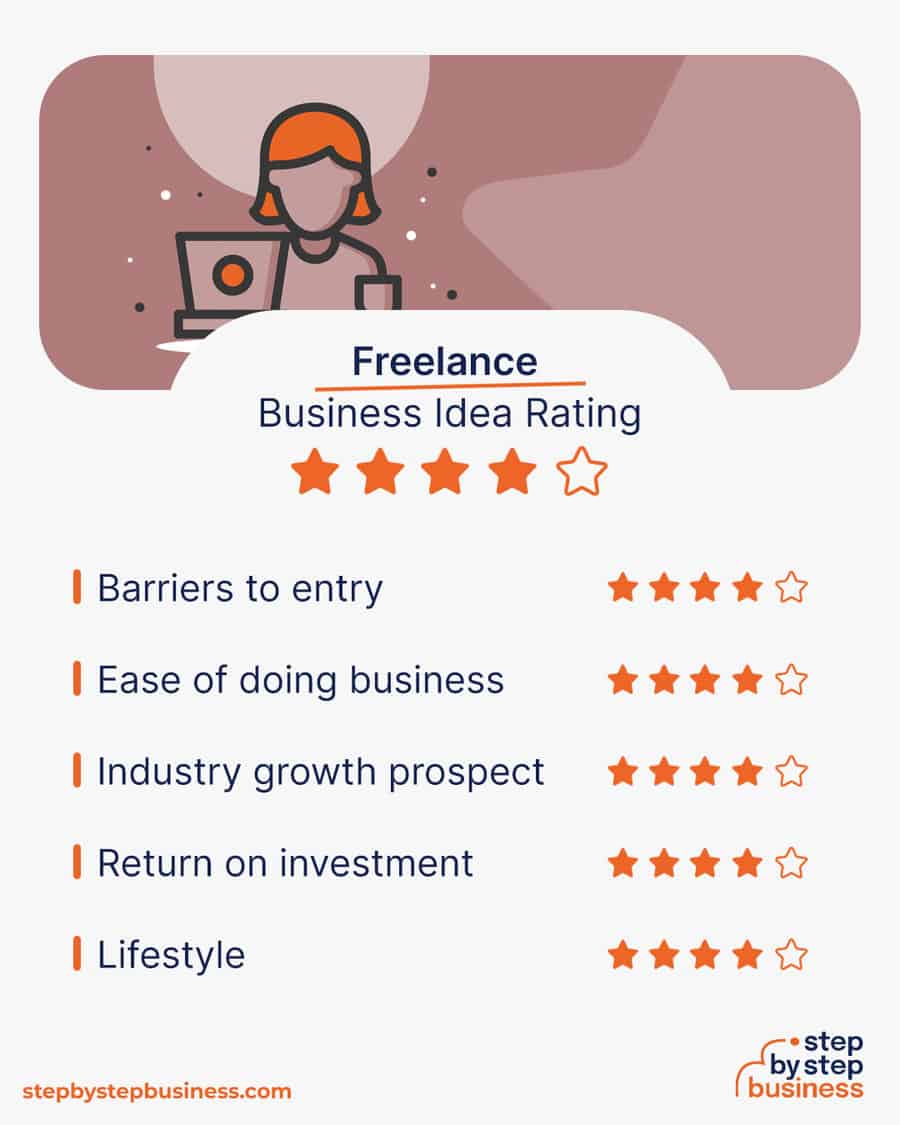

What barriers to entry are there?

There are a few barriers to entry for a freelance business. Your biggest challenges will be:

- Having skills that lend themselves to freelancing

- Competition from other freelancers in your field

Step 2: Hone Your Idea

Now that you know what’s involved in starting a freelance business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research freelance businesses online to examine their services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the market is missing a 3D printing business that ships fast, or a resume and CV expert.

![]()

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as web design for retail outlets or freelance business writing.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your products or services

Your services will depend on your freelance specialty. Make a list of all the services you can offer in that specialty based on your skills. Then decide if you want to offer a variety of services or specialize in just a few services.

How much should you charge for freelancing?

Prices will vary based on what skills you’re freelancing. Look at what others in your field with similar experience are charging. Your costs with most freelancing specialties should be limited to marketing, so you should aim for a profit margin of about 90%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will mainly be businesses, which you can find on LinkedIn. If you message them or call them directly, you may find some freelance jobs. You should also post a profile on freelance job boards such as Upwork and Freelancer.

Where? Choose your business premises

You’ll probably always want to run your business from home, but if you ever want to rent an office, you can find commercial space to rent in your area on sites such as Craigslist, Crexi, and Instant Offices.

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Business Name

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “graphic design” or “freelance writer”, boosts SEO

- Name should allow for expansion, for ex: “Jim’s Bakery” over “Jim’s Cookies”

- Avoid location-based names that might hinder future expansion

- Use online tools like the Step by Step Business Name Generator. Just type in a few keywords and hit “generate” and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Search

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Business Plan

Every business needs a plan. This will function as a guidebook to take your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision:

- Executive Summary: Brief overview of the entire business plan; should be written after the plan is complete.

- Business Overview: Overview of the company, vision, mission, ownership, and corporate goals.

- Product and Services: Describe your offerings in detail.

- Market Analysis: Assess market trends such as variations in demand and prospects for growth, and do a SWOT analysis.

- Competitive Analysis: Analyze main competitors, assessing their strengths and weaknesses, and create a list of the advantages of your services.

- Sales and Marketing: Examine your companies’ unique selling propositions (USPs) and develop sales, marketing, and promotional strategies.

- Management Team: Overview of management team, detailing their roles and professional background, along with a corporate hierarchy.

- Operations Plan: Your company’s operational plan includes procurement, office location, key assets and equipment, and other logistical details.

- Financial Plan: Three years of financial planning, including startup costs, break-even analysis, profit and loss estimates, cash flow, and balance sheet.

- Appendix: Include any additional financial or business-related documents.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

![]()

Save up to 40% using LivePlan business plan software!

Visit LivePlan

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to freelance businesses.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your freelance business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC, which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

Form Your LLC

Choose Your State

Search

We recommend ZenBusiness as the Best LLC Service for 2023

Visit ZenBusiness

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number, or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

![]()

The IRS website also offers a tax-payers checklist, and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan.

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a freelance business. You might also try crowdfunding if you have an innovative concept.

Step 8: Apply for Licenses/Permits

Starting a freelance business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your freelance business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use project management software, such as ClickUp, Notion, or Monday, to manage your projects, workflows, and documents.

Accounting

- Popular web-based accounting programs for smaller businesses include Quickbooks, Freshbooks, and Xero.

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Marketing

Some of your business will come from the casual online visitors, but you should still invest in digital marketing! Getting the word out is especially important for new businesses, as it’ll boost customer and brand awareness.

Once your website is up and running, link it to your social media accounts and vice versa. Social media is a great tool for promoting your business because you can create engaging posts that advertise your products:

- Facebook: Great platform for paid advertising, allows you to target specific demographics, like men under age 50 in the Cleveland area.

- Instagram: Same benefits as Facebook but with different target audiences.

- Website: SEO will help your website appear closer to the top in relevant search results, a crucial element for increasing sales. Make sure that you optimize calls to action on your website. Experiment with text, color, size, and position of calls to action such as “Schedule Consultation Now”. This can sharply increase purchases.

- Google and Yelp: For businesses that rely on local clientele, getting listed on Yelp and Google My Business can be crucial to generating awareness and customers.

Kickstart Marketing

Take advantage of your website, social media presence and real-life activities to increase awareness of your offerings and build your brand. Some suggestions include:

- In-Person Sales – Offer your freelance services to business owners.

- Email marketing/newsletter – Send regular emails to customers and prospects. Make them personal.

- Start a blog – Start a blog and post regularly. Change up your content and share on multiple sites.

- Seek out referrals – Offer incentives to generate customer referrals to new clients.

- Paid ads on social media – Choose sites that will reach your target market and do targeted ads.

- Pay–per-click marketing – Use Google AdWords to perform better in searches. Research your keywords first.

- Testimonials – Share customer testimonials about how your freelance services helped them.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism. They are unlikely to find your website, however, unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

You can create your own website using services like WordPress, Wix, or Squarespace. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your freelance business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your freelance business could be:

- Professional graphic design for any project

- Web design and SEO to accelerate your business

- Professional content writing to connect you with your customers

Networking

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a freelance business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in freelancing for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in freelancing. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But if you want to grow into a company that offers your specialized service, you will likely need workers to fill various roles Potential positions for a freelance business include:

- Specialist – perform specialized services

- General Manager – scheduling, project management, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Start Making Money!

With a marketable skill, starting your own freelance business is a fairly easy process. If you already have a computer, it doesn’t take much to get started, and it’s a great way to work flexibly from home. You can make good money too, particularly once you have some experience and a track record.

Now that you know the steps, it’s time to get out there and begin your successful career in freelance!

Freelance Business FAQs

How profitable is a freelance business?

Freelancing can be very profitable. Most freelancers of all types report that they make more money than they did when they worked a regular job. If you do quality work and provide value to your clients, the money will follow.

How much can I charge for freelancing?

You’ll need to check the prices of other freelancers in your specialty to find an average. Then you can set prices based on your experience. You just need to make sure you’re competitive in the market.

![Toni Kroos là ai? [ sự thật về tiểu sử đầy đủ Toni Kroos ]](https://evbn.org/wp-content/uploads/New-Project-6635-1671934592.jpg)